Business24-7.ae is committed to the highest ethical standards and reviews services independently. Learn How We Make Money.

eToro is a common choice among beginners looking for an easy-to-use platform and app, copy trading features, and access to multiple markets. It offers 0% commission on stocks and ETFs, Islamic swap-free accounts, and the biggest social trading community in the industry.

Page Summary

Review Summary

eToro is a multi-asset broker founded in 2007. It has licenses from three major financial regulators, including the FCA, ASIC. The broker offers access to 5,000 financial instruments, including stocks, ETFs, forex, cryptos, CFDs, commodities, and indices. Users can also invest long-term through pre-build thematic portfolios (Smart Portfolios).

eToro’s proprietary trading platform (Web Trader) and mobile app (eToro App) stand out for their slick design and intuitive trading features. These include a copy trading tool (CopyTrader) that allows users to follow and copy the trading strategies of other traders, making it a great fit for beginners.

Trading fees at eToro are slightly higher compared to similar brokers like AvaTrade and Pepperstone. They charge 0% commission on stocks, ETFs. eToro also charges overnight, inactivity ($10/month) and currency conversion fees ($5/conversion).

Below is a detailed break down of eToro’s services in each of the different categories staring with assets.

Assets (Best Stock Broker For Beginners)

eToro users can trade on over 5,000 financial instruments including:

- 2000 Shares

- 2000 Stocks as CFDs

- 52 Forex pairs

- 264 Funds and ETFs

- 32 Commodity

- 20 Index CFDs

- 74 Cryptocurrencies

Based on their vast coverage of different stocks & stocks as CFDs in combination with an easy to use platform and zero commission stock trading fees, we listed eToro as the top stock broker in UAE for beginners.

eToro also allows users to trade and invest in real cryptocurrencies ( and not only crypto CFDs). The option to buy stocks, cryptos and other assets using the same platform make eToro a great option for those looking to invest in both crypto and conventional asset classes.

eToro Commissions and Fees

With zero commissions on stocks and ETFs, 1% trading fees on cryptos, and wide spreads on forex currency pairs (1-3pips), eToros fees are industry average.

Users are also charged in the form of overnight fees (on CFD trades), currency conversion fees (0.0050 pips) and inactivity fees ($10/month).

Below we break down eToro’s trading and non trading fees in more detail:

Trading fees

| Trading Fee | eToro | Interactive Brokers |

| Stocks | $0,00 | $0,00 |

| Cryptocurrencies | 1% | 0,18% |

| Forex | 1pip (EUR/USD) | 0.9 pip (EUR/USD) |

| CFD | 0.5 to 1pip/trade | 0.05% |

While eToro trading fees are competitive when trading stocks, ETFs and cryptocurrencies, it is expensive to trade with currencies other than EUR/USD!

Non-trading fees

| Type of Fee | eToro | Interactive Brokers |

| Inactivity Fees | $10/month after 12 months of inactivity | No inactivity fees |

| Conversion Fees | 0.0050 pips | $50/conversion |

| Withdrawal Fees | $5 | None |

| Management Fees | None | None |

| Social copy trading fees | None | N/A |

With charges for inactivity ($10/month), withdrawal fees ($5/withdrawal), and currency conversion fees (if deposits are different than USD) eToro’s non trading fees are above industry average.

eToro Deposits & Withdrawals

Deposit and withdraw money on eToro is fast and simple. While a conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted.

Users can choose between the following deposit and withdrawal methods: Credit Cards (Visa, MasterCard, Diners Club, and Maestro), PayPal and Neteller. Traders can use Wire Transfer.

eToro’s minimum deposit is $100. Future deposits must be $50 or more. The only supported currency is USD.

eToro deposit and withdrawals compared with other brokers

| Broker | eToro | Interactive Brokers |

| Bank Wire | ✓ | ✓ |

| Credit/Debit card | ✓ | ✗ |

| E-Wallets | ✓ | ✗ |

| Crypto | ✓ | ✗ |

| Account Minimum | $200 | $0,00 |

| Deposit Charges | None | None |

| Withdrawal Charges | $5 | 1-free, next $10 |

Account Types

eToro offers 4 different account types:

- Professional account: requires the user to pass a knowledge test to get him ranked as a professional trader and also requires a minimum deposit of $10,000.

