Page Summary

This guide helps users to find the best forex brokers in UAE with high leverage. Trading with leverage is a popular trading instrument in UAE as it allows trading with bigger positions and increases potential for profits and in turn losses. Due to the variety of brokers that offer trading with leverage and different conditions of their service, it can be a daunting task to choose the ideal option for individual needs.

Comparing, researching and evaluating different providers and their services can help traders to select a broker with high maximum leverage, low fees, wide range of currency pairs and reliable trade execution.

This guide assesses 77 online brokers in UAE that offer trading with leverage. To help users make an informed decision, forex brokers are evaluated and reviewed considering fees, number of currency pairs, max leverage, minimum deposit, risk management tools, customer support, and educational materials.

To help users analyze and find the ideal option for their needs, the 5 best high leverage forex brokers in UAE are listed below.

Best High Leverage Forex Brokers in UAE

- eToro – Best Overall High Leverage Forex Broker

- Capital.com – Best High Leverage Trading Platform

- Libertex – Offers 600:1 Leverage for Professional Traders

- Skilling – Offers 500:1 Leverage

- AvaTrade – Best High Leverage Broker for Expert Traders

- VantageFX – Top High Leverage Forex Broker

- FinmaxFX – Offers 200:1 Leverage for Retail Traders

- Plus500 – User-friendly High Leverage Trading for CFD’s on Forex Instrument’s

- Forex.com – Offers over 90 Forex Pairs for Forex Traders and High Leverage

- FXTM – Offers the Highest Leverage of 1000:1

Top High Leverage Brokers Reviewed

The highest rated high leverage forex brokers in UAE are reviewed below.

1. eToro – Best High Leverage Forex Broker for UAE Traders

Min Deposit: $100

Fees: 4.8

Assets available: 4.8

Total Fees:

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro is the best high leverage forex broker that also offers access to social trading. You can trade on over 50 forex pairs with leverage up to 30:1 or trade cryptocurrencies, stocks, and ETFs with leverages between 5:1 and 10:1. You can open a professional trading account with eToro to increase your maximum leverage on forex pairs to 400:1 after passing a test. If you don’t want to trade the markets yourself, you can use eToro’s social trading platform to copy the trades of expert high-leverage traders.

Pros

- Up to 30:1 leverage on standard accounts and 400:1 on professional accounts

- Licensed and regulated broker

- Low minimum deposit of only 200 AED

- Offers social trading

Cons

- Charges inactivity and withdrawal fees

- Few technical analysis tools are available

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

2. Capital.com – Best High Leverage Trading Platform in the UAE

Min Deposit: $20

Fees: 4.8

Assets available: 4.7

Total Fees:

CFD trading carries risk. Capital.com is regulated by the Securities and Commodities Authority.

Capital.com offers UAE traders up to 30:1 leverage. They have their own proprietary trading platform, which is compatible with MetaTrader 4. You can trade over 140 currency pairs via Capital.com and open an account for only 75 AED. Capital.com doesn’t charge any commission and has low spreads. They offer technical analysis tools and educational material to their traders.

Pros

- Up to 30:1 leverage

- Possible to connect with MetaTrader 4

- Offers over 140 currency pairs

- Low minimum deposit to open account

Cons

- Only CFD trading

- No options trading

CFD trading carries risk. Capital.com is regulated by the Securities and Commodities Authority.

3. Libertex Review March 2024 – Offers 600:1 Leverage for Professional Traders

Libertex is a regulated forex broker that has been in business for over 25 years and that offers up to 600:1 leverage to professional traders. Retail traders can trade with up to 30:1 leverage on Libertex. Libertex offers trading via MT4, MT5, and their own trading platform. On all these platforms you can trade 51 currency pairs with high leverage. You can open a Libertex account from 40 AED.

