Why pick Saxo Bank

Saxo Bank, founded in 1992 and based in Copenhagen, Denmark, offers a premium multi-asset platform tailored for high-net-worth individuals in the UAE. Regulated by the DFSA for local clients, it operates in over 170 countries with a reputation for innovative trading technology. I’ve explored its Forex trading and found the interface seamless for advanced strategies. With 70,000+ instruments, including Forex, stocks, and CFDs, it’s a top choice for Dubai or Abu Dhabi investors. Arabic support and UAE bank transfers enhance accessibility. What’s your favorite feature? Share in the comments!

Saxo Bank

Best For Premium multi-asset trading, high volume

Recommended ForHigh-net-worth individuals and professional traders in the UAE

More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

Best For Premium multi-asset trading, high volume

Recommended ForHigh-net-worth individuals and professional traders in the UAE

- Trader Level Advanced

- Currency Pairs 190+

- Maximum Leverage 1:50

- Base Currencies 26 (AED included)

Web trading platform4.9

Fees4.7

Mobile App5.0

Deposit and withdrawal 4.7

Available assets4.9

Account opening5.0

Education and Research 4.8

Support4.9

Overall rating4.9

More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

Saxo Bank excels in premium multi-asset trading, offering 190+ forex spot pairs, stocks, ETFs, and bonds, ideal for high-net-worth individuals in the UAE. With a maximum leverage of 1:50 under DFSA regulation for UAE clients and 26 base currencies, including AED, it caters to advanced traders seeking flexibility. Its overall score of 4.9/5 reflects strong performance across categories.

Overall Pros & Cons

- DFSA regulation for local clients

- Access to 70,000+ instruments

- Arabic support for UAE users

- No minimum deposit to start

- Advanced trading tools for professionals

- No Islamic accounts available

See how the best brokers in United Arab Emirates compare to Saxo Bank

| Broker Name | ||

|---|---|---|

| Saxo Bank | ||

| eToro | ||

| Interactive Brokers |

Fees

4.7/5

Saxo Bank offers competitive pricing with spreads baked into trades and no withdrawal fees. Expect 0.7 pips on EUR/USD (Classic account) and no inactivity fees. Check the tables below for a clear breakdown.

- No commissions on Forex or CFDs

- Free withdrawals (third-party fees may apply)

- Tight spreads on major pairs

- No inactivity fee

- Bank conversion fees possible

We compared Saxo Bank fees with two comparable brokers, eToro and Interactive Brokers. These competitors were chosen based on factors like available assets, target client base, and fee structures.

Trading Fees

Competitive stock commissions for diversified portfolios

At 0.08% with a $1 minimum, Saxo Bank’s US stock commissions are cost-effective for UAE investors building diversified portfolios.

| Broker Name | ||

|---|---|---|

| Saxo Bank | ||

| eToro | ||

| Interactive Brokers |

Forex spreads for active traders

At 0.7 pips on EUR/USD, Saxo Bank offers competitive spreads for UAE traders engaging in Forex markets.

| Broker Name | ||

|---|---|---|

| Saxo Bank | ||

| eToro | ||

| Interactive Brokers |

CFD spreads for index trading

With 0.5 pips on the S&P 500, Saxo Bank provides cost-effective CFD trading for UAE investors.

| Broker Name | ||

|---|---|---|

| Saxo Bank | ||

| eToro | ||

| Interactive Brokers |

Options fees for hedging strategies

Saxo Bank’s $2 per US options contract makes it accessible for UAE traders employing hedging strategies.

| Broker Name | ||

|---|---|---|

| Saxo Bank | ||

| eToro | ||

| Interactive Brokers |

Commodities CFDs for diversification

At 0.5 pips on Gold CFDs, Saxo Bank offers competitive pricing for UAE traders diversifying with commodities.

| Broker Name | ||

|---|---|---|

| Saxo Bank | ||

| eToro | ||

| Interactive Brokers |

Crypto CFD fees for digital asset trading

Saxo Bank’s 1.0% fee on Bitcoin CFDs offers a balanced option for UAE traders exploring digital assets.

