This guide helps to compare and find the best forex brokers in UAE. Currency trading is a popular investment for beginners and advanced traders in UAE to achieve financial gains. However, with 174 local and offshore online brokers available in UAE offering different trading conditions, it is tough to select the ideal option for individual needs.

To help beginners and advanced traders make the right choice, the services of available providers have been assessed considering: the range of forex trading instruments, fees, accessibility, trading tools & platforms, research & education materials, islamic accounts availability and customer support.

This guide compares 174 providers for users to review and find the ideal forex broker for their needs. To help them make an informed decision, a list of the best forex brokers in UAE is shared below, followed by in-depth reviews and comparisons.

Page Summary

Best Forex Brokers in United Arab Emirates

- AVAtrade – Overall Best Forex Broker in UAE

- eToro – Best Beginners Broker

- Multibank – Best Forex Trading Broker

- Plus500 – Best Web Trading Platform

- Pepperstone – Best Forex CFD Broker

- Saxo Bank – Best Advanced Forex Broker

The Top Choices Compared

Key features of the highest ranked brokers for forex trading in UAE are compared in the table below.

| Broker | AvaTrade | eToro | Multibank | Plus500 | Pepperstone | Saxo Bank |

| Nr. of Forex Pairs | 65 | 49 | 55 | 66 | 60+ | 190+ |

| Leverage | 1:400 | 1:30 | 500:1 | 1:30 | 1:400 | 1:30 |

| Min. Deposit | $100 (370 AED) | $50 (185 AED) | $50 (185 AED) | $100 (370 AED) | $0 (0 AED) | $2000 (7,345 AED) |

| Trading Platforms | MT4 MT5 WebTrader AvaGo | eTorro app | MultiBank-Plus (Coming Soon) MetaTrader 4 MetaTrader 5 WebTrader MT4 WebTrader MT5 Social Trading | Plus500 | MT4 MT5 TradingView cTrader | SaxoTraderGo SaxoTraderPro TradingView MultiCharts UpData |

| Copy Trading Tools | Ava Social DupliTrade Mql5.com | CopyTrader | MultiBank Mql5.com | N/A | N/A | IC Social ZuluTrade Myfxbook AutoTrade Mql5.com |

| Algorithmic Trading | YES | NO | YES | NO | YES | YES |

Forex Spreads and Commissions Compared

Spreads and commissions of top choices are compared in the table below.

| Broker |

EUR/USD spread (standard) |

GBP/USD spread (standard) |

AUD/USD spread (standard) |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AVAtrade | ||||||||||||||||||

| eToro | ||||||||||||||||||

| Multibank | ||||||||||||||||||

| Plus500 | ||||||||||||||||||

| Pepperstone | ||||||||||||||||||

| Saxo Bank |

Top 6 Forex Brokers in UAE Reviewed

The best forex brokers in UAE are reviewed below including key features.

1. AVAtrade – Best Overall Forex Broker in UAE

BEST FOR: Low Fixed Spreads

LEVEL: Average & advanced

FX PAIRS: 55 forex & 44 options

MAX LEVERAGE: 1:400

AVAtrade is the best forex broker in UAE. They charge low fixed spreads of 0.6 pips on most forex pairs. Users can trade on a wide range of currencies including 55 forex CFDs and 44 forex options.

Avatrade’s trading platform has an intuitively designed trading dashboard. It supports a wide range of third party integrations including MT4, MT5, TradingView, DupliTrade, Zulutrade and Capitalise.ai. It also offers implementation of Expert Advisors, trading bot scripts and APIs for trade automatisation.

Avatrade Spreads

Avatrade charges a low fixed spread of 0,9 pips (EUR/USD) without additional commission.

Avatrade’s spreads and commission are compared with other brokers in the table below.

| Broker | AvaTrade | Pepperstone | eToro | IG | IC Markets | Saxo Bank | Forex.com | XM |

| EUR/USD | 0,9 | 0,6 | 0,9 | 0,8 | 0,3 | 0,9 | 1,1 | 1,7 |

| USD/JPY | 1,0 | 1,2 | 0,9 | 0,7 | 0,4 | 1,0 | 1,5 | 1,6 |

| GBP/USD | 1,5 | 1,3 | 2,0 | 0,9 | 0,8 | 1,1 | 1,5 | 2,1 |

| AUD/USD | 1,1 | 0,6 | 1,0 | 0,8 | 0,6 | 0,8 | 1,4 | 1,8 |

| Min. Deposit | $100 | $20 | $50 | $5,445 | $200 | $2,000 | $100 | $5 |

| Swap Free Account | Yes | Yes | Yes | No | Yes | No | Yes | Yes |

| Inactivity Fee | Yes | No | Yes | Yes | No | Yes | Yes | Yes |

| Funding Fee | No | No | Yes | No | No | No | No | No |

Avatrade Account Types

AvaTrade have 3 account types: Retail, Standard and Professional.

- Retail and Standard Account – is the basic account with access to all asset classes. It allows trading with up to 1:30 leverage

- Professional Account – access to 1:400 leverage

- Demo Account – allows practice trading with $100,000 virtual balance

- Islamic Forex (Swap-free) Account – charges low spreads of 0.3 pips

All account types have a demo and islamic account option.

Avatrade Forex Pairs

Avatrade offers access to 800+ CFDs including 55 forex currency pairs (major, minor and exotic) and 44 forex options.

Avatrade Trading Platforms

The 5 trading platforms available on Avatrade are listed below.