Pros

- 30:1 leverage for retail traders and 600:1 for professional traders

- Over 25 years in business as regulated broker

- Low minimum deposit to open account

Cons

- Offers few other assets to trade

4. Skilling – Offers 500:1 Leverage to UAE Forex Traders

Skilling is a new forex and CFD broker that offers up to 500:1 leverage on major currency pairs, and 200:1 on minor ones to UAE traders. With Skilling you can trade gold shares with up to 200:1 leverage, commodities with up to 100:1 leverage, stocks with 10:1, and cryptocurrencies with 5:1. On Skilling, you can trade 800 different financial instruments and they offer social trading services. Skilling doesn’t charge trading fees but only spreads and is regulated by the FSA and CySEC.

Pros

- Offers high leveraged trading to UAE traders

- Doesn’t charge trading fees

- Offers social trading

Cons

- Doesn’t offer ETFs

5. AVAtrade – Best High Leverage Broker for Expert Traders

AvaTrade is the best high leverage broker for expert traders known for its advanced trading tools, multiple trading platforms and leverage up to 400:1 on forex currency pairs. You can trade commodities with up to 200:1 leverage, ETFs with 20:1, and 10:1 on stocks with AvaTrade. For Muslim UAE-based traders AvaTrade offers Islamic forex trading accounts.

Pros

- Offers up to 400:1 leverage

- Has Islamic accounts available

- Compatible with MT4 and MT5

Cons

- Charges margin fees

71% of retail CFD accounts lose money

6. Vantage – Top High Leverage Forex Broker

Vantage offers UAE traders up to 500:1 leverage on forex pairs and a range of trading platforms. You can use technical analysis tools on VantageFX and they offer free forex signals, negative balance protection, fast execution, and even a 50% welcome bonus. For Islamic traders from the UAE VantageFX offers Swap-Free Islamic accounts.

Pros

- Offers up to 500:1 leverage

- Doesn’t charge spreads

- 50% welcome bonus for new traders

- Islamic accounts available for Muslim traders

Cons

- Not regulated by top-tier regulators

74-89% of retail CFD accounts lose money

7. FinmaxFX – Offers 200:1 Leverage for Retail Traders

FinmaxFX is a forex broker that offers 200:1 leverage on forex pairs for retail traders. It isn’t regulated by FCA or CySEC, which is why it can offer this high leverage. You can trade over 50 currency pairs and 400 other assets with FinMax and they support automated trading.

Pros

- Offers up to 200:1 leverage

- Supports automated trading

- Compatible with MT4 and MT5

Cons

- Charges high inactivity and withdrawal fees

- Not licensed by top-tier regulators

8. Plus500 – User-friendly High Leverage Trading for CFD’s on Forex Instrument’s

Plus500 is a CFD and CFD on Forex instrument’s broker that offers up to 1:30 leverage to retail traders and 300:1 to professional traders. Plus500 is regulated by CySEC, FCA, and DFSA. You can trade over 70 CFD on forex instrument pairs with them, but also other CFD’s like stocks, commodities, options and ETFs. Recently they added CFD options to their available assets.

Pros

- Offers up to 300:1 for professional traders and 30:1 for retail traders

- Offers CFD options

- Regulated by top-tier regulators

Cons

- Charges high overnight fees

CFD Service. Regulated by the DFSA. Trading carries risk.

9. Forex.com – Offers over 90 Forex Pairs for Forex Traders and High Leverage

Forex.com is one of the best high leverage forex brokers for UAE traders. They offer up to 50:1 leverage on over 90 currency pairs, which is more than most forex brokers have available. Forex.com charges low spreads and is an STP broker. Apart from forex, you can trade over 4,500 assets with them, including stocks, cryptocurrencies, ETFs, indices, and commodities.

Pros

- Over 90 currency pairs

- Over 4,500 available assets

- Transparant licensed and regulated STP broker

Cons

- Unclear trading fees

80% of retail CFD accounts lose money

10. FXTM – Offers the Highest Leverage of 1000:1

FXTM offers the highest possible leverage of 1000:1. They charge low spreads and don’t reduce the maximum leverage on smaller account types. On some assets, they don’t charge spreads. You can trade forex majors with 1000:1 leverage, minor pairs with 500:1 leverage, and exotic forex pairs with 50:1 leverage with them.

