If you are new to trading you need to know how to trade the markets first. In this article, we will explain the best day trading strategies in UAE. You will have a bigger chance of beating the markets with these strategies.

Best Day Trading Strategies in UAE – Overview

- Day Trading Strategy 1: Understanding how the Market Works

- Day Trading Strategy 2: Avoiding Volatile Instruments

- Day Trading Strategy 3: Knowing how and when to use Day Trading Orders

- Day Trading Strategy 4: Learning how to trade with a Day Trading Simulator

- Day Trading Strategy 5: Learning how to use Bankroll Management Strategies

- Day Trading Strategy 6: Staying up-to-date on Financial News

- Day Trading Strategy 7: Learning how to apply Technical Analysis

- Day Trading Strategy 8: Automating your Day Trading Strategy

- Day Trading Strategy 9: Learning how Overnight Positions work

- Day Trading Strategy 10: Learning how to Choose the Right Broker

Learn to trade with a $100,000 demo account

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

01. Understanding the Market

Understanding the market is the most important thing for new traders. If you want to trade cryptocurrencies, for example, you will need to know how they work. If you’re looking to trade forex, you need to know which factors influence currency prices.

Specializing in one asset class or one certain market is smarter than trying to master all at once. This will give you the best chance of making consistent gains. We recommend only trading markets that you have knowledge of.

02. Avoiding Volatile Instruments

You want to avoid volatile instruments if you are a new trader. Volatile instruments are assets that increase and decrease faster than other assets. Cryptocurrencies are a good example of volatile instruments. It is common for cryptocurrencies to rise and fall by double-digit percentages daily.

It is the best idea to stick with assets that aren’t volatile. Indices like Dow Jones and FTSE100 or forex pairs like EUR/USD and GBP/USD are good examples.

03. Knowing How and When to use Day Trading Orders

It is important that you know how day trading orders work. Most brokers allow you to place different kinds of orders to enter the market.

- The most common order type is the buy or sell order. You place such an order when you think an asset will increase or decrease in value.

- Then there are stop-loss orders. These are risk management orders that you place to protect yourself against losing money. If you want to limit your losses at 2%, you set a stop-loss order at 2% below the price you are buying.

- You specify when you want to take profit with a take-profit order. If you set this at 2% above the price you are buying, you will sell the asset whenever it increases by 2% in price.

There are two more types of orders. These are the market order and a limit order. A market order executes at the best available price. With a limit order, you specify the price you are willing to buy the asset at.

04. Learning how to trade with a Day Trading Simulator

Day trading simulators are demo accounts at trading platforms. These demo accounts come with a virtual balance of $10,000 to $100,000 and are ideal to learn how to trade the markets with. The stock and other asset prices change as they would in the real market.

You can use these day trading simulators to test trading strategies and see how trading works in general. eToro offers a day trading simulator with a $100,000 virtual balance on it. We recommend practicing with this demo account before trading with real money.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

05. Using Bankroll Management Strategies

Bankroll management is the practice of spreading your investments and risks according to your available trading capital. By applying bankroll management strategies you don’t lose all your money in a short timeframe.

A good bankroll management strategy is to only invest 1% of your trading balance per position. This means that if you have $10,000 in your trading account, the largest position you open is $100. This way you can open many positions and spread your risk, without allowing one position to ‘blow up your account’.

If you grow your trading capital from $10,000 to $12,000, you can now invest $120 per position. In the case you went from $10,000 to $9,000, you only invest $90 per position. As long as you keep using the bankroll management strategy of investing 1% per trade, you aren’t taking unnecessary risks.

06. Staying up-to-date on Financial News

If you want to start day trading but have little experience in reading charts, you can stay up-to-date on financial news. There are two types of analysis: technical analysis and fundamental analysis. Technical analysis means reading the charts and using technical knowledge to your advantage. Fundamental analysis means following the news and knowing all the latest market trends.

Financial news always impacts the prices of assets. For this reason, it is important to follow the news daily. Let’s say for example Tesla will be releasing their quarterly earnings report. Analysts expected their revenue to go up by 5%, but it only went up 3%. This will cause Tesla share prices to drop that day. In this case, you open a sell order to profit from this price drop.

You cannot stay up-to-date on all financial news in the world, but you can try to at least follow all the financial news about the assets you have invested in. For this reason, it is important that you only stick with one or very few markets as a beginner daytrader.

One of the best tools to help you stay ahead of the curve is an economic calendar. This tool shows you when important financial news comes out. Most brokers offer such a tool for free.

07. Learning how to apply Technical Analysis

Now that you know about fundamental analysis, let’s discuss technical analysis. Although it might seem hard in the beginning, you must learn how to read charts as a daytrader. Most of your trading positions will be open for minutes, hours, or days. You will need analysis tools to spot favorable moments to enter the market and determine your exit points.

There are many technical indicators to help you with this. These technical indicators look for specific trends. One of the most common technical indicators is the Moving Average. This indicator looks at the average price of an asset over various timeframes.