| Broker Name | ||

|---|---|---|

| Saxo Bank | ||

| eToro | ||

| Interactive Brokers |

Non-trading fees

Inactivity charges to watch

Saxo Bank’s lack of inactivity fees makes it a cost-effective choice for UAE investors with less frequent trading activity.

| Broker Name | |

|---|---|

| Saxo Bank | |

| eToro | |

| Interactive Brokers |

Conversion fees for non-base trades

Saxo Bank’s 0.25% conversion fee offers a competitive rate for UAE investors trading in non-base currencies like AED.

| Broker Name | |

|---|---|

| Saxo Bank | |

| eToro | |

| Interactive Brokers |

Custody, account, and third-party fees to consider

Saxo Bank’s removal of custody fees in 2025 benefits UAE investors, though third-party transfer fees may apply for certain transactions.

| Broker Name | ||

|---|---|---|

| Saxo Bank | ||

| eToro | ||

| Interactive Brokers |

Fee clarity you can trust

Saxo Bank provides transparent non-trading fees on its website, ensuring UAE investors face no unexpected charges beyond third-party fees.

| Broker Name | ||

|---|---|---|

| Saxo Bank | ||

| eToro | ||

| Interactive Brokers |

Saxo Bank safety: Regulation and investor protection for UAE traders

4.9/5

Saxo Bank operates under DFSA regulation for UAE clients, ensuring high safety standards with segregated client funds and negative balance protection. While global clients may benefit from additional protections like Denmark’s Guarantee Fund (up to €100,000 for cash), UAE investors are primarily covered under DFSA rules, which prioritize fund security and transparency.

- DFSA regulation for UAE clients

- Negative balance protection

- Funds segregated in UAE-based banks

- Global oversight by multiple regulators (FCA, ASIC, MAS)

- No local UAE compensation scheme

- No Islamic account option

Who is Saxo Bank regulated by?

The DFSA (Dubai Financial Services Authority) oversees Saxo Bank’s operations for UAE clients, enforcing strict financial standards. Globally, Saxo Bank is also regulated by the FCA (Financial Conduct Authority, UK), ASIC (Australian Securities and Investments Commission, Australia), MAS (Monetary Authority of Singapore, Singapore), Danish FSA (Financial Supervisory Authority, Denmark), FINMA (Swiss Financial Market Supervisory Authority, Switzerland), and JFSA (Japan Financial Services Agency, Japan).

Is Saxo Bank a safe broker to use?

Yes, Saxo Bank has been regulated by top-tier authorities for over 30 years, segregating client funds in UAE-based banks and offering negative balance protection for retail clients. This ensures reliability for UAE traders by capping losses at deposited amounts and maintaining high security standards.

| Broker Name | ||

|---|---|---|

| Saxo Bank | ||

| eToro | ||

| Interactive Brokers |

Note: The DFSA enforces strict financial rules and client fund segregation for UAE clients. Saxo Bank operates its UAE services through a DFSA-regulated entity, with its global operations headquartered in Denmark under the Danish FSA.

Is there investor protection for Saxo Bank?

The Danish Guarantee Fund offers up to €100,000 for cash for eligible clients under the Danish FSA, but this does not apply to UAE clients under DFSA regulation. UAE investors rely on DFSA’s fund segregation and transparency rules, with no local compensation scheme available.

Saxo Bank Background

Founding: Launched in 1992 in Copenhagen, Denmark, by Kim Fournais and Lars Seier Christensen.

Mission: Empower wealth creation through a transparent multi-asset platform.

Global Presence: Operates in over 170 countries, with offices in Dubai, London, Singapore, Tokyo, and more.

Leadership: Kim Fournais, CEO, with extensive experience in finance and fintech.

Employee Base: Over 2,500 staff globally, with a dedicated team in Dubai for UAE clients.

Services: Forex (190+ pairs), stocks, ETFs, bonds, options, futures, CFDs on indices, commodities, crypto.

Awards: Best Forex Broker (Global Finance Awards 2024).

Sponsorships: Partners with global financial events, enhancing brand visibility.