- Retail account: is the standard account type that provides access to all assets and all order types including self directed and copy trading

- Demo account: is the paper trading account that does not require any account approval and allows users to test their trading strategies before investing real money

- Islamic swap-free account: enabled traders to trade according to Sharia law. It does not allow you to trade or invest in Haram companies or cryptocurrencies!

All eToro account types allow you to trade:

- x30 for forex

- x10 for commodities

- x5 for CFD stocks and ETFs

- x2 for CFD cryptoassets

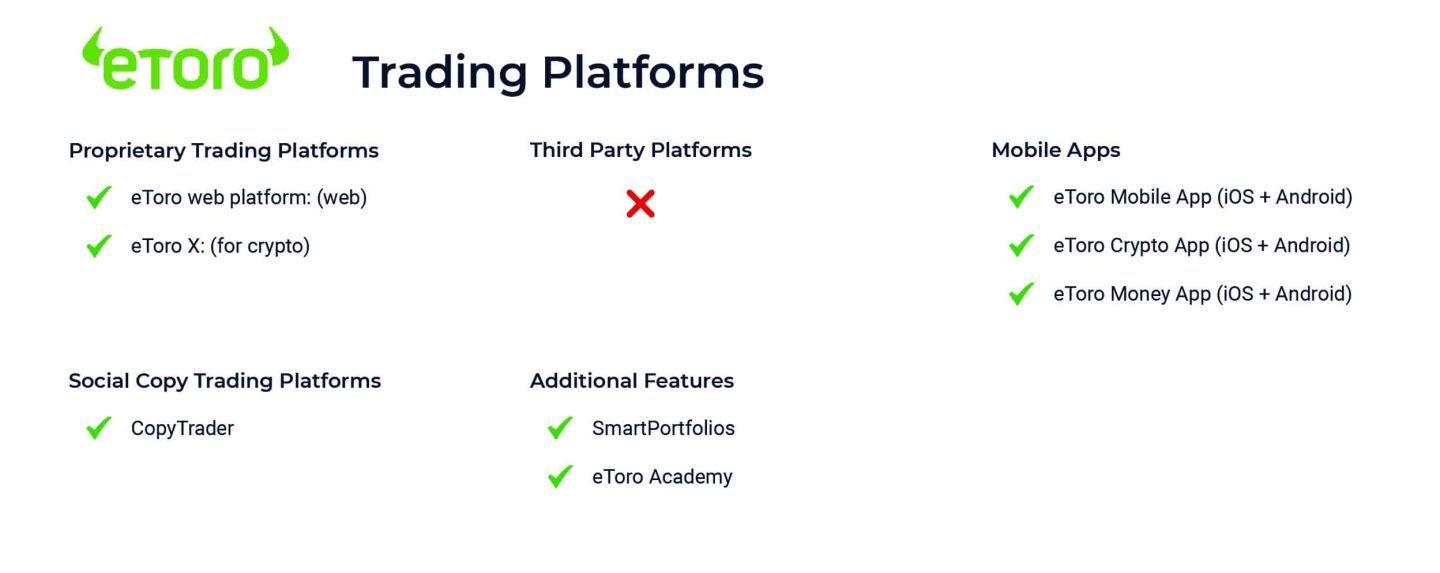

Trading Platforms and Tools (Best Trading Platform in UAE for Beginners)

eToro offers a multi asset trading platform that combines autonomous and social trading from the same dashboard. A huge variety of tradable assets, basic technical and analytical tools, and “ease of use” are additional benefits. Their online trading platform has a clean design and useful functions, especially for beginners.

Although eToro only offers one single platform for both desktop and mobile and does not allow any third party integrations, it still ranks among the top rated platforms in UAE and Dubai for beginners. This is because of their simple order types and highly intuitive features that include multiple charting options, order types, an easy-to-use search bar, filter system and watch list.

Note that the eToro’s platform does NOT support technical indicators, complex order types, or Expert Advisors. It is also NOT compatible with MetaTrader 4, MetaTrader 5, cTrader, or any other external platform or automated trading software. While this is great for beginners and casual traders not to get confused with too many trading features and options, professional traders will most likely find this set up lacking on advanced customization settings.

