Business24-7.ae is committed to the highest ethical standards and reviews services independently. Learn How We Make Money.

Page Summary

The following is a detailed review of Sarwa, a full-service broker based in the UAE. If you are on the edge of signing up with Sarwa to invest in stocks, ETFs or Cryptos, keep reading as we break down all aspects of their brokerage service to help you make an informed decision. Keep in mind that our findings are backed up with researched data and comparisons with similar brokers from the industry to help you get the complete picture of their overall offering.

What Is Sarwa?

Sarwa is a full-service broker, meaning it combines automated investing, self-directed trading and financial advisory services at the same time. Users can either use their automated trading services to invest in a diversified portfolio based on their evaluated risk profile, trade on their own or combine both options. This gives users a great selection of different services from the same dashboard, all at very reasonable fees.

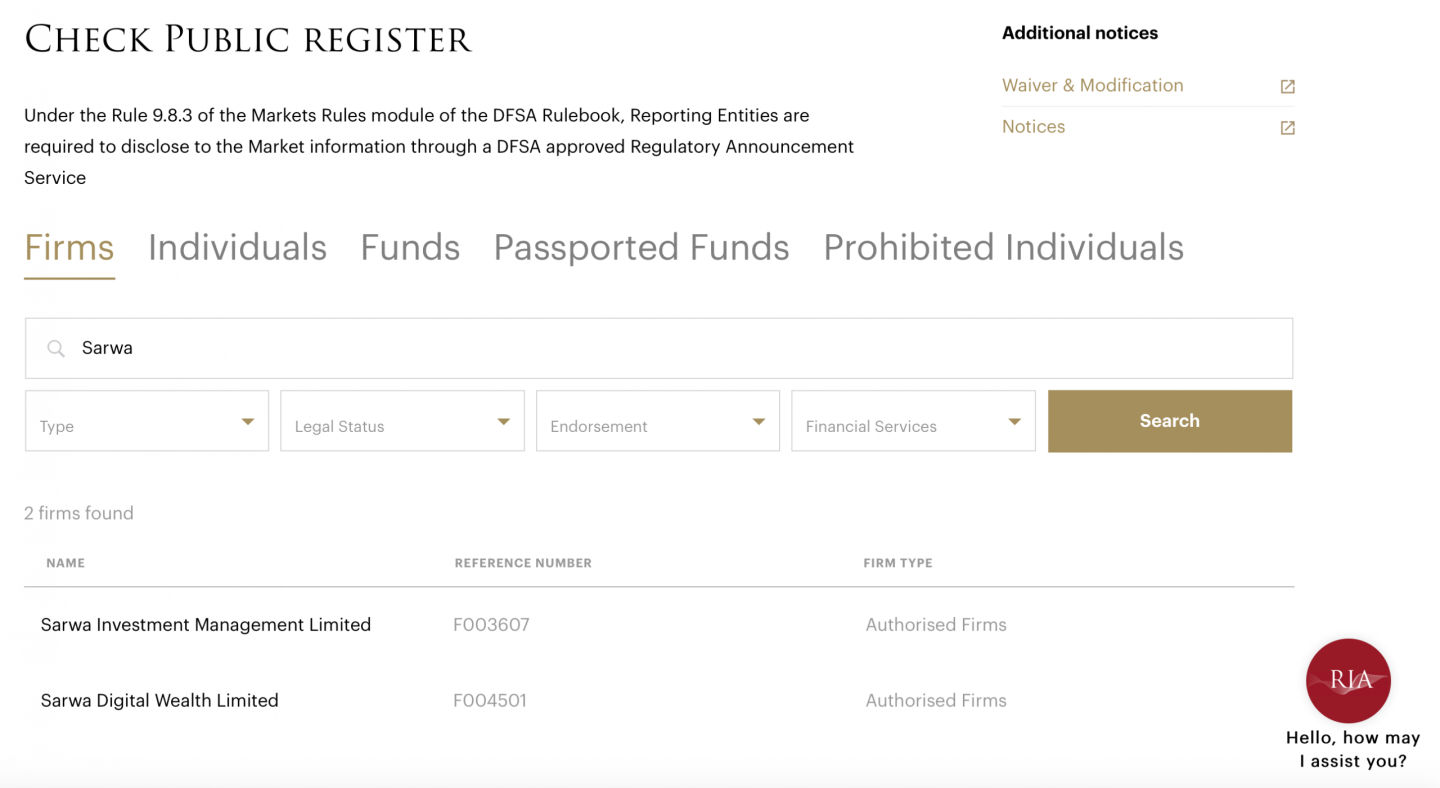

Established in 2017 in Dubai, Sarwa is regulated by the UAE’s main regulatory authorities (DFSA and FSRA) and is therefore considered safe.