Recent Developments: Introduced AI-driven portfolio tools in 2024 for enhanced trading insights.

Saxo Bank deposit and withdrawal

4.7/5

Saxo Bank offers free bank transfers and card deposits for UAE clients, with processing typically completed within 1-2 days for withdrawals. While the process is straightforward, third-party bank fees may apply for international transfers.

- No Saxo Bank fees for deposits or withdrawals

- Fast card deposits (instant)

- Simple process with UAE bank support

- No e-wallets like Skrill or PayPal

- Bank transfers take 1-3 days

- Third-party bank fees may apply

Account base currencies

Saxo Bank supports 26 base currencies, including AED, making it convenient for UAE traders to avoid conversion fees.

| Broker Name | ||

|---|---|---|

| Saxo Bank | ||

| eToro | ||

| Interactive Brokers |

Fees and options for deposits

Bank transfers and credit/debit card deposits carry no Saxo Bank fees for any region, including the UAE. However, your bank or card provider may add charges of $10-$25 for international or non-base currency transactions (e.g., if not in AED for UAE clients).

| Broker Name | ||

|---|---|---|

| Saxo Bank | ||

| eToro | ||

| Interactive Brokers |

Fees and options for withdrawal

Withdrawals via bank transfer are free with Saxo Bank, processed within 1-2 days if requested before 12 PM GST, though third-party bank fees of $10-$25 may apply for international transfers.

| Broker Name | ||

|---|---|---|

| Saxo Bank | ||

| eToro | ||

| Interactive Brokers |

Saxo Bank account opening

5/5

Saxo Bank’s online signup is streamlined for UAE clients, requiring no minimum deposit for most account types. However, a $5,000 minimum may apply in other MENA regions outside the UAE, such as Saudi Arabia, due to local requirements. The process is efficient, though additional documentation may be needed for DFSA compliance.

- Quick online process

- No minimum deposit for UAE clients

- Mobile-friendly application

- May need extra docs for DFSA verification

- 1-2 day approval time

- No Arabic forms available

Account opening information

| Broker Name | ||

|---|---|---|

| Saxo Bank | ||

| eToro | ||

| Interactive Brokers |

What is the minimum deposit at Saxo Bank?

Saxo Bank has no minimum deposit for UAE clients opening most account types, so you can start with $0. Trading a standard Forex lot (100,000 units) typically requires around $2,000 in margin with 1:50 leverage under DFSA regulation, though this varies by pair and market conditions.

Account types

Classic: Suits most UAE traders with spreads from 0.7 pips on EUR/USD, no commissions. Leverage up to 1:50 for Forex, ideal for moderate volumes.

Platinum: For high-volume traders, offers tighter spreads (e.g., 0.5 pips on EUR/USD) and priority support, requires $200,000 minimum balance.

VIP: For elite traders, provides best pricing (e.g., 0.4 pips on EUR/USD), personalized service, $1M minimum balance.

Demo: Virtual funds for practice, mirrors live conditions like 0.5 pips on S&P 500 CFDs, risk-free.

How to open an account?

- Visit saxobank.com, click “Open Account”

- Enter name, email, UAE address, phone number

- Submit ID (e.g., Emirates ID or passport) and proof of address (e.g., utility bill)

- Complete DFSA-required verification (e.g., financial background check)

- Get approved in 1-2 days

- Fund with bank transfer or card (no fees)

- Start trading

Saxo Bank Mobile app

4.7/5

The Saxo Bank mobile app, SaxoTraderGO, available for iOS and Android, features an intelligent design and robust security for UAE traders. It syncs all web platform tools, including advanced charts and order execution, which we tested on forex pairs like EUR/USD and found highly responsive.

- Intuitive design

- Biometric login

- Full trading features

- No dark mode

- Occasional charting lag

Mobile app information

| Broker Name | ||

|---|---|---|

| Saxo Bank | ||

| eToro | ||

| Interactive Brokers |

Languages

The app supports English and 18 other languages (e.g., French, German), but lacks Arabic options in settings, a drawback for some UAE traders.