Then there is another indicator, the Moving Average Convergence Divergence (MACD) that looks at the relationship between two timeframes. If you use both indicators, you can check if an asset is likely to move up or down in price.

You can use the Relative Strength Index to see if an asset is overbought or oversold and check whether the market is bullish or bearish. There are hundreds of these technical indicators, each with its own features and purposes. Once you know how to apply them, you will have a better chance of beating the markets.

08. Automating your Day Trading Strategy

If you don’t want to learn technical analysis or think you cannot, you can consider automated trading. With automated trading, you use robot trading software or Copy Trading services to trade on auto-pilot. You won’t have to follow any news or apply technical analysis then.

The best broker for automated trading is eToro. They offer a Copy Trading service that allows you to copy what other traders are doing. By ‘copying’ another trader your trading account does exactly what that person does with the amount of money you specify.

You can check how other traders are performing before copying them. eToro provides detailed information about every trader. They show you exactly how much risk they take, what their average trade size and duration is, and what their preferred assets or markets are.

eToro offers this copy trading service for free and you can get started with it for as little as $200 USD.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Past performance is not an indication of future results.

09. Using Overnight Positions the Right Way

Most day traders don’t want to keep their positions open overnight. They keep their positions open for a few minutes or hours and then close them. This is called scalping and it is a good trading strategy. However, you shouldn’t be afraid to keep your positions open overnight.

You pay a small fee to your broker for doing so, but it’s better than closing a position with a loss. When you invest in assets like stocks, bonds, or ETFs you don’t pay overnight fees. Keeping your positions open for more than one day isn’t called day trading but swing trading. Swing trading requires different trading strategies than day trading.

10. Choosing the Right Broker

It is important that you choose the right broker when you want to day trade the markets. Brokers charge different fees, support different payment methods and offer different assets. You want to trade with a broker that suits your needs and that charges low fees. The general of thumb is that the more fees you need to pay, the less profitable you will become.

Some brokers charge commissions whilst others charge spreads. A commission is a flat fee per trade and spread is a mark-up on the original asset price. We recommend trading at eToro. This is the best regulated commission-less broker in the UAE.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Best Day Trading Brokers in UAE

To help you choose the right broker we have put together reviews of the best day trading brokers. Below we will outline the pros and cons of each broker.

1. eToro Review UAE 2025 – Best for Social/Copy Trading

Min Deposit: $100

Fees: 4.2

Assets available: 4.0

Total Fees: Low

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

eToro is a reputable global brand and industry leading broker for copy trading. Their robust and cutting edge copy trading platform and social trading features allow users to copy trades and portfolios from professional traders and investors.

As a CFD multi asset broker, eToro allows users to trade on over 3075 different symbols including stocks, forex, cryptos, indices and commodities. Trading spreads are wide, deposits are free and account minimum is low. There are conversion and inactivity fees. eToro provides a comprehensive list of technical tools, charts, and newsfeeds. Their customer support is available through email and live chat in Arabic and English.

eToro is a well established market maker broker with a clean history record, regulated by top tier regulators.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Pros

- Great proprietary Social trading service (you can trade all available trading instruments by matching popular traders trades)<

- Trading platform is easy to use well-suited for beginers

- Low trading fees on Forex and CFDs; Zero commision fees on Stocks and ETFs

- Very good choice of different trading instruments

Cons

- Trading platform is lacking some advanced features

- Charges inactivity and withdrawal fee

Key features

- Sophisticated social-copy trading features

- Multiple different payment options

- Crypto exchange and brokerage services on the same dashboard

- Super fast registration and KYC on-boarding process

- Zero commission stock trading

- Great ease of use level

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. Capital.com Review – Best for Algorithmic Trading

Min Deposit: 20 USD/EUR/GBP or 80 AED (bank cards)

Fees: 4.8

Assets available: 4.7

Total Fees:

CFD trading carries risk. Capital.com is regulated by the Securities and Commodities Authority.

Capital.com is a top choice for traders looking for a discount broker with great educational content and resources, advanced research tools and a premium trading interface. They offer a wide range of tradable assets including CFDs on cryptos, stocks, indices, commodities and forex pairs.

Founded in 2016, Capital.com is an international fintech company which has group of entities authorised and regulated by the Financial Conduct Authority (“FCA”), the Australian Securities and Investments Commission (“ASIC”), the Cyprus Securities and Exchange Commission (“CySEC”), and the Financial Services Authority of Seychelles (“FSA”). It does not operate a bank and is not publicly traded.

Choose Capital.com if you are looking for a great mobile trading experience, professional web trading interface, day trading features. Beginner traders will like the low minimum deposit ($20), industry leading commission structure, and award winning education section.

Pros

- MT4 and TradingView Trading platforms are

- Algotitmic trading is avaliable through Trading platforms and through APIs

- Very competitive Forex trading fees

- No inactivity and withdrawal fee

Cons

- Only Forex and CFDs are available for trading

- Above average Index CFD fees

Key features

- Access to 4.100 trading instruments

- High quality research and educational content

- Patented AI trade bias system

- $20 minimum deposit

- No inactivity fees

CFD trading carries risk. Capital.com is regulated by the Securities and Commodities Authority.

