Page Summary

Forex markets manage trillions of dollars daily. Traders at all levels of experience search for the best brokerage firms to trade forex, CFDs, and stocks. Many new forex brokers might not be as secure as you think.

Each online forex broker has its strengths and weaknesses. This article discusses how to avoid forex trading scams in 2023.

Broker’s Licenses

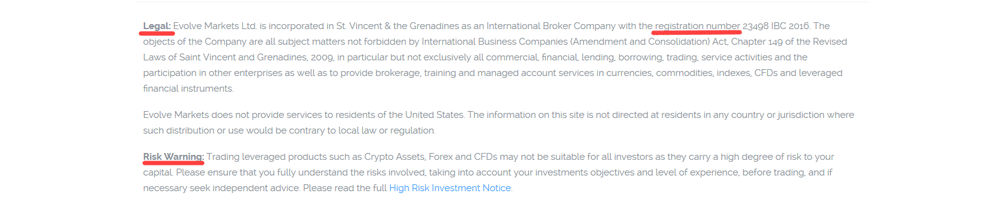

Trustworthy forex brokers have top-tier licenses. This regulation ensures they report to a governing body and are held accountable for their actions. The best way to check a broker’s registration is to check at the bottom of their website. A safe broker will reveal the risks involved with trading and the authorization it has to operate trades.

When a broker has a license, it includes proper risk disclaimers and regulatory information on all its websites. Read more about online brokers and licenses in our in-depth reviews.

Regulatory Body

Another aspect to consider is how trustworthy a regulatory body is. There are cases in which brokers claim to have a forex license by a body that does not monitor forex companies. You should always research additional information on both the broker and regulatory body.

Trustworthy forex brokers have top-tier licenses from entities like:

- FCA Regulated – Financial Conduct Authority – United Kingdom – (Great)

- CySEC Regulated – Cyprus Securities & Exchange Commission – Cyprus (OK)

- ASIC Regulated – Australian Securities & Investment Commission – Australia (Good)

- SFC Authorized – Securities Futures Commission – Hong Kong (Good)

- MAS Authorized – Monetary Authority of Singapore – Singapore (Good)

- FCA Regulated – Financial Conduct Authority – United Kingdom – (Great)

- CySEC Regulated – Cyprus Securities & Exchange Commission – Cyprus (OK)

- ASIC Regulated – Australian Securities & Investment Commission – Australia (Good)

- SFC Authorized – Securities Futures Commission – Hong Kong (Good)

- MAS Authorized – Monetary Authority of Singapore – Singapore (Good)

Claims

A noticeable sign a forex broker is a scam comes from the way it advertises its portfolio. For example, if a provider promises a 96% success rate, it is likely a scam. Safe forex brokers do not promise returns of any kind.

High Cash Bonus

If you want to avoid forex scams, you should pay close attention to high cash bonuses. It is most likely a scam when a broker has a suspicious cash bonus amount for new accounts and doesn’t share details about it.

Most regulated areas around the world do not allow bonuses for opening new accounts. The USA and China are two notable exceptions.

Automated Trading To Guarantee Profits

Most scam brokers provide access to automated trading performed by an algorithm. These brokers state their robots use trade signals to help you make more money. In most cases, such scam brokers focus on cryptocurrency and binary options.

Brokerage Firm Information

A reliable and trustworthy online broker shares credible information about the company. This means you will be able to easily check a company’s history, financials, and headquarters. Scam brokers don’t share any names, locations, or contact information.

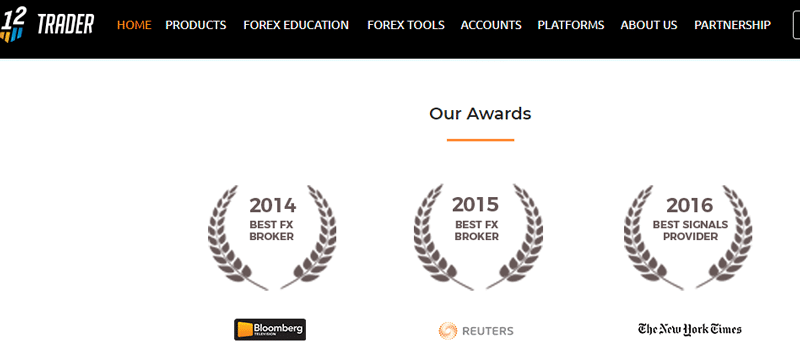

Awards Authenticity

Many scam brokers say they have impressive awards. Most of the time, these will say “Best Broker 2015” without any additional information. Scam brokers purposely use fake awards from a couple of years ago, as these are challenging to verify.

Sponsorship

A common scam to avoid is corporate sports sponsorship advertising. If a brokerage firm has a major sponsor paying for their name to be on a jersey, it doesn’t imply it is trustworthy. So before creating a forex trading account, learn more about the most secure brokerage firms in 2023.

Final Word

Before you start trading, you should do some research. Reading our in-depth reviews will help you discover which are the best forex brokers in 2021. If you want to avoid scams, you should pay close attention to the aspects discussed above.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and crypto assets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.