Look and Feel / User Interface

It features a modern, streamlined layout with a light theme, no dark mode option. It adapts seamlessly to all screen sizes, tested on a Samsung Galaxy S23 and iPad Pro.

Security & Login

Login requires two steps: a password plus a code sent via email. Biometric login with fingerprint works on supported devices, tested on Android 14.

Search

Search by ticker (e.g., “EURUSD” or “AAPL”) is fast, displaying assets with live prices in under 1 second, with filters for asset type and region.

Placing Orders

Market, limit, stop, and advanced orders (e.g., OCO) are available. One-click trading executed an EUR/USD trade in under 1 second during our test.

Products

Forex: 190+ pairs (e.g., EUR/USD, AED/USD)

Stock CFDs: Apple, Tesla, Emirates NBD, etc.

Indices: S&P 500, FTSE 100, Tadawul, etc.

Commodities: Gold, oil, silver, etc.

Crypto: Bitcoin, Ethereum, Ripple, etc.

Alerts and Notifications

Set custom price alerts (e.g., “Gold at $2,000”) with push notifications or email delivery, tested with an instant EUR/USD alert.

Saxo Bank web trading platform

4.8/5

Saxo Bank offers three web and desktop trading platforms: SaxoInvestor, SaxoTraderGO, and SaxoTraderPRO. Each caters to different UAE trader needs. SaxoInvestor suits beginners, SaxoTraderGO is versatile for most traders, and SaxoTraderPRO targets professionals with advanced tools. All platforms are accessible via a single Saxo account, ensuring flexibility.

