City Index has competitive spreads, reliable platform options, several products available, professional research tools, and knowledgeable customer service. Multi-asset traders opt for using City Index because it is backed up by GAIN Capital, the largest retail broker on the globe.

City Index

Best ForForex & CFDs

Recommended ForSpread Betting Traders, News & Event Traders, Day Traders & Scalpers

More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

Best ForForex & CFDs

Recommended ForSpread Betting Traders, News & Event Traders, Day Traders & Scalpers

- Trader Level Advanced

- FX Fees Low

- Index CFD Fees Low

- Account Opening Speed 24 hours

Web trading platform4.2

Fees4.3

Mobile App4.3

Deposit and withdrawal 3.5

Available assets2.9

Account opening5.0

Education and Research 4.3

Support4.2

Overall rating4.1

More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

In A Nutshell

We tested the top 30 forex brokers over five months and discovered the following about City Index:

- City Index is owned by publicly-traded GAIN Capital. It has three tier-1 certificates, which is why it is a low-risk broker for CFDs and forex trading.

- It is an excellent choice for low-cost trading thanks to its proprietary platforms.

- It lets you trade with either its proprietary platforms or MetaTrader. Also, you get access to professional tools, reliable market research, and several offerings for its trading products. So, City Index offers an excellent copy trading experience, but there are other copy trading brokers with better products.

City Index Review & Insights

City Index was founded in 1983 in the United Kingdom. It is one of the leading multi-asset brokers in London, and it was purchased in 2015 by Forex.com operator, GAIN Capital Holdings (NYSE: GCAP). The Forex.com’s UK office team manages clients from both businesses since they have the same offices.

City Index comes with more than 30 years of experience in offering traders spread-betting possibilities and Contracts for Difference (CFDs). It expanded its offering by purchasing IFX Markets, FX Solutions, and Finspreads before GAIN Capital acquired it. You can discover additional information about this broker on Wikipedia: City Index.

1. Fees and Spreads

City Index is a broker with competitive spreads on spread-betting, CFDs, and Forex products.

We tested their offering and discovered that the standard spreads are higher on MT4 than its proprietary platforms. City Index is in the top 7 Best In Class ranking for cost. Variable (floating) and fixed spreads cost options are available.

Advanced Trader: The all-in-costs for all traders are similar to pricing leaders like CMC Markets. The standard spreads on the USD/ EUR are 0.8 pips (according to October 2019 data).

MetaTrader: The spreads on MT4 platforms are significantly higher, as they come with an average spread of 1.7 pips on the USD/ EUR over the same timeframe. There is no price tolerance setting on MT4, but you can use such settings on City Index’s proprietary trading platforms.

City Index Fees and Spreads

| Feature | City Index |

|---|---|

| Minimum Initial Deposit | £50.00 |

| Standard Average Spread USD/EUR | 0.8 (Oct 19) |

| Active All-In-Cost USD/EUR | 0.8 (Oct 19) |

| VIP or Active Trader Discounts | Yes |

2. Withdrawals And Deposits

City Index has a minimum deposit of £100.

This broker offers several methods to fund your account. You can use the platform’s MyAccount portal to fund, withdraw, add a card, or remove a card. Also, you can opt for a direct bank transfer.

The only restriction at City Index is related to Citibank cards. You are not allowed to fund your account with Citibank cards, which is why you can transfer money with a Citibank account only through CHAPs or BACs.

3. Trading Options

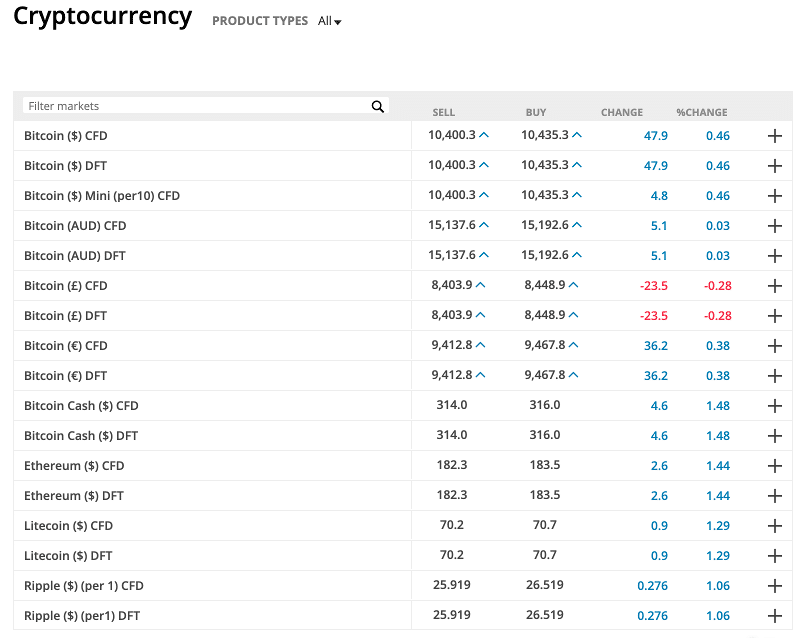

City Index offers its clients several investment products.