What Do They Offer?

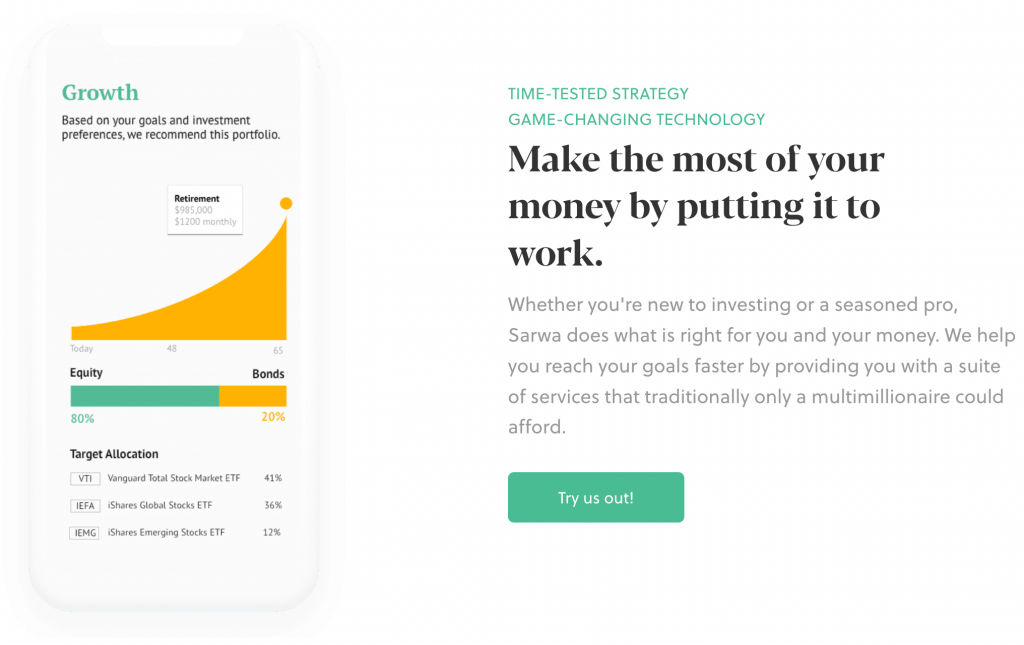

Sarwa offers an “autopilot” kind of investment option, where users are guided through a set of questions, and their answers determine where, for how long, and at what risk exposure their money is invested.

They also offer free financial advisory services, meaning you can get all the information while talking to an actual live human being and not just a robot. This combination makes Sarwa a great option for beginners and casual traders who need some “hand holding” when stepping up their game.

Sarwa also offers access to self-directed trading through Sarwa Trade. This allows users to trade on their own using intuitive trading features, basic buy & sell options (market and limit orders) and different charting tools (historical and daily stock price movements and metrics, company info).

They do not charge any commission or transfer fees on stocks and ETFs and have a low minimum deposit of $5. This makes them not only a cheap broker, but also accessible for beginners who want to start out small.

- Auto invest options with low fees

- Access to zero commission stock and ETF trading

- Regulation by the DFSA and FSRA

- Low minimum deposits

- Easy to use and intuitive trading platform

The Good and Bad Listed Side by Side

After we analyzed Sarwa across 8 different categories, we came up with their pros and cons, which we think users should be aware of before signing up:

Based on their low fees and intuitive automated investment options, Sarwa would be a great choice for long-term investors or casual investors with no time for trading on their own.

Pros

- Competitive fees across all accounts

- User friendly layout which makes is easy to set up an account, trade and invest

- Possibility to trade on your own and auto-invest with the same dashboard

- Access to a wide range of different markets

Cons

- Few deposit and withdrawal options

- Beginners will miss out educational materials and resources

- Professional investors will miss out advanced trade types

Based on their simple buy and sell options and limited customization options, we think Sarwa would not be a good option for seasoned (professional investors), institutional investors or active traders.

Sarwa Invest Compared With Sarwa Trade and Crypto

Being a full-service broker, Sarwa combines automated trading through Sarwa Invest and general brokerage services through Sarwa Trade and Sarwa Crypto. This allows users access to different types of investments, meaning they can let professionals manage their portfolios, trade on their own, or combine both options.

Below is a breakdown of all the different investment types offered by Sarwa:

01. Sarwa Invest

Sarwa Invest is an automated trading tool that allows users to invest in different assets (stocks, real estate, bonds, SRI etc.) based on their risk exposure profile and with the help of robo-advisor technology. This means that at account opening, users are guided through a five-step set-up process where they choose between different investment criteria. Their choices are evaluated based on AI, and users’ preferences are converted into a diversified investment portfolio. Those are adjusted based on market fluctuations and performance quarterly.

