In A Nutshell

Charles Schwab offers a full-service brokerage. It is the pioneer in the industry in terms of fees because it has eliminated many common fees. It removed the ETF and equity commissions once the founder’s book: “Invested” appeared. Charles Schwab owns both TD Ameritrade and the USAA’s Investment Management Co.

Charles Schwab

Best ForStocks, ETFs, Options

Recommended ForLong-Term Investors, ETF & Index Fund Investors, Beginner Investors

More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

Best ForStocks, ETFs, Options

Recommended ForLong-Term Investors, ETF & Index Fund Investors, Beginner Investors

- Trader Level Beginner-Advanced

- Stock & ETF Commission $0

- Options Fees Low

- Account Opening Speed 24 hours

Web trading platform4.4

Fees5.0

Mobile App3.0

Deposit and withdrawal 1.3

Available assets4.8

Account opening5.0

Education and Research 5.0

Support4.0

Overall rating4.1

More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

This is a transparent and reliable broker because:

- It is one of the best ETF screeners and ETF broker

- It has many services and tools for all levels of trading experience

- Its mobile and web platforms come with all the features shown in the desktop version

- Its clients can increase their returns on uninvested cash

Charles Schwab Review & Insights

Charles Schwab is a great choice for both active traders and self-directed investors. It is a full-service investment firm with access to the latest technology in the industry. Customers receive portfolio management and investment advice. The advantage is that futures traders use a separate account with access to all assets.

- Reliable ETF Screener on StreetSmart Edge

- Outstanding customizability on StreetSmart Edge

- Mobile apps and web platforms feature similar functionality

- No automatic cash sweeps

- Limited ETF screener on the website

- Almost all derivatives tools are on StreetSmart Edge

Advantages Explained

- Charles Schwab offers an ETF screener via StreetSmart Edge with 150+ screening criteria. These include asset class, fund performance, regional exposure, Morningstar category. You can view and export your results depending on your preferences.

- The StreetSmart Edge platform has great customizability for the tools you use.

- This broker concentrates on improving their services. It bought optionsXpress to merge the technology, offering premium experiences for its customers. Charles Schwab’s platforms have a similar appearance.

Disadvantages Explained

- The disadvantage is the absence of an automatic sweep for uninvested cash. This broker’s base interest rate is low. You can receive more interest on cash, but you’ll have to move the money back when you want to trade.

- The ETF screener on the website is basic when compared with the one in StreetSmart Edge. The fixed revenue and mutual fund screeners are old.

- Most of the derivative trading tools are available on the StreetSmart Edge platform. But if you want to trade equities, you’ll have to use the basic tools on the website.

1. Fees and Spreads

Charles Schwab is one of the first brokers to join the zero fees policy.

- It has no fees for ETF, online equity, and OTCBB trades

- It has no per-leg commission on options trades. It charges $0.65 per-contract

- The cost for ordering 50 options contracts is $32.50

- The cost for a covered call trade of 500 shares and five contracts is $3.25

- The fee for mutual funds outside the No Transaction Fee program is $49.95

- There is no fee for new fixed-income. But there is a $1 fee per bond for secondary market trades

- The margin interest starts at 9.325% for $10,000 and can get as low as 7.825% for more than $100,000

- The fee for futures transactions is $1.50 per contract

- The fee for currency exchanges is 1% for under $100,000 and 0.2% for more than $1 million

- This broker has no fee for account closure, transfer, or inactivity. Sending/receiving wires, checks, paper statements, and trade confirmations are free of charge

- The fee for live broker per trade is $25

- Most trades come with exchange fees. These represent fractions of a penny per share or contract

Charles Schwab adheres to the zero-policy fee. It focuses on transparency and the best standards for its customers.

- Interest on cash balances: this broker doesn’t automatically sweep uninvested cash. So, the base interest rate is low. But you’ll have to move your money several times to receive a better rate.

- Payment for order flow: this broker gets $0.0009-$0.0030 per share via market makers that handle its orders.

- Stock loan programs: clients can join a stock loan program. The downside is that you can’t select which stocks to loan. You can only analyze the predictions of potential income on Schwab’s website.

- Price Improvement: Charles Schwab offers price improvement on options trades and equities.

- Portfolio margining: This decreases the margin required depending on the calculated risk. It functions best for clients trading derivatives. These reduce the inherent risk in equity positions.

Schwab lets its clients trade available asset classes on mobile and web platforms. Futures traders need to use a separate account. The downside is that cryptocurrency trading isn’t available.

- This broker offers useful information for trading stocks. Short sales depend on the shares available for loan at the time you enter the trade. Hard-to-borrow stocks are unavailable to short. Each short position comes with an annualized cost of borrowing the stock. It is a unique feature you won’t see with other brokers.

