Page Summary

This guide helps users to find the best HFX trading platforms in UAE. With the rising number of online brokers that offer high-frequency trading, it can be hard for traders to select the optimal platform for their trading goals and preferences.

Doing detailed research, comparison, and due diligence on available services can help traders to avoid selecting a platform lacking in order execution speed, reliability, trading tools & features, and availability of assets.

This guide assesses 58 online brokers in UAE for users to review, compare and find the ideal platform for their needs. To help them make an informed decision, a list of the best HFX trading platforms in the UAE is shared below, followed by detailed review sections and comparisons.

TOP 5 HFX Trading Platforms UAE

- IC Markets – Lowest Fees

- Capital.com – Ideal For Mobile Trading

- AVAtrade – Best For Forex overall

- IG Trading – Best Trading Platform Selection

- ETX Capital – Highest Speed of execution

The Best HFX Brokers In UAE Reviewed

Online brokers with the highest rated HFX platforms in UAE are reviewed below.

1. IC Markets – Best Fees

Min Deposit: $200

Fees: 4.7

Assets available: 3.6

Total Fees:

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71,65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

IC Markets is reputable online forex and CFD broker great for investors looking for high frequency trading (HFX). Regulated by financial authorities including ASIC and CySec, they offer HFX traders access to over 60 tradable forex and fiat/cryptocurrency pairs. High-frequency trading is a breeze as they support the usage of EAs and other forms of automated trading via their API. IC Markets offers up to 1:500 leverage and charges low, floating spreads from 0,0 pips on major currency pairs.

Users have access to multiple trading platforms compatible with MetaTrader, cTrader, myfxbook AutoTrade, and ZuluTrade. Professional traders can open a Raw Spread, Standard or Islamic account at IC Markets and set up their complex algorithms via trading bots straight away, whilst beginners can practice trading and tweak their settings first with the available unlimited demo paper trading account.

You can fund your IC Markets account by bank transfer, credit card, or e-wallets like PayPal at 0% commission and receive access to a free VPS server after opening an account with them.

Pros

- Algorithmic trading available with MetaTrader 4 (MT4), TradingView, and APIs

- Competitive fees for Forex pairs

- Fast and reliable trade execution

Cons

- Deos not offer VPS service

- Swap-free account is not available

Key features

- Access to over 4,100 CFDs on stocks, bonds, indices, commodities, forex, and digital currencies

- Islamic swap-free accounts available on request

- Compatible with MetaTrader 4, 5, cTrader, ZuluTrade, and Myfxbook AutoTrade

- Raw spreads from 0,0 pips

- Well-suited for both beginner and experienced traders

- Expert Advisors and other forms of automated trading allowed

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71,65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

2. Capital.com Review – Best For Mobile Trading

Min Deposit: 20 USD/EUR/GBP or 80 AED (bank cards)

Fees: 4.8

Assets available: 4.7

Total Fees:

CFD trading carries risk. Capital.com is regulated by the Securities and Commodities Authority.

Capital.com is a low-entry CFD and forex broker where HFX traders can trade over 125 forex and pairs and over 4,100 CFDs on stocks, commodities, cryptocurrencies, and other financial instruments. Although Capital.com doesn’t offer digital options trading, high-frequency traders can make use of their extensive API built in REST style in combination with their WebSocket API to open countless positions, set stop and limit orders, set stop-loss (CFD trading carries risk. Capital.com is regulated by the Securities and Commodities Authority.

) and take-profit levels, and receive both real-time prices and price history of all available assets.

Capital.com has its own proprietary Web Platform and trading app but is also compatible with MetaTrader 4. HFX traders can use 75 technical indicators and all of TradingView’s dynamic charting features as Capital.com has partnered up with TradingView. Simply open your TradingView trading panel and authorize Capital.com to connect your Capital.com account with TradingView.

HFX traders can get started at Capital.com by opening an account from $20 or test and finetune their Expert Advisors and other automated trading software with Capital.com’s free demo account first. Note that two-factor authentication is required prior to API key generation to set up your algorithmic trading software.

Pros

- Algorithmic trading available with MetaTrader 4 (MT4), TradingView, and APIs

- Competitive fees for Forex pairs

- Fast and reliable trade execution

Cons

- No VPS service

Key features

- Access to 4.100 CFDs

- High quality research and educational content

- Patented AI trade bias system

- $20 minimum deposit

- No inactivity fees

CFD trading carries risk. Capital.com is regulated by the Securities and Commodities Authority.

