Business24-7.ae is committed to the highest ethical standards and reviews services independently. Learn How We Make Money.

Page Summary

In A Nutshell

Trading 212 is a global FX and CFD broker that allows its customers to invest in ETF and stock without extra costs. The company was founded in 2004 and had its headquarters in London. This forex broker has regulations from the Bulgarian Financial Supervision Commission (FSC) and the U.K. Financial Conduct Authority (FCA).

Trading 212 is a safe broker due to its top-tier FCA regulation.

Disclaimer: CFDs represent professional trading instruments that have a high risk of losing money quickly because of leverage. Up to 76% of retail investor accounts lose assets when trading CFDs with this broker. It is best to get additional information on how CFDs work and whether or not you can cover for the high risk of losing your capital.

Trading 212 Review and Insights

Good:

- Commission-Free ETFs & Real Stocks

- Straightforward Account Opening Process

- Excellent Trading Platforms

Bad:

- Limited Product Portfolio

- Average Fundamental Analysis Tools

- Costly USD/ EUR Fee

Trading 212 offers ETFs and stock without commission. You can create an account online with little to no hassle, and this broker’s mobile and web trading platforms are user-friendly and well-designed.

There is a downside, though. The product portfolio at Trading 212 is limited, and standard asset classes, including bonds or options, are not available. In our review, we noticed that the research tools for fundamental analysis was basic. Also, the costs of USD/ EUR are high.

| Features |

Trading 212 |

|---|---|

| Country Of Regulation |

Bulgaria & The United Kingdom |

| Trading Fees Class |

Low |

| Inactivity Fee |

$0 |

| Withdrawal Fee |

$0 |

| Minimum Deposit |

$1 |

| Time For Opening Accounts |

24 hours |

| Credit/ Debit Card Deposits |

Available |

| Electronic Wallet Deposits |

Available |

| Base Currencies Available |

9 |

| Demo Account Available |

Yes |

| Products Offered | Cryptocurrency, CFD, Forex Stock and ETF |

1. Fees and Spreads

Trading 212 has low CFD fees, along with no commission for ETFs and stock.

Good:

- Free ETF And Stock

- Low CFD Fees

- No Fee For Inactivity Or Withdrawal

Bad:

- High Fees For USD/ EUR

We liked that there are no additional costs for inactivity, withdrawal, and deposit. Still, this broker has high fees for USD/ EUR trading.

| Assets | Fee | Fee Conditions |

|---|---|---|

| S&P 500 CFD |

Low | The fees are built into spread, with an average spread cost of 0.1. |

| Europe 50 CFD |

Low | The fees are built into spread, with an average spread cost of 4.3. |

| USD/ EUR | High | The fees are built into spread, with an average spread cost of 0.8 pips. |

| Inactivity Fee | Low | No Inactivity Fee |

How We Assessed Fees

We assessed Trading 212’s fees as low, average, or high, depending on how they compare to those of all forex brokers we reviewed.

To help you get a broader understanding of our process, here is the distinction between trading and non-trading fees.

- Trading fees happen when you trade. These can be conversion, commission, spreads, or financing rate fees.

- Non-trading prices are not direct costs linked to trading. These can be inactivity or withdrawal fees.

Next, we shared the most important fees of Trading 212 for each asset class. As an example, for stock index and forex trading, the main fees are commissions, spreads, and financing rates.

We analyzed Trading 212 costs with those of two similar forex brokers, XTB and eToro. Our assessment relies on objective features, like fee structure, client profile, and products offered.

Here are our top findings of trading fees at Trading 212.

Trading Fees At Trading 212

Overall, trading fees are low with this forex broker. We like the transparent policy at Trading 212, as the broker displays the prices clearly. As an example, you can look at the daily swap rates directly on the broker’s website or trading platform.

We understand that it is challenging to compare trading costs for CFD brokers. So, we made fees comparable and clear by calculating all the standard costs for trading specific products.

In our review, we used instruments from each asset class:

- Stock index CFDs: EUSTX50 and SPX

- Stock CFDs: Vodafone and Apple

- Forex: USD/ EUR, USD/ GBP, USD/ AUD, CHF/ EUR and GBP/ EUR

A standard trade is about purchasing a leveraged position, keeping it for seven days, and afterward selling it. We selected a $2,000 position for the stock CFDs and index, along with $20,000 for forex transactions to assess the volume. The leverage we had was:

- 20:1 for stock index CFDs

- 5:1 for stock CFDs

- 30:1 for forex

All this data covers commissions, spreads, and financing costs for all brokers. So, here are our findings for Trading 212 fees.