Additional offerings: Similar to other brokers in the United Kingdom, City Index lets you trade various CFD products with a spread bet. So, if you live in the UK, using spread-betting gets you specific tax benefits, and it can be advantageous as an alternative to CFDs.

Offering Of Investment Comparison

| Feature | City Index |

|---|---|

| Spot Trading Forex | Yes |

| Total Forex Pairs (Currency Pairs) | 84 |

| Total CFDs offered | 4500 |

| Copy-Trading/ Social Trading | Yes |

| Cryptocurrency traded as actual | No |

| Cryptocurrency traded as CFD | Yes |

4. Web Trading Platform

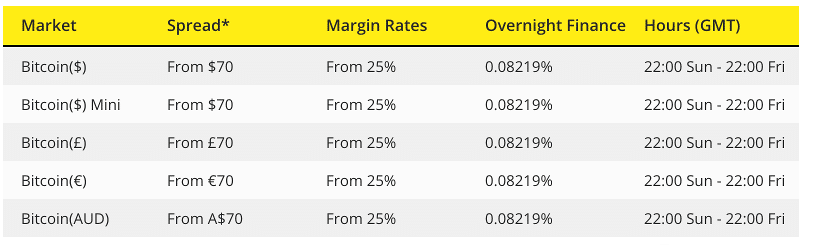

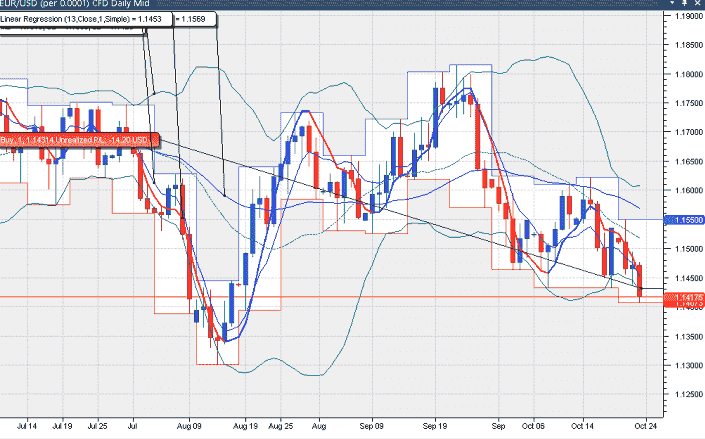

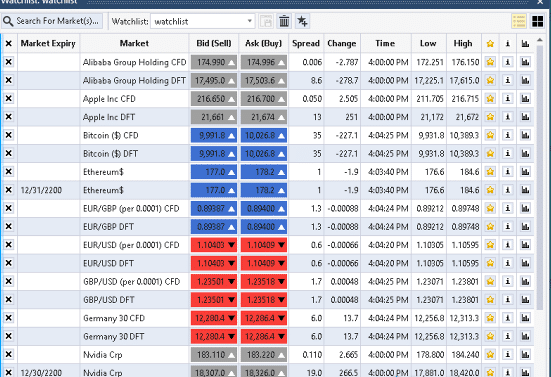

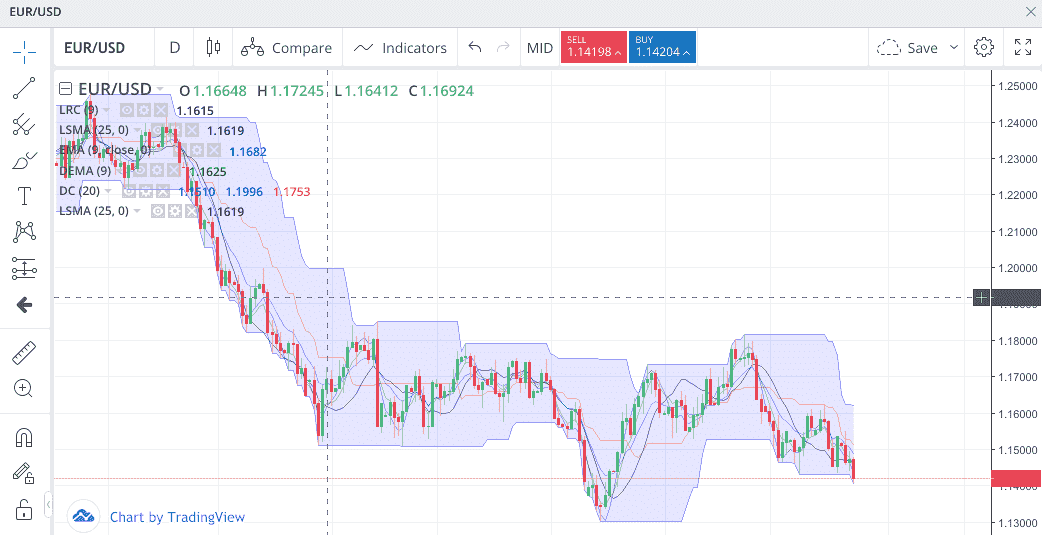

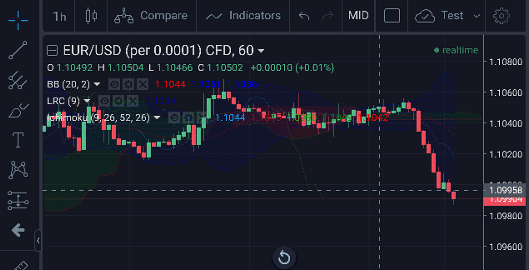

City Index has access to MetaTrader4 (MT4) and two proprietary platform suites: Web Trader (web-based) and AT Pro (desktop-based). Overall, it offers a professional CFDs and forex trading experience.