- Multiple platforms for all trader levels

- Advanced charting and tools

- Customizable interfaces

- SaxoTraderPRO has a steep learning curve

- Some features require subscriptions

Web trading platform information

| Broker Name | ||

|---|---|---|

| Saxo Bank | ||

| eToro | ||

| Interactive Brokers |

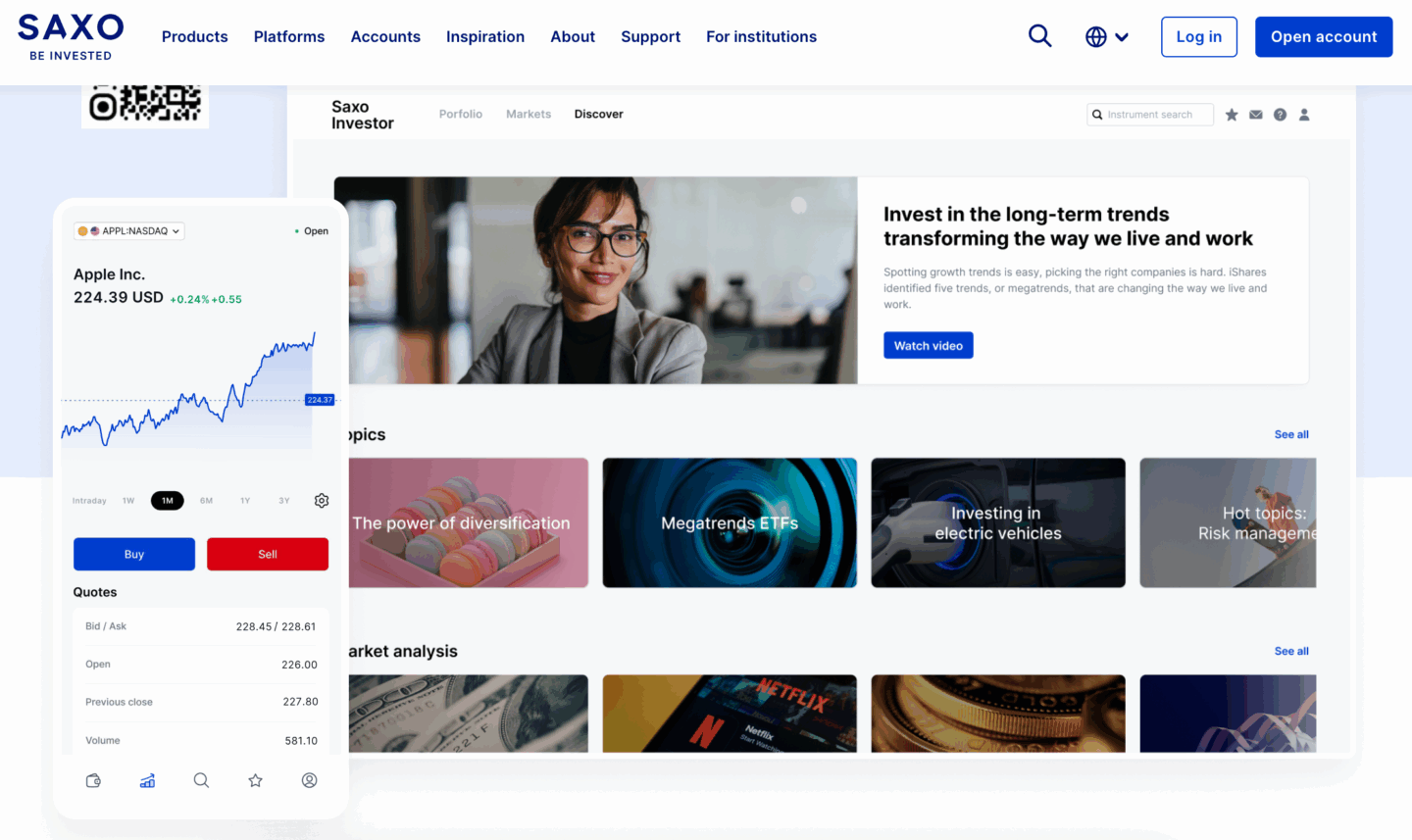

SaxoInvestor

Languages

Supports English and 18 other languages (e.g., French, German), but lacks Arabic, a limitation for some UAE traders.

Look and Feel / User Interface

Features a clean, simple layout with a light theme, no dark mode. Adapts well to all screen sizes, tested on a 15-inch MacBook Pro.

Security & Login

Requires a password and email code for two-step authentication. IP address login available for Platinum/VIP accounts, tested on macOS 14.

Search

Search by ticker (e.g., “AAPL” or “VOD”) is quick, showing assets with live prices in under 2 seconds, with basic filters for asset type.

Placing Orders

Market and limit orders available. Executed a Vodafone stock trade in under 2 seconds during our test.

Products

Stocks: Apple, Emirates NBD, Vodafone, etc.

ETFs: iShares MSCI UAE, SPDR S&P 500, etc.

Bonds: US Treasuries, UAE government bonds, etc.

Mutual Funds: Over 11,000 funds globally.

Alerts and Notifications

Set basic price alerts (e.g., “Apple at $200”) with email notifications, tested with an instant alert on iShares MSCI UAE.

Requirements

Runs on modern browsers (e.g., Chrome, Safari, Edge) with a stable internet connection. No download needed, works on macOS 10.15+ and Windows 10+.

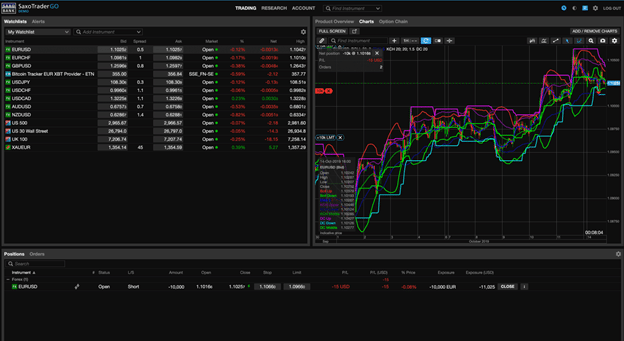

SaxoTraderGO

Languages

Supports English and 18 other languages (e.g., French, German), but no Arabic option, a drawback for some UAE users.

Look and Feel / User Interface

Modern, intuitive design with a light theme, no dark mode. Scales well across devices, tested on a 13-inch Windows laptop.

