Here at Business24-7, we want to make it easy to find the right online broker for you. Reliable and unbiased data serve as the basis for all our content. To help us in our task, we have decades of experience in fund management and investments to call upon. Along with valuable feedback from our users, we harness this knowledge and expertise to make Business24-7 the world’s leading broker comparison resource. Here’s a quick primer on our approach!

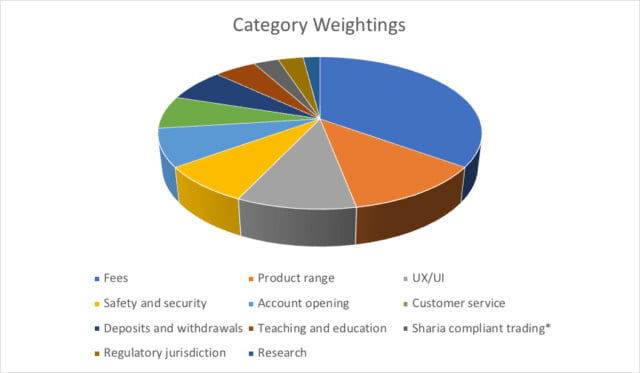

Category Weightings

Our broker assessments are broken down into the categories that are most important to our readers. It makes sense to meet our readers’ expectations and demands, which is why we have ranked the importance of each feature to them when deciding on which broker to use. Our 17-strong team of analysts then applied the findings of their combined years of research to give a final weighting for each. Please see the table below for more details.

Categories | Weighting |

|---|---|

Fees | 35% |

Product range | 12% |

UX/UI | 10% |

Safety and security | 8% |

Account opening | 8% |

Customer service | 7% |

Deposits and withdrawals | 7% |

Teaching and education | 5% |

Shariah-compliant trading* | 3% |

Regulatory jurisdiction Research | 3% 2% |

*The category for Shariah-compliant trading was a much-requested feature from our readers, who are primarily based in the Middle East and South Asia.

As you can see, the fee structure offered by a broker is far and away the most important category for traders. In second place is the number of products and services on offer, with a broader range assessed more favourably. A good user experience is next on the list, along with an intuitive and easy-to-user interface. The categories of safety and security, ease of account opening, customer service standards, as well as the ease, speed, and cost of deposits and withdrawals, are ranked similarly in importance. As a group, these are considered critical factors when determining which broker to choose, totalling 30% of the total category weighting. Training, education, and research standards also make the list since they give our readers confidence in the broker’s professionalism and commitment to helping inexperienced traders. The regulatory oversight of a broker is also considered an important consideration, along with whether Shariah-compliant trading is offered.

Broker testing process

Our analysts open live accounts with each broker, using our own funds to test every feature on our list of criteria. This testing is conducted without the knowledge of the broker. We then take our readers’ opinions, comments, and preferences into consideration before publishing our final scores. After checking the broker criteria, we use a weighting system to convert our findings into a points tally. Our expertise and the preferences of our readers serve as the basis for our weighting system, which ensures that our scoring actually mirrors what our clients need to know and the features they are interested in. None of the brokers reviewed receive any financial compensation during the review scoring process. Occasionally, some are consulted on the overall scores we calculate, and this gives us the opportunity to eliminate any errors – nevertheless, we have the final say on all published results. A final point to note is that every broker listed on Business24-7 is monitored by one or more of the leading financial regulators. This is how we can be sure that none are a scam. We also go to great lengths to ensure that any broker we review either has a strong banking background or is available on a reputed stock exchange.

Research duration

Despite adopting a complex methodology and having a strong awareness of what checks are important, we spend between 7 and 10 days researching and writing up each Business24-7 review. That’s time we save you, and even if you were to do your own research, spending a couple of hours looking at each broker (which nobody does), all the raw information would take at least 7 days to collate.

Data relevance

Every year, we conduct a complete overhaul of our methodology and testing process. Each criterion is re-scored and each broker review is rewritten. But we go further. We also continuously monitor each broker all year around and make any adjustments required during the year to mirror the most up-to-date information available.

