Business24-7.ae is committed to the highest ethical standards and reviews services independently. Learn How We Make Money.

Page Summary

In A Nutshell

Tickmill is an international CFD and forex broker, established in 2014.

The broker has several regulations from the Financial Services Authority Seychelles, the Financial Conduct Authority, and the Cyprus Securities and Exchange Commission (CySEC).

Tickmill is considered a safe broker due to its top-tier FCA license.

Disclaimer: CFDs represent complex instruments and involve a significant risk of losing money because of leverage. Up to 73% of retail investor accounts lose funds when trading CFDs with this broker. You should assess how you can cover the high risk of losing money and how CFDs work.

Tickmill Good & Bad

Tickmill comes with low non-trading and trading costs. It has one of the lowest forex fees among brokers. Opening an account is simple, fully digital, and fast. You have several options for withdrawal or deposit, without costs.

However, Tickmill has limited products in its portfolio: you can only trade CFDs and forex. Essential assets like ETFs or real stocks are missing. This broker’s trading platform is from MetaTrader, which has an outdated design. Also, news feeds are average and come with no structure.

Good:

- Low Fees

- Excellent Account Opening

- Free Withdrawal & Deposit

Bad:

- Only CFDs And Forex

- Outdated Design For Trading Platforms

- Basic News Feed

Main Features And Highlights At Tickmill

| Country Of Regulation | UK, Seychelles, Cyprus |

|---|---|

| Trading Fees | Low |

| Inactivity Fee | No |

| Withdrawal Fee | $0 |

| Minimum Deposit | $100 |

| Account Opening Time | 1 Day |

| Debit/ Credit Card Deposit | Available |

| Electronic Wallet Deposit | Available |

| Number Of Base Currencies Supported | 4 |

| Demo Account | Yes |

| Products Offered | CFD, Forex |

1. Fees and Spreads

Tickmill has competitive prices. It offers low CFD and forex trading commission. There is no fee for inactivity, withdrawal, or deposit.

Good:

- Low Forex Fees

- No Withdrawal Fee

- No Inactivity Fee

Bad:

- None

Fees At Tickmill

| Assets | Fee | Fee Terms |

|---|---|---|

| USD/ EUR | Low | Pro account has a commission of $/€/£ 2 per trade per lot plus 0.1 pips is the average spread cost. |

| USD/ GBP | Low | Pro account has a commission of $/€/£ 2 per trade per lot plus 0.3 pips is the average spread cost. |

| S&P 500 CFD | Low | The fees are built into spread, 0.69 is the average spread cost. |

| Inactivity Fee | Low | No inactivity fee |

How We Assessed Fees

We assessed Tickmill’s fees as low, average, or high, depending on how they compare to those of all forex brokers we reviewed.

To help you get a broader understanding of our process, here is the distinction between trading and non-trading fees.

• Trading fees happen when you trade. These can be conversion, commission, spreads, or financing rates fees.

• Non-trading prices are not linked to trading. These can be inactivity or withdrawal fees.

We shared in this review the most critical fees at Tickmill for each asset class. For example, commissions, spreads, and financing rates are the most important for both stock index and forex trading.

We reviewed Tickmill’s costs in comparison with those of two competitor brokers, FXCM and AxiTrader. Our assessment relies on objective factors, like client profile, fee structure, or products available.

Here are our top findings of Tickmill trading fees.

Tickmill Trading Fees

Tickmill has low trading fees. Distinct account types come with different fee structures. For this review, we tested the Pro Account. It comes with a commission, and it provides tight spreads.

We understand that it is challenging to compare trading costs among brokers. However, we made our comparison based on the total amount of fees for a standard trade of selected products.

We selected popular items with forex brokers in each asset class:

- Forex: USD/ EUR, USD/ GBP, USD/ AUD, GBP/ EUR and CHF/ EUR

- Stock Index CFDs: EUSTX50 and SPX

A standard trade refers to purchasing a leveraged product, holding it for seven days, and then selling. We used a $2,000 position for stock CFD and stock index and a $20,000 position for forex so that we assess the volume. The leverage was:

- 30:1 for forex

- 20:1 for stock index CFDs

All this data includes all standard fees: financing costs, commission, and spreads for all brokers.

Here’s our Tickmill fees review.

Forex Fees

Tickmill offers low forex fees. These costs are among the lowest when compared with competitor brokers.

Forex Benchmark Fees For A $20,000 30:1 Long Position Held For One Week At Tickmill

| Tickmill | AxlTrader | FXCM | |

|---|---|---|---|

| USD/ EUR Benchmark Fee | $9.2 | $13.8 | $16.5 |

| USD/ GBP Benchmark Fee | $8.0 | $11.6 | $13.0 |

| USD/ AUD Benchmark Fee | $8.8 | $9.5 | $17.3 |

| EUR/ CHF Benchmark Fee | $3.7 | $1.1 | $4.6 |

Tickmill’s low commission is what determines these low forex fees. The commission is two base currency units (first currency pair) for each lot and trade. For example, a lot per trade for USD/ EUR costs €2, and a lot per trade for USD/ GBP costs £2.

CFD Fees

CFD fees at Tickmill are lower than this broker’s competitors.

CFD Fees For A $2,000 Long Position Held For One Week At Tickmill

| Tickmill | AxlTrader | FXCM | |

|---|---|---|---|

| S&P 500 Index CFD Fee | $1.4 | $1.7 | $2.2 |

| Europe 50 Index CFD Fee | $1.5 | $1.2 | $1.6 |

Non-Trading Fees

Tickmill offers low non-trading fees, and there is no extra charge for inactivity, withdrawal, or deposits.

| Tickmill | AxlTrader | FXCM | |

|---|---|---|---|

| Account Fee | No | No | No |

| Inactivity Fee | No | No | Yes |

| Deposit Fee | $0 | $0 | $0 |

| Withdrawal Fee | $0 | $0 | $0 |

2. Account Opening

Opening an account at Tickmill is user-friendly and fast. Our account was confirmed in 24 hours. All accounts, except VIPs, have a minimum deposit fee of $100.

Good:

- Fast

- Fully Digital

- Low Minimum Deposit

Bad:

- None

This broker accepts customers from various places in the world. However, some countries are not allowed, including Canada and the United States.

Minimum Deposit At Tickmill

The minimum deposit is $100. VIP accounts have to keep a $50,000 balance or more.

Account Types At Tickmill

Tickmill offers several account types with different minimum deposits, minimum account balance, and pricing.

| Pro | Classic | VIP | |

|---|---|---|---|

| Minimum Deposit | $100 | $100 | – |

| Minimum Account Balance | – | – | $50,000 |

| Pricing | Tight Spread & Commission | Wide Spread & No Commission | Tight Spread & Commission |

| Fee For $100,000 Trade | $2 | No Commission | $1 |

Tickmill Europe Ltd and Tickmill UK Ltd allows its customers to use maximum leverage of 1:30. Tickmill Ltd allows its retail customers to use leverage up to 1:500.