ETF And Stock Fees

Trading 212 is a unique broker due to the commission-free ETF and real stock. It is a CFD broker, but it allows you to trade with both ETFs and real stocks via a Trading 212 Invest account.

ETF and stock commision for trading $2,000:

| |

Trading 212 | eToro | XTB |

|---|---|---|---|

|

US Stock | $0.0 | $0.0 | $10.0 |

|

UK Stock | $0.0 | $0.0 | $10.0 |

|

German Stock | $0.0 | $0.0 | $8.8 |

CFD Fees

In most cases, this forex broker has low CFD trading costs. The fees are slightly higher when compared to eToro’s and cheaper than XTB’s.

| | Trading 212 | eToro | XTB |

|---|---|---|---|

|

Fee For S&P 500 Index CFD | $2.6 | $2.4 | $2.0 |

|

Fee For Europe 50 Index CFD | $3.9 | $2.7 | $2.2 |

|

Fee For Apple CFD | $10.5 | $6.3 | $17.9 |

|

Fee For Vodafone CFD | $4.5 | – | $20.9 |

Forex Fees

The forex fees at Trading 212 are average. A couple of currency pairs, like USD/GBP or USD/AUD, come with competitive prices. Still, leading currencies, such as USD/EUR, have higher fees.

| | Trading 212 | eToro | XTB |

|---|---|---|---|

|

Benchmark Fee For USD/ EUR | $19.6 | $19.6 | $15.0 |

|

Benchmark Fee For USD/ GBP | $12.8 | $16.2 | $11.1 |

|

Benchmark Fee For USD/ AUD | $8.5 | $12.4 | $10.0 |

|

Benchmark Fee For CHF/ EUR | $16.1 | $11.8 | $6.6 |

|

Benchmark Fee For GBP/ EUR | $17.4 | $19.9 | $9.9 |

Non-Trading Fees

Trading 212 has low non-trading fees. There is no additional cost for inactivity, deposit, withdrawal, or account maintenance.

| | Trading 212 | eToro | XTB |

|---|---|---|---|

|

Account Fee | No | No | No |

|

Inactivity Fee | No | Yes | No |

|

Deposit Fee | $0 | $0 | $0 |

|

Withdrawal Fee | $0 | $5 | $0 |

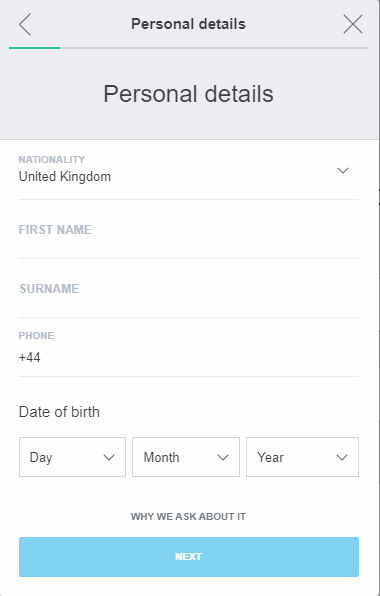

2. Account Opening

Creating an account with Trading 212 is simple, fast, and user-friendly. Our account was approved within 24 hours.

Good:

- Fast

- Digital

- No Minimum

Bad:

- Problems With Account Verification

Overall, you can open an account with Trading 212 from anywhere on the globe. But, of course, there are some exceptions. As an example, Canadian or U.S. clients can’t create an account with this broker.

Minimum Deposit

The minimum deposit required by this broker is $10 for ISA or Invest accounts and only $1 for CFD accounts. It is one of the best brokers for those looking forward to investing or trading in small amounts. Numerous brokers have a minimum deposit of $10,000 or more.

Account Types

You can opt between three account types. These differ in assets you can trade with and availability in different countries.

| | CFD Account | Invest Account | ISA Account |

|---|---|---|---|

|

Available Countries | All Countries | All Countries | UK |

|

Available Products | CFDs | ETF And Real Stock | ETF And Real Stock |

The downside is that there are no corporate accounts available.

How To Open An Account At Trading 212

Account opening at Trading 212 is digital and straightforward. Almost all accounts are verified and approved in one business day. Still, while reviewing this broker, we had some issues uploading the documents, and the account was approved in three business days.

The steps you have to follow to create an account at Trading 212 are:

- Offer information about your country of residence, along with personal data, such as date of birth or email address.

- Submit your tax I.D. or tax information, such as the country where you pay taxes.

- Choose the account type and base currency.

- Answer questions about your trading experience, financial, and employment status.

- Agree to the terms and conditions and activate your account by verifying your residency and identity.