- WebTrader – web based platform

- AvaTradeGo – mobile trading app

- AVAoptions – options platform

- AVAsocial – social copy trading app

- Mac Trading – MAC trading app

All trading platforms offer a wide range of trading tools such as: Trading calculator, Avaprotect, fundamental and technical analysis tools and advanced order types.

The platforms also support different trading styles including short selling, scalping, swing and automated trading.

Customer Service

AvaTrade’s customer service is available 24/7 by email, live chat, phone and even WhatsApp in English and Arabic.

Key Features for Forex Traders:

- Nr. of forex currency pairs: 55 forex pairs (CFDs) and 44 forex options

- Average spread (EUR/USD): 0.6 pips (EUR/USD)

- Trading platforms: Proprietary, MT4, MT5, TradingView, ZuluTrade, DupliTrade

- Maximum leverage: 1:400

- Regulators: ASIC, CySEC, FCA, FRSA

- Islamic swap free account: YES

- Micro lot trading: YES

- Recommended experience Level: Average to advanced

- Supported trading strategies: Automated trading, short selling, scalping

- Nominated: Recommended trading platforms for forex trading in UAE

71% of retail CFD accounts lose money

2. eToro – Best Forex Broker For Beginners

BEST FOR: Social & Copy Trading

LEVEL: Beginner

FX PAIRS: 49 major, minor, exotic

MAX LEVERAGE: 1:20

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro is an investment company founded in 2007. They offer access to 49 major forex currency pairs as CFDs. eToro charges low fixed spreads of 0.9 pips on EUR/USD and variable commissions.

Their trading platform has an easy to use interface for starters. It offers a wide range of beginner trading tools including easy buy/sell options, copy trading and risk management tools. Users can access the platform through a web (WebTrader) and mobile app (Android and iOS).

eToro Spreads and Fees

eToro charges a fixed spread of 0.9 pips on EUR/USD. An extra variable commission is applied on forex CFD trades.

The broker also charges a monthly inactivity fee ($10 ), withdrawal fee (a $5 ) and a currency conversion fee (0.1%).

eToro Account Types

eToro has 2 different forex account types: Retail and Professional.

- Retail account: is the basic account that allows access to all forex pairs including forex CFDs

- Professional account: requires users to pass a test for professionals and requires a minimum deposit of $10,000.

Both accounts offer a free demo and an islamic (swap-free) account option.

Deposit and withdrawals are free of charge. Deposits and withdrawals are available through: wire transfer, credit card, or e-wallets (PayPal, Neteller, or Skrill)

Assets

eToro offers access to 49 forex currency pairs including all major, minor and exotic pairs. All assets are available as real assets and as CFDs.

eToro Platforms

eToro has two trading platforms: a web-based platform (WebTrader) and an intuitive mobile app.

The platform does not support common trading tools like technical indicators, complex order types, or Expert Advisors. This can be a drawback for advanced forex trader looking for customisation options.

Customer Service

Their support team is responsive. It is available through email, live chat, or phone.

Key Features For Forex Traders:

- Nr. of forex currency pairs: 49 forex pairs (CFDs)

- Average spread (EUR/USD): 0.9 pips

- Trading platforms: Proprietary Web Trader and CopyTrader

- Maximum leverage: 1:20

- Regulators: FCA, ASIC, CySECA

- Islamic swap free account: YES

- Micro lot trading: NO

- Recommended experience Level: Beginner

- Supported trading strategies: Social/copy trading

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

3. Multibank – Best Forex Trading Broker

MultiBank is a Dubai-based multi-asset broker founded in 2005 that allows users to trade CFDs on metals, shares, indices, commodities, cryptocurrencies, and forex pairs. Its range of trading platforms includes MetaTrader 4 and 5 and its proprietary MultiBank-Plus and Social Trading platforms. Users can trade through the web, desktop, and mobile apps.

MultiBank Spreads and Commissions

MultiBank charges low spreads from 0,0 pips (on EUR/USD) on its ECN accounts.

Spreads charged on main MultiBank accounts are listed below.

- Standard Accounts are subject to variable spreads from 1,5 pips (on EUR/USD)

- Pro Accounts are subject to variable spreads from 0,8 pips (on EUR/USD)

- ECN Accounts are subject to variable spreads from 0,0 pips (on EUR/USD) and $3,00 commission per lot per side

MultiBank Account Types

MultiBank has 3 different account types: Standard, Pro, and ECN. All accounts allow trading with up to 500:1 leverage, conduct social trading, have demo variants, and have access to 24/7 technical support.

MultiBank Assets

MultiBank allows users to trade over 20,000 financial instruments, including 55 forex currency pairs.

MultiBank Platforms

MultiBank’s selection of platforms includes a proprietary (web, mobile, and desktop) platform (MultiBank-Plus), the full MetaTrader suite (4 & 5), and a social trading platform. Additionally, users can access a free Forex VPS server and deploy Expert Advisors (EAs) on all available trading platforms.

Trading Platforms available on MultiBank are listed below.

MultiBank-Plus Trading Platform – is MultiBank’s proprietary web trading platform that provides access to the most liquid markets in the world, 24-hour instant and stable nano-second execution, up to 5 levels of market depth, up to 500:1 leverage, free VPS, MAM, and PAMM accounts, and that has negative balance protection and no restrictions on the usage of Expert Advisors.