Professional traders can use higher leverage, up to 1:300 for Tickmill Europe Ltd and up to 1:500 for Tickmill UK Ltd. The criteria for professional traders are:

- An average frequency in the previous four quarters of 10 trades for each quarter

- A financial instrument portfolio of more than €500k

- One-year experience (or more) in a relevant financial position

Customers can create swap-free Islamic accounts and corporate accounts. Islamic accounts don’t come with daily swap rates. But they have an administration fee if you hold a couple of exotic currencies for more than three nights.

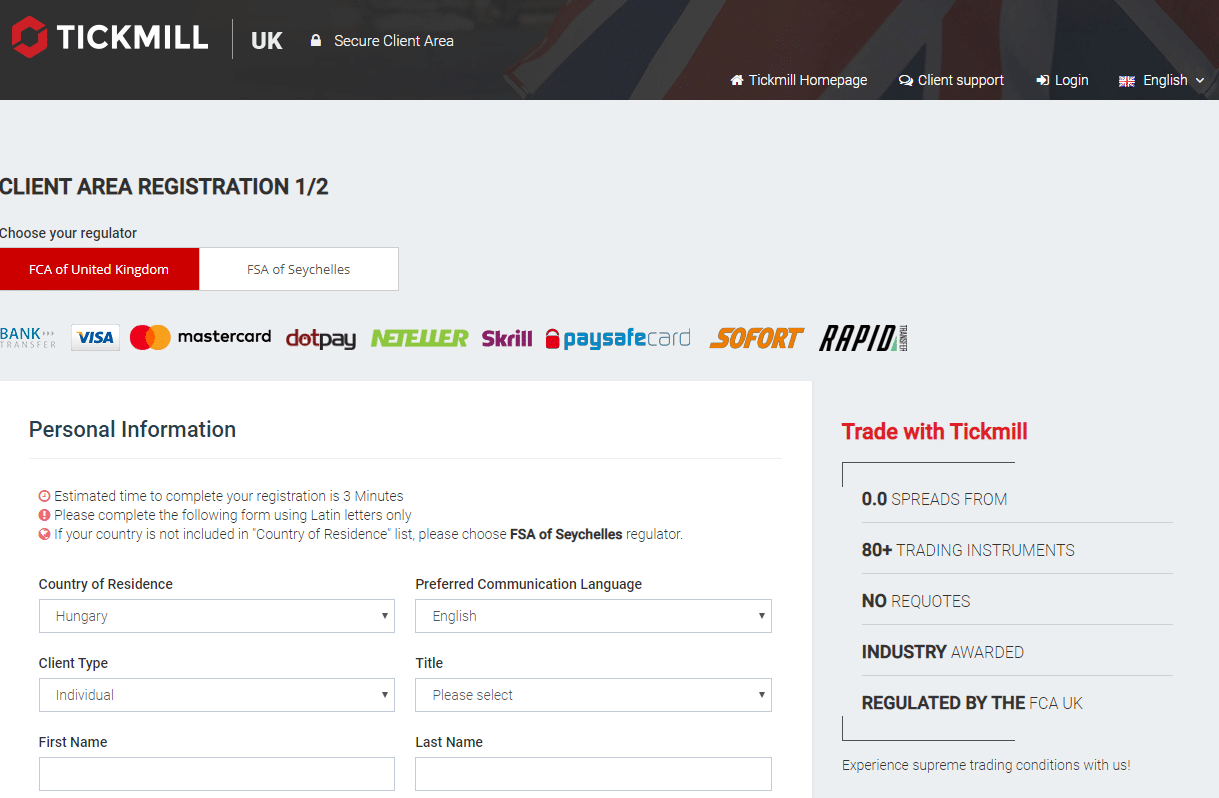

Opening An Account At Tickmill

Opening an account with this broker is fast, reliable, and fully digital. You can fill out an online form in a couple of minutes. Our account was approved in 24 hours.

These are the steps for creating an account at Tickmill:

- Select a regulator. This step will determine for which Tickmill site you will sign up: the Cyprus, Seychelles, or the UK Authority. If available in your country, we suggest you choose the EU (Cyprus) or the UK entities.

- Submit your name, email address, telephone number, and country of residence.

- Fill personal information, like address and date of birth.

- Choose the base currency.

- Answer questions about your financial knowledge and offer information about your financial status.

- Choose your account type: Pro, VIP, or Classic.

- Verify your residency and identity with a passport, copy of your National ID, or driver’s license. Also, you can use bank statements or utility bills for this step.

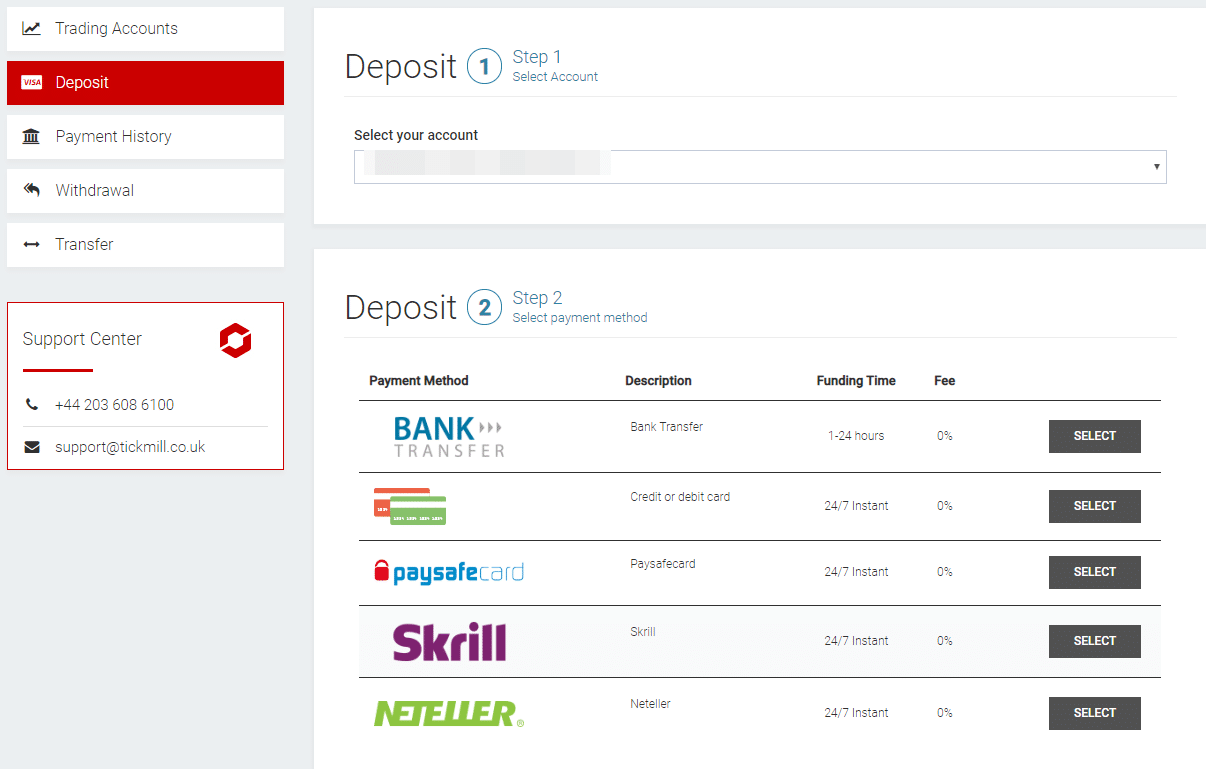

3. Withdrawals And Deposits

Withdrawals and deposits at Tickmill are commission-free and fast. There are several options debit/credit cards, bank transfer, or electronic wallets.