To verify your identity, Trading 212 requires:

- Proof of identity, such as passport, national I.D. or driver’s license

- Proof of address, such as a utility bill from the last three months or a bank statement

We tested the account opening process several times, and one time we had a problem with uploading proof of address. Their system didn’t recognize the address, which is why we had to reach out to Trading 212’s customer service team. As soon as we reached out, the issue was solved within a couple of hours.

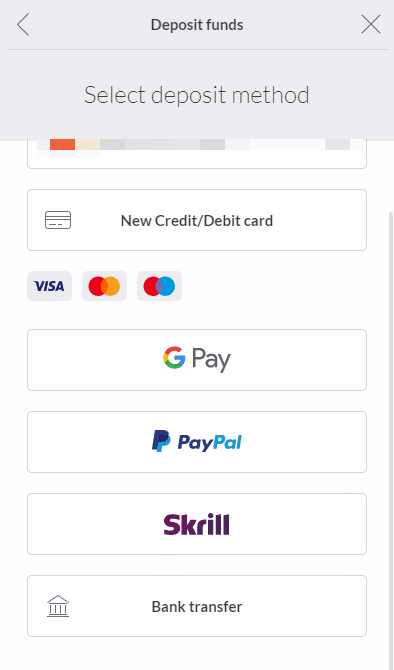

3. Withdrawals and Deposits

Withdrawals and deposits at Trading 212 are fast, free-of-charge, and have various forms. There is a downside: there are only some account base currencies available in one country.

Good:

- Debit And Credit Card Available

- No Withdrawal Fee

- No Deposit Fee

Bad:

- Limited Base Currencies Available In One Country

Account Base Currencies

Trading 212 has the following account base currencies: RON, GBP, USD, EUR, CHF, PLN, NOL, CZK, and SEK. Still, only two or three account base currencies are available in one country (the local currencies plus USD). As an example, in the U.K., you can use GBP, USD, and EUR.

This account base currency is better when compared to that of eToro’s and XTB’s.

| | Trading 212 | eToro | XTB |

|---|---|---|---|

|

Number Of Base Currencies | 9 | 1 | 4 |

This information is essential for your trading experience. You don’t have to pay a conversion price if your trading account has the same currency as your bank account. Also, if you trade assets in the same currency as your trading account base, there will be no conversion fee.

If you want to save on currency conversion fees, you can use a multi-currency bank account at a digital bank. Transferwise or Revolut provide bank accounts in numerous currencies with excellent exchange rates and affordable or free international bank transfers. Creating an account takes a couple of minutes on a smartphone.

Options And Deposit Fees

Trading 212 has no deposit fees. You can use bank transfers, debit or credit cards, along with the electronic wallets listed below:

- Google Pay

- PayPal

- Skrill

- ApplePay

- Dotpay

- Giropay

- Carte Bleue

- Direct eBanking

- iDEAL

Keep in mind that not all these electronic wallets are available in all countries. Also, it is not clear which one is available where.

| | Trading 212 | eToro | XTB |

|---|---|---|---|

|

Bank Transfer | Yes | Yes | Yes |

|

Debit/ Credit Card | Yes | Yes | Yes |

|

Electronic Wallets | Yes | Yes | Yes |

Instant payment is available with a debit or credit card. A bank transfer can take several business days. Also, you can deposit funds from accounts that are in your name.

Withdrawal Fees And Options At Trading 212

As is the case with deposits, this broker has no withdrawal fees. Also, you can use the same options to withdraw as to deposit.

| | Trading 212 | eToro | XTB |

|---|---|---|---|

|

Bank Transfer | Yes | Yes | Yes |

|

Debit/ Credit Card | Yes | Yes | No |

|

Electronic Wallets | Yes | Yes | No |

|

Withdrawal Fee | $0 | $5 | $0 |

For this review, we used the debit card withdrawal. It took one business day to complete the process.

You can withdraw money only to accounts in your name by following these steps:

