Business24-7.ae is committed to the highest ethical standards and reviews services independently. Learn How We Make Money.

Page Summary

Finq.com is a popular CFD and Forex broker for traders of all experience levels. It offers an advanced trading platform and mobile app with an extensive range of assets. Finq.com has a demo account and several other account tiers with fixed spreads. This broker has higher spreads than its competitors.

Summary

Finq.com is a reputable online forex and CFD broker regulated by the Seychelles Financial Services Authority. Users choose from over 2000 tradable instruments, including 60 forex currency pairs.

Finq.com offers a multilingual interface, excellent for all levels of trading experience. It has real and valuable educational materials to help traders achieve the best trading experience.

We recommend Finq.com for traders looking for trading volume bonuses and a multilingual trading platform. Customers who make initial deposits over $100,000 receive the lowest spreads and fees.

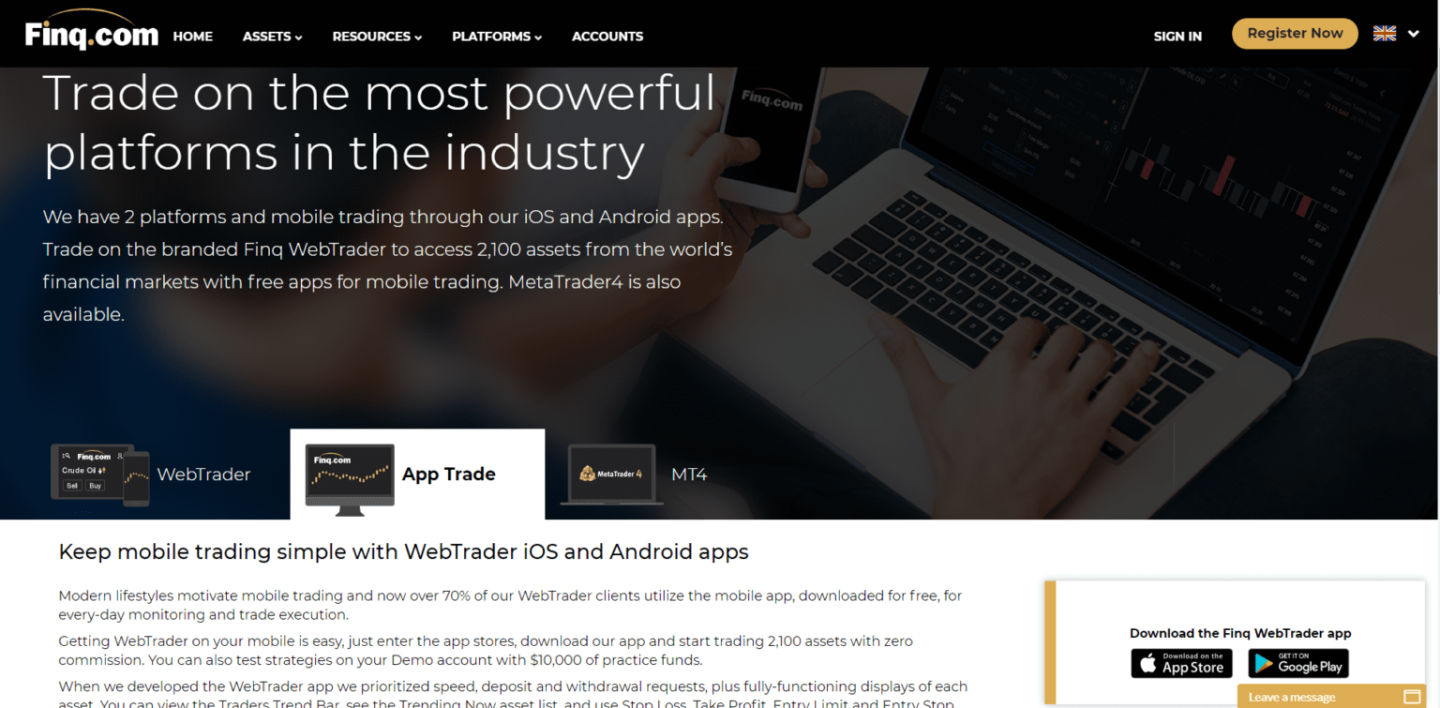

Trading Platform

Finq.com has reliable trading platforms which focus on account security. It uses the MetaTrader 4 and has a proprietary platform, WebTrader. Finq.com has an excellent service with many assets and immediate bonus offers. Finq’s trading platforms are multilingual and have a straightforward interface. Standard trading tools are available across Finq.com’s platforms.

MetaTrader 4

The MetaTrader 4 platform is excellent for forex and CFD trading. It is professional and straightforward, being the gold standard among trading platforms. The MetaTrader 4 has a multilingual interface and an in-depth technical analysis package.

Traders receive Real-Time access to market prices and liquidity. MetaTrader 4 is flexible and offers robust account security. It is the top choice for experienced traders. It suits intermediate traders’ needs because of its reliable learning tools.

WebTrader

Finq.com WebTrader functions as a professional, customizable trading suite. It uses cutting-edge technology with secure access to your account. WebTrader doesn’t need additional software installation, offering immediate access to trading.

Finq.com WebTrader includes independent spreads, lower than other platforms. It has professional tools including the Events and Trade function. The web-based interface looks similar to the original MetaTrader for desktop. It is safe and easy to trade with.

Mobile Trading

Finq.com has a reliable and simple-to-understand mobile trading app. It is downloadable on Windows, iOS, and Android devices for hassle-free trading. The finq.com app has impressive user reviews thanks to its versatility and tools.

The mobile app at Finq.com provides standard trading tools. It offers access to a economic calendar and educational tools. Traders who want access to all instruments and tools available at Finq.com use WebTrader or MetaTrader 4.

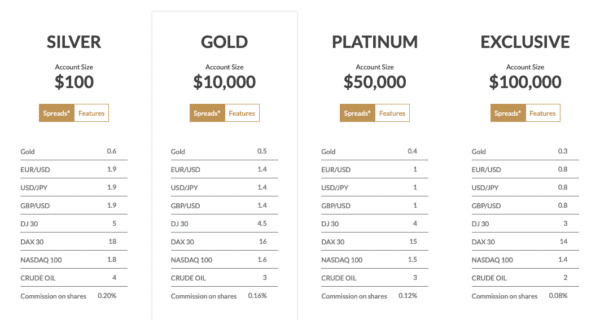

Fees and Spreads

Finq.com has fixed spreads for each account type. For the EUR/USD pair, the spreads are 1.9 pips. It offers an impressive range of assets for beginners and professional traders.

Finq.com allows you to trade CFDs on Forex, Cryptos, Stocks, Indices, Bonds, ETFs and Commodities

Leverage at Finq.com varies from 1:50 up to 1:300. Using leverage depends on your level of experience since it comes with significant risks.

Deposit & Withdrawal

Finq.com has a smooth deposit and withdrawal process. The minimum deposit for the Silver account at Finq.com is $100. Deposit amounts increase up to $100,000 for the Exclusive account.

Finq.com has no commission fees on trades, except for stocks. They allow you to trade over 2100 assets. It has competitive spreads with no commission on deposits or withdrawals. Deposits and withdrawals are available through several methods, including:

- Bank transfers,

- Debit/Credit cards

- FasaPay

- Neteller

- Skrill.

Finq.com doesn’t charge hidden fees that other payment processors charge. Its base pricing is higher than its competitors.

Account Types

Finq.com offers versatile account tiers, including 4 account types and a demo account. It provides a good variation for different trading styles, experience levels, and investment sizes. The minimum deposit fee at Finq.com is $100. It vary depending on the account type you choose.

Demo Account

Finq has a demo account that offers access to $10,000 of virtual money. The currencies available in the demo account are USD, RUB, and ZAR. This demo account is great for determining whether Finq.com is suitable for your trading skills. It helps traders experience trading at Finq.com without needing to invest money upfront. This demo account is a good learning tool for inexperienced traders.

Silver Account

The Finq.com basic account has a $100 deposit fee. It supports the web and mobile trading platforms. The basic account offers access to standard trading tools, being a good choice for beginner traders. For in-depth research tools, traders use one of the premium accounts.

Classic Account

The Classic Account includes all the standard features, and it has a $1,000 minimum deposit fee. It offers improved spreads, a daily review, and a dedicated account manager. It is a good choice for experienced traders looking to improve their trading skills.

Gold, Platinum, And Exclusive Accounts

The Finq.com Gold Account has a minimum deposit of $10,000. It offers everything the Classic Account has, plus a premium daily analysis and access to Trading Central.

The Finq.com Platinum and Exclusive Accounts have a deposit fee of $50,000 and $100,000. Exclusive account holders see spreads from 1 pip. These account types are best for professional traders.

Regulation & Reputation

Finq.com holds a license from the FSA in Seychelles. Competitor brokers have more licenses from more respectable authorities to support their financial strength, including FCA and CySEC. Finq.com has outstanding market coverage.

Finq.com focuses on security and keeps client funds in top global banks. Payment methods are reliable and vetted according to the industry’s highest standards.

Customer Service

Finq.com customer service is available by email or phone. It is reachable during market hours Monday to Friday. Customer support is available in English, Indonesian, Malay, Urdu, Vietnamese, and Arabic languages.

Finq has a multilingual customer service team that is well-trained in trading and support. The constant training is the reason Finq.com has excellent customer service reviews.

Research & Education

Finq.com aims to provide an in-depth approach to trading by offering access to many research and education tools. It aims to assist traders in analysis and risk management.

It offers an economic calendar, a daily roundup of the market outlook, and a reliable FAQ section for the WebTrader platform.

Conclusion

Finq.com is a great online broker for traders looking to trade forex and CFDs on a reliable trading platform, low deposits and big bonuses. They offer 7 different asset classes, over 2100 tradable instruments, zero commission trading and excellent educational tools.

Users like that Finq.com is accessible and has good support and education for traders of all levels. Its multilingual interface and customer support team contribute to a good trading experience. It’s open 24 hours a day and provides access to unique global markets.

The downside is that Finq.com has one license from the FSA of Seychelles. Competitor brokers have additional licenses from reputable authorities like the FCA in the UK, CySEC, or the ASIC from Australia. Finq’s regulatory status is a concern for beginner and experienced traders.

We recommend Finq.com for professional traders with the skills to mitigate regulatory risks.

FAQ

Which are the trading hours available at Finq.com?

Finq.com allows you to trade 24/5. It accommodates the relevant trading hours for global exchanges and markets. There is a weekend trading schedule to ensure you trade at your convenience.

Which countries does Finq.com operate in?

Finq.com accepts traders from: Thailand, South Africa, Singapore, Hong Kong, India, The United Arab Emirates, Kuwait, Qatar and most other countries. Restricted Jurisdictions: Finq.com does not establish accounts to residents of certain jurisdictions including the European Union, United States or any particular country or jurisdiction where such distribution or use would be contrary to local law or regulation. For further details please see Finq.com’s Terms & Conditions.

Is it safe to trade with Finq?

Are there any bonuses for trading at Finq?

Finq offers up to 30% deposit bonus and a ‘refer a friend’ bonus. Traders are eligible for a volume-based bonus depending on their volume of trades.

Does Finq offer Auto and Social Trading?

Finq.com offers auto trading but no social trading.

Disclaimer