MetaTrader 4 Trading Platform – provides users access to a pure Non-Dealing Desk ECN trading structure with direct access to over 20 interbank trading prices without conflict of interest—downloadable software, not directly accessible through a web browser.

MetaTrader 5 Trading Platform – offers all the same features of the MetaTrader 4 platform and provides improved trading functionalities, such as enhanced scripting tools for custom indicators and expert advisors. Additionally, it offers 80+ technical analysis indicators and analytical tools, alert notifications to track essential market events, and shows the current market depth for the latest price quotes.

Social Trading Platform – allows users to copy the trades of experienced traders, which is ideal for beginner traders or those who don’t have the time to monitor the financial markets constantly.

MultiBank App – is the mobile version of the MultiBank-Plus trading platform that contains all the same features and allows users to trade on the go from Android and iOS mobile devices.

Research and Education

MultiBank’s research and education tools include explainer video courses, a free forex VPS, and an economic calendar, making MultiBank the go-to broker for beginner and data-driven traders. Additionally, the free forex VPS is useful for algorithmic and high-frequency traders.

MultiBank education and research tools are compared with other brokers in the table below.

| Research & Education Features | AvaTrade | Capital.com | eToro | IG | IC Markets | Saxo Bank | XM | MultiBank |

| Trading Signals | No | No | No | Yes | No | No | Yes | No |

| Educational Resources | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Webinars | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No |

| In-depth Market Analysis | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Personal Training and Trading Room | No | No | No | No | No | Yes | Yes | No |

MultiBank Key Features For Forex Traders:

- Nr. of forex currency pairs: 55 forex pairs (CFDs)

- Average spread (EUR/USD): 0 pips (on EUR/USD)

- Trading platforms: MultiBank-Plus, MetaTrader 4, MetaTrader 5, Social Trading

- Maximum leverage: 1:500

- Regulators: ASIC, AUSTRAC, BaFin, CIMA, CySEC, FMA, FSC, MAS, FMA, SCA, TFG, and VFSC

- Islamic swap free account: YES

- Micro lot trading: YES

- Recommended experience level: average traders

- Supported trading strategies: algorithmic trading, MAM/PAMM accounts, FIX API bot trading integration

74-89% of retail CFD accounts lose money

4. Plus500 – Best Web Trading Platform

BEST FOR: Browser-based forex trading

LEVELS: Intermediate

FX PAIRS: 66

MAX LEVERAGE: 30:1 retail, 500:1 professional

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. Consider whether you understand how CFDs work and whether you can afford to risk losing your money.

Plus500 is a London Stock Exchange-listed, globally operating multi-asset broker founded in 2008 that allows users to trade CFDs on stocks, indices, ETFs, commodities, cryptocurrencies, 66 forex pairs, and invest in more than 2,000 international stocks.

Its proprietary browser-based trading platforms and apps are intuitively designed for beginner to intermediate traders and investors.

Plus500 Spreads and Commissions

Plus500 offers commission-free CFD and forex trading charges $0,006 per share and has low spreads, starting at 0,8 pips (on EUR/USD). Other trading fees include overnight margin funding fees and guaranteed stop-loss order fees. Additionally, Plus500 charges users non-trading fees, including currency conversion fees and inactivity fees ($10/month) after 12 months of inactivity.

Plus500 Account Types

Plus500 had 4 account types, of which 3 are available for UAE traders and investors, including the:

- Plus500 CFD – Suitable for retail day traders and swing traders who want to trade with up to 30:1 leverage.

- Plus500 Professional – Is meant for professional and institutional traders with more than $500,000 in capital who want to trade with up to 500:1 leverage.

- Plus500 Invest – Aimed at long-term investors that want to build up their investment portfolio.

- Plus500 Futures (only available to USA-based traders and investors) – Suitable for options and futures traders that reside within the US.

An Islamic swap-free account is also available on request for traders and investors who want to trade according to Sharia law.

Plus500 Assets

Plus500 allows users to trade 66 major, minor, and exotic forex pairs, 2,000+ CFDs and stocks, and over 250 futures on crypto, metals, forex, interest rates, equity indices, and commodities.

Plus500 Platforms

Plus500’s selection of trading platforms includes its proprietary desktop CFD, Invest, and Futures platforms, and two mobile trading apps (Plus500 CFD and Plus500 Futures). Plus500 is not compatible with MetaTrader 4, 5, TradingView, cTrader or other third-party trading platforms. Additionally, the usage of Expert Advisors for algorithmic trading is not supported at Plus500, and the broker doesn’t offer social or copy trading features.

Plus500 Research and Education

Plus500 offers users research and education tools through webinars, in-depth market analysis, an economic calendar, and explainer videos. However, the broker doesn’t offer trading signals, personal training, or access to a live trading room.

Use the table below to compare Pluys500’s research and educational tools with those of our other top-rated forex brokers for UAE traders.

| Broker | AvaTrade | eToro | Plus500 | Multibank | Pepperstone |

| Trading Signals | No | No | No | No | No |

| Educational Resources | Yes | Yes | Yes | Yes | Yes |

| Webinars | Yes | Yes | Yes | No | Yes |

| In-depth Market Analysis | Yes | Yes | Yes | Yes | Yes |

| Personal Training and Trading Room Access | No | No | No | No | No |

Plus500 Key Features for Forex Traders:

- Nr. of forex currency pairs: 66 forex pairs (as CFDs)

- Average Spread (EUR/USD): 1,2 pips

- Trading platforms: Plus500 CFD, Plus500 Invest, Plus500 Futures

- Maximum leverage: 30:1 for retail traders and 500:1 for professional traders

- Regulators: DFSA, CySEC, ASIC, FCA, SFS, EFSR, MAS

- Islamic swap free account: Yes

- Micro lot trading: Yes

- Recommended experience level: Intermediate

Supported trading strategies: day trading, swing trading, scalping

CFD Service. Regulated by the DFSA. Trading carries risk.