AT Pro: AT Pro is for experienced or professional traders thanks to the advanced and complex functions. It comes with reliable charting (25 drawing tools and 139 indicators), along with a Development Studio with automated trading functions. It lets its traders back–test potential strategies based on historical data. There are more than 100 pre-loaded strategies.

Web Trader: Web Trader is designed exclusively on HTML5. It is a versatile, rapid, and user-friendly platform. Web Trader has a little less than half as many features as the AT Pro desktop platform, which makes it excellent for casual traders.

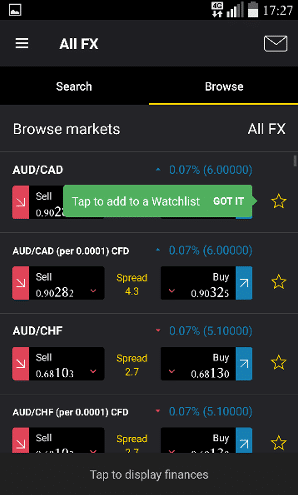

5. Mobile Trading Platform

The mobile app from City Index is average but still competitive when compared to several multi-asset brokers like Saxo Bank, IG, or CMC Markets.

Overall, the app has a user-friendly design, is bug-free, and offers a good trading experience for adding alerts, reading news, trading, or depositing money in your account.