eToro platforms and tools compared with other brokers

| Broker | eToro | Interactive Brokers |

| Desktop Platform | ✓ | ✓ |

| Web Platform | ✓ | ✓ |

| Mobile Platform | ✓ | ✓ |

| Easy to Use | ✓ | ✗ |

| Watchlist | ✓ | ✓ |

| Market Depth/Level 2 | ✗ | ✓ |

| Advanced Charting | ✗ | ✓ |

| Trading Alerts | ✓ | ✓ |

| Demo Account | ✓ | ✓ |

| MT4/MT5 | ✗ | ✗ |

| TradingView | ✗ | ✗ |

| Other non-Proprietary | ✗ | ✗ |

| Proprietary | ✓ | ✓ |

| Social/Copy Trading | ✓ | ✗ |

| Strategy Tester | ✗ | ✓ |

| Scalping | ✓ | ✓ |

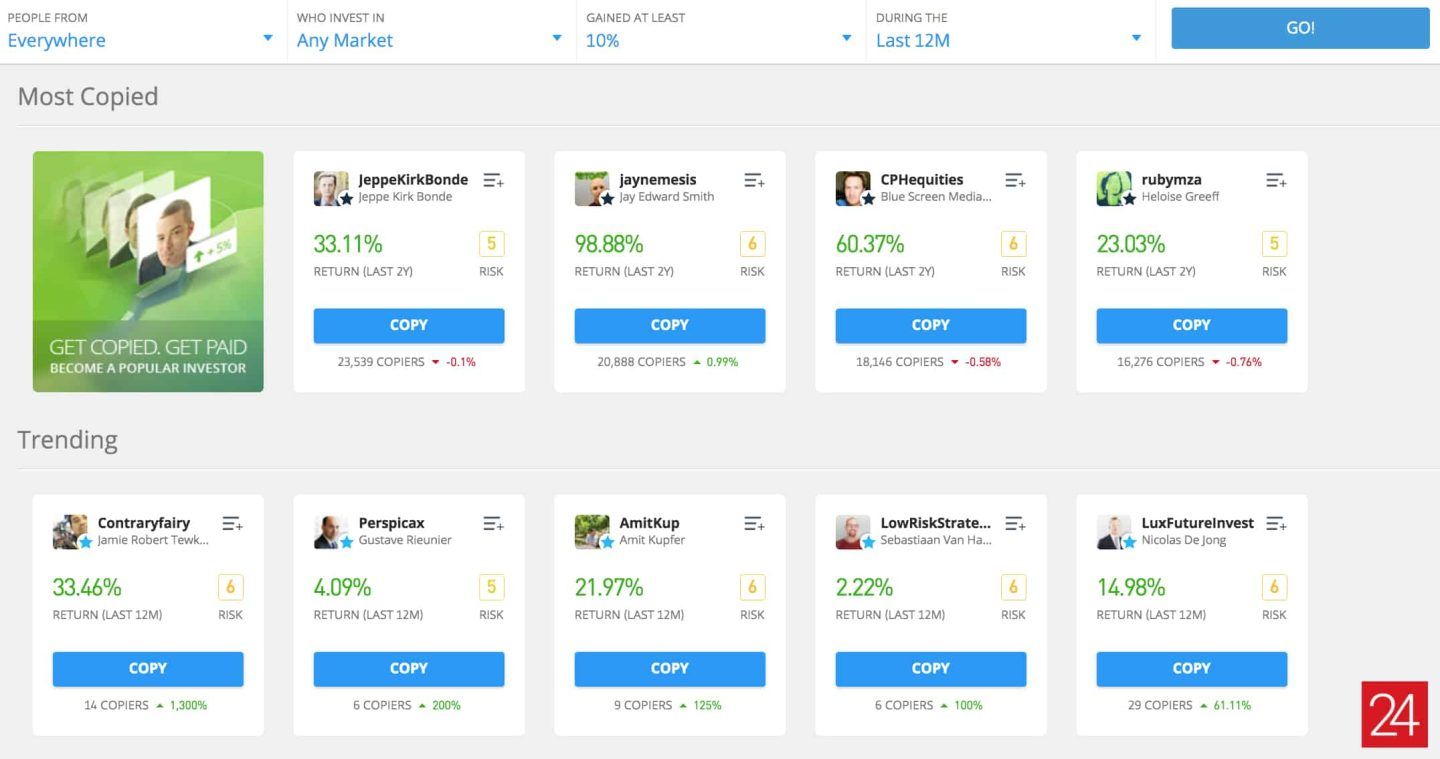

“Best In Class” For Social Trading

The most unique feature of the eToro platform is its social trading component where users can interact, discuss ideas, share trading strategies with other traders, and even copy their trades using eToro CopyTrader. You don’t need any automated trading software or expert advisor to automate your trading with this feature. Simply click a trader, review their statistics, and decide with what part of your account (percentage or amount of money) you want to copy their exact trades.