5. Pepperstone – Top Forex CFD Broker (Best Forex Trading App in UAE)

BEST FOR: Forex CFDs

LEVEL: Average & advanced

FX PAIRS: 60 major, minor, exotic

MAX LEVERAGE: 1:400

Pepperstone is a reputable forex CFD broker with a license from the DFSA. They offer access to 60+ forex pairs and 700+ different CFDs. Pepperstone charges 0.0 spreads on most forex pairs and a fixed commission of $3,50. High liquidity is provided at 99.72% fill rate.

Pepperstone list of trading platforms include MetaTrader 4, MetaTrader 5, Tradingview and cTrader. Users can integrate a variety of third party add-ons including Capitalise.ai, AutoChartist, cTrader Automation, and VPS hosting. The trading interface is easy to use for starters and advanced.

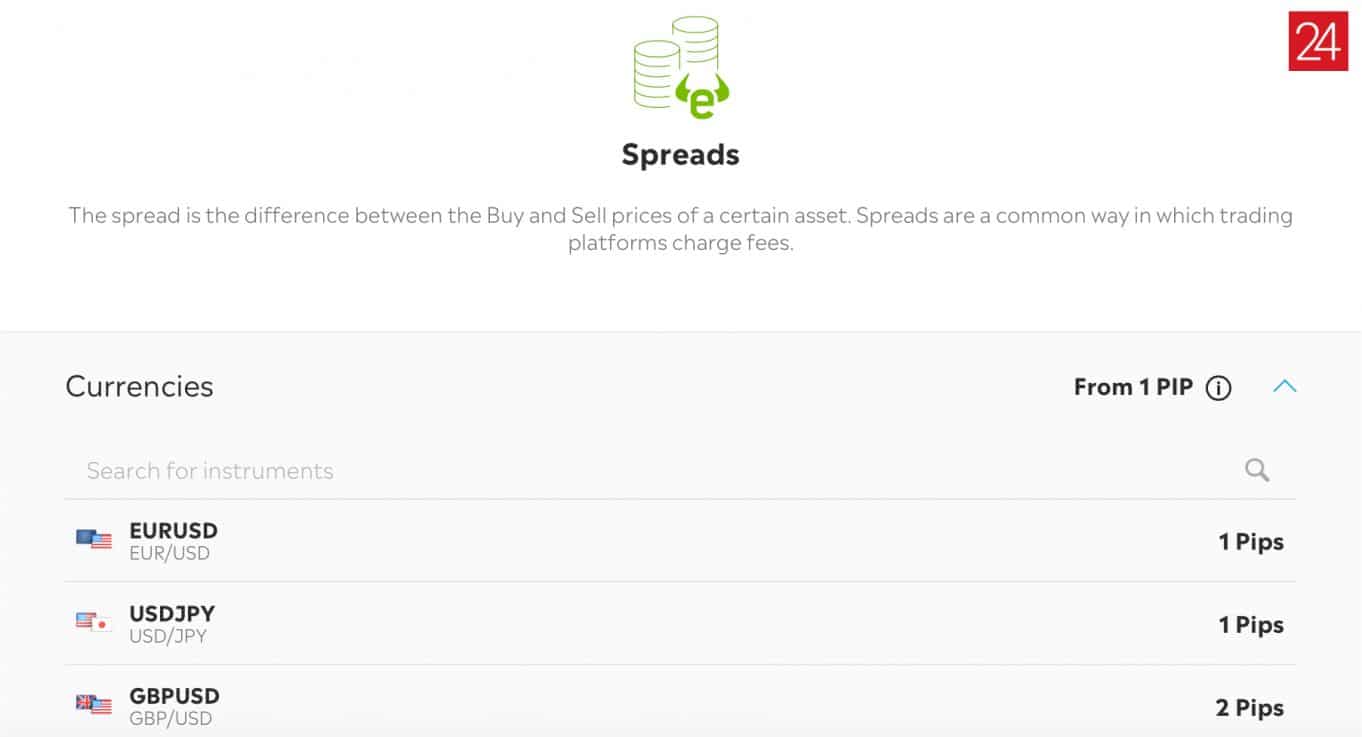

Pepperstone Spreads and Commissions

Pepperstone charges low spreads of 0.0 pips on most forex pairs including EUR/USD, GBP/USD, USD/JPY. They charge a variable commission from $3,5 depending on the underlying currency pair and account type.

Pepperstone Account Types

Pepperstone has 2 forex account types: Standard and Razor:

- Standard account: charges average spread of 1.1pips EUR/USD

- Razor account: charges an average spread of 0.0 – 0.3 pips EUR/USD plus a $2.60 commission.

Both account types have a free demo account. Users can trade on both with up to 1.30 leverage.

Pepperstone does not charge deposit or withdrawal fees.

| Features | Standard | Plus | Premier | Invest |

| Minimum Deposit | 70AED | 11,000AED | 36,000AED | 70AED |

| Spreads | 0.6 pips | 0.6 pips | 0.6 pips | 0.6 pips |

| Webinars & Events | No | No | Yes | No |

| Leverage | 1:30 | 1:30 | 1:30 | 1:30 |

Pepperstone Currency Pairs:

Pepperstone offers access to 1,200 instruments including 60+ forex currency pairs. All assets are available as real assets and as CFDs.

