Avoid crypto trading scams with our expert guide. Discover tailored strategies for secure trading, recognizing fraud, and protecting your investments.

Thousands of crypto projects have launched in the last decade, with new tokens entering the market daily. By May 2024, over 23,000 cryptocurrencies report price data on CoinMarketCap. Avoiding crypto scams has become significantly harder compared to ten years ago, mainly due to the sheer number of cryptocurrencies, crypto projects, and crypto companies on the market.

Even the most sophisticated crypto investors can fall victim to scams. As technology evolves, scam techniques become more elaborate, making it increasingly difficult for traders of all experience levels to stay safe on the internet.

We’ve been researching and writing about cryptocurrency for years and have found that the first step to protect yourself from crypto scams is to use only legitimate crypto exchanges and highly regulated crypto brokers. This guide will arm you with the knowledge you need to avoid crypto scams and provide the resources you need if you’ve been scammed.

What Are Crypto Trading Scams?

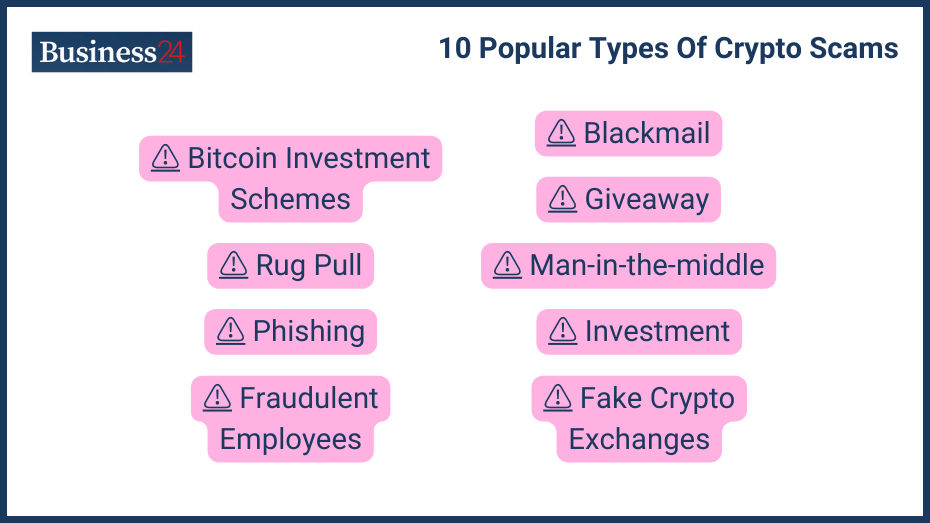

Crypto trading scams are deceptive practices designed to manipulate market prices or defraud traders through fake trading platforms or misleading trading opportunities. The crypto market is plagued by numerous trading scams. Scammers create fake crypto exchange/trading websites to indulge in pump-and-dump schemes, phishing attacks, wash trading, and manipulative trading bots. They promise guaranteed, unrealistic returns for investors. Here is how you can detect, identify, and avoid crypto trading scams.

Detailed Examination of Trading Platform Scams

Scammers use a range of sophisticated, lucrative fake websites to trick unsuspecting investors.

Their main play is to mimic well-known crypto trading platforms with only slightly different domain names. Everything else about the same appears the same. Sometimes, these shady websites also offer lucrative returns, including unrealistic staking opportunities or bot trading that guarantees big gains in a short amount of time.

These fake crypto trading websites look very similar to their original counterparts. They often pop up after clicking on a shady sponsored ad link or while visiting a website. Fake trading websites use the following shady techniques to extract funds from traders:

- Phishing links: You enter your username/email and password and other financial information or 2FA details. The attacker uses these details to access your monetary accounts and steal funds.

- Theft: They behave like a real platform for a short while. On paper, they show you how much gains you have made, like tripling your money. You deposit more and more money, and your gains multiply. However, when you wish to withdraw, your account is frozen, or the requests don’t go through.

Analysis of Common Trading Schemes

Common trading scams include pump-and-dump schemes and wash trading. These are used on fake crypto trading websites and messaging apps to defraud investors of their money. Here is how they work:

- Pump-and-dump schemes typically involve a closely knit team of scammers heavily promoting a certain token, often a low-market-cap altcoin. They use messaging apps like Telegram and WhatsApp and social media outlets like Facebook and Instagram for this purpose. They spur a price increase and start dumping their tokens when the profits start rolling in. Ordinary investors who aren’t part of this elaborate scheme are left holding in the bag. Pump-and-dump schemes can be kept in check by on-chain analysis.