- OTCBB (Penny stocks)

- This broker offers access to more than 16,000 mutual funds. Around 4,000 come with a transaction fee.

- Treasury, corporate, municipal, CD, international, new issues, and secondary markets bonds

- Commodities/Futures

- Futures options

- 7 forex currencies

- Fractional shares of stocks with a starting cost of $5 per buy

This broker has a robo-advisor integrated into the mobile app and website platform.

International customers can use cash conversion and buy stock in the local market. They can trade online equities in 12 non-US markets depending on local currencies:

- Australia

- Canada

- United Kingdom

- Hong Kong

- Japan

- Norway

- Many European exchanges

This broker has a proprietary wheel-based router for order management. It handles exchange outages, volatile markets, and real-time execution. But there is no trading simulator for Schwab’s customers. You can’t automate or backtest a trading strategy.

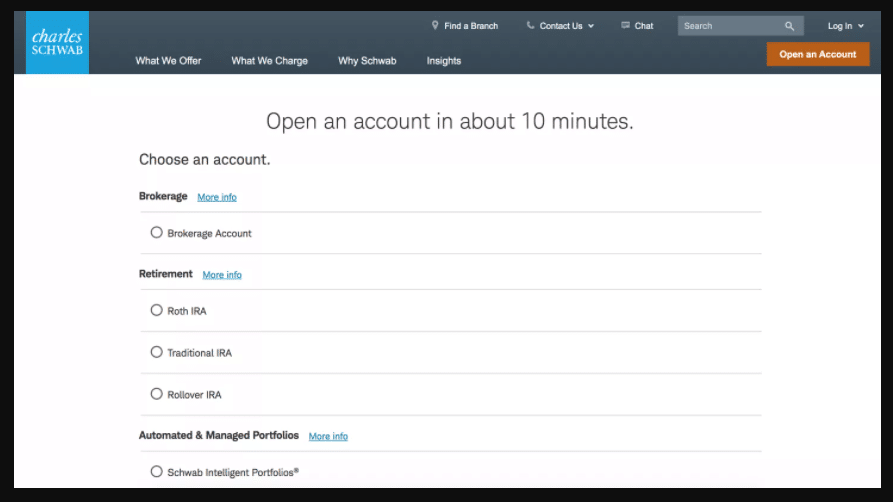

2. Account Types

Charles Schwab has several account types with a simple sign-up process. You can fund an account in a browser or on a mobile device. The website navigation features two-level menus with several choices. It can be confusing for inexperienced traders.

Some of the features of this broker’s accounts include:

- Clients can use portfolio margining.

- Eligible customers can use the stock loan program. It can help them earn money when short sellers borrow their stock.

- Cash balances have low-interest rates. Customers can move excess cash into a money market fund, too. There is no automatic sweep program. So, customers have to ensure their accounts have enough funds.

- Clients can choose to join a dividend reinvestment program when buying a stock.

You connect non-Schwab accounts for a clearer picture of your finances:

- Investment accounts

- Bank accounts

- Credit cards

- Mortgages

- Loans

- Real estate from over 15,000 financial institutions

It is an excellent feature. It lets you analyze the combined information of all your accounts. The charts make it simpler to determine your investments and financial status.

We like the Schwab Portfolio Checkup Tool. It allows you to look at your investments and calculate the rate of return. All information is in real-time. But you can’t establish your expected income from dividends and interest.

Schwab has a free digital financial planning tool, Schwab Plan. It is useful for keeping track of your finances and retirement goals. It can aid you in evaluating your decisions after a trade.

3. Trading Platforms

This broker’s trading experience is all about the All-In-One Trade Ticket. The All-In-One Trade Ticket is an order entry most investors know. There are useful learning resources to help you understand it. The downside is that futures trades are part of the StreetSmartCentral. The All-In-One Trade Ticket functions across Charles Schwab platforms. This includes Trade Source and StreetSmart Edge.

The website platform can feel bulky. It has a tiered menu that can be hard to read. But the broker aims to repackage the website functions to make it more user-friendly.

The website offers fewer customization opportunities. The Trade Source is simple to use and has a selection of stock streaming data. We like the research capabilities due to their user-defined alerts.

Schwab lets its customers trade fractional shares of stock via Schwab Stock Slices. With this tool, investors buy fractional shares in up to 10 publicly-traded companies. This action comes with no commission if done in a single transaction.

The downloadable StreetSmart Edge is customizable. It offers to active traders: workflows, trade alerts, and improved trading experience. You can use StreetSmart Edge in the cloud. But for this, you’ll need a third-party app, Citrix. The downside with StreetSmat Edge is the lack of screeners. Not all screeners available on the website are available in the mobile app.

Trade Source has the cleanest interface and reliable visual representation. But both Trade Source and StreetSmart Edge are straightforward.