Pepperstone Trading Platforms

Forex trading platforms available on Pepperstone are listed below.

- MetaTrader 4

- MetaTrader 5

- Tradingview and

- cTrader

Users can integrate a variety of third party add-ons including Capitalise.ai, AutoChartist, cTrader Automation, and VPS hosting.

Pepperstone offers a variety of trading tools. The most important are listed below.

- TradingView integration

- Real-time price quotes

- Fast order execution

- Deep liquidity

- Expert advisors

- Robo – advisors

Customer Service

Pepperstone’s customer support is available 24/7 in English and Arabic. They are reachable through email, live chat, and phone.

Pepperstone Key Features For Forex Traders:

- Nr. of forex currency pairs: 60+ Forex pairs and 700+ different CFDs

- Average spread (EUR/USD): 0.0 pips

- Trading platforms: MetaTrader 4, MetaTrader 5, cTrader

- Maximum leverage: 1:400

- Regulators: FCA, FSA, ASIC, CySec

- Islamic swap free account: YES

- Micro lot trading: YES

- Recommended experience Level: Average and experienced traders

- Supported trading strategies: Day trading, Algorithmic trading, Swing trading, Scalping

- Nominated: best CFD trading platforms in UAE

74-89% of retail CFD accounts lose money

6. Saxo Bank – Leading Forex Broker for Professional Traders

BEST FOR: High Volume Trading

LEVEL: Advanced

FX PAIRS: 200 spot, 125 forwards

MAX LEVERAGE: 1:500

69% of retail investor accounts lose money when trading CFDs with this provider.

Saxo Bank is a Danish investment bank, founded in 1992. With 200 currencies, they have the biggest selection of forex pairs. They charge average spreads of 0.7 pips EUR/USD. High liquidity is provided through 99.01% fill rate.

Saxo Bank’s trading platform has a variety of advanced trading tools including enhanced trading tickets, extensive charting tools, options chains and fundamental & technical analysis tools. Users can implement third party integrations such as MultiCharts, TradingView, Updata and Dynamic Trend.

Saxo Bank Spreads and Commission

Saxo Bank’s spreads vary based on account type. Spreads charges on two main Saxo Bank accounts are compared below.

- An average spread of 0.7pips (EUR/USD) on classic account

- An average spread of 0.5pips (EUR/USD) on the VIP account

Saxo Bank Account Types

Saxo Bank’s accounts types are listed below.

- Saxo Account

- Joint Account

- Corporate Account

- Professional Account

All accounts have access to an Islamic account option. Minimum deposit required to open a live account is $2,000. Deposit and withdrawals are available through credit cards and bank wire transfers.

Saxo Bank Availability of Assets

Saxo Bank offers access tp 60,000 financial instruments including 200 forex spot pairs and 125 forwards. This makes them finish as the best forex brokers for availability of forex currency pairs.

| Broker | AvaTrade | eToro | Multibank | Plus500 | Pepperstone | SaxoBank |

| Forex | 59 | 49 | 55 | 66 | 100 | 190 |

| CFD Stocks | 100 | 2800 | 2000 | 1900 | 1400 | 7800 |

| CFD Indices & ETFs | 29 | 250 | 27 | 125 | 124 | 1120 |

| CFD Commodities | 15 | 54 | 13 | 24 | 32 | 20 |

| CFD Bonds | 0 | 12 | 0 | 0 | 0 | 8 |

| CFD Crypto | 14 | 10 | 11 | 19 | 21 | 0 |

| Max. Leverage | 1:400 | 1:30 | 1:500 | 1:30 | 1:400 | 1:30 |

Saxo Bank Platforms

Saxo Banks has two proprietary trading platforms: SaxoTraderGO and SaxoTraderPRO. All platforms allow integration of third party extensions including: MultiCharts, TradingView, Updata and Dynamic Trend. Saxo Banks’s Fix and Open APIs allow algorithmic traders to deploy Expert Advisors and other automated trading software.

Customer Service

Saxo Bank customer service is available by phone, email, and live chat in English, Arabic and over 20 other languages. VIP clients have access to personal expert meetups, exclusive events, and 1:1 strategy advice.

Saxo Bank Key Features For Forex Traders:

- Nr. of forex currency pairs: 200 forex spot pairs and 125 forwards

- Average spread (EUR/USD): 0.7 pips

- Trading platforms: Proprietary, MultiCharts, TradingView, Updata, Dynamic Trend

- Maximum leverage: 1:500

- Regulators: ASIC, SFC, JFSA, MAS, FINMA, FCA

- Islamic swap free account: YES

- Micro lot trading: YES

- Recommended experience Level: Advanced traders

- Supported trading strategies: Day trading, scalping, high volume trading

69% of retail investor accounts lose money when trading CFDs with this provider.

How To Find The Ideal Broker and Forex Trading Platform in UAE?

Criteria that help selecting the best forex broker and forex trading platform in UAE are listed below.

- Availability of forex trading instruments. Brokers with access to a wide range of forex instruments should be preferred. They allow deverzification, flexibility and hedging which increases chances for profit. The most common instruments are forex currency pairs, forex derivatives (forex CFDs, options, futures), ETFs and currency swaps, micro lots etc.