- Wash trading is a deceptive approach to inflating trading volumes and transactions to show more activity than reality. Scammers use this approach to artificially inflate the value of a digital currency. Once they have achieved their goals, the artificial trading activity ceases, and the coin loses significance.

How to Identify Safe and Secure Trading Platforms?

Identifying safe trading platforms involves thorough checks on platform security measures, regulatory compliance, and user reviews. If a platform doesn’t check all of these boxes, chances are that it is a scam, and it will steal your valuable funds.

Key Security Features of Reliable Platforms

A secure trading platform offers a range of security features to keep infiltrators at bay. They include:

- Encryption: Crypto exchange platforms need at least basic encryptions like SSL for their domain. Websites or apps need “https” in the URL to secure your transactions. It is highly questionable if the exchange platform doesn’t have https in its link.

- Two-Factor Authentication (2FA): This is a useful security measure that requires input from multiple personal digital sources before crucial actions are taken on your exchange. For example, you can mandate a One-Time Password (OTP) from your phone for withdrawals and sign-ins.

- Cold Storage is an offline storage approach to secure digital currencies. Crypto exchanges have a lot of funds, and their online, aka “hot wallets,” are susceptible to hacks and thefts. This is why responsible, reputable crypto exchanges keep a majority of their funds in cold storage.

Importance of Regulatory Compliance

Cryptocurrency exchange regulation is a hot topic of debate in government circles. The situation is quite complex overall, and regulations vary from country to country and even state to state. However, there are some common-sense agreements among regulators. They include:

- Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements: All top cryptocurrency exchanges follow this widely agreed-upon law. They verify users’ identities using government-issued IDs and passports. If a cryptocurrency exchange doesn’t follow these rules, it is in open violation and will be shut down. Choosing exchanges with robust AML and KYC protocols is a good idea.

- Investor protection and fairness: To benefit large players, the exchange must treat all users fairly, with no foul play. Investor deposits must be protected and insured, at least to a certain degree.

- Securities Regulations: Certain countries treat cryptocurrencies as securities and want crypto exchanges to behave like stock exchanges. They apply the same rules for both entities including additional disclosure requirements.

To avoid crypto trading scams, you need to prefer regulated crypto exchange platforms. Some platforms have lax implementations, but they are also susceptible to scams.

What Are Specific Red Flags in Trading Scams?

Specific red flags in trading scams include unusual trading volume, price manipulation signs, and promises of guaranteed returns. These red flags present themselves at the start of the trading process so they can be avoided.

Behavioral Patterns of Trading Scams

Behavioral patterns of crypto trading scammers include:

- Urgent Call to Action: Scammers create Fear of Mission Out (FOMO) scenarios to take drastic actions.

- Free Money or Guaranteed Returns: Crypto trading con artists promise unbelievable Returns on Investment (ROI).

- They use wash trading to bump up trading volumes on their exchange

- They manipulate the crowd with celebrity endorsements like the now-defunct FTX exchange

Technical Indicators of Unreliable Trading Activities

Suspicious technical patterns often give advance warning of a crypto trading scam. Specific inconsistencies and red flags to look for:

- Manipulation Potential: Cryptocurrencies with relatively low volumes are more susceptible to manipulation than their more popular counterparts.

- Confusing Charts and Signals: Scam “trading signals” often use confusing charts overloaded with technical indicators. They can make things seem more technical than they are.

- Over-reliance on a single indicator: Scammers pick and choose an indicator that works for them and overload it on technical graphs. One indicator doesn’t define the entire market sentiment. That is why we have a host of technical indicators out there to try and understand the market situation.

- Zoom in, Zoom Out Graph at Will: Scammers use inaccurate graphs to try and predict a significant price breakout.

Best Practices for Avoiding Trading Scams

Best practices for avoiding trading scams involve using trusted and well-reviewed trading tools, practicing stringent security protocols, and continuously educating oneself about new scamming techniques. Detailed research always pays off if you are new to the crypto sector.