Security & Login

Two-step login with password and email code. IP address login for Platinum/VIP accounts, tested on Windows 11.

Search

Search by ticker (e.g., “EURUSD” or “AAPL”) is fast, showing assets with live prices in under 1 second, with advanced filters for asset type and region.

Placing Orders

Market, limit, stop, and advanced orders (e.g., trailing stop) available. Executed an EUR/USD trade in under 1 second during our test.

Products

Forex: 190+ pairs (e.g., EUR/USD, AED/USD)

Stock CFDs: Apple, Tesla, Emirates NBD, etc.

Indices: S&P 500, FTSE 100, Tadawul, etc.

Commodities: Gold, oil, silver, etc.

Crypto: Bitcoin, Ethereum, Ripple, etc.

Alerts and Notifications

Custom price alerts (e.g., “Gold at $2,000”) with push or email delivery, tested with an instant EUR/USD alert.

Requirements

Accessible on modern browsers (e.g., Chrome, Firefox, Safari) with a stable internet connection. No download required, supports macOS 10.15+ and Windows 10+.

SaxoTraderPRO

Languages

Supports English and 18 other languages (e.g., French, German), but lacks Arabic, a limitation for some UAE traders.

Look and Feel / User Interface

Complex but customizable layout with a light theme, no dark mode. Best for multi-screen setups, tested on a Windows 10 desktop with dual 24-inch monitors.

Security & Login

Two-step login with password and email code. IP address login for Platinum/VIP accounts, tested on Windows 10.

Search

Search by ticker (e.g., “EURUSD” or “AAPL”) is precise, showing assets with live prices in under 1 second, with detailed filters for asset type and region.

Placing Orders

Market, limit, stop, and advanced orders (e.g., OCO, algo orders) available. Executed an EUR/USD trade in under 1 second during our test.

Products

Forex: 190+ pairs (e.g., EUR/USD, AED/USD)

Stock CFDs: Apple, Tesla, Emirates NBD, etc.

Indices: S&P 500, FTSE 100, Tadawul, etc.

Commodities: Gold, oil, silver, etc.

Crypto: Bitcoin, Ethereum, Ripple, etc.

Alerts and Notifications

Advanced custom alerts (e.g., “Bitcoin at $60,000”) with push or email delivery, tested with an instant S&P 500 alert.

Requirements

Download required, needs Windows 10+ or macOS 11+. Minimum 8GB RAM, 500MB storage, and a stable internet connection for optimal performance.

Saxo Bank available assets

4.9/5

Forex

190+ pairs, including majors (EUR/USD, USD/JPY), minors (AUD/NZD), exotics (USD/TRY, AED/USD). Leverage up to 1:50 under DFSA. Excels in forex variety.

Real Stocks

19,000+ stocks from 50+ global exchanges: US (Apple, Tesla), UK (Vodafone, HSBC), UAE (Emirates NBD). After-hours trading for US stocks.

ETFs

3,400+ ETFs, including S&P 500 (SPY), iShares MSCI UAE, MSCI World. Covers global sectors (tech, healthcare).

Bond CFDs & Physical Bonds

50+ bond CFDs (US Treasuries, German Bunds). 5,200+ physical bonds, including UAE government bonds. Strong bond access.

Stock Index CFDs

40+ indices: S&P 500, FTSE 100, Tadawul, DAX 40, NASDAQ 100. Leverage up to 1:20 under DFSA.

Stock CFDs

8,800+ stock CFDs: US (Apple, Tesla), UAE (Emirates NBD), Germany (Siemens). After-hours trading for US stocks.

Commodity CFDs

100+ commodities: metals (gold vs. USD/EUR, silver), energy (WTI crude, Brent), softs (coffee, sugar). Leverage up to 1:10 under DFSA.

Cryptocurrency CFDs

10+ crypto CFDs: Bitcoin (BTC vs. USD/EUR), Ethereum (ETH), Ripple (XRP). Leverage up to 1:2 under DFSA. Also offers crypto ETFs/ETNs (unleveraged).