- Fees. There are two types of fees to be considered: trading fees (spreads, commissions) and non-trading fees (overnights, conversion fees, deposit and withdrawal fees). Brokers with low overall fees should be preferred.

- Forex Trading Platforms and Third Party Integrations. A wide range of platforms and integrations are offered by brokers. Some of the most popular forex platforms are: MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView. Knowledge level, trading style and trading goals consideration will help traders select the right forex trading platform.

- Reputation. Choosing a reputable broker helps avoiding scams. The following criteria build a brokers reputation: number of users, number of positive user feedback, number of tier-one licences.

- Experience level. Brokers offer trading features and tools for different experience levels (beginners, intermediate and advanced). Traders knowledge level needs to betaken into account.

- Personal Preferences. Preferences that need to be to considered when choosing a broker include: Religion (Islamic account options), Language (Arabic, English), Trading style (automated trading, swing trading, day trading, algorithmic trading, leverage)

There are a few things to be considered before choosing the best forex broker. Signing up with the right broker ( with the right trading features and fees), can make the different between making profit and loosing money.

Popularity and Trade Execution Of Top Choices Compared

Number of users and trade execution speed of the top choices are compared in the table below.

| Broker |

Popularity of broker |

Execution speed |

||

|---|---|---|---|---|

| AVAtrade | ||||

| eToro | ||||

| Multibank | ||||

| Plus500 | ||||

| Pepperstone | ||||

| Saxo Bank |

User Interface, Application and Dashboard Of Top Forex Brokers in Dubai Compared

AvaTrade

eToro

Multibank

Plus500

Pepperstone

Saxo Bank

What To Consider Before Starting With Forex Trading in UAE?

Characteristics to be considered by forex traders in UAE are listed and explained below.

Usage Of Demo, Micro-Lot and Cent Accounts

The usage of demo accounts (paper trading accounts), should be considered by beginners (unexperienced traders). These accounts allow users to test trading strategies without the risk of loosing money. They increase overall chances for profitable trading and prevent unnecessary looses. Micro lot accounts and cent accounts can be used instead of demo accounts.

Fixed Spread VS Variable Spread Brokers

Variable spreads change based on current market conditions (they are sensitive to volatile price movements) and can unexpectedly increase overall trading costs. Fixed spreads on the other hand allow forex traders to know exactly how much their current positions cost. To avoid unexpected increases of trading costs, fixed spread broker should be preferred (especially by high volume traders and day traders).

Trading Courses and Mentors

Forex trading courses and trading mentors help users expending their knowledge on trading. Better education of traders helps choosing the right broker, avoiding scams and making better investment choices. Courses and mentors to follow as a UAE trader are listed in this article.

Trading With Leverage

Trading with leverage (borrowed money from the broker) allows traders to amplify their trading position. While it increases potential profits, it also amplifies the risk of potential losses. Trading with leverage should be avoided by beginner traders because of the greater chances of loosing money.

Forex Trading Hours in UAE

Forex trading in UAE follows trading hours of the global forex markets. The forex market is open 24/5, from Sunday evening until Friday evening. The forex market has four major trading sessions: the Sydney session (5:00 AM to 2:00 PM UAE time), the Tokyo session (7:00 AM to 4:00 PM UAE time), the London session (11:00 AM to 8:00 PM UAE time), and the New York session (8:00 PM to 5:00 AM UAE time).

How Is Forex Trading Regulated in the UAE?

The United Arab Emirates (UAE) is a federation of seven emirates (Abu Dhabi, Dubai, Sharjah, Ajman, Umm Al Quwain, Ras Al Khaimah, and Fujairah). Forex trading regulation in UAE has two regions: the Dubai International Financial Centre (DIFC) and the rest of the UAE.

Dubai International Financial Centre (DIFC) is an economic free zone in Dubai, founded in 2002. It is regulated by the Dubai Financial Service Authority (DFSA). The DFSA oversees all financial activities in the area, including forex trading, licensing and monitoring activities.

The rest of the UAE is regulated by the Securities and Commodities Authority (SCA). The SCA is a federal government agency established in 2000. It is issues licences to forex brokers in UAE that meet their regulatory requirements including minimum capitalisation, risk management, client fund segregation, reporting and disclosure. The SCA overseas financial activities on security and commodity markets (exchanges) in UAE including the Dubai Financial Market (DFM), the Abu Dhabi Securities Exchange (ADX) and NASDAQ Dubai.

Forex Brokers do not require a licence from the SCA to accept clients from the United Arab Emirates. Broker authorisation can be verified by contacting the SCA support.

Getting Started With Forex Trading in UAE and Dubai in 2024

To start forex trading in the UAE or Dubai, choosing a well-regulated forex broker that ideally has a license issued by the DFSA or SCA is crucial. Follow these five steps to ease this process:

- Choosing a Regulated Forex Broker – Double-check whether your broker is SCA or DFSA-regulated, depending on whether you live within the DIFC or elsewhere in the UAE. Verify that your forex broker is well-capitalized, regulated, and financially stable.

- Use a Free Demo Account – Practice forex trading with a free demo paper trading account before trading with real money. Familiarize yourself with your brokers’ trading platform, software, and features before placing any real-money trades.

- Develop a Trading Plan – Develop a solid trading plan that suits your personal needs, goals, and risk appetite. Determine how much you want to make, what amount of money you want to risk per trade (or per day, week, or in total), the ideal trade size, and the duration of each trade.