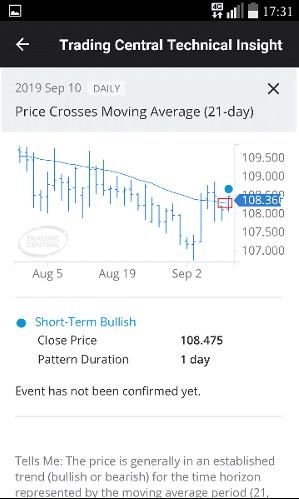

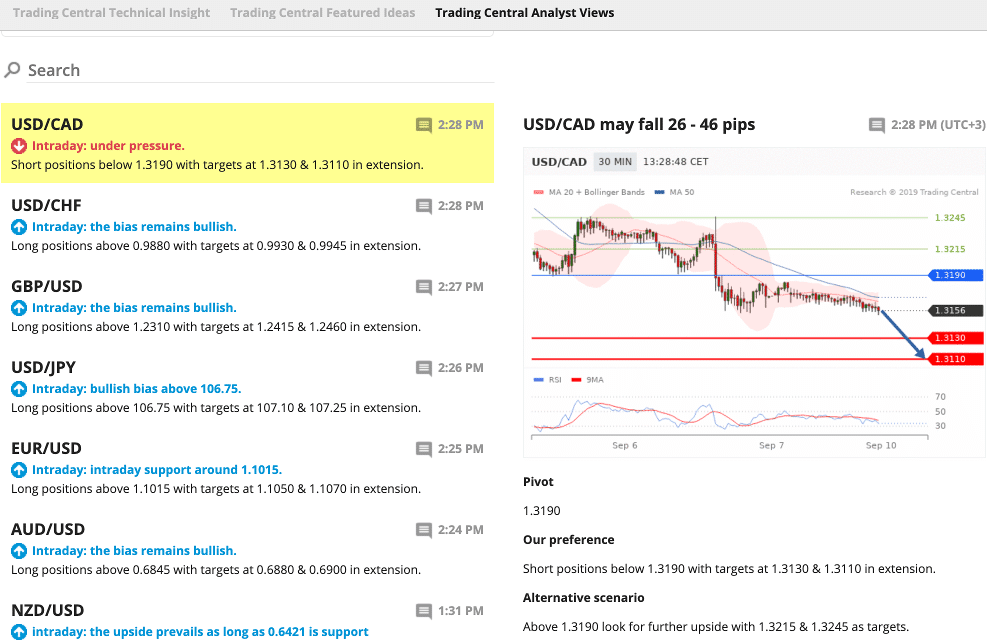

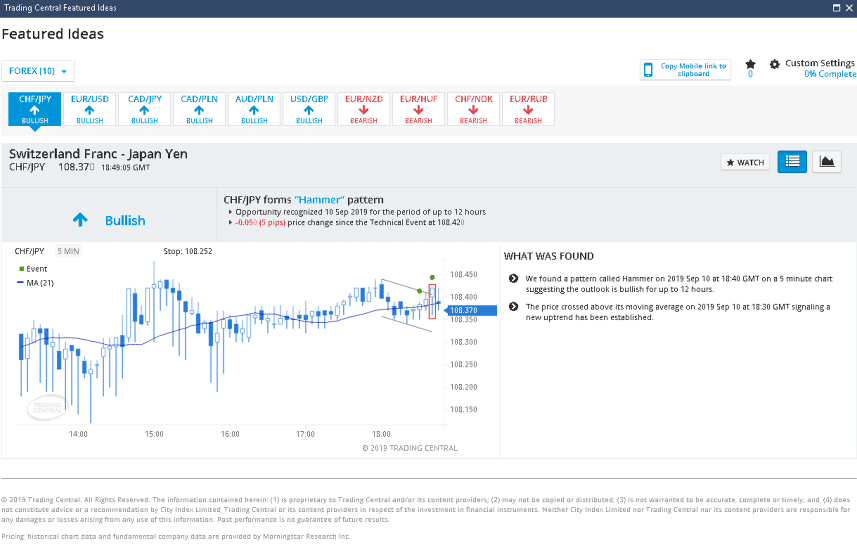

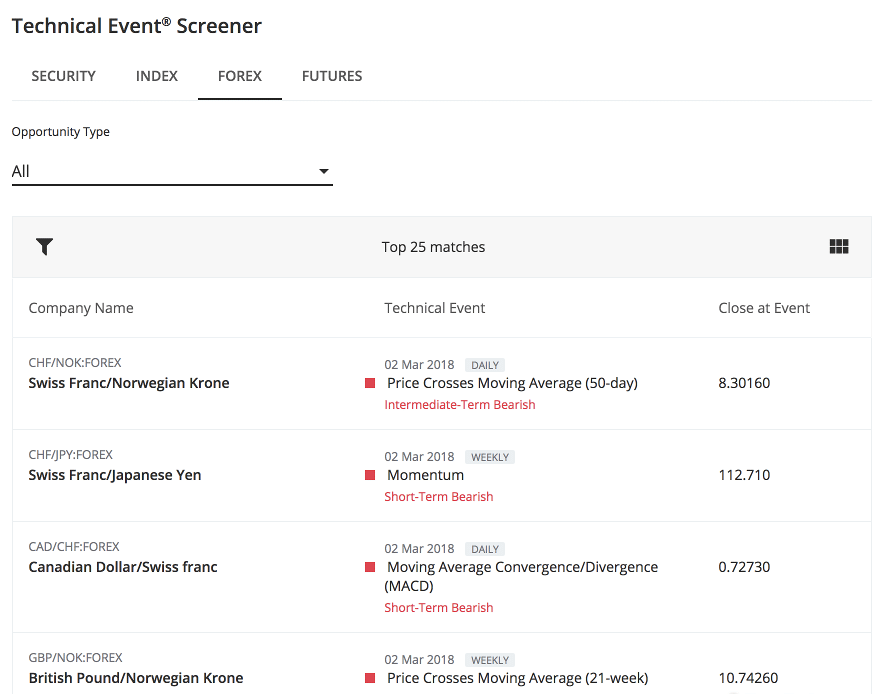

Mobile Tools: City Index’s mobile app has charts from Trading View. It offers access to 74 indicators for charting and standard technical analysis activities with trend lines. Trading Central is professionally implemented into the mobile app. It comes with various modules, like Featured Ideas, Analyst Views, or Technical Insights.

