Page Summary

This guide helps to compare and find the best forex brokers in UAE with demo accounts. Demo (paper) accounts allow users to test their trading strategies with virtual money before applying them to real accounts. However, with 106 local and offshore online brokers available in UAE offering different trading conditions, selecting the ideal option for individual needs is hard.

To help beginners and advanced traders make the ideal choice, the services of available providers have been assessed considering: the range of forex currency pairs, amount of virtual money, minimum deposit, spreads & commissions, available trading tools, research & education materials, Islamic accounts availability, and customer support.

This guide compares 106 providers for users to review and find the ideal forex broker for their needs. To help them make an informed decision, a list of the best forex brokers in UAE offering demo accounts is shared below, followed by in-depth reviews and comparisons.

Best Demo Account Forex Brokers in UAE

- eToro – Best Overall Choice

- Capital.com – Top For Forex CFDs

- AvaTrade – Ideal For Variety Of Platforms

- Forex.com – Best For MT4

- FXCM – Optimal For Algorithmic Trading

Top Demo Account Forex Brokers in UAE Reviewed

Forex brokers in UAE with the best demo accounts are reviewed below including key features.

eToro

Min Deposit: $100

Fees: 4.8

Assets available: 4.8

Total Fees:

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro is a top brokerage firm with advanced forex trading platforms. It is an excellent choice for traders who want access to secure social trading tools. This forex broker has a valuable portfolio with access to popular forex currency pairs.

eToro has an impressive virtual account. Demo trading is helpful for both beginner and experienced traders. It lets you test forex trading strategies with live market data. eToro’s demo account is useful for improving your forex trading strategy.

This online broker has a competitive fee structure. It doesn’t charge hidden commissions. eToro is a secure broker with premium trading tools. It identifies well-performing traders and allows other traders to copy their positions. This online broker has many payment methods and an excellent support team.

Pros

- Features many popular forex currency pairs;

- Regulated by the FCA;

- Mobile forex trading app available;

- Demo trading account;

- Retail investor accounts

Cons

- High spreads;

- Limited assets

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Capital.com

Capital.com is a top forex trading broker with a virtual trading account. It offers many services, including CFD and forex trading. This brokerage firm follows strict rules and has top-tier licenses. All its platforms use industry-leading safety protocols.

The demo account at Capital.com is intuitive. It is an excellent choice for beginner forex traders. The Capital.com demo account has many educational materials. It is an attractive forex trading strategy if you want to learn more about market volatility.

Pros

- Competitive fee structure with cost-free forex platforms;

- Access to many tradable forex instruments;

- Top-tier licenses from ASIC

Cons

- Expensive overnight fees;

- Lack of ownership for stocks;

- Limited payment methods with no access to PayPal;

- Limited markets and securities

79.17% of retail CFD accounts lose money

AvaTrade

AvaTrade is a beginner-friendly broker with forex trading platforms and a demo account. It offers a secure platform with average trading fees. AvaTrade offers CFDs and access to leading forex trading pairs. This broker has attractive learning tools and forex tutorials.

AvaTrade has a comprehensive research and learning center. It offers reliable market data and useful forex trading tools. We recommend this broker for traders at all levels. It provides useful forex trading solutions.

Pros

- Excellent forex trading platform with automated trading tools;

- Access to MT4/MT5;

- Low deposit requirement;

- Zero commissions and tight spreads

Cons

- Expensive inactivity fees;

- Lack of traditional investments

71% of retail CFD accounts lose money

Forex.com

Forex.com is an online broker with an excellent reputation and virtual trading tools. It is a leading platform with high-tech tools and professional forex materials. Forex.com offers different assets, including CFD and forex pairs.

Forex.com has excellent forex learning tools. It offers tutorials and instructional videos. Forex.com provides access to an industry-leading virtual account. It is a comprehensive solution for testing different forex strategies. Forex.com is a top choice for both new and advanced traders.

Pros

- Access to a comprehensive selection of forex pairs;

- Impressive forex analysis tools;

- Excellent reputation;

- Dedicated learning center

Cons

- Not suitable for equity trades;

- High requirement for professional client status eligibility

80% of retail CFD accounts lose money

How To Find The Best Forex Demo Accounts in UAE?

The term “Demo Account” refers to a special kind of practice account. Forex traders use these accounts to familiarise with the brokers trading platform environment and features. Criteria for selecting a forex broker with the ideal demo account in UAE are listed below.