- Identifying Favorable Trading Opportunities – Learn to spot favorable trading opportunities by looking at charts, conducting technical and fundamental analysis, or by using trading signals or Expert Advisors. It is mandatory to identify favorable trading opportunities for your trading strategy promptly.

- Test Your Forex Trading Strategy With Real Money – After demo trading, test your forex trading strategy with real money by opening a live account and trading the real forex markets. Start with an amount of capital you can afford to lose, and scale this up when you are ready.

RISKS OF FOREX TRADING:

Our experts want to take the time to warn you of the most important risks associated with forex trading in the UAE and Dubai – leverage and the percentage of retail investor accounts that lose money.

- Leverage – In forex trading, leverage can work to your advantage by magnifying your gains, but it can also backfire as it magnifies your losses as well.

- Rate of Success – Based on our recent studies, as much as 90% of all forex traders are estimated to lose money while trading the markets.

Paper Trading on Demo Accounts

Demo accounts allow users to practice forex trading, develop profitable trading strategies, and familiarize themselves with the financial markets. Our experts highly recommend opening a demo account before trading the live forex markets.

Developing a Trading Plan

‘’If you fail to plan, you plan to fail’’ is a common expression in business, and the forex market is no exception to this rule. Most traders methodically follow a written trading plan, which entails:

- Goal Definition – Determine your financial objectives, time horizon, and risk tolerance if you are new to trading.

- Trading Style Selection – Identify your trading style, reflecting your personal preferences, such as day trading, swing trading, position trading, or long-term investing.

- Strategy Development – Create a detailed forex trading strategy that outlines how you approach the markets. Criteria and methods that can be included are technical and fundamental analysis, indicators, entry and exit strategies, risk management techniques, and position sizing.

- Realistic Expectation Setting – Set realistic expectations for your forex trading journey to avoid disappointment later.

- Comprehensive Market Analysis – Conduct comprehensive market analysis to detect potential trading opportunities. Analyze charts, trends, news, economic indicators, and more, and consider the overall market situation.

- Risk Management Development – Protect your forex trading capital by deploying risk management strategies. Allocate only a certain amount of money or percentage of your portfolio per trade and stick to it. Naturally, this amount should be the maximum amount of money you are willing to lose per trade. Additionally, use Stop-Loss and Take-Profit orders to secure your profits timely.

- Trade Management Plan – Decide how you will manage and adjust your trades by using Stop-Loss and Take-Profit orders, trailing stops, or exit your trades manually.

- Trading Discipline Maintenance – Follow your developed trading plan thoroughly. Do not abandon or adjust your trading plan because of emotions or significant market volatility.

- Monitoring and Trade Evaluation – Keep a detailed record of your forex trading activity, including entry and exit values, profits and losses, and the reasons for taking each trade. Our experts recommend frequently reviewing and evaluating your trades to identify patterns, strengths, weaknesses, and more.

- Continuous Education—Stay up-to-date about the latest forex market trends, trading techniques, economic news, and more by attending seminars and webinars, reading books, following educational guides, watching tutorial videos, interacting with other traders, etc.

Identifying Trading Opportunities

Successful forex trading requires identifying profitable trading opportunities, which is done by watching out for strong currencies, researching well, focussing on a small set of forex pairs, keeping an eye on the news, accurate timing, using tools and indicators, and finding the right trading platform.

- Watching out for Strong Currencies – Forex traders should identify strong and weak currencies quickly. Strong currencies move with the trend and are often less volatile. Weak currencies are not traded as much as strong currencies and are less liquid.

- Research Well – Conducting research on the currencies you want to trade is crucial as a forex trader. Keep a close eye on major economic and global events that can effect currency prices, and try to spot positive or negative market surprises as fast as possible to profit from them.

- Focus on a Small set of Currencies – We recommend focusing on a small set of currencies in order to fully understand their trends, price patterns, and behavior. Trading fewer currencies leads to an increased focus on each currency and eases the procedure of researching them and conducting due diligence.

- Keep an Eye on the News – Keep an eye on the news to be up-to-date about the currencies you want to trade. It is crucial to follow all important economic, national, political, micro, and macro factors that can impact the values of these currencies.

- Focus on Timing – Forex traders need to act fast to capitalize on their trading opportunities. The markets are the most volatile during opening and closing, which could be ideal if you are risk-aversive.

- Using Tools and Indicators – Use tools and indicators like support and resistance, RSI, MACD, and more to support your technical analysis.

- Finding the Right Trading Platform – All the above factors are just as important as finding the right trading platform. Compare the best forex brokers in the UAE and Dubai in 2024 in this guide to find out which broker suits your personal needs the best.

Avoiding Forex and CFD Scams in the UAE and Dubai in 2024

The forex market is the largest financial market globally, with a daily turnover of over $6 trillion. This high number, combined with the effects of leverage, means there are always profit-making opportunities. However, this also counts for unethical business practices and outright scams because of the market’s size.

It is crucial to identify common forex scams promptly, understand the importance of regulated brokers, and trade with a broker that keeps its clients’ funds in segregated accounts and offers them negative balance protection.

There are many types of forex scams in broker and non-broker forms, with the most common ones being:

- Forex Mutual Fund (PAMM) Scams – When forex mutual funds claim their fund managers are professional while they aren’t, claim inflated returns, or charge excessive management fees, they should be avoided.

- E/A Trading Robots Scams – Expert Advisors (EAs) and trading robots are powerful trade automation tools, but ‘’guaranteed’’ or ‘’unlimited’’ returns don’t exist. Some EA trading robot scams involve free software if users deposit with a ‘’recommended’’ broker to generate commission for the scammer by referring new clients to the broker.