The downside is that the number of available account base currencies is limited.

Good:

- Free Withdrawal

- No Deposit Fee

- Various Account Base Currencies

Bad:

- Limited Account Base Currencies

Account Base Currencies

You can select from the following base currencies: PLN, USD, EUR, and GBP. This selection is less than AxiTrader’s, but more than FXCM’s.

| Tickmill | AxlTrader | FXCM | |

|---|---|---|---|

| Number Of Base Currencies | 4 | 11 | 3 |

Account base currencies are essential due to two reasons. If you trade in the same currency as your trading account base currency, or you finance your trading account using the same currency as your bank account, you will have no conversion fee to pay.

If you want to save on currency conversion costs, you can use a multi-currency bank account at a digital bank. Transferwise or Revolut is our top choice, as they offer free or affordable international bank transfers, along with excellent currency exchange rates. Creating an account at a digital bank takes a couple of minutes on your phone.

Options And Deposit Fees

Tickmill has no deposit fees. You can use debit/credit cards, bank transfers, and several electronic wallets:

- Neteller

- Skrill

- dotpay

- Paysafecard

- Sofort

- Rapid by Skrill

- China Union Pay

- Fasapay

- Ngang Luong

- Qiwi

- Sticpay

- Webmoney

| Tickmill | AxlTrader | FXCM | |

|---|---|---|---|

| Bank Transfer | Yes | Yes | Yes |

| Debit/ Credit Card | Yes | Yes | Yes |

| Electronic Wallets | Yes | Yes | Yes |

Deposit with a debit/credit card is instant. A bank transfer might take several business days.

You can only transfer money from accounts in your name.

Options And Withdrawal Fees

As is the case with deposits, this broker has no withdrawal fee. You can utilize identical options for withdrawal as for deposit.

| Tickmill | AxlTrader | FXCM | |

|---|---|---|---|

| Bank Transfer | Yes | Yes | Yes |

| Debit/ Credit Card | Yes | No | Yes |

| Electronic Wallets | Yes | Yes | Yes |

| Withdrawal Fee | $0 | $0 | $0 |

For this review, we assessed the debit card withdrawal. It took one business day to complete.

You can only transfer money to accounts in your name.

Withdrawing Money From Tickmill

- Log in to your account

- Go to Withdrawal Funds

- Select your account and withdrawal method

- Add the withdrawal sum

- Start the withdrawal

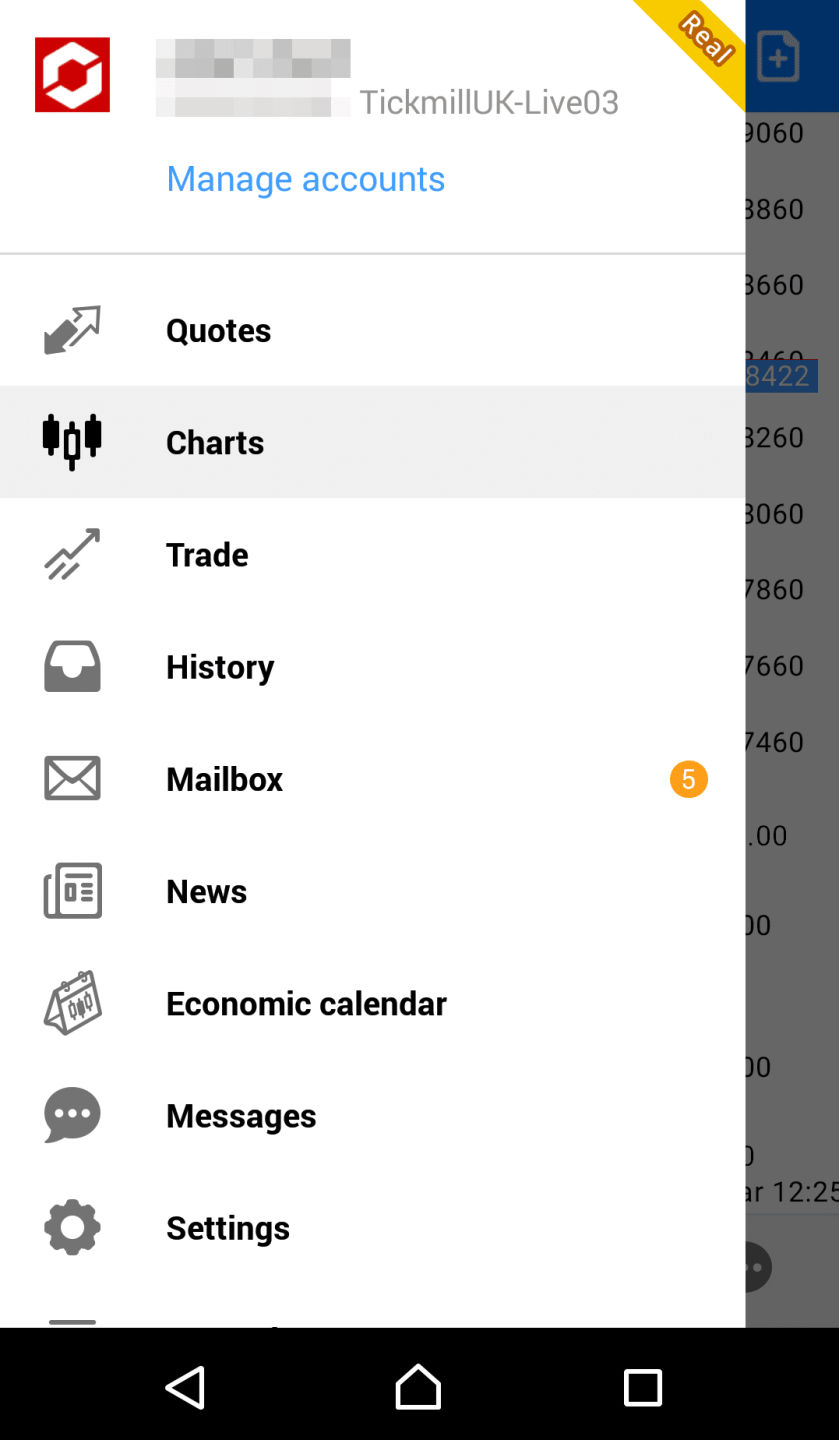

4. Trading Platform

MetaTrader is the web trading platform at Tickmill. It comes with excellent customizability and a transparent fee report.

However, the platform doesn’t have price alerts, while the design is outdated.