3. Interactive Brokers Review UAE 2025 – Best For active trading

Interactive Brokers is a highly trusted global broker with a well-rounded offer of tradable markets, great educational content and sophisticated order type configuration. It is a high trusted and well capitalize company with an industry leading trading platform, a competitive fee structure and great global market access. Their low entry level and the Global Trader platform, which is intuitive and easy to use trading station, make this broker s great choice for beginners and advanced forex traders.

Professional and seasoned traders will appreciate the great selection of advanced trading tools and order type configurations available on their proprietary Trader Workstation desktop platform (TWS).

Pros

- Great choice of trading instuments available (and many different asset classes)

- Very professional trading platform with lots of advaced features, research tools and over 100+ different order types

- Very competitive trading fees on all asset types, Zero fees on Stocks and ETFs

Cons

- Market data for all products in demo account delayed by 10-15 minutes except for OTC spot FX and OTC spot Metals

Key features

- Margin loan rates on stocks of 1.3%

- Access to 135+ global markets

- Advanced order types, tools and features

- Access to frictional shares

- Lowest commissions in the industry

63.3% of retail investor accounts lose money when trading CFDs with IBKR.

Getting Started with Day Trading in UAE

You can get started with day trading within 10 minutes. To do so follow the simple steps below.

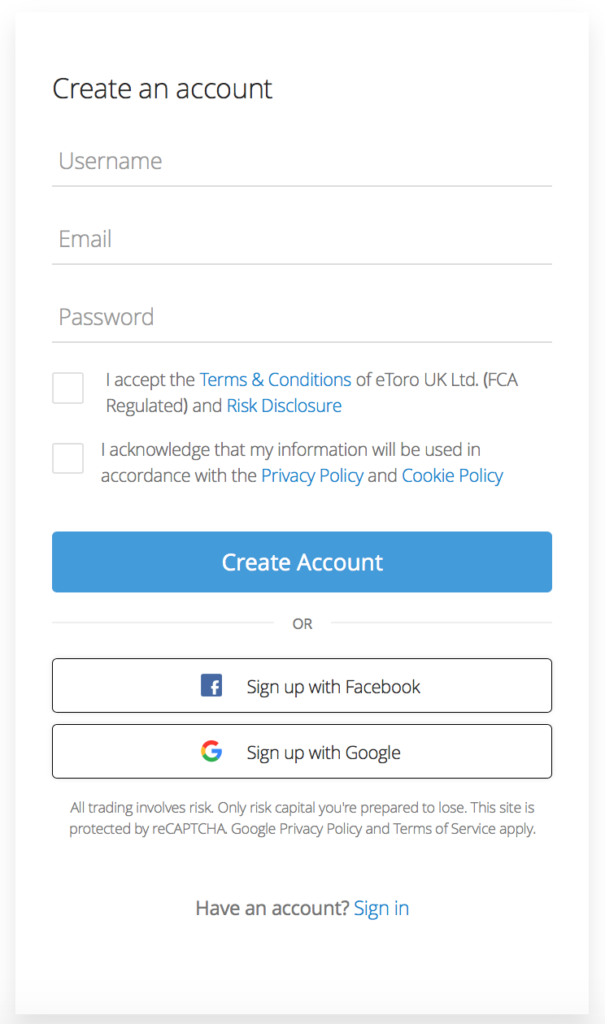

01. Open an eToro Day Trading Account

Visit the eToro website and click ‘Start Investing’. A pop-up will show and you will have to enter your personal details. They will also ask you for a photo of your driver’s license, passport, or national ID card to verify your identity.

02. Deposit Funds

Once you have verified your identity it is time to make a deposit. You can do this with a credit card, PayPal, Skrill, or Neteller.

03. Buy an asset

Now that you made your first deposit it is time to open your first position. Use the search bar to search for your preferred stock, crypto, or commodity. Once you have found the asset you want to trade, click on it.

A pop-up window will open where you can choose how much money you want to invest and at what price you want to stop loss and take profit. When you have set everything up the way you want, click ‘Set Order’ to open your trade.

Open eToro Day Trading Account

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Best Day Trading Strategies in UAE – Bottom Line

You now know the importance of applying the right trading strategies and choosing the right broker. Day trading isn’t hard, as long as you apply these trading strategies. If you want to get started today we recommend opening an account with eToro.

FAQ

What is the best day trading broker in UAE?

We recommend eToro as the best day trading broker in the United Arab Emirates.

How can I practice day trading in UAE?

You can practice day trading in UAE with a demo account. This is an account with a virtual balance that works the same way as a real trading account.

What is the best day trading strategy for beginners?

We recommend trying the eToro Copy Trading Tool. You don’t need to apply technical or fundamental analysis this way because you copy professional traders.

How can I make long-term profits with day trading?

By learning how to apply technical and fundamental analysis. Once you have mastered this, you will be able to consistently make a profit trading the markets.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.