- Trading Signals Scams – Trading signals are trade ideas or suggestions sent to traders to help them spot profitable trading opportunities more easily. Individuals and businesses can create trading signals manually or automatically, relying on technical or fundamental analysis. Inflated accuracy like ‘’90%+’’ or free signals with ‘’recommended’’ brokers are red signals that should always be avoided.

- ‘’Holy Grail’’ Forex Scams – These forex scams promise to profit from the markets 24/7/365 because of some trading software, strategy, or other type of ‘’holy grail’’ system and should be avoided at all costs. There is no such thing as a holy grail in trading.

- Guaranteed Returns Scams – With these forex scams, users will earn fixed periodic profits in return for depositing funds at a recommended broker. Always keep in mind that there is no foolproof forex trading strategy that doesn’t come with losing positions every once in a while.

- Price Manipulation – Some forex brokers manipulate their trading platforms to be at a disadvantage of traders using techniques like negative slippage and a practice known as ‘stop hunting,’ where the broker takes the Stop-Loss of a trader before providing him with the correct quotes.

- Unusually High Leverage – Forex and CFD trading with leverage can profitable, but it can also backfire. Usually, brokers will allow retail traders to trade with a maximum leverage of 30:1, whilst professional and institutional traders are allowed to trade with up to 500:1 leverage. Unusually high leverage ratios like 2,000:1 and upwards can virtually only wipe out accounts with a single losing trade, and should be avoided at all costs.

- Unsegregated Client Bank Accounts – Scam forex brokers will use a single bank account for both their users’ and their own operational funds. This is definitely a bad practice, as traders’ funds will be comingled with the brokers’ in the case of of a bankruptcy, and porbably not returned.

- Fake Bonuses and Promotions – Many forex brokers offer generous bonuses and promotions to attract and retain clients, but shady brokers lure traders and investors with bonuses and promotions that ‘’lock’’ the trader in, making sure they cannot withdraw their own deposited funds or any profits made.

- Personal Data Scams – Scam forex brokers harvest personal data from their users and sell it to data brokers or use it themselves to commit credit card fraud and other cybercrime-related felonies.

Avoiding Broker Scams

Broker scams can be devastating as they can empty unknowing victim’s savings accounts and have their personal and banking details copied and sold on the internet. It is crucial to protect yourself against forex scams by identifying a reputable and reliable broker, that is regulated by top-tier regulators like the DFSA, FCA, ASIC, or CySec. Further reading on what to do if you’ve been scammed.

Regulated brokers keep their client’s funds in segregated bank accounts and separate their working capital. These reputable brokers are also randomly checked to ensure they adhere to the strict rules set out by their regulators.

Most regulated brokers offer negative balance protection, a safeguard that ensures traders cannot lose more funds than they have deposited into their forex trading accounts. This prevents traders from racking up debts with their broker.

Video Summary

Watch a short recap of the top rated broker in the video below.

Conclusion

It can be difficult and time intensive to compare and evaluate services of different brokers in UAE to find the ideal option. Users need to collect and evaluate relevant information in order to make the optimal choice for their needs.

This guide does the hard work for our readers by comparing and evaluating the top choices for different types of traders and trading goals. The results of our analysis of the best forex broker in UAE are summed up in the table below.

| BROKER | AVG. SPREAD (EUR/USD) | NR. OF FOREX PAIRS | MIN. DEPOSIT | BEST FOR |

| AVAtrade | 0.9 pip | 59 | $100 | Low fix spreads |

| eToro | 0.9 pip | 49 | $200 | Beginners |

| Multibank | 0.0 pip | 55 | $50 | Trading Tools |

| Plus500 | 0.8 pip | 66 | $100 | Mobile Trading |

| Pepperstone | 0.6 pip | 138CFDs | $20 | Forex CFDs and app |

| Saxo Bank | 0.9 pip | 300 | $2,000 | Advanced traders |

FAQ

How To Know If A Forex Broker Is Trustworthy?

Trustworthy broker are licensed by top-tier financial authorities and have a scam free history record. Top tier regulators in UAE include the SCA, DFSA and FSRA.

How to check If a broker is licensed by the SCA?

To check if a brokers is licensed by the SCA, residents need to contact their support. The SCA does not provide a public list of regulated brokers.

Is forex trading legal in the UAE?

Yes, trading forex in the UAE is legal, and citizens have access to both domestic and offshore forex brokers.

What Is The Difference Between A Dealing Desk And An Agency Broker?

A dealing desk broker processes forex trades on his own, while an agency broker routes their clients trades to another dealer.

What kind of forex brokers have the lowest spreads?

No Dealing Desk Brokers (NDD) and Electronic Communications Network brokers (ECN) offer the lowest spreads.

Is forex trading Halal?

Forex trading is considered halal if a swap free account and a trading strategy are used.

How are profits made with forex trading taxed in UAE?

Profits of UAE citizens and companies generated though forex trading are not subject to income tax. Profits of expats and tourists living in the UAE are subject to tax laws of their country of residence.

Are UAE citizens and expats allowed to trade with international (offshore brokers)?

Yes, both UAE citizens and expats are allowed to trade with offshore brokers that accept clients from the UAE.

Which forex platforms allow direct AED (Dirham) deposits?

Platforms that allow direct AED deposits include eToro, IBKR and AvaTrade.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.