3. AVAtrade – Best For Forex overall

AVAtrade is one of the best online brokers for HFX, CFD, and options trading. High-frequency traders can trade CFDs and digital options on over 1365 financial instruments at AvaTrade, including more than 40 forex and fiat/cryptocurrency pairs. AvaOptions provides access to 13 option strategies, real-time price streams, visual risk management tools that clearly show Delta, Vega, Theta, and implied volatility levels, and allows traders to compile custom watchlists.

AvaTrade fully supports all types of algorithmic trading via both MetaTrader 4 and MetaTrader 5, DupliTrade, and ZuluTrade. Set up Expert Advisors, custom indicators, deploy scripts available from the Library or create your own with MetaEditor.

A free virtual private Server (VPS) is available for every trader with either a real or risk-free AvaTrade demo account. You can upload your EAs right after account opening and run them 24/7 with 100% uptime guarantee.

Account opening is fast, and deposits and withdrawals are free of charge. The minimum deposit is $100.

You should choose AvaTrade if you want to trade both forex and digital options or when you are looking for a regulated broker with a robust infrastructure that caters to HFX traders by providing a free VPS and access to MT4, MT5, DupliTrade, and ZuluTrade.

Pros

- Algorithmic trading available with MetaTrader 4 (MT4), TradingView, and APIs

- Competitive fees for Forex pairs

- Fast and reliable trade execution

Cons

- Deos not offer VPS service

- Swap-free account is not available

Key features

- Access to 1250 CFDs and 44 forex options

- Excellent copy trading features

- Advanced mobile trading app (AvaOptions)

- Industry average pricing

- Perfect for casual and advanced traders

- Access to the full meta trader suite

71% of retail CFD accounts lose money

4. IG Trading – Best Trading Platform

IG is one of the best brokers for HFX trading that has been in business since 1974. With IG Markets you can trade over 90 forex pairs and CFDs on over 18,000 stocks, commodities, indices, and other financial instruments. High-frequency traders can deploy Expert Advisors and other automated trading software via either IG’s cutting-edge ProRealTime trading platform using IG’s native APIs or create their own EAs and trading scripts using MetaTrader 4’s MetaEditor. With ProRealTime, high-frequency traders can set price action algorithms according to market size, time frame, size of the trades, and time of the day the algorithm should operate.

IG offers an extensive range of backtesting tools which high-frequency traders can use to refine their algorithms and EA settings against historical price data to establish the best combination of buy or sell parameters. High-frequency traders also have the option to finetune their algorithmic trading settings on IG’s unlimited free demo account before trading with real money to ensure maximum profitability.

Pros

- Algorithmic trading available with MetaTrader 4 (MT4) and ProRealTime (PRT) trading platforms; also APIs

- ProRealTime platform accessed via APIs

- Reliable trade execution

Cons

- No VPS service

Key features

- Trade over 17,000 markets with a broker that has been in business since 1974

- Access to Turbo24s, and CFDs and options on forex, indices, crypto, stocks, and commodities

- Unlimited free demo paper trading account

- Advanced research and analysis tools like L2 Dealer and ProRealTime

- Access to APIs to set up Expert Advisors and other automated trading software

- Receive trading signals and alerts to find excellent entry and exit points

75% of retail CFD accounts lose money

5. ETX Capital – Best Speed of execution

ETX Capital, recently rebranded to OvalX, is a top-tier brokerage firm that has been in business since 1965, that offers traders access to over 6000 tradable symbols via their OvalX Trader Pro platform. ETX Capital is regulated by the Financial Conduct Authority, offers CFDs on over 60 forex and fiat/crypto pairs, indices, shares, and commodities, and is compatible with MetaTrader 4. You can set up your own Expert Advisors with MetaEditor or find algorithmic trading scripts written by other traders to use in MetaQuote’s extensive EA library.

ETX Capital charges low, fixed spreads and has multiple advanced order types available like GTC, GSLO, and OCO. Apart from many different order types they offer over 60 indicators and 14 drawing tools, providing high-frequency traders with the technical analysis tools they need to successfully analyse their automated trading strategies.

High-frequency traders can keep track of their portfolio and performances of their trades on the go with the two apps ETX Capital has available, the OvalX Trader Pro and the MetaTrader 4 trading app.

The ETX Capital customer service can be contacted 24/7 by email, live chat, and phone and is of excellent quality as can be concluded from their 4,5/5 star rating of over 247 reviews on TrustPilot.If you are looking to trade high-frequency with a reliable, regulated broker, we highly recommend trading on ETX Capital’s new OvalX trading platform.