Pros

- Offers up to 1000:1 leverage

- No spreads on certain assets

Cons

- Few available assets apart from currency pairs

80% of retail CFD accounts lose money

How to Choose The Ideal Forex Broker For Trading With High Leverage in UAE?

Criteria that need to be considered to select the optimal forex broker for trading with leverage are listed below.

- Number of forex trading instruments

- Maximum leverage ratios

- Requirement for trading with leverage (some brokers require additional verification)

- Fees (trading fees and non-trading fees)

- Trading Platforms and Third Party Integrations ( MetaTrader 4, MetaTrader 5, cTrader, TradingView)

- Reputation (number of users, number of positive user feedback, number of tier-one licences)

- Personal Preferences (Religion, Language, Trading style)

Top Brokers With High Leverage Compared

Key features of the top rated high leverage forex brokers in UAE are compared in the table below.

| Broker | Nr. of Forex Pairs | Maximum Leverage | Spreads on EUR/USD |

|---|---|---|---|

| eToro | 47 | 30:1 (EU) | 0.9 pip |

| Capital.com | 120+ | 30:1 (EU), up to 200:1 (non-EU) | 0.6 pips |

| Libertex | 50+ | 30:1 (EU), 600:1 (non-EU) | 0.9 pips |

| Skilling | 73 | 30:1 (EU), 500:1 (non-EU) | 0.7 pips |

| AvaTrade | 50+ | 400:1 | 0.9 pips |

| VantageFX | 40+ | 500:1 | 1.4 pips |

| FinmaxFX | 50+ | 200:1 | 2 pips |

| Plus500 | 70+ | 1:30 | 0.6 pips |

| Forex.com | 80+ | 200:1 (US), 400:1 (non-US) | 1.0 pips |

| FXTM (ForexTime) | 60+ | 1000:1 | 0.1 to 0.5 pips |

What is High Leverage Forex Trading?

High leverage forex trading is the practice of borrowing big amounts of money from brokers to open larger positions. Traders can trade the markets with small amounts of their own money and take bigger risks with high leverage forex trading because both the profit and loss potentials are multiplied. Brokers charge traders swap and overnight fees for borrowing money from them.

What is the Best Leverage for Forex Trading?

The best leverage for forex trading depends on your risk appetite. The higher the leverage, the more risk you take. Trading with higher leverage can increase your profits but also your losses. Some asset classes like cryptocurrencies are very volatile. Brokers don’t offer high leveraged trading on volatile assets because this is risky.

Why Should I Trade With leverage?

You should trade with leverage because you can trade with larger amounts of money by borrowing from your broker. This increases your profit potential.

High Leverage Trading Tips

We recommend traders that want to trade with high leverage to use trailing-stop orders and other risk management tools the broker offers, understand the value of a pip before opening a trade, apply a risk-reward ratio, and use the high leverage only for short-term trading.

Getting Started with High Leverage Forex Trading

You get started with high leverage forex trading by opening an account with a forex broker. In this guide, we will explain how to do this with eToro.