Good:

- Transparent Fee Report

- Excellent Customizability For Workspace & Charts

- Order Confirmation

Bad:

- No Two-Step Authentication

- No Price Alerts

- Average Design

Trading Platforms At Tickmill

| Trading Platform | Score | Available |

|---|---|---|

| Web | 3 | Yes |

| Mobile | 4 | Yes |

| Desktop | 3.5 | Yes |

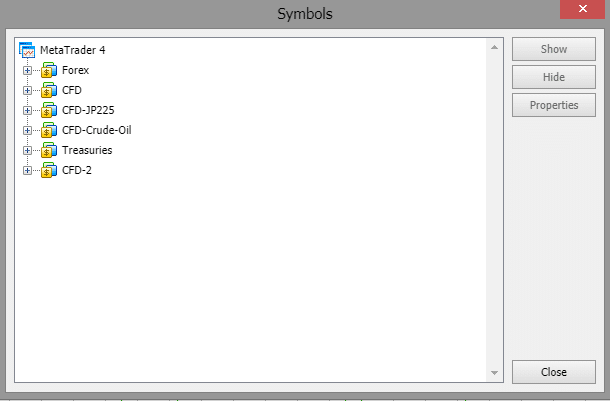

Tickmill doesn’t have a proprietary platform, and it uses MetaTrader 4. This third-party platform is available in numerous languages.

Tickmill Web Trading Platform Languages

| Arabic | Bulgarian | Chinese | Croatian | Czech | Danish |

|---|---|---|---|---|---|

| Dutch | English | Estonian | Finnish | French | German |

| Greek | Hebrew | Hindi | Hungarian | Indonesian | Italian |

| Japanese | Korean | Latvian | Lithuanian | Malay | Mongolian |

| Persian | Polish | Portuguese | Romanian | Russian | Serbian |

| Slovak | Slovenian | Spanish | Swedish | Tajik | Thai |

| Traditional Chinese | Turkish | Ukrainian | Uzbek | Vietnamese | Cell |

Look And Feel

This web trading platform is easy to customize. You can modify the position and size of the tabs with ease.

The downside is that the platform feels outdated. Some settings are hard to discover. For example, for our review, it was challenging to understand how to add an asset to the watchlist.

Security And Login

Tickmill only has one-step authentication. A two-step login would be more secure.

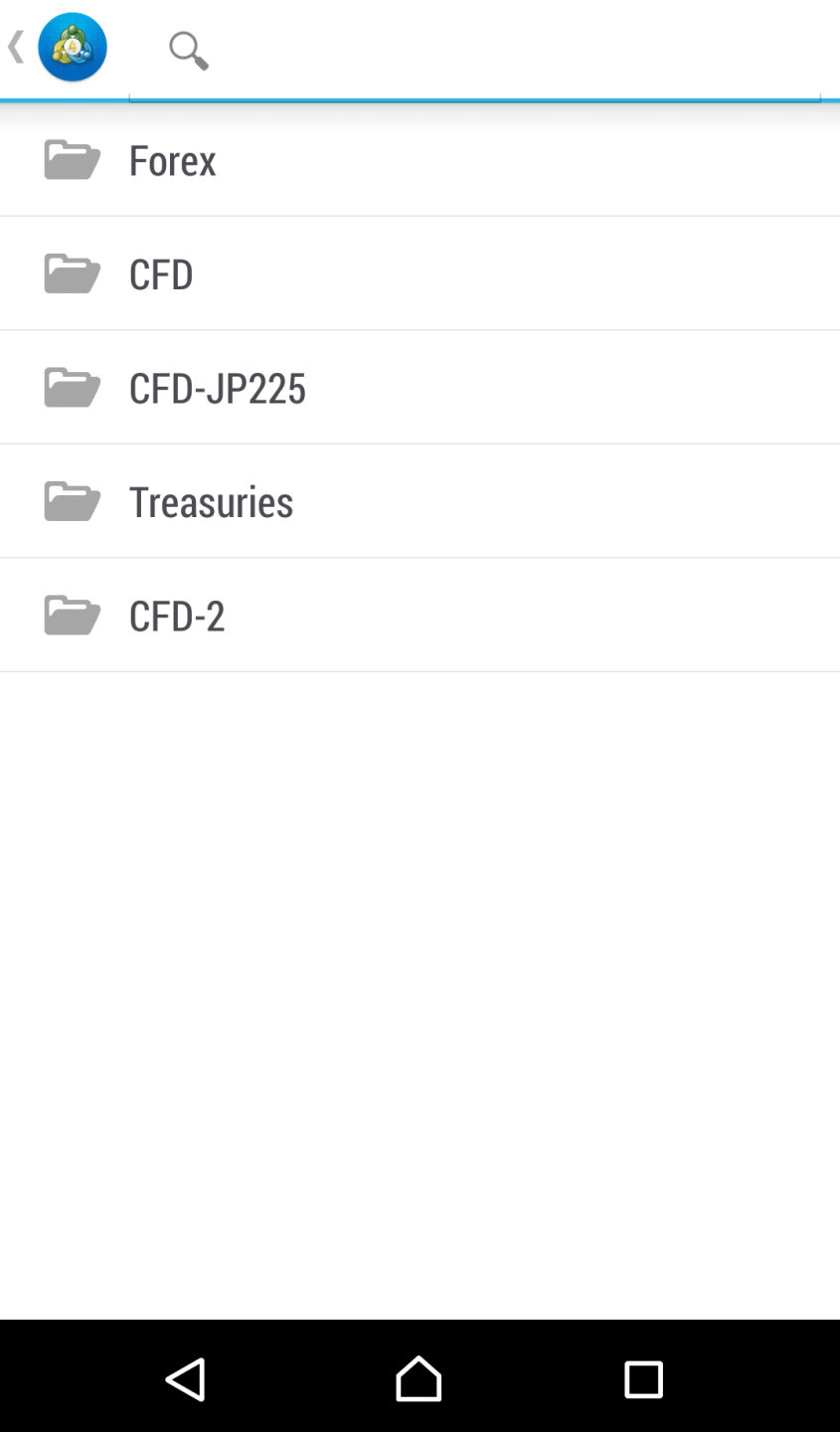

Search Features

Search futures are decent. You can see assets grouped into distinct categories. The downside is that you can’t type the name of an asset and use the standard search function.