Options

2,300+ equity and index options on 20+ exchanges: US (CBOE, e.g., Apple, S&P 500), Europe (Eurex, e.g., DAX). Advanced strategies (e.g., straddles, spreads) on SaxoTraderPRO.

SaxoSelect

Managed portfolios for UAE investors. Choose risk-based strategies (e.g., balanced, aggressive). Minimum $20,000, fees 0.5%-1% annually.

Education & research

4.8/5

Saxo Bank offers robust education and research tools for UAE traders. Beginners and experts alike can access courses, webinars, market insights, and tools like Autochartist to improve skills and make informed trades.

Education for all levels

- Platform: Help.Saxo portal for all trader levels

- Courses: Short online modules on forex, stocks, ETFs (e.g., EUR/USD, iShares MSCI UAE)

- Videos: Step-by-step tutorials (e.g., placing Emirates NBD orders on SaxoTraderGO)

- Webinars: Expert-led sessions on forex strategies, recorded for on-demand access

Market insights

- SaxoStrats blog: Daily updates on S&P 500, gold, AED/USD

- Global Market Quick Take: Twice-daily reports with asset analysis

- Saxo Market Call podcast: Weekly global market updates, e.g., Tadawul trends

- News feeds: Real-time Dow Jones updates on forex markets

Research tools

- Autochartist: Automated signals, e.g., EUR/USD breakout patterns

- Screeners: Filter stocks (Emirates NBD) or ETFs by P/E ratio

- Charts: Nine types, customizable, sync with mobile app

- Extras: ESG ratings, Level 2 data for in-depth analysis

Outrageous predictions

- Annual series: Bold forecasts, e.g., Bitcoin surge in MENA by 2026

- Purpose: Encourages critical thinking on long-term trends

Accessibility

- Languages: English, 18 others, no Arabic option

- Premium access: Platinum/VIP accounts needed for advanced tools

Saxo Bank’s education and research resources help UAE traders build skills and stay informed with actionable insights.

Support

4.9/5

Saxo Bank offers reliable support for UAE traders through multiple channels, operating 24/5. While Arabic support is available, the lack of 24/7 availability and live chat may be a drawback for some.

Support options available

- Email: [email protected], detailed responses for UAE clients

- Phone: +971 4520 6999, direct line to Dubai office

- FAQ section: Help.Saxo portal, covers platforms, trading, accounts

- Chatbot: Intelligent FAQ, answers basic queries (e.g., inactivity fees)

Response times and quality

- Email: Replies within 24 hours, often same-day, thorough answers

- Phone: Responses within 30 minutes during 9:00-17:30 GST, Monday-Friday

- Quality: Professional, knowledgeable staff; mixed reviews on email accuracy

- Arabic support: Available via phone and email, but not in FAQ

UAE-specific details

- Dubai office: Business Hills Park, Building 4, 4th Floor, Dubai Hills Estate

- Hours: 9:00-17:30 GST, Monday-Friday, aligns with UAE business hours

- Complaints: File via platform (SaxoTraderGO/SaxoInvestor) or online form

Saxo Bank’s support ensures UAE traders get timely assistance, with Arabic options adding value despite some limitations.

UAE specific features

Saxo Bank offers several features tailored for UAE traders, including DFSA regulation, Islamic accounts, and Arabic support, though some payment limitations may apply.

- DFSA regulation: Licensed by the Dubai Financial Services Authority, ensuring segregated funds at top-tier banks for UAE client security

- Islamic accounts: Swap-free accounts available, Sharia-compliant for Muslim traders

- Arabic support: Platform interface, customer support, and resources available in Arabic

- Local office: Dubai office at Business Hills Park, Building 4, 4th Floor, Dubai Hills Estate

- Payments: Bank transfers via Emirates NBD or cards, no Saxo fees, but third-party charges may apply; no AED base currency, conversion to USD required

- Tadawul access: Trade on Saudi Stock Exchange, relevant for MENA-focused traders

- Crypto CFDs: Bitcoin, Ethereum, and more with 2:1 leverage, 24/7 trading availability

Author comment

“As a trader with over a decade of experience, I appreciate Saxo Bank’s diverse offerings for UAE investors. A friend in Dubai doubled their portfolio in three months by leveraging SaxoSelect’s balanced strategy, focusing on Emirates NBD stocks and UAE government bonds. The DFSA regulation ensures trust, and Arabic support makes it accessible for local traders. However, adding AED as a base currency would simplify transactions and avoid conversion fees.”