- Availability of forex trading instruments

- Minimum deposit requirement

- Amount of virtual money available

- Fees

- Forex Trading Platforms and Third Party Integrations

- Broker’s reputation

- Personal Preferences of the trader

Top Demo Account Brokers in UAE Compared

Key features of forex brokers with the highest ranked demo accounts are compared in the table below.

information might have changed.

| Broker | Number of Forex Pairs | Virtual Money for Demo Account | Spreads on EUR/USD | Max Leverage | Trading Platforms | Deposit & Withdrawal Methods | Customer Support Options | Regulators |

|---|---|---|---|---|---|---|---|---|

| eToro | 50 | $100,000 | starting from 0.9 pips | 1:30 | eToro Platform, Mobile Apps | Credit/Debit Card, Wire Transfer, e-wallets | Live Chat, Tickets | FCA, CySEC, ASIC |

| Capital.com | 130+ | Unlimited | starting from 0.6 pips | 1:30 | Capital.com Platform, Mobile Apps | Credit/Debit Card, Wire Transfer, e-wallets | Live Chat, Email, Phone | FCA, CySEC |

| AvaTrade | 50+ | $100,000 | starting from 0.9 pips | 1:400 | MetaTrader 4, MetaTrader 5, AvaTradeGo, AvaOptions | Credit/Debit Card, Wire Transfer, e-wallets | Live Chat, Email, Phone | Central Bank of Ireland, ASIC, JFSA, FSCA, ADGM, FRSA, BVI |

| Forex.com | 80+ | $10,000 | starting from 0.2 pips | 1:30 | Advanced Trading Platform, Web Trading, MetaTrader 4 | Credit/Debit Card, Wire Transfer | Live Chat, Email, Phone | CFTC, FCA |

| FXCM | 39+ | $20,000 | 1.3 pips | 1:30 | Trading Station, MetaTrader 4, NinjaTrader | Credit/Debit Card, Wire Transfer, e-wallets | Live Chat, Email, Phone | FCA, ASIC, FSCA |

What Are The Advantages Of Forex Demo Accounts?

If you’re looking for a new broker, signing up for a demo account might be the quickest and most risk-free method for testing if that trading platform has all the features you need. It’s generally recommended to do this before putting any real money into an account with that broker.

Demo accounts can also be used to evaluate trading strategies and test trading robots. By using a demo account, traders are able to see how particular trading strategies would perform based on real-world data without needing to risk real money during the learning process.

Trading platforms provide charting features, indicators, and functions that are invaluable in the trading process. Signing up for a forex demo account can provide you with the valuable experience needed to confidently and quickly use a new trading platform. The more adept you are with the trading platform, the more likely you will trade profitably.

What Are The Disadvantages Of Forex Demo Accounts?

Probably the most significant disadvantage with a forex demo account is that it’s not real money. This removes risk, but it also removes any potential gains. Connected with this, you don’t experience the intense emotional swings of real-life trading. This means demo accounts don’t help you develop a resistance to emotional trading. Emotional trading is trading based on what you “feel” is the right trade. Emotional trading – instead of trading based on a strategy – is one of the leading causes of failure on the market.

Inexperienced traders also tend to be complacent when using a demo account to practice their trading skills. Subconsciously, they know that there is no real risk involved, and so they may take more significant risks then they would do in a real-money environment. This lack of emotional experience with emotional control can cause the research and learning acquired from the demo account to be less than accurate, and therefore, less than reliable in the real world.

Lastly, some demo accounts are completely removed from real market trading data. That means essential real-world factors – such as lag time, slippage, and latency – might be invisible inside of the demo account.

What Are Demo Account Alternatives?

If a demo account doesn’t seem to fit your needs, you might consider a micro account. Micro accounts are funded with real money and can be used to simulate actual trading. For example, if you were to make it $2000 trade inside of a demo account and that $2000 trade were to increase significantly, you wouldn’t make any money. However, had you been trading inside of a micro account, you might have received some of the profit.

Another benefit of micro accounts is that they provide you with real-market conditions such as surprise news, slippage, and latency. Each of these things can dramatically affect the success (or failure) of a trade.

Trading Psychology And Demo Accounts

There’s a surprising amount of psychology involved in forex trading. It can be mentally and emotionally challenging, requiring that forex traders have complete control over their emotions along with a fact-based strategy for their trading behavior. If you take the demo account seriously, it can be an incredibly useful way for you to improve your mental and emotional fortitude for trading.

Account Size Management And Demo Accounts

No matter what form of trading or investing you are involved in, risk management it’s fundamental to your success. There are many different ways to manage risk and one of them that is related to demo accounts is account size management. Account size management is where you attempt to avoid significant losses in your account by choosing the size of your trades in proportion to the size of your account.

For example, if the trader has $100,000 in his trading account and decides to use 20% trade sizes ($20,000 per trade). If the first trade is lost, the account will lose 20% of its value. If two more losses of 20% happen, the account will be drawn down a total of $60,000. That trader must make a gain of 150% just to break even.