4. Mobile Trading

Charles Schwab’s mobile app is like the website. The workflow is simple to understand and intuitive. All asset classes are available in the app, and you can submit conditional orders.

We like that the watchlists are the same on all platforms. If you use the downloadable version of StreetSmart Edge, you can save watchlists on a device.

The news feed in the mobile app is good. The downside is that fundamental research is light. The charting function offers a wide range of technical indicators without drawing tools.

5. Research

Charles Schwab has an impressive research offering. It includes flexible screeners for most asset classes, tools, and calculators.

- Equity Screeners

- The Screener Plus on StreetSmart Edge offers:

- Real-time data

- Filtered stocks depending on fundamental and technical criteria

- Technical signals from Recognia

The website screen has MSCI ratings and 120 other criteria. It includes equity ratings and 15 data points for dividends.

The ETF screener on StreetSmart Edge comes with more than 150 screening criteria:

- Asset class

- Morningstar category

- Fund performance

- Top ten holdings

- Regional exposure

- Distribution capabilities

You can customize 16 predefined screeners. You can export and view the results via seven distinct standard views. The ETF screener is available for customers using StreetSmart Edge and prospects.

Mutual Fund Screeners

The mutual fund screeners are basic due to the outdated interface. The standard screener has sixteen criteria and the advanced one 60. You’ll receive ten predefined screens. It is available for both customers and prospects.

Options Screeners

The website offers customizable, predefined screeners. But these look outdated and offer little to no help. You can use some probability tools and options pricing.

Fixed Income Screeners

Customers can look for:

- agency

- municipal

- treasuries

- treasury zeros

- certificate of deposits

- mortgage-backed securities

- secondary market corporate

Tools And Calculators

The website has calculators for:

- income guidance

- retirement

- tax efficiency

- margins

- portfolio mix

You can use professional options and stock strategy selections.

Trading Idea Generator

Charles Schwab purchased optionsXpress. This came with Idea Hub, an interesting feature for options trading ideas. You can use it on StreetSmart Edge.

News And Research

This broker has the best news and research offerings. It provides free access to news feeds from:

- BondSource

- MarketEdge

- Schwab Investing Insights Brief

- Argus Research Alerts

- Briefing.com

- Morningstar Equity Research Alerts

- Business Wire

- PR Newswire

- Credit Suisse

- CFRA

- Vickers Insider Activity

You can use premium third-party research available at a good price:

- Briefing. Com premium services

- Investor’s Business Daily

- MarketEdge Platinum

- Trader’s Library

- XTF ETF Experts

- Wiley Trading Bookstore

- StockCharts.com

- Fly on the Wall

- Quantcha Options Play

- Technical Analysis And Charting

StreetSmart Edge charts feature Recognia recognition tools. The website has basic charting, while the StreetSmart Edge platform is for professionals. You can save your preferences, studies, settings, and layouts. Charting in mobile apps have several technical indicators but no drawing tools.

6. Education

Investor education is a top priority at Charles Schwab. Every year, this broker invests millions of dollars in top-quality educational resources. Some of the resources they offer include:

- Schwab Live Daily broadcasts

- Research via the Schwab Center for Financial Research

- Articles on the Insights & Ideas pages

- Webinars

- In-person events

The Schwab Live feature has up to 5 hours of daily live videos. These are accessible on the StreetSmart Edge platforms and the web. On the website, you can check diverse educational content. The Education Center has all the archived webinars by topic.

Schwab’s Knowledge Center functions as a glossary and FAQ section. The life stage planning tools are in the Intelligent Portfolio of the website.

7. Customer Service

Schwab says the average wait time for retail clients calling support is 22 seconds. They are responsive to complaints on Twitter. But they encourage clients to send a direct message for a private discussion.

- It has 24/7 customer support available by phone

- It offers an online chat with a Charles Schwab representative

- It allows you to discuss with a live broker

8. Safety

Charles Schwab has the best security standards in the industry.

- The mobile app has a biometric recognition log in

- Both the mobile app and website have risk-based security technology and encryption. It prevents unauthorized access to your account

- Customers can request two-factor authentication

- Customers can get Securities Investor Protection Corporation insurance. Lloyd’s of London offers this insurance at $149,500,000 per account. Also, it has a total of $600 million for uninvested cash

- This broker encourages its clients to contribute to their online security

- There was no important data breach reported by the Identity Theft Research Center

The Bottom Line

Charles Schwab is one of the leading online brokers. It offers several services and tools to its customers. Its mobile apps are some of the best in the industry, and its security measures are top-notch. This broker encourages its clients to work with an advisor: robo or human. Investors and self-directed traders can use Trade Source and StreetSmart Edge platforms. Charles Schwab is an excellent choice for most traders. But they could offer automated sweep features for uninvested cash.