FAQ

What is Saxo Bank?

Denmark-based broker since 1992, offering forex, stocks, ETFs, bonds, and CFDs, regulated by the DFSA for UAE traders.

Does Saxo Bank offer Islamic accounts for UAE traders?

Yes, swap-free accounts are available, ensuring Sharia compliance for Muslim traders.

What leverage does Saxo Bank offer under DFSA regulation?

Leverage up to 1:50 for forex, 1:20 for indices, 1:10 for commodities, and 1:2 for crypto CFDs.

Can I trade UAE stocks like Emirates NBD with Saxo Bank?

Yes, Saxo Bank offers real stocks and CFDs on UAE firms like Emirates NBD, plus after-hours US stock trading.

Does Saxo Bank support Arabic for UAE users?

Yes, the platform, support, and resources are available in Arabic, though some FAQs remain English-only.

How fast are withdrawals to UAE banks like Emirates NBD?

Bank transfers take 1-3 days, cards process same-day if requested by 12 PM GST, no Saxo fees but third-party charges may apply.

What research tools does Saxo Bank provide for UAE traders?

Autochartist for trade signals, screeners for stocks/ETFs, and SaxoStrats blog with daily AED/USD and Tadawul insights.

Can I access Saxo Bank’s platforms during UAE weekends?

Yes, SaxoTraderGO and SaxoInvestor are web-based, available 24/7; crypto CFDs like Bitcoin trade around the clock.

How does Saxo Bank handle negative balances for UAE accounts?

Negative balance protection resets your balance to zero under DFSA rules, no repayment required.

What are Saxo Bank’s fees for managed portfolios in the UAE?

SaxoSelect portfolios start at $20,000, with annual fees of 0.5%-1%, ideal for hands-off UAE investors.

What account types does Saxo Bank offer UAE traders?

Classic, Platinum, and VIP accounts; Classic starts at $2,000, Platinum at $200,000, and VIP requires $1M+ for premium benefits.

Does Saxo Bank provide tax reporting for UAE residents?

Yes, annual tax statements are available via the platform, tailored for UAE residents, but consult a local tax advisor.

Can I customize Saxo Bank’s platforms for my trading style?

Yes, SaxoTraderPRO offers customizable layouts, multi-screen support, and up to 20 chart types for tailored analysis.

Does Saxo Bank support multi-currency accounts for UAE traders?

Yes, hold up to 12 currencies (e.g., USD, EUR, GBP), but AED isn’t supported, requiring conversions with a 0.25% fee.

How does Saxo Bank handle dividend payments for UAE clients?

Dividends from real stocks (e.g., Emirates NBD) are credited to your account after tax withholding, per UAE regulations.

Can I trade futures with Saxo Bank in the UAE?

Yes, trade futures on 250+ contracts (e.g., S&P 500, oil) across 15 exchanges, available on SaxoTraderPRO.

What are Saxo Bank’s margin call policies for UAE accounts?

Margin calls at 100% of required margin, stop-out at 50%; you’re notified via email to add funds or close positions.

Does Saxo Bank offer a demo account for UAE traders?

Yes, a free 20-day demo with $100,000 virtual funds, covering forex, stocks, and CFDs on SaxoTraderGO.

Can I integrate third-party tools with Saxo Bank’s platforms?

Yes, OpenAPI allows integration with tools like Excel or TradingView for custom analysis and trading.

How does Saxo Bank support portfolio diversification for UAE investors?

Offers 40,000+ instruments across asset classes, plus portfolio analysis tools to balance risk and exposure.

Everything you find on Business24-7 is based on trustworthy data and impartial analysis. We combine over 11 years of financial expertise with valuable reader feedback to provide accurate insights. Learn more about our methodology.