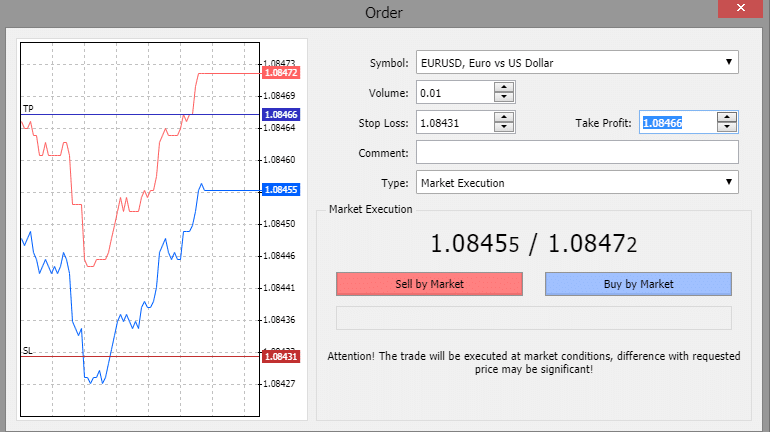

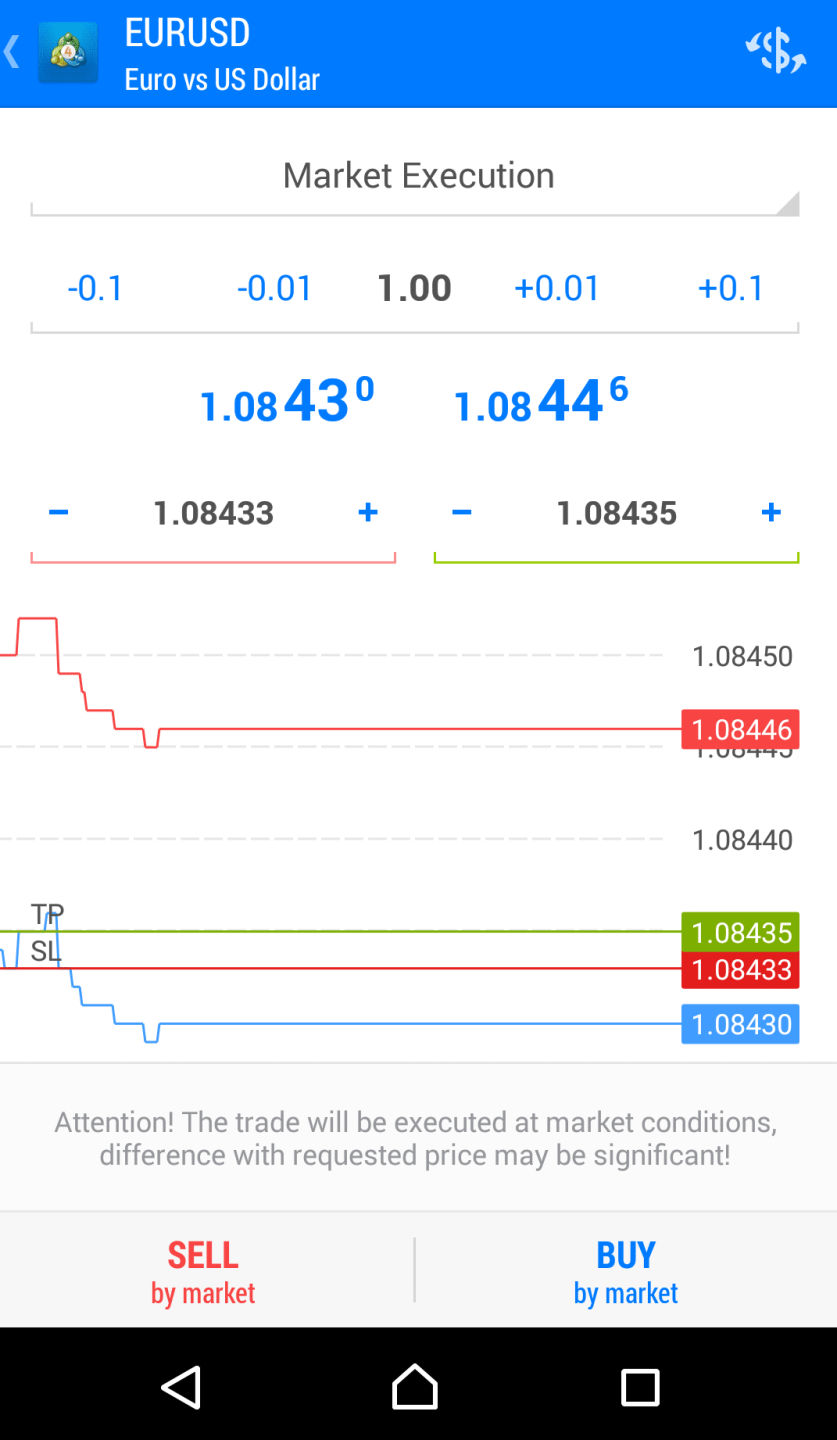

Placing Orders

All standard order types are available, but complex order types like ‘one cancels the other’ are not. The order types you can use are:

- Market

- Limit

- Stop

You can use order time limits, too:

- Good ’til canceled (GTC)

- Good ’til time (GTT)

Notifications And Alerts

Notifications and Alerts are not available on the web trading platform. You can set alerts on the desktop trading platform.

Fee Reports And Portfolio

Fee reports and portfolios are transparent. You can check your paid commissions or profit-balance under the ‘History’ tab. The downside was that we couldn’t download this data.

5. Mobile Trading Platform

The mobile trading platform at Tickmill comes from MetaTrader 4. It has an excellent design with reliable search functions. But even though it is a user-friendly platform, it lacks secure authentication.

Good:

- User-friendly

- Reliable Search Tools

- Price Alerts

Bad:

- No Two-Step Authentication

- No Biometric Authentication

- No Order Confirmation

As it happens with the web trading platform, this broker has MetaTrader 4 as its mobile trading platform. The MetaTrader 4 app is for both Android and iOS. We used the Android platform.

When you install the MT4 mobile trading platform, you have to select a server: TickmillUK-Live03.

There are numerous languages on the mobile trading platform, too. The downside is that switching languages on Android devices is difficult. You can do this by changing the default language of your mobile.

Tickmill Mobile Trading Platform Languages

| Countries | ||||

|---|---|---|---|---|

| Arabic | Chinese (Simplified) | Chinese (Traditional) | Czech | English |

| French | German | Greem | Hindi | Indonesian |

| Italian | Japanese | Korean | Polish | Portuguese |

| Portuguese (Brazil) | Russian | Spanish | Thai | Turkish |

| Ukrainian | Vietnamese | Cell |

Look And Feel

Tickmill has an excellent mobile trading platform. It has a user-friendly design, and you can identify all the features fast.

Security And Login

You can only use one-step authentication. A two-step authentication process would be safer.

Biometric authentication, like Face ID or fingerprint, is not available. These features would be more convenient.

Search Features

Search functions are reliable, and you can look up data by entering the name or category of the product.

Placing Orders

This mobile platform has the same order time limits and order types as on the web trading platform.

Notifications And Alerts

You can create notifications and alerts from the desktop platform. It would be simpler to set alerts directly on the mobile app.

6. Desktop Trading Platform

The MetaTrader 4 desktop platform at Tickmill has reliable functionality and good design. It is similar to the web trading platform. The difference is that you can create price alerts on the desktop trading platform.

Good:

- Transparent Fee Report

- Excellent Customizability For Workspace & Charts

- Price Alerts

Bad:

- No Two-Step Authentication

- Average Design

Tickmill has MetaTrader 4 as its desktop trading platform.

It comes with the same languages, order types, design, search features, fee reports, and portfolio as the web trading platform.

The difference is that you can create notifications and alerts on the desktop platform: email notifications or mobile push alerts. For this purpose, you will have to add your mobile MetaQuotes ID (it is available in the MT4 app settings) or email address. Access the ‘Tools’ menu and click on the ‘Options.’

7. Markets And Products

With this broker, you can trade only commodities, CFDs on forex, stock indices, and German government bonds.

The downside is that you can’t trade popular asset classes like mutual funds, bonds, stocks, ETFs, and options.

Tickmill is a forex and CFD broker. You can check our CFD trading insights for additional information on the topic.

Disclaimer: CFDs represent complex instruments and involve a significant risk of losing money because of leverage. Up to 73% of retail investor accounts lose funds when trading CFDs with this broker. You should assess how well you can cover the high risk of losing money and how well you understand how CFDs work.