Pros

- Algorithmic trading available with MetaTrader 4 (MT4)

- Competitive fees on Forex pairs

- Reliable order execution

Cons

- No VPS service

- No APIs for automated trading

Key features

- Access over a thousand CFDs on forex, indices, shares, commodities, and cryptocurrencies

- Compatible with MetaTrader 4

- Wide range of educational material in the form of trading guides, analysis, and webinars

- Low, floating spreads

- Advanced order types available like GTC, GSLO, and OCO

- Free unlimited demo paper trading account

73.85% of retail CFD accounts lose money

Top Brokers For HFX Trading Compared

Key features of online brokers with top rated platforms for HFX trading are compared in the table below.

| Broker | Assets | Low Latency | Algorithmic Trading | APIs and Integrations | Access to High-Quality Real-Time Market Data | Risk Management Tools | VPS Servers | High Reliability and Server Uptime |

|---|---|---|---|---|---|---|---|---|

| IC Markets | Forex, CFDs, Bonds, Indices, Futures, Stocks, Cryptocurrencies | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Capital.com | Forex, Indices, Commodities, Cryptocurrencies, Stocks | Yes | Yes | Yes | Yes | Yes | No | Yes |

| AvaTrade | Forex, Commodities, Indices, Stocks, Bonds, ETFs, Options, Cryptocurrencies | Yes | Yes | Yes | Yes | Yes | No | Yes |

| IG Trading | Forex, Indices, Commodities, Stocks, Bonds, ETFs, Options, Cryptocurrencies | Yes | Yes | Yes | Yes | Yes | No | Yes |

| ETX Capital | Forex, Indices, Commodities, Stocks, Cryptocurrencies | Yes | Yes | No | Yes | Yes | No | Yes |

How To Find The Best HFX Trading Platforms and Brokers in UAE?

Factors that need to be considered to choose the best suited platform for HFX trading are listed below.

- Assets: HFX trading requires access to multiple asset classes. Make sure your broker offers: stocks, ETFs, commodities, futures, forex, indices, mutual funds, bonds, and cryptos.

- Mobile Trading: You can use mobile trading platforms to trade from anywhere a smartphone operates. Make sure your HFX system works with the mobile platform you choose.

- Research & Education: Your broker should include market research and educational assets with your account. Look to see what kind of materials the broker includes, and get the most from your account.

- Customer support: HFX trading systems need a fast API to operate with trading platforms, so make sure your broker has a full time support service to troubleshoot any issues you have.

- Fees: Trading fees impact HFX trading profits, and you need to find the best broker for your needs. Look for brokers that have low, or 0% trading fees, so your trades make the biggest profits possible.

- Trading platforms: The trading platform is a vital part of any HFX trading operation. Make sure your broker supports HFX trading and gives you the execution times and data you need to trade.

- Deposit & Withdrawal: There is no need to pay for deposits and withdrawals, and you should look for a broker that has payment methods you like.

- Regulation: Only trade with a broker regulated by the FCA, CySEC, and ASIC. With so many compliant brokers in the UAE, there is no need to trust your money to an unregulated broker.

*Islamic Accounts: Brokers in the UAE have account options compliant with Sharia law. Our guide will help you get the right account for HFX trading in UAE.

What Is HFX Trading?

HFX Trading is a term used for High-Frequency Forex trading. It is a strategy that lets traders quickly buy and sell forex currency pairs. It uses technology and algorithms for fast transaction rates. HFX trading comes with high trading speeds and strict rules. It has high turnover rates and order-to-trade ratios.

If you want to start HFX trading, you need a trustworthy platform. Online forex brokers offer secure platforms for UAE traders at all levels.

What Is The Best Way To Start With HFX Trading in UAE?

The best way to start with HFX trading in UAE is by signing up with one of the recommended platforms from our list: IC Markets, Capital.com, AVAtrade, IG or ETX Capital.

We recommend you use IC Markets for HFX trading in the United Arab Emirates. It has secure accounts and social trading features.