“Past performance is not an indication of future results”

Another useful feature for beginners is Smart Portfolios. These are ready-made thematic portfolios such as medical cannabis or driverless cars that you can add to your own portfolio to diversify your investments in a strategic manner. A minimum account balance of $500 is required to be able to use this feature.

eToro Research and Education

Besides having a beginner-friendly platform, eToro also offers an extensive research and education section that helps novice traders one their first trading steps. The education section is split up into three sections:

1. eToro Academy: offers basic educational materials and trading examples that will help beginners to read the platform’s features, charts, and trade options.

2. eToro Plus: provides traders with daily insights in the form of technical and fundamental analysis

3. The Bull Club is a daily podcast where users can listen to financial leaders and investors discussing macro-economic topics that can help make the right trading moves.

When it comes to research, eToro provides a comprehensive list of technical tools, charts, and newsfeeds. Those include analyst consensus, price targets, hedge fund sentiments, and insider trading sentiments. They are very useful research tools, but only available for a few of the best known stocks.

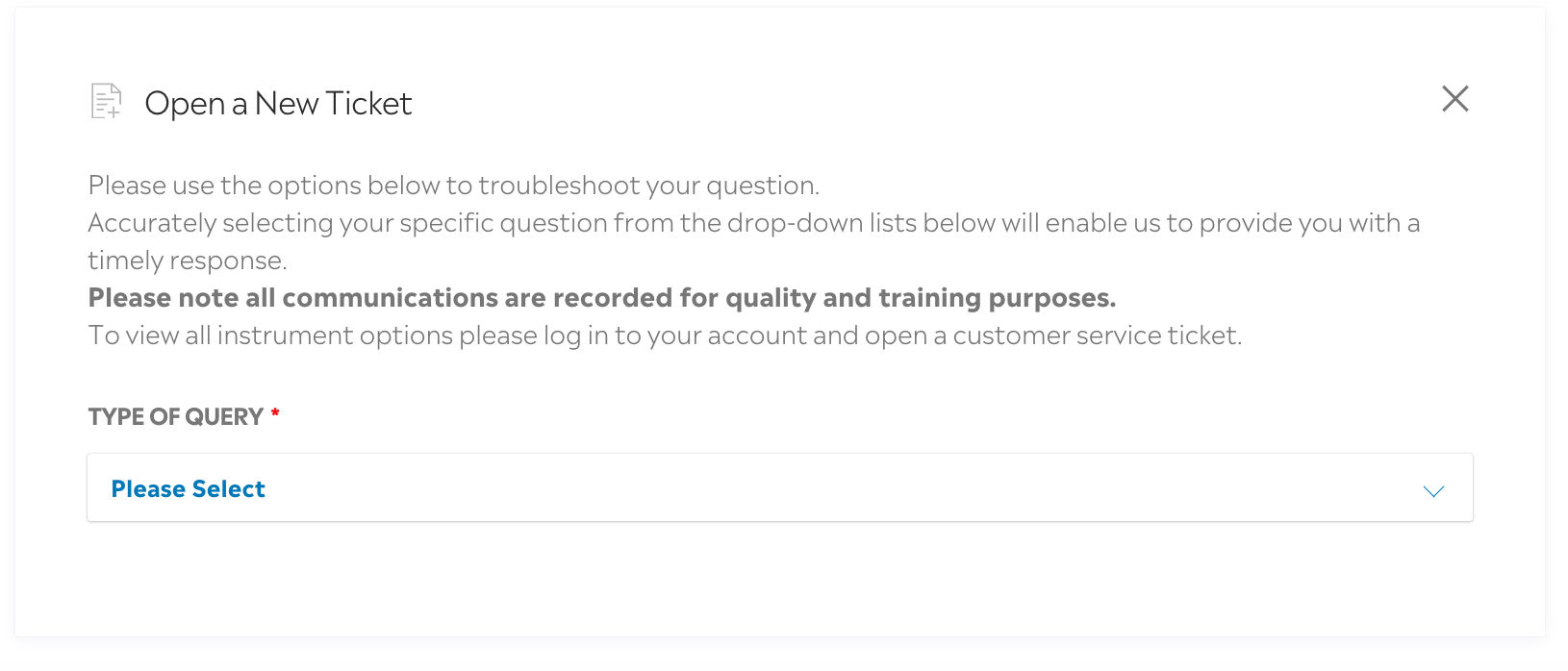

Customer Service

During our testing periods, the eToro customer service was responsive and available around the clock via live chat in English and Arabic. The problems we had setting up the trading dashboard were fixed in a reasonable time frame. Their average email response time is 24h.

eToro Regulation

eToro is regulated by two tier-1 regulators; FCA and CySEC. This means that eToro is a safe broker to trade with.

eToro UAE Special Features

- This broker is regulated by top-tier financial regulators and is considered safe for UAE and Dubai citizens.