Smart Trading Habits

Smart trading habits that can help you curtail your losses with scammers:

- Diversifying assets: It is important to avoid putting all your eggs in one basket.

- Use multiple exchange platforms: Even legitimate cryptocurrency exchanges can fail or be hacked, so it is important to use multiple exchange platforms for this purpose.

- Look for long-term growth rather than short-term quick-rich schemes: Prioritize established assets with a robust, long-term potential.

- Risk what you can afford: Don’t trade with loans. Risk only what you can afford to lose because even if a digital asset is not a scam, it is still a risky asset.

- Use on-chain analytics: On-chain analytics is crypto’s major redeeming quality. Use it as much as you can to stay ahead of the game.

Educational Resources for Traders

Educational resources and courses for crypto traders include:

- r/CryptoMarkets on Reddit

- BitcoinTalk

- Courses on Udemy

- Crypto trading on Binance

Steps to Take If You Suspect a Trading Scam

If you suspect involvement in a trading scam, immediate actions include withdrawing your assets, reporting to authorities, and alerting the trading community. Follow these steps:

Immediate Response Checklist

- Halt all trading activities and try to withdraw as much crypto from the scam website as possible.

- Gather as much evidence of wrongdoing as possible.

- Contact a lawyer for legal information

Reporting Channels and Community Support

- Immediately follow these steps:

- Report to the FBI, the US Department of Justice (DOJ), FinCEN, and others.

- Alert the community as early as possible. You can post on Reddit, BitcoinTalk, X, and email crypto media outlets.

Essential Definitions Related to Crypto Trading Scams

This section will provide definitions for key terms that will be manually added later to enhance understanding.

What is the definition of a Ponzi Scheme?

A Ponzi scheme is a quick-rich scam that often operates as a pyramid scheme to drain investors of their money. It is illegal by law.

What is the definition of Phishing?

It is a deceptive technique used by hackers to access your credit card information, email passwords, and other data.

What is the definition of a Pump and Dump Scheme?

A pump-and-dump scheme is a market manipulation exercise to inflate, profit from, and dump an asset. Once profitability has been achieved, fraudsters are quick to sell their coins.

What is the definition of Wash Trading?

Wash trading involves artificially inflating transactions and trading volumes of a particular asset, making it more appealing than it actually is.

What is the definition of Market Manipulation?

Market manipulation is an illegal act of influencing the market to deceive investors.

What is the definition of API (Application Programming Interface)?

API is the tool that allows two software to interact with each other. For example, Google Maps APIs can be used in other software applications.

What is the definition of a Trading Bot?

It is an automated trading entity that executes trades based on the code programmed inside it. Some automated bots can be scams.

What is the definition of Cold Storage?

Cold storage is offline storage for cryptocurrencies’ private keys. It cannot be accessed directly via the Internet.

What is the definition of Two-Factor Authentication (2FA)?

2FA involves verification from multiple authenticators to access a sensitive account like your bank or crypto exchange.

What is the definition of a Fake Exchange?

A fake exchange is a fraudulent website that looks like a real exchange platform, but it is a scam. It can steal your funds.

Frequently Asked Questions About Crypto Trading Scams

Answers to specific questions focused on trading, such as:

- How do I verify the authenticity of trading signals?

- Trading signals need to be based on actual technical indicators. Also, signals like instant 200% and 300% price increases are red flags and may indicate pump-and-dump schemes.

- What should I look for in a trading platform’s security practices?

- They include two-factor (2FA) authentication, cold storage for crypto, and encryption.

- Can trading bots be a part of scam operations?

- Yes, trading bots are automated programs. Scammers can create backdoors in trading bots, which can result in fund loss.

- How do market manipulations affect ordinary traders?

- Ordinary traders are affected by illegal acts like wash trading and pump-and-dump schemes. They start to believe a project is worth much more than it actually is on the ground.

What Are the Key Takeaways and Final Thoughts on Avoiding Crypto Trading Scams?

The key to avoiding crypto trading scams is staying informed, practicing due diligence, and using secure transaction methods. Always choose a well-regulated, reputable cryptocurrency exchange for trading. It needs to have complete KYC/AML protocols and have some level of investor safety nets as required by the law. With crypto trading platforms, it is important to remember that if it is too good to be true, it probably isn’t right for you.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.