- Log into your account

- Access the ‘Manage funds‘ menu

- Submit your password

- Select the withdrawal amount

- Confirm the withdrawal request

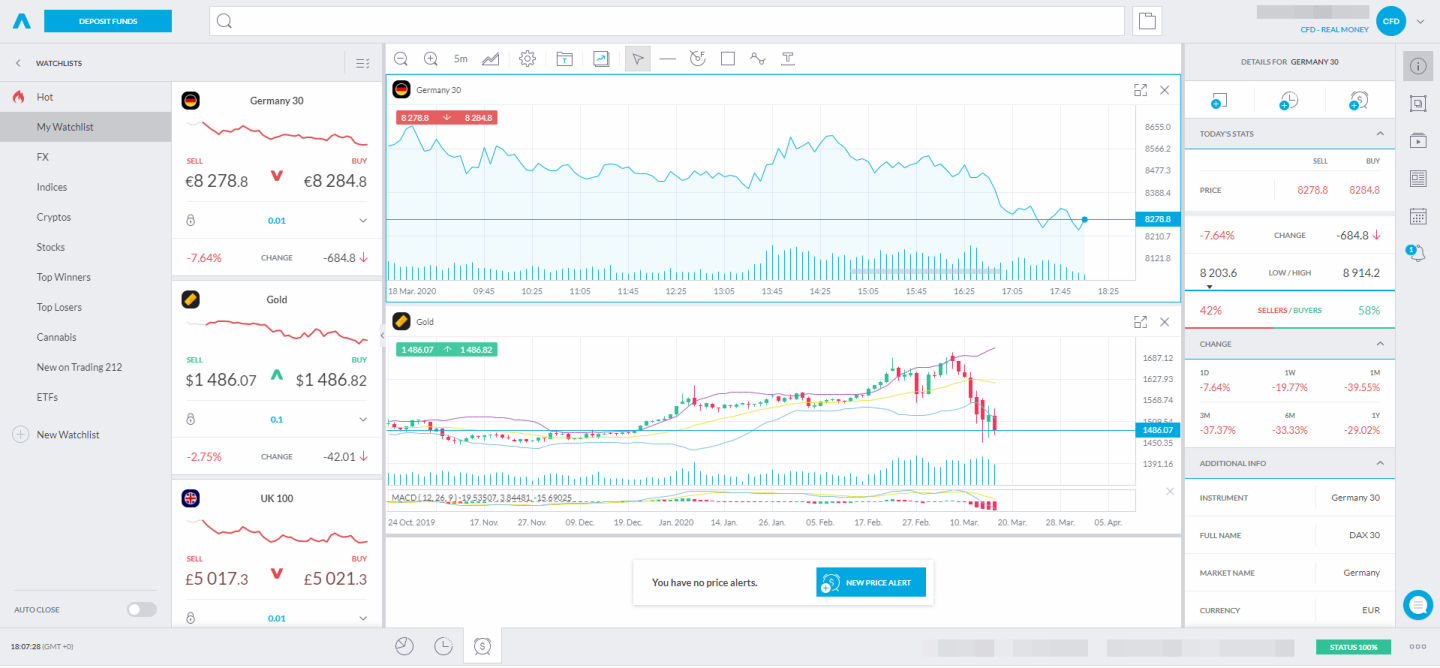

4. Web Trading Platform

Trading 212 has a customizable web trading platform with a user-friendly interface.

Good:

- User-friendly

- Reliable Search Option

- Great Customizability For Workspace And Charts

Bad:

- No Two-Step Authentication Login

The downside is that it doesn’t feature two-step authentication. Also, the range of available order types is limited.

Trading Platform | Score | Available |

|---|---|---|

|

Web | 4.4 / 5 stars | Yes |

|

Mobile | 4.4 / 5 stars | Yes |

|

Desktop | – | No |

This broker has a proprietary web trading platform. It is available in several languages.

| Countries | |||||

|---|---|---|---|---|---|

| English | German | Dutch | Spanish | French | Italian |

| Polish | Russian | Romanian | Arabian | Chinese | Cell |

Look And Feel

Trading 212 has a professional, user-friendly, and well-designed web platform. It is simple to understand and use, no matter your trading experience.

What we liked most was the vast customizability, as you can modify with ease the size of tabs or the position.

Security And Login

Trading 212 has only one-step authentication. A two-step authentication would be more secure.