The currency pair availability is good, more than FXCM’s, and less than AxiTrader’s selection. You can trade with some CFDs on bond, commodity, or stock. The downside is that ETF, CFD, stock CFD, and crypto CFDs are not available.

| Tickmill | AxlTrader | FXCM | |

|---|---|---|---|

| Currency Pairs | 62 | 86 | 45 |

| Stock Index CFDs | 32 | 15 | 14 |

| Commodity CFDs | 6 | 5 | 14 |

| Bond CFDs | 7 | – | 1 |

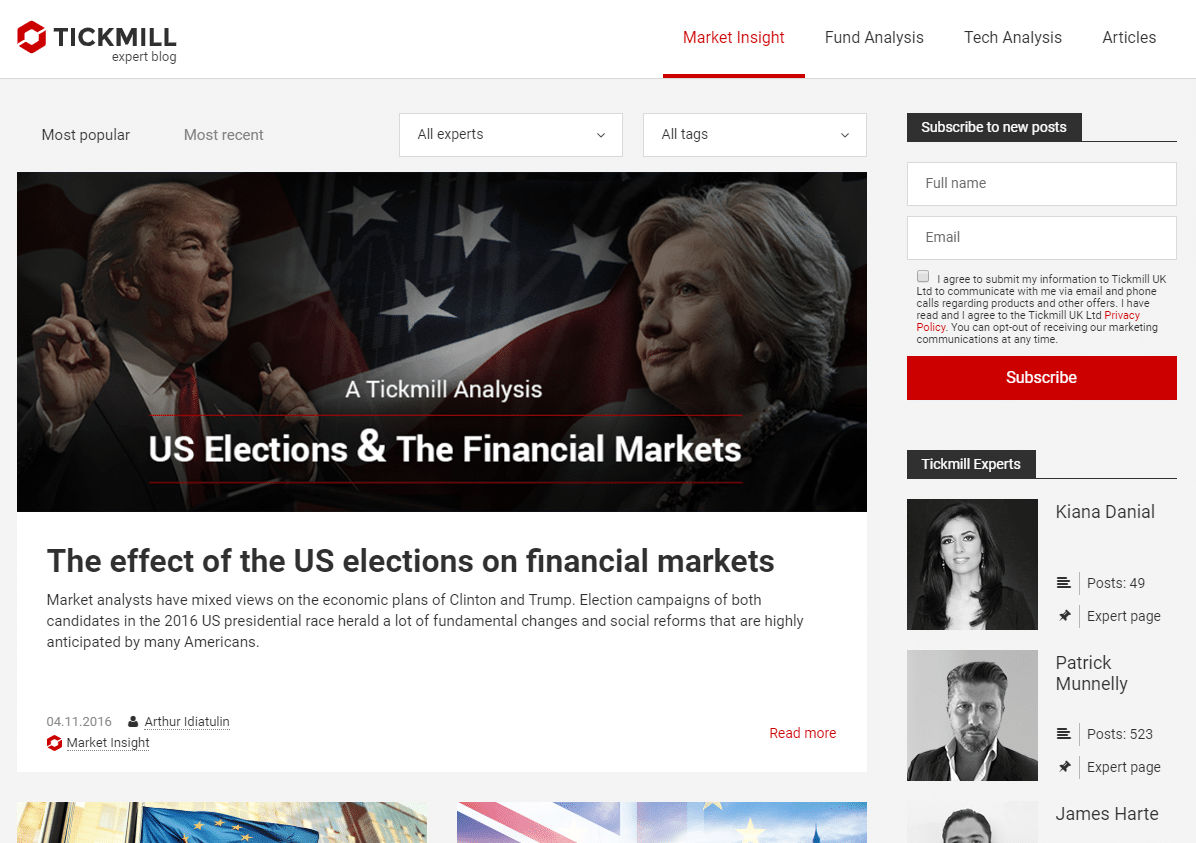

8. Research

Tickmill offers several research services. For example, Autochartist is a reliable chart pattern recognition tool.

Also, on Tickmill’s blog, you can discover reliable data analysis. The downside is that the charting tools come with an outdated design, and the news feed is average.

Good:

- Autochartist Integrated

- Excellent Analysis Offered By Tickmill Experts

- Good Economic Calendar

Bad:

- Average Design Of Charting Tools

- Limited News Feed

Research tools at Tickmill include:

- MetaTrader trading platform

- Autochartist in the ‘Client Area’

- ‘Client Tools’ section on the website

- Tickmill’s blog

Trading Ideas

Several authors (named experts) share daily blog posts for Tickmill. They comment and explain essential market events. Also, such blogs come with useful charts and show trading opportunities. You can reach out to these experts for additional information or questions. It is a valuable approach for beginner traders.

We liked Autochartist, as it offers trading ideas inspired by identified patterns on the charts.

Fundamental Data

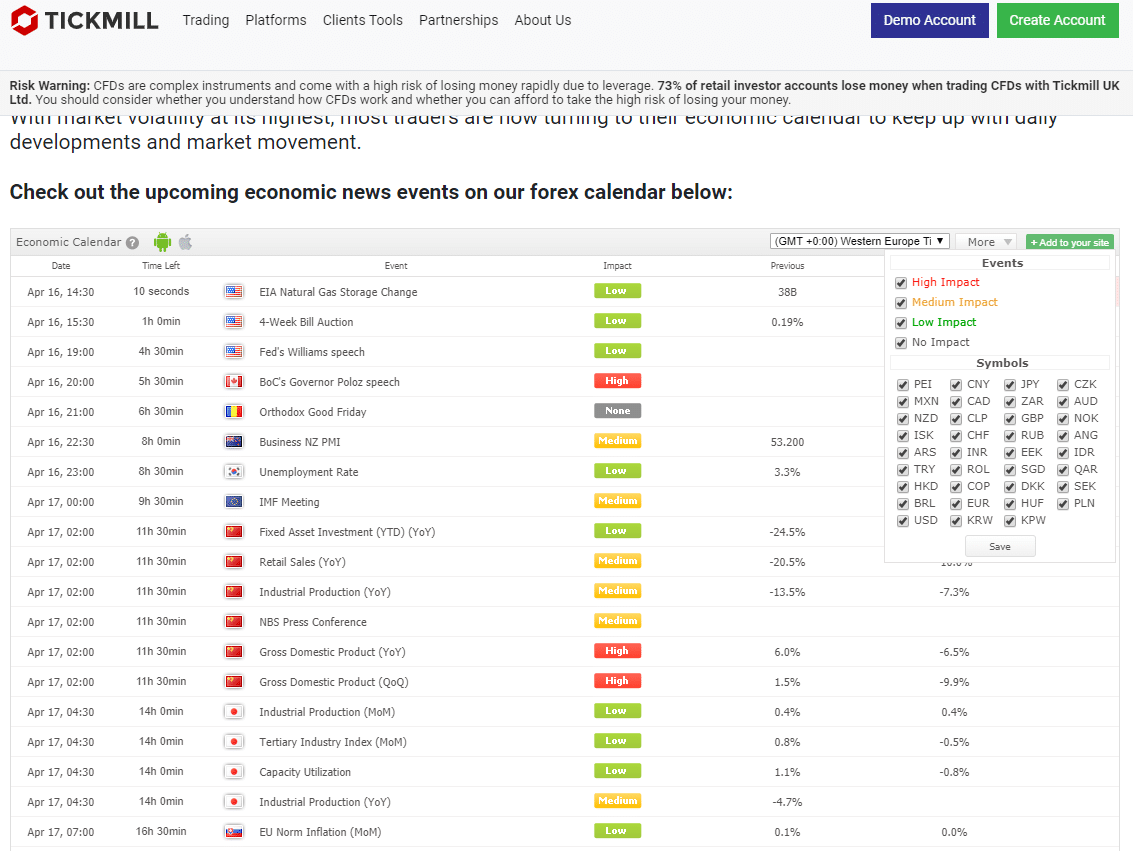

Tickmill is a forex trading broker. You would expect macroeconomic data, but what you find is the basic company information.

