Page Summary

Double-spending is a flaw within cryptocurrency protocols that allow users to spend tokens or coins more than once. Cryptocurrencies consist of files that users can duplicate or falsify when they are vulnerable. Double-spending leads to the inflation of the cryptocurrency involved. Blind signatures and secret splitting are ways to prevent double-spending.

Blind Signatures

Blind signatures are digital signatures in which the content of a message is disguised before it is signed. People can verify the blind signature against the original.

Secret Splitting

Secret splitting or secret sharing is a method to distribute a secret among multiple people, each knowing a part of the secret. People can solve the secret only when they combine enough parts of the secret.

How are cryptocurrency transactions verified?

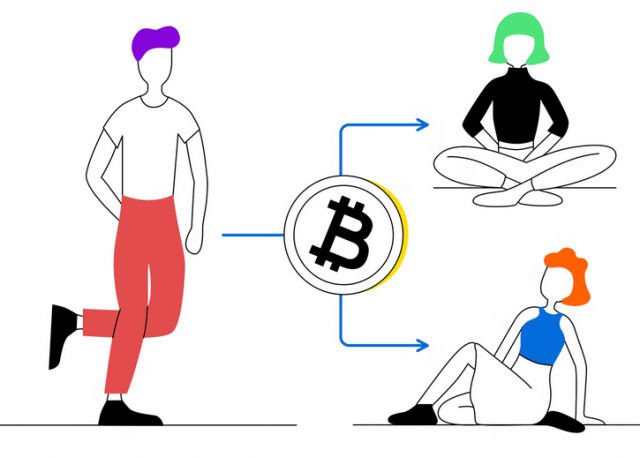

Centralized currencies use a central trusted party to verify transactions. Decentralized currencies don’t use a third party to verify transactions, but rely on validators. These are servers that store copies of the current blockchain ledger. Validators reach a consensus about the legitimacy of transactions. They do this by either proof-of-work or proof-of-stake. Proof-of-work is a cryptographic system that involves the solving of computational puzzles called mining. With proof-of-stake, the validators that own the most cryptocurrency have the most voting power when it comes to deciding the legitimacy of transactions.

51% Attack

A 51% attack is when a network of computers contributes more than 51% of all computational power to a decentralized proof-of-work system. Any such network can overturn transactions and double-spend. In 2014 Ghash.io obtained more than 51% of the total Bitcoin computational power. They decided to voluntarily cap their hash rate to 39,99% and requested other mining pools to do the same if that ever were the case.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.