Integrity

We are often asked if the results of our assessments are swayed by fees paid to us by brokers, and the short answer is no. Many of the brokers who do pay us often do not get included in the recommendations we submit to our readers. The reason is simple. Customer focus and unbiased opinions are paramount to determine which broker is best for your specific requirements. Not taking this approach would jeopardise the trust our readers place in us.

Category Breakdown

Each of the 10 categories we use to rate brokers are important in their own way, and each may have more or less importance to the traders reading our reviews, depending on their specific needs. Here we go into more detail about what we look for.

Fees

The researchers at Business24-7 obtain details on fee structures from the websites owned by the brokers we review. Every fee goes under the microscope, including those for forex, funds, stocks, etc. Not only do we bring hidden costs to light, we also deep dive into all trading and other fees. To get the precision our customers need, we work out the fees required to buy a position, hold it for a week and sell it.

Product range

The brokers we assess include those specialising in forex, futures, options, CFDs, cryptocurrency, and several other asset classes. However not every broker covers every area, and so we rank our brokers on the basis of which has the broadest range of products and services available. Our readers prefer a one-stop shop to fulfil their trading needs.

UX/UI

Our readers place great importance on how they feel when using an online broker, which is why the user experience (UX) is ascribed such significant weighting among our criteria. We analyse the quality of the experience on both mobile and desktop, and how intuitive they are to use. Is it easy to find essential information? Is the experience clunky or smooth? How easy is it to customize your experience, authenticate yourself, and place orders? These are just some of the questions we pose.

Safety and security

As custodians of your funds, we consider the broker’s record on safety and security to be paramount. What measures are in place to protect you from hacks and other potential breaches of your personal data? All this information should be published on the broker’s website. We look for security features such as SSL encryption to ensure that your payment data is protected, and that no hacker can access your private information.

Account opening

To save you time, we try out the process of opening accounts for you. It is often the case that the documents required to open an account are not clearly specified. We overcome this by providing all relevant data on the account opening process, including the ease of doing so, the account types available and the minimum deposit level.

Customer service

Fast and accurate customer service, available 24/7, can be very reassuring to traders, especially those who are inexperienced. That’s why our analysts test every support channel offered by each broker. We evaluate customer service quality using our own interactions with support as our research basis. In the interests of thoroughness, these include email, phone, and live chat.

Deposits and withdrawals

We use our own funds to place deposits and effect withdrawals for each broker we review, which is the only way to know how easy the process is. We have learned that the process itself, the fees charged, and the timeframes involved are primary considerations for our readers, and these criteria all have their own weightings. For example, we give brokers that allow credit card purchases a higher score than those which only make fee-based wire transfers available.

Teaching and education

With the range of products and services on offer constantly increasing, it is vital that teaching and education keeps pace. Those brokers which put emphasis on this aspect of their platform demonstrate their commitment to making the experience more secure and understandable. Those brokers which provide educational tools (demo accounts, webinars, tutorial videos, etc.) that achieve this goal are favoured in our rating system.

Shariah-compliant trading

One of the core principles of Islamic finance is that money is a medium of exchange and has no intrinsic value. With many of our readers hailing from countries where Islam is well represented, it is therefore important that we highlight Shariah-compliant brokers to ensure they are choosing the right broker and service for them.

Regulatory jurisdiction

It is vital to understand all details regarding each broker’s regulatory status, the governing jurisdiction, and the investor protection available. Without this data, the safety of any investment would be compromised and that is why we give these criteria significant weighting.

Research

Higher costs are fine if the range, depth, ubiquity, and usefulness of the research tools available justify them. They can aid understanding of trends, market sentiment, the companies themselves and their tickers. Therefore we examine each research tool offered by each broker we review.

Do you have any questions or ideas about our methodology and approach? If so, we would be very keen to hear from you! Please write to us at info@business24-7.ae to let us know your thoughts!