6. Customer Satisfaction

Customer satisfaction findings come from the data offered by the research group Customerwise.

Approximately 330 phone tests from locations all around the United Kingdom were done over six weeks.

Findings:

- Average Connection Time: 1 – 2 minutes

- Average Net Promoter Score: 7.6 / 10

- Average Professionalism Score: 7.9 / 10

- Overall Score: 8.0 / 10

- Ranking: 10th (22 brokers)

7. Research Tools And Educational Programs

City Index provides high-quality market research at a level that goes beyond the industry standard.

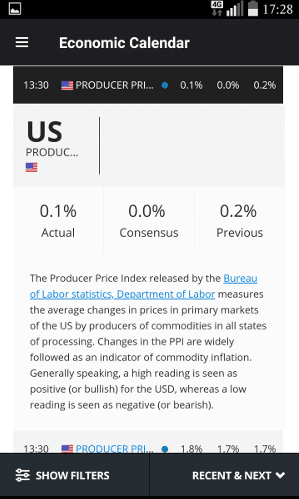

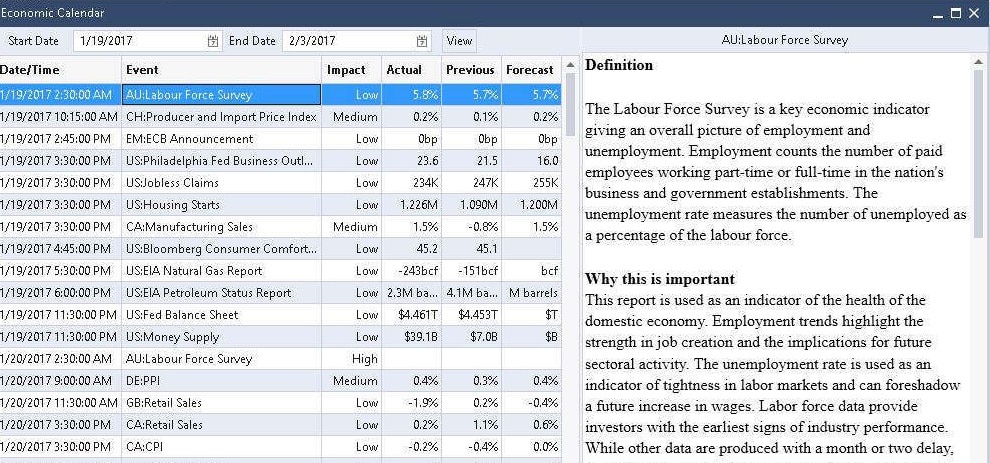

Some of the main features are the news headlines from Thomson Reuters, Trading Central, AutoChartist for MetaTrader, and an economic calendar offered by FXStreet.

8. Safety And Privacy

City Index is a low-risk broker, and it has a Trust Score of 93 out of 99. It trades publicly, but it doesn’t operate a bank.

City Index has three tier-1 regulations (high trust), no tier-2 regulations (average trust), and one tier-3 regulation (low trust). The following tier-1 regulators authorize City Index: the Financial Conduct Authority (FCA), Monetary Authority of Singapore (MAS), and the Australian Securities & Investment Commission (ASIC).

Regulations Comparison

| Feature | City Index |

|---|---|

| Year Founded | 1983 |

| Publicly Traded | Yes |

| Bank | No |

| Tier-1 Licenses | 3 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 1 |

| Trust Score | 93 |

The Bottom Line

City Index offers several possibilities for traders to reach global markets thanks to its offerings in Asia and Europe. It features 15 forwards, 65 spot forex pairs, and more than 10,000 CFDs on various trading platforms. This broker is recommended for all traders, no matter their level of experience in trading. City Index is in the Best in Class ranking across six categories: Beginners, Overall, Trading Options, Fees & Spreads, Research, and Education.