There is an economic calendar on their website. It offers insights about historical macroeconomic information. The filter setting is reliable, and it lets you choose the data type, country, and importance.

Charting

The charting tools at Tickmill are useful and offer 31 technical indicators. These tools are available on the MetaTrader trading platforms.

However, the design is outdated, and some settings are hard to use. For example, it was challenging to discover how to remove an indicator from the chart.

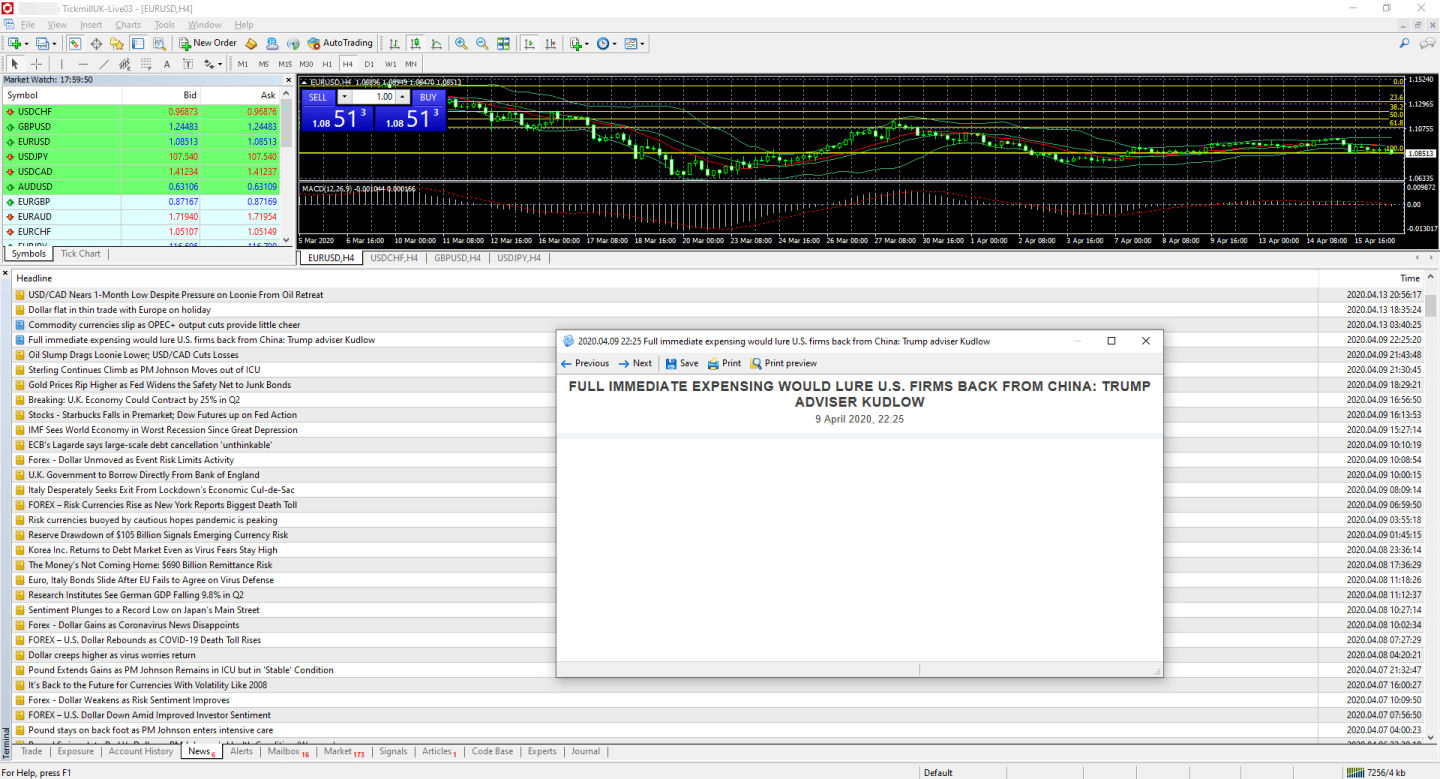

News Feed

The news feed at Tickmill is average. It has no structure, and it is difficult to discover relevant news. Clicking on the news only reveals a link to Investing.com.

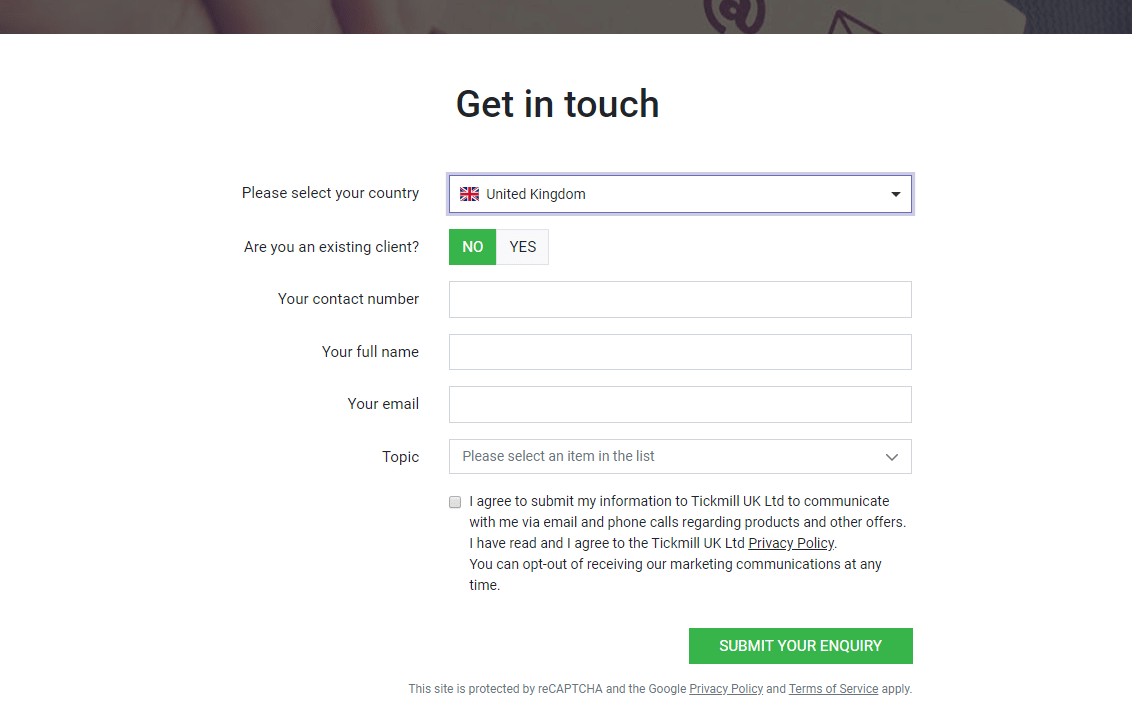

9. Customer Support

Customer service is ok. We received useful and fast answers on the email and telephone. The team for the live chat was knowledgeable, too.