- The minimum deposit for eToro UAE users who are using an Islamic account is USD 1,000.

- eToro offers islamic accounts for people who want to follow Halal and Islamic finance restrictions while investing

- UAE users can’t deposit money into their account in AED. A conversion fee of $50 is automatically applied to convert AED deposits to USD

eToro – The Good and Bad

Pros

- Access to over 4000+ tradable symbols

- Great overall market coverage

- Easy to use mobile trading app and platforms

- Industry leading social/copy trading app

- Great cryptocurrency trading features

- Responsive customer support

Cons

- Algorithmic trading not available

- Forex and CFD fees above industry average

- Education and research tools missing

Is eToro Legal in UAE?

eToro has received primary authorization (In-Principle Approval) from the Abu Dhabi Global Market (ADGM), allowing the company to offer brokerage services in the UAE’s security, derivative, and crypto markets. The initial approval marks a significant milestone in obtaining the necessary license from the ADGM, which will allow eToro to legally offer financial services in the UAE.

Does eToro Have Offices in UAE and Dubai?

While eToro does not presently have offices in the UAE, its worldwide operational framework is designed to guarantee flawless service delivery and support for clients based in the UAE. The entity responsible for accounts of UAE clients is eToro AUS Capital Limited, which has its headquarters in Australia.

What Is eToro’s Phone Number For UAE Clients?

eToro does not provide a designated local phone number for its customers located in the UAE. eToro’s customer support is accessible through the various other channels listed below.

Support ticket system

Users can contact the customer service by opening a support ticket through their account dashboard.

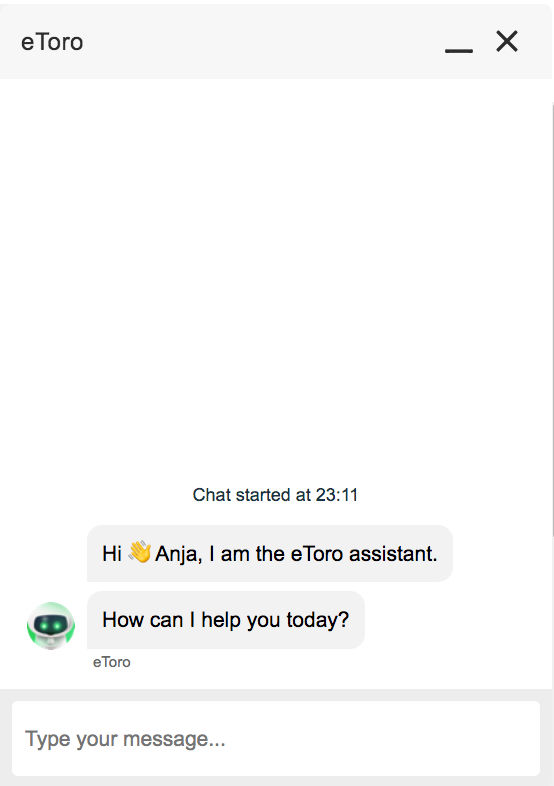

Live Chat-Bot

eToros live chat feature helps resolving user questions in real time. Note that the lice chat feature is only available on week days (24/5).

Users can get directly in touch with eToro’s customer support team via their email support@etoro.com

Does eToro Work in UAE?

The answers is Yes! eToro does not have any limitations in place for customer based in the UAE. Their platform and app are available with all features, add-ons and tools. There are no restrictions, no special requirements or exceptions for United Arab Emirates users.

Conclusion

With easy to understand order types, a highly intuitive platform interface, and responsive customer support in Arabic, it is easy to understand why eToro is popular among beginner traders. Keep in mind that eToro also offers a great social trading platform and the world’s largest social trading community that both help newcomers to step into the markets confidently.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.