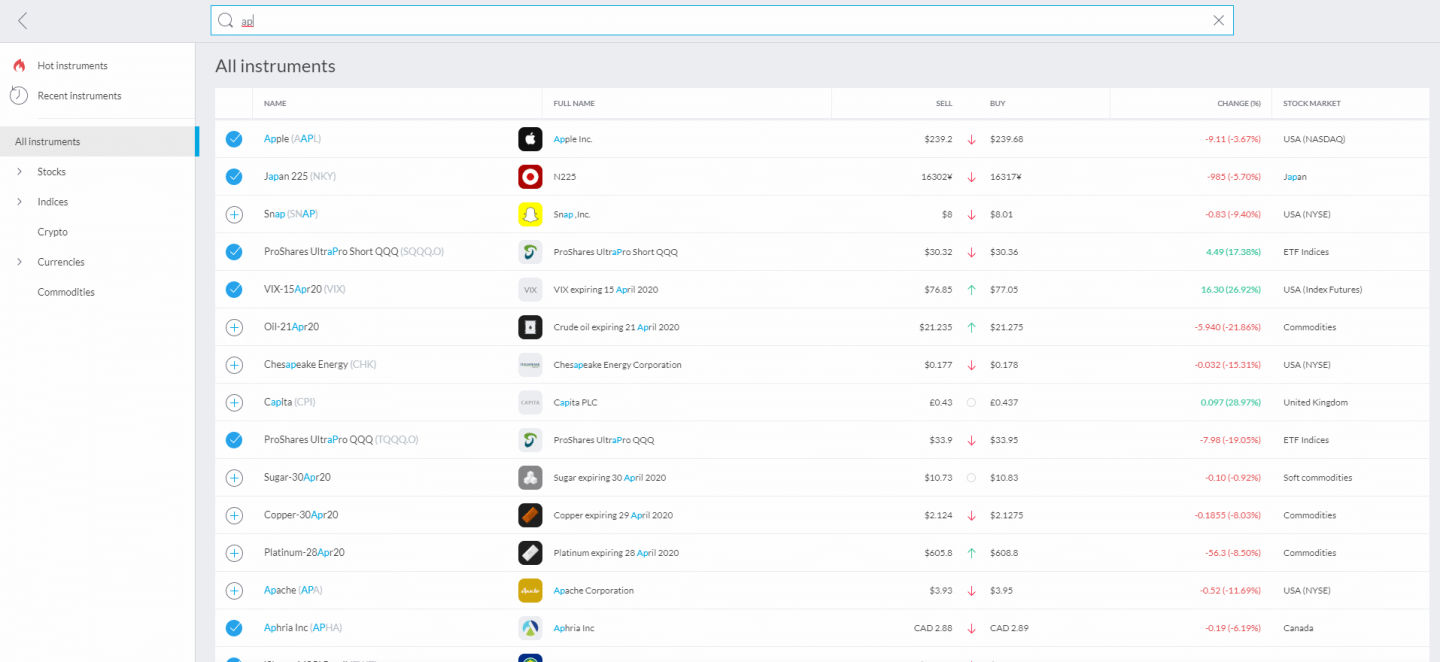

Search Features

The search functions at Trading 212 are reliable. You can search by typing the name of the asset, or you can use a pre-built category, like indices or stocks.

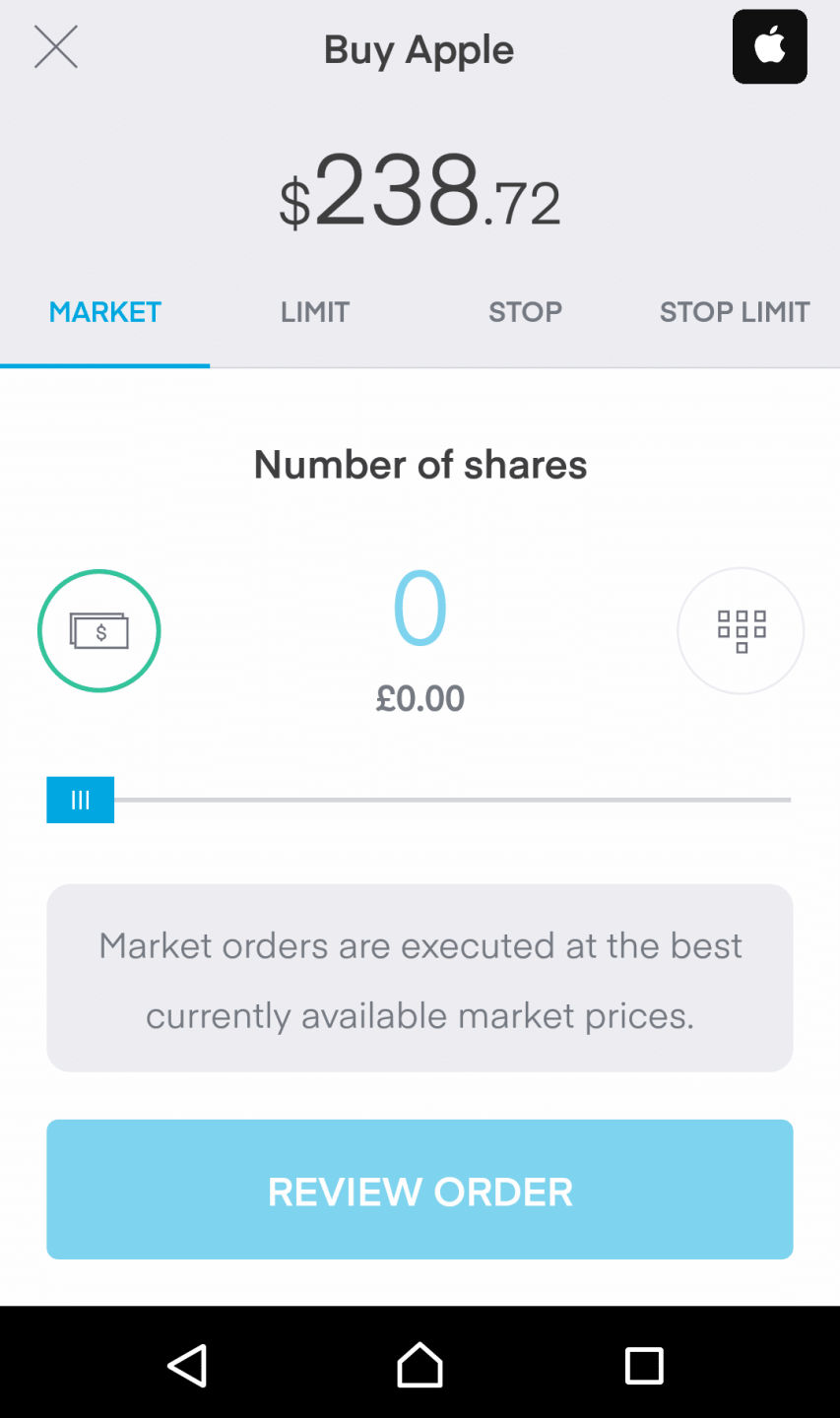

Placing Orders

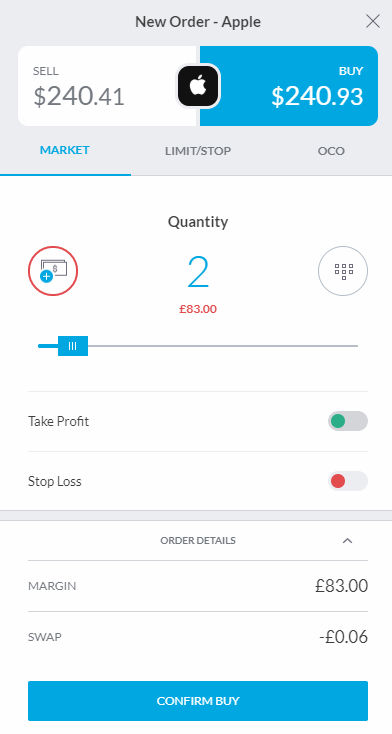

Invest, and CFD Accounts come with distinct order time limits and types:

Order Type | CFD Account | ISA/ Invest Accounts |

|---|---|---|

|

Market | Yes | Yes |

|

Limit | Yes | Yes |

|

Stop | Yes | Yes |

|

Stop Limit | No | Yes |

|

OCO | Yes | No |

|

Canceled/ Good Until The End Of Day | No | Yes |

Clicking on sell or buy an asset, will offer a trade ticket. You can use it to look at essential details of the order, such as stamp duty at U.K. real stocks, swap rates, or margin.

Notifications And Alerts

You can create price alerts, and you can receive notifications for margin calls, executed order news, and other information. We believe it is best to receive notifications via SMS and email as well.

Fee Reports And Portfolio

Trading 212 has a transparent fee report and portfolio. You can look at this data by clicking on your username and accessing the ‘Report‘ menu. Here you can read your interest (swap points) earned or charged, results, and cash balance.

5. Mobile Trading Platform

Trading 212 has an excellent mobile trading platform.

It has a smooth design and user-friendly interface. Also, the search functions are reliable, while creating price alerts or giving orders is simple. The downside is that it doesn’t feature two-factor authentication or any of the biometric identification technology.

Good:

- User-friendly

- Reliable Search Function

- Price Alerts

Bad:

- No Two-Factor Authentication

- No Biometric Identification

The mobile trading platform from Trading 212 is available for iOS and Android. For this review, we used the mobile app on Android. It is available in the same languages as the web trading platform.

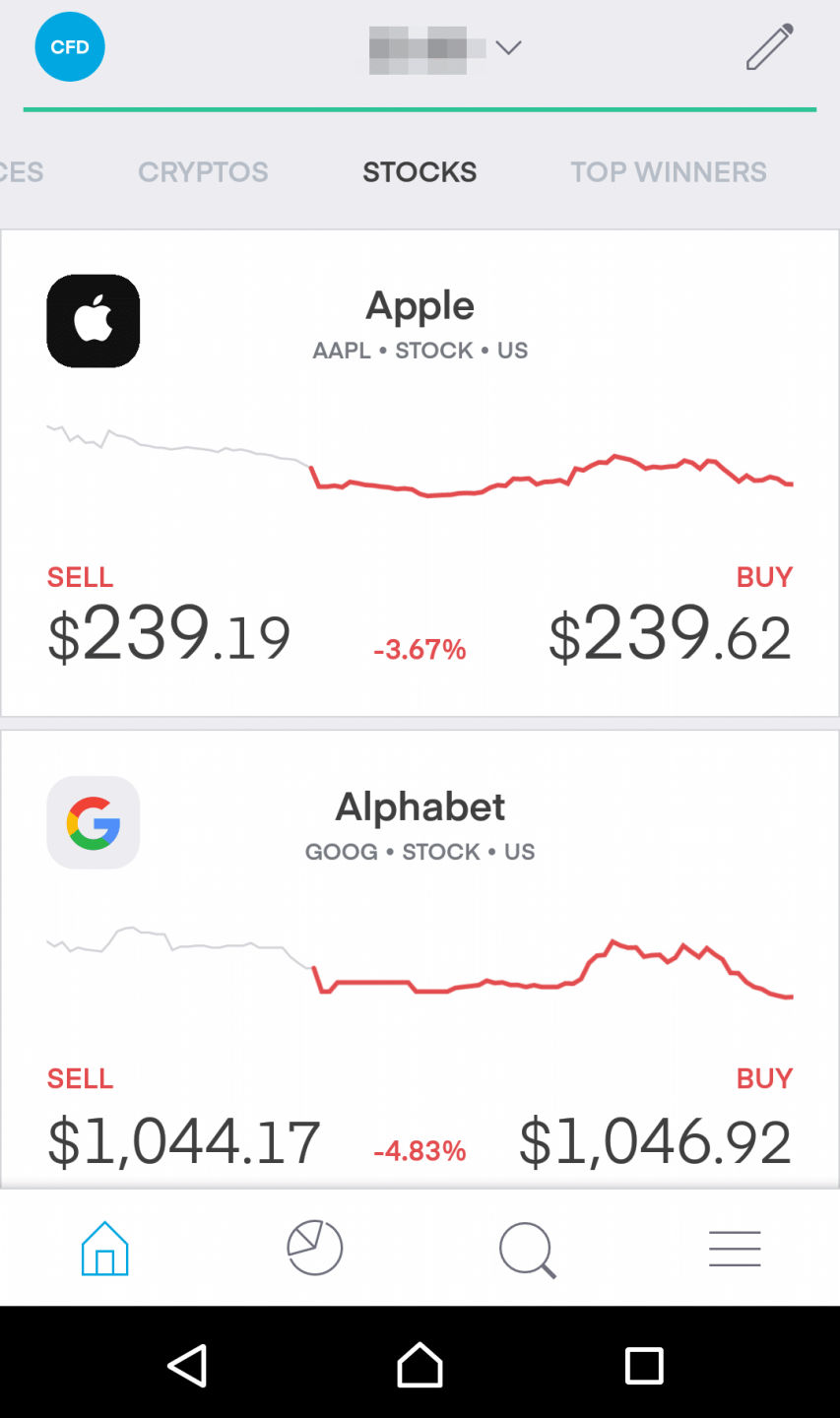

Look And Feel

This mobile trading platform has a reliable design and user-friendly interface. After testing it, we concluded that it offers an outstanding trading experience.

Security And Login

Trading 212 offers only one-step authentication. A two-step authentication would be more secure. Also, biometric authentication solutions (face recognition or touch-ID) are not available.

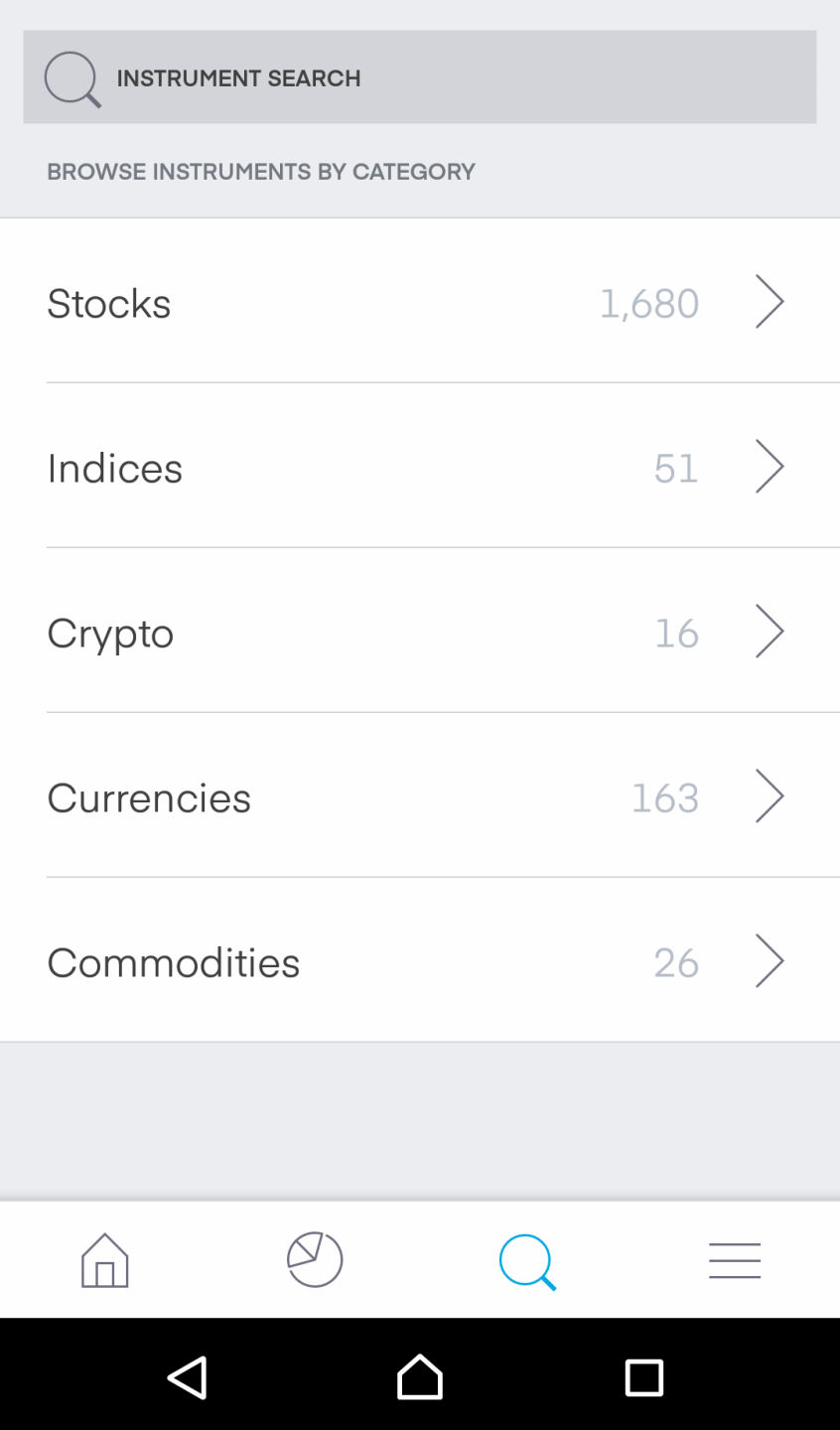

Search Features

Search features on the Trading 212 mobile platform are excellent. You can identify your assets with ease.

Placing Orders

There are the same time limits and order types as on the web trading platform.

Notifications And Alerts

You can receive push notifications and price alerts. Still, price alerts are not available via email or SMS.

6. Desktop Trading Platform

Trading 212 does not have a desktop trading platform. For some traders, this could be a major obstacle.

7. Markets and Products

The products available at Trading 212 consist mostly of crypto assets, forex, and CFDs. Also, you can use ETFs or real stock. The most popular classes, such as mutual funds, bonds, futures, or options, are not available with this broker.

Even though Trading 212 provides ETFs and real stocks, it is a forex and CFD broker. For more information on CFDs, read our CFD trading insights.

Disclaimer: CFDs represent professional trading instruments that have a high risk of losing money quickly because of leverage. Up to 76% of retail investor accounts lose assets when trading CFDs with this broker. It is best to get additional information on how CFDs work and whether or not you can cover for the high risk of losing your capital.

Trading 212 has cryptocurrency, forex, and commodity CFD selection. The stock index CFD and stock CFD are standard. The number of CFD ETFs is low.

| | Trading 212 | eToro | XTB |

|---|---|---|---|

|

Currency Pairs | 179 | 52 | 70 |

|

Stock Index CFDs | 35 | 13 | 33 |

|

Stock CFDs | 1.530 | 2.000 | 2.022 |

|

ETF CFDs | 28 | 264 | 167 |