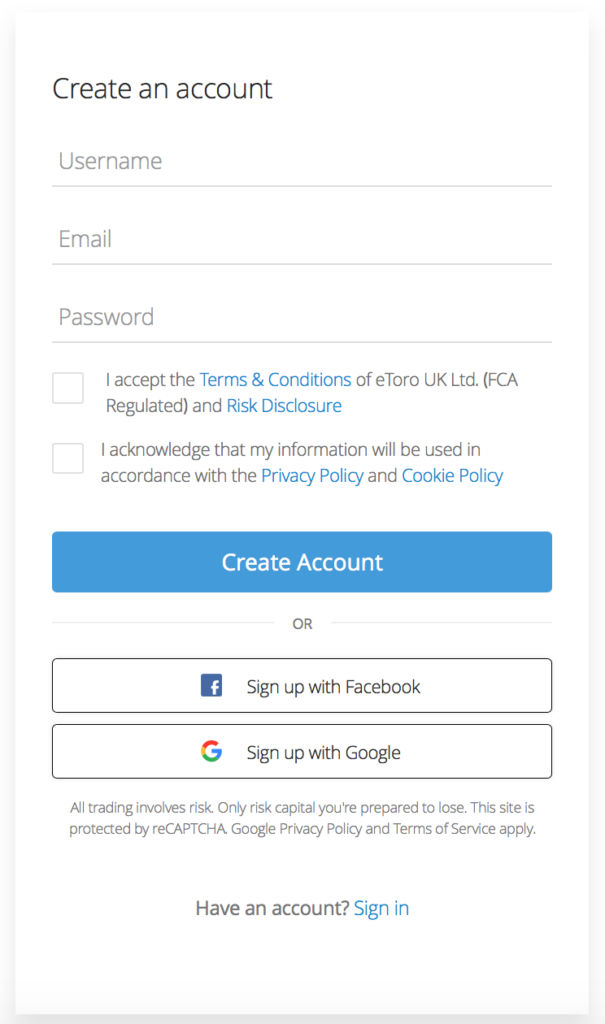

Open a Forex Trading Account

You open a forex trading account at eToro by going to the eToro website, clicking on ‘Sign Up’, choosing a username and password, filling in your email address, and accepting the terms and conditions. It is possible to sign up with Google or Facebook instead.

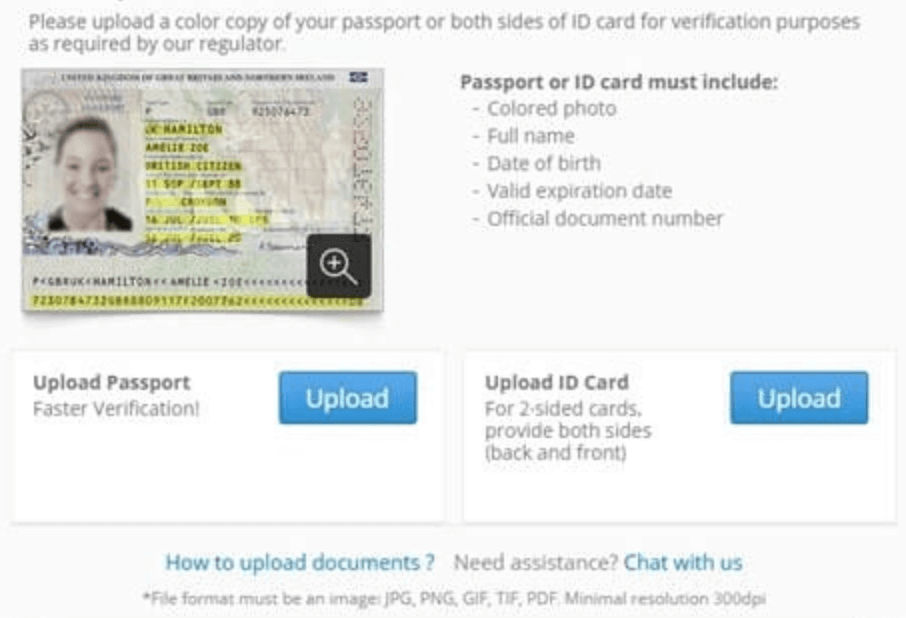

When you have created your account, you will need to verify your identity. You do this by going through the KYC procedure and uploading a picture of your passport, driver’s license, or national ID card, and a recent utility bill or bank statement.

Depositing Funds

Once your account is verified, you need to deposit funds into it. You do this by logging in to your account, clicking ‘Deposit’, and choosing a preferred payment method and the amount you want to trade with.

Practice High Leverage Trading with a Demo Account

We recommend practicing high leverage trading with a forex demo account before trading high leverage with real money. This way you familiarize yourself with the process.

Start Trading with Leverage

Once you are ready to trade with leverage with real money, start doing so with low leverage ratios and slowly move up to a level you are comfortable with.

Conclusion

Due to the wide range of available brokers, it can be difficult to compare and evaluate their service to find the ideal option. To make an optimal choice for their needs, traders need to collect relevant data and reviews them considering certain criteria.

Based on our review, we consider eToro as the best forex broker in UAE for leverage trading. Despite leverage rates of 1:400, they offer great copy trading features, an intuitive trading platform, and free demo accounts.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.