Compare that to a trader who decides to use 4% trade sizes. If this new trader also loses three sequential trades (the same as the first trader), he would’ve only lost $12,000 and could reach breakeven with a 17.6% gain.

Especially in times of significant market volatility and adversity, risk management is the key to staying solvent. Account size management within a demo account is a great way to develop your account size management skills.

How To Start Virtual Trading?

Virtual trading is available with online brokers. We recommend the eToro demo account. eToro is a trustworthy brokerage firm with attractive forex and social trading tools. It has an excellent multi-asset trading platform. eToro is a good choice for both inexperienced and professional traders. Here is a step-by-step guide on virtual trading with eToro.

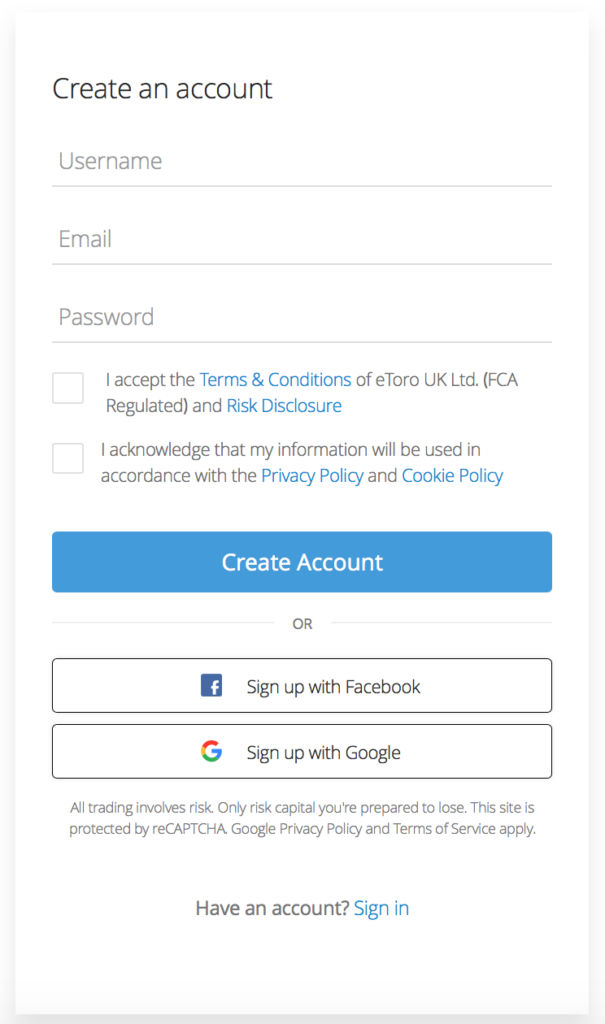

Step 1: Register A Trading Account

The first step is to register a trading account. eToro offers a simple sign-up form on its website. You have to upload personal information, including your full name and source of funds.

Step 2: Change To Virtual Trading Mode

After you open your account, eToro will request a deposit. You should skip this step and switch to the demo mode. You will receive access to $100,000 in paper funds.

Step 3: Choose A Forex Market

The next step is to choose a forex market. Search for the forex pair you want to trade, and start testing your strategy.

Step 4: Place A Demo Forex Trade

Choose from a buy or sell order and place your demo forex trade. Submit your stake and click on the “Open Trade” button. When you close the position, you will see the profit or loss on the trade.

Conclusion

It requires time and effort to compare and evaluate the services of different brokers in the UAE to find the ideal demo account provider. Users must explore and evaluate relevant information to make the optimal choice for their needs.

This guide does the hard work for you, comparing and evaluating the top choices for different types of traders and trading goals. The results of our analysis of brokers with the best forex demo accounts in UAE are summed up in the table below.

Leveraged and speculative product. Not suitable for all investors. You should consider whether you can afford to take the high risk of losing your money. Capital is at risk.

| RANK | BROKER | PLATFORM SCORE | BEST FOR | WEBSITE |

|---|---|---|---|---|

| #1 | eToro | 3,3/5 | Best Overall | Official website |

| #2 | Capital.com | 4,9/5 | Forex CFDs | Official website |

| #3 | AvaTrade | 4,9/5 | U.S. Forex Options | Official website |

| #4 | Forex.com | 4,9/5 | Options Trading App | Official website |

| #5 | FXCM | 3,0/5 | CFD Options | Official website |

Disclaimer

eToro is a multi-asset investment platform. The value of your investments may go up or down. Leveraged and speculative product. Not suitable for all investors. You should consider whether you can afford to take the high risk of losing your money. Capital is at risk. Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Crypto assets are unregulated& highly speculative. No consumer protection. Capital at risk.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.