The downside was the response time, which was slower than expected. Also, customer service is 24/5 only.

Good:

- Live Chat

- Useful Answers

- Available In Local Languages

Bad:

- No 24/7 Support

You can reach customer service by:

- live chat

- telephone

The phone support at Tickmill is reliable. We received useful and fast answers.

The email support came with relevant answers sent within a day.

The live chat has average speed, but the staff is helpful and allows you to use screenshots to explain your problem.

The only disadvantage is that there is no 24/7 availability.

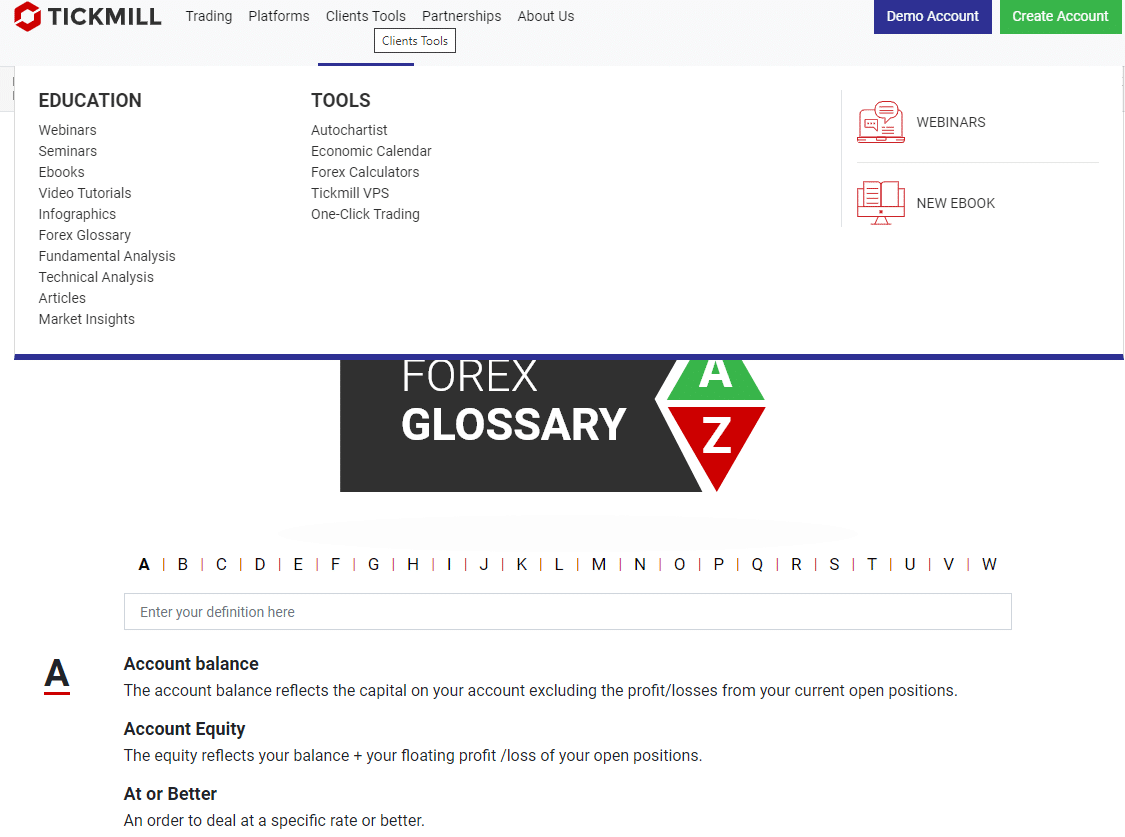

10. Education

Tickmill has excellent educational tools. You can learn with demo accounts, videos, and webinars. However, platform tutorial videos are not organized.

Good:

- Demo Account

- Educational Videos

- Excellent Production Quality

Bad:

- Platform Videos Are Not Categorized

With this broker, you can learn with:

- Demo account

- General educational videos

- Platform tutorial videos

- Webinars

- Quality educational articles

You can find general educational videos on the ‘Client Portal,’ under ‘Forex Tools.’ The quality of these videos was excellent.

You can find the platform tutorial videos on Tickmill’s website in the ‘Client Tools’ menu under the ‘Video Tutorials’ section. These videos are not categorized, but they are available in several languages.

11. Safety

Tickmill has licenses from several financial authorities, including the UK FCA. The downside is that this broker doesn’t have a bank parent, and it is not featured on any exchange.

Good:

- Top-Tier Licenses

- Negative Balance Protection

Bad:

- No Banking License

- Not Featured On Stock Exchange

Tickmill Regulations

Tickmill has regulations from numerous financial authorities, like the Financial Services Authority of Seychelles, the UK’s Financial Conduct Authority (FCA), and the Cyprus Securities and Exchange Commission (CySEC).

This broker has its headquarters in the UK and was founded in 2014.

Tickmill Safety

When it comes to Tickmill safety concerns, it is best to check the following:

• Protection if something goes wrong

• Background of the broker

Account Protection At Tickmill

You can set up an account at one or more of Tickmill’s legal entities, depending on your country of residency. The entity you opt for determines the Investor protection amount. The regulator is different from entity to entity.

| Country Of Clients | Protection Amount | Regulator | Legal Entity |

|---|---|---|---|

| Middle East, South America, EU | £85,000 | Financial Conduct Authority (FCA) | Tickmill UK Ltd |

| Globally Several Countries | €20,000 | Cyprus Securities and Exchange Commission (‘CySEC’) | Tickmill Europe Ltd |

| Globally Several Countries | No protection | Financial Services Authority of Seychelles | Tickmill Ltd Seychelles |

We suggest you choose the UK entity, as we ranked the FCA license as the best one.

Tickmill offers negative balance protection for retail clients. As such, if your account balance goes into negative, you will receive protection.

Background

Tickmill was founded in 2014. The length of a broker’s track record is strong evidence for its success in surviving previous financial crises.

Bottom Line

Tickmill is a low-cost CFD and forex broker with licenses from various global authorities like the top-tier FCA.

We liked the low CFD and forex fees. Also, the account creation is smooth, and you get access to several free withdrawal/deposit options.

There are some downsides at Tickmill. It has a limited product range, and you can only use commodities, CFDs on some stock indexes and forex. Trading platforms come with average news feeds and outdated designs.

Tickmill is an excellent choice for those looking to trade forex and CFD on a MetaTrader platform. You can test the demo account to decide if it is a good fit for you.

Disclaimer