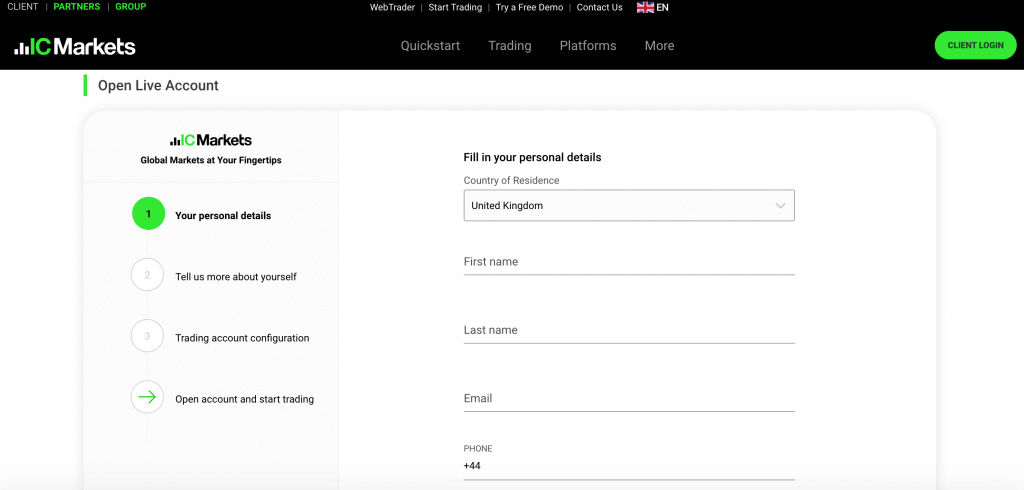

There are four steps to follow for HFX trading with IC Markets:

- Open an IC Markets account: The first step for traders in the United Arab Emirates is to open an IC Markets account. Navigate to the broker’s official website, click on the sign-up button, submit your personal details, and click on ‘Create New Account.’

- Submit a copy of your ID: IC Markets is a trustworthy broker. It follows strict Know Your Customer (KYC) rules and has licenses from industry-leading regulators. All UAE traders need to pass this account verification process. A copy of a valid I.D., like a passport or driver’s license, is necessary.

- Fund your IC Markets account: After having passed account verification, you have to make your first deposit. UAE traders have different funding options, including bank transfers and credit card deposits.

- Start HFX trading: Select the forex pair you want to trade and search for its ticker. Click on the asset’s symbol and start HFX trading.

Why Should You Consider HFX Trading?

HFX trading in the UAE is rewarding. It is a powerful trading strategy with the potential for high returns. Online trading of digital assets is attractive. But we don’t recommend it for beginner UAE traders.

How Much Does HFX Trading Cost?

HFX trading costs vary depending on the platform you choose. For example, the minimum balance needed to trade stocks in the U.S. is $25,000. Advanced traders say that online forex trading generates excellent profits over time. But you should remember that online assets are speculative. Read our in-depth platform reviews for details on assets and HFX trading costs.

HFX Trading Safety In The UAE

IC Markets is our top recommendation for traders in the UAE who want to start HFX trading safely. It has reliable platforms and apps for traders at all levels. It has many funding options and access to instant transactions. We recommend HFX trading with a broker that has top-tier licenses.

The Risks Of HFX Trading

HFX trading in the UAE remains risky. Online assets are speculative and have high risks. Start with a minimum trade to avoid losing money. Online trading strategies are reliable, but these might be challenging for new traders. We recommend you use secure HFX trading platforms in the UAE.

Conclusion

With the numerous online brokers in UAE offering different platforms and features, finding the ideal option for individual needs is tough. Comparing and evaluating the services of different providers can be stressful and requires time and knowledge.

This guide does the hard work by comparing and evaluating the top choices for different strategies and trading goals. The results of our analysis of the best HFX trading platforms in UAE are wrapped up in the table below.

| RANK | BROKER | PLATFORM SCORE | BEST FOR | WEBSITE |

|---|---|---|---|---|

| #1 | IC Markets | 4,5/5 | Best Fees | Official website |

| #2 | Capital.com | 4,8/5 | Best For Mobile Trading | Official website |

| #3 | AVAtrade | 4,9/5 | Best For Forex overall | Official website |

| #4 | IG Trading | 4,2/5 | Best Trading Platform | Official website |

| #5 | ETX Capital | 4,1/5 | Best Speed of execution | Official website |

FAQ

Is HFX trading allowed and regulated in the UAE?

There are no specific laws that regulated high frequency trading. As HFX trading is not prohibited, this trading strategy can be legally used by traders in the UAE.

Is high frequency trading risky?

Yes, high frequency trading is a high risk trading strategy because it involves computer algorithms and high speed trade execution, exposure to market volatility and risk of systematic failure.

Is high frequency trading recommended for beginners?

High frequency trading is commonly not recommended for beginners as it requires advanced knowledge and understanding of complex trading systems, financial markets and programming.

What are the most common order types for HFX Trading?

The most common HFX order types include market orders and limit orders. Forex traders commonly use orders depending on the timeframes including : – Good-till-canceled (GTC) – Day Order – One week – One month – End of week – End of month – End of Year – Good-till-date (GTD) – Immediate or cancel (IOC)

Disclaimer