Users can choose to auto-deposit monthly, reinvest their dividends, or invest with human advisors.

Sarwa Invest is a great option for users who are looking for a “set and forget” investment strategy where their portfolio is managed by professional investors.

Here is an overview how Sarwa performs compared to the best financial advisors:

| Features | Sarwa | Holborn Assets |

| Account opening | Online | In person |

| Minimum Investment | $5 | $30,000 |

| Fees | 0.5% – 0.85% | 1%-1,5% |

| Portfolio Costs | 0.1% | 1.2% |

| Additional Costs | No extra fees | Set up fee: 1,5% Performance fee: 1% |

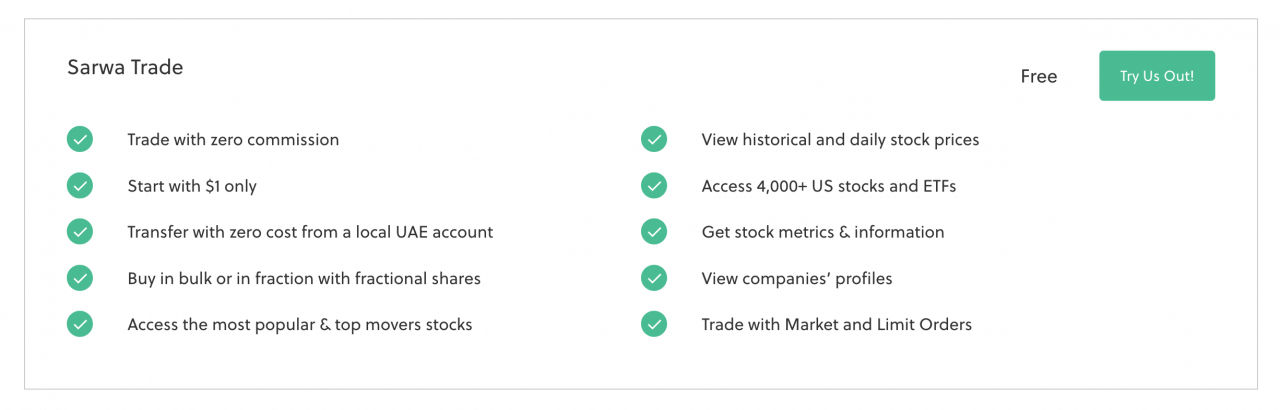

02. Sarwa Trade

Sarwa Trade allows users to trade on their own on over 4000+ stocks and ETFs with no trading fees.

The Sarwa Trade platform is intuitive, easy to use, and offers simple trading features. Users have access to fractional shares, meaning that they don’t need to buy the whole stocks, and there is no minimum deposit required. AED account transfers are free of charge. The minimum trade is $1.

Here is an overview of how Sarwa Trade performs compared to the best stocks brokers in UAE:

| Fees | Sarwa | Interactive Brokers | Saxo Bank | eToro |

| Transfer Fees | $0 | $0 | $0 | $0 |

| Trading Fees | $0 | $0.005/share | $1.0/share | $0 |

| Inactivity Fee | $0 | $0 | $100 after 6months | $10 monthly after 1 year |

| Number of Stocks | 4,000 | 16,500 | 30,000 | 2,800 |

03. Sarwa Crypto

Sarwa Crypto users can access the most trusted cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Bitcoin Cash, using advanced market, stop and limit orders. There are no inactivity fees, transfer fees and no commissions charged on cryptocurrency trades, which makes Sarwa a cheap broker for cryptocurrency trading. With a Sarwa Crypto account, users also have access to free cold storage of their crypto coins.

The below table shows how Sarwa compares with the best Crypto exchanges:

| Fees | Sarwa | Binance | Coinbase | FTX |

| Transfer Fees | $0 | $0 | $0 | $0 |

| Trading Fees | $0 | 0.075% | 0.6% | 0.02% |

| Spread | $0 | 0.075% | 0.4% | $0 |

| Number of Cryptos | 5 | 393 | 167 | 167 |

| Spot Volume (BTC) | / | 400,000 | 76,000 | 50,000 |

Regulation

Sarwa is regulated by two top-tier financial regulators from the UAE, including the Dubai Financial Services Authority (DFSA) and the Financial Services Regulatory Authority of Abu Dhabi (FSRA). Sarwa also owns an Investor Compensation Fund license (number #F003607) from the DFSA. This means that the UAE Central Bank will cover users’ deposits if the company goes bankrupt.

Safekeeping securities additionally protect users through foreign custodians. That means the assets you invest with Sarwa are held in a custodian account at Saxo Capital Markets and are protected by the EU banking and investment directives. Furthermore, Sarwa has the Know-Your-Customer (KYC) policy in place and complies with the Anti-Money Laundering Policy.

Pros

- Regulated by two top tier regulators

- Custodial account protection

- Bankruptcy and scam protection from the UAE CB

Cons

- Tier one regulation missing

Investment Account Types

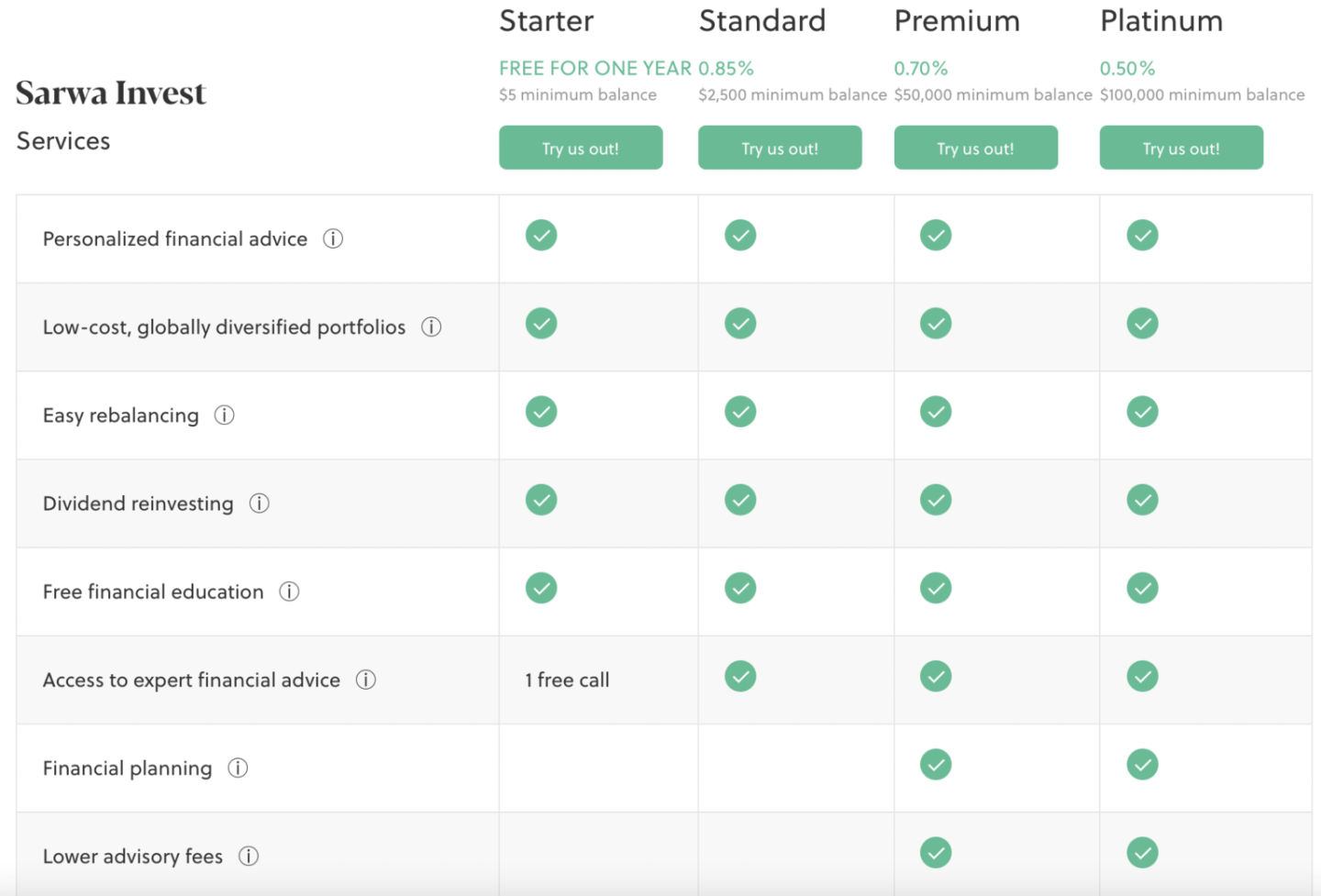

Users choose between 4 different account types based on their minimum amount balance: starter account, standard account, premium account, and platinum account.

Starter Account

With a minimum deposit of $5 and no management fees for the first year, a starter account is a good option for traders who are just starting out. In addition, users get access to a free advisory by professionals on how much to invest, where to allocate assets, and how to reinvest, which is excellent if you are new to trading.

Standard Account

The standard account is for users looking to invest from $2,500 to $50,000 and comes with a yearly operating cost of 0.85%. The account offers everything from the starter account with additional free advisory calls or emails.

Premium Account

With a minimum deposit requirement of $50,000 and a spectrum of different trading and investment options, this account is a great choice for determined investors. The operational cost for this account is 0.70%/year.

Platinum Account

If you plan to invest over $100,000 and are looking for a package where everything is included, choose the platinum account. This account comes with an operational fee of 0.50%/year and offers premium support, financial advisory, and lower fees.

The picture below breaks down the difference between the different Sarwa accounts.

Pros

- Fast and simple account opening (100% online)

- Different account options

- Access to all accounts from the same dashboard

Cons

- Demo account option missing

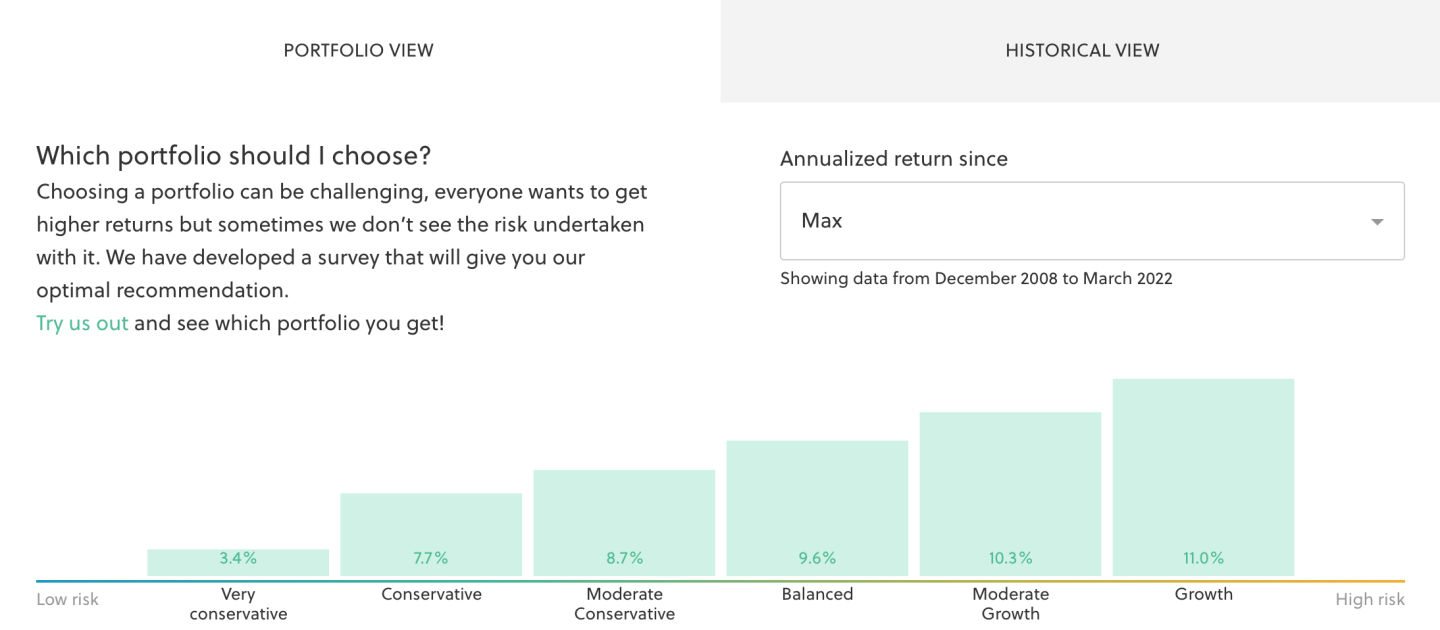

Investment Portfolio Types

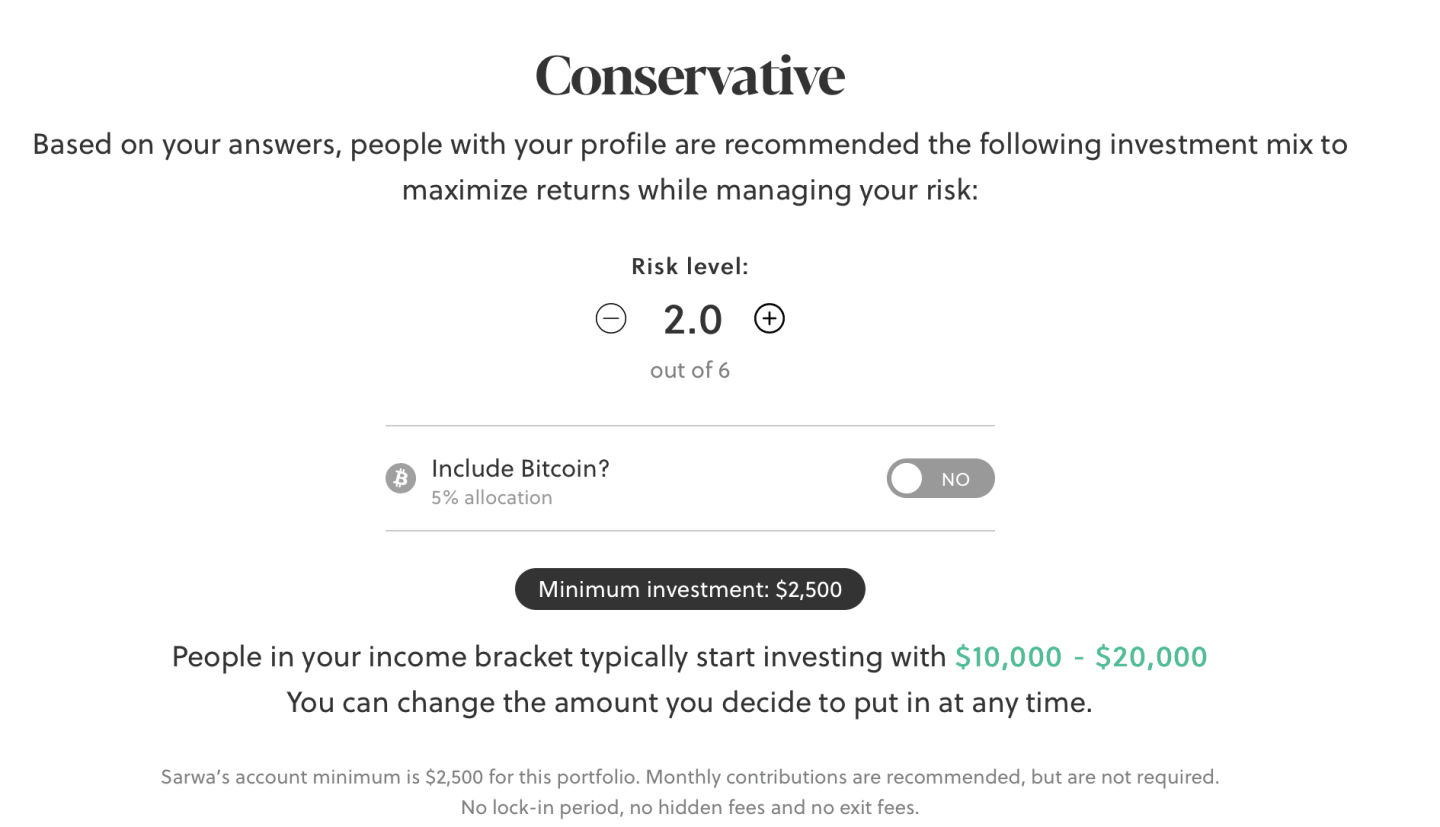

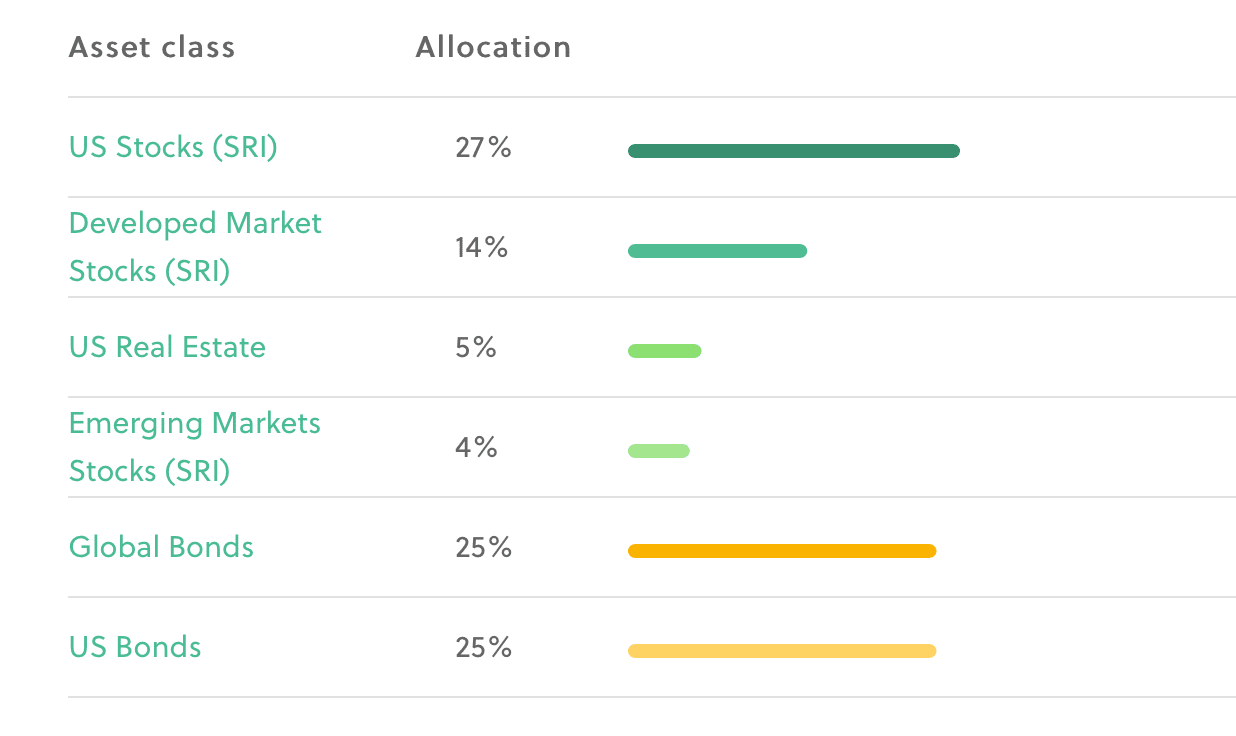

Sarwa users can choose between 4 different portfolio types based on their goals and risk-reward strategy:

- Conventional portfolios – Contain low-risk ETFs like Blackrock and Vanguard ETFs that cover multiple industries.

- Socially responsible investing portfolios – Contain eco-friendly companies with a positive social impact.

- Halal portfolios – Contain Sharia-compliant stocks, indices, commodities, and currencies, that do not profit from interest and do not involve gambling, tobacco, and other Haram companies.

- Crypto portfolios – Contain cryptocurrency investments like Bitcoin and Ethereum.

Based on different portfolio types, here are the pros and cons you should be aware of:

Pros

- Great diversity of portfolio types

- Easy to set up and allocate

- Great risk-reward chart

Cons

- Limited crypto market coverage

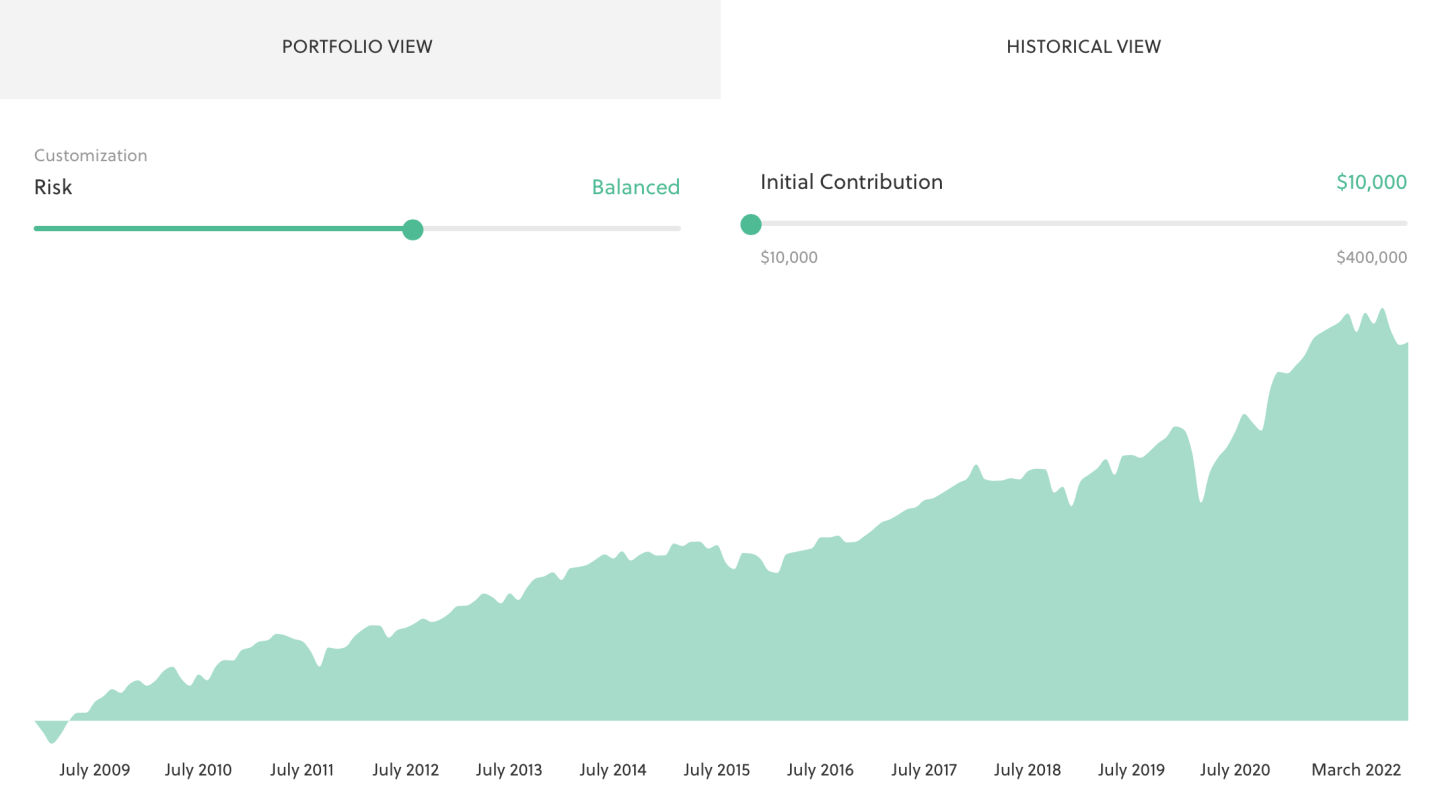

Sarwa Invest Returns

In 2021 Sarwa’s investment portfolios generated between 3% and 11% net return yearly, depending on the risk level selection. When you open an Invest account and deposit money into it, your money will be automatically divided into stocks and other assets according to your chosen portfolio type.

Your dashboard lets you quickly see your current realized returns and how your funds are allocated.

Fees and Minimum Deposits

Sarwa does not charge any commission on stock trades, and they don’t charge any transfer fees when depositing money in AED. They charge low trading fees on ETFs (0.15-0.25%) and low fees for advisory services (0.5-0,85%), which makes Sarwa an overall cheap broker.

Our analytics team looked into Sarwa trading terms to see how their fees structure performs compared to the best full service brokers. Sarwa trading fees are competitive and are among the lowest in the industry.

The table below breaks down Sarwa’s overall fee structure based on the different account types:

| Fee Type | Starter Account | Standard Account | Premium Account | Platinum Account |

| Advisory fee | None | 0,85% | 0,7% | 0,5% |

| ETF fee | 0,25% | 0,1% | 0,15% | 0,15% |

| Minimum deposit | $5 | $2.500 | $50.000 | $100.000 |

Minimum deposits are low and vary based on type of investment and portfolio.

Minimum deposits based on investment types:

- Minimum deposit on conventional investments: $5

- Minimum deposit on Halal plan: $500

- Minimum deposit on Crypto portfolios: $2500

Minimum deposits based on the account types:

- Minimum deposit on starter account: $5

- Minimum deposit on standard account: $2,500

- Minimum deposit on premium account: $50,000

- Minimum deposit on platinum account: $100,000

Pros

- Competitive operational fees across all accounts

- Low advisory fees

- Low ETF fees

- Low minimum deposits

Cons

- ETF fees on starter account are high

Customer Service

Sarwa’s customer service is responsive, well-educated and available in Arabic and English. It is accessible 24/7 by phone, WhatsApp, live chat, email, and social media channels, including Facebook, Twitter and Instagram. They also have an extensive FAQ section, where they answer the most common users’ questions.

We recommend you use the following information to contact them:

- Telephone: +971 4 512 6219

- WhatsApp: +971 50 415 1476

Pros

- Fast and responsive

- Available in English and Arabic

- Extensive FAQ section

- Personal account managers on Platinum accounts

Cons

- Live chat available to account holders only

Deposit and Withdrawals

Deposits and withdrawals at Sarwa are limited to bank transfers (wire transfers) only. Users can deposit and withdraw money in two main currencies: USD and AED.

Sarwa offers one free deposit and withdrawal per month. Each next deposit and withdrawal is charged a fee of $10. Deposits take up to 3 business days to show up on your account. Withdrawals take from 4-6 days, depending on account type.

Pros

- First deposit and withdrawal each month is free

- Withdrawal and deposit fees are low

Cons

- Bank transfer (wire) only

Conclusion

Sarwa is a reputable online broker offering robo-advisory and brokerage services at the same time. Their trading platform is intuitive, easy to use and offers excellent stock, ETF and crypto trading features.

Based on our review, we recommend Sarwa to beginner and intermediate traders looking for “hands of investments” with the option to invest in stocks, ETFs, and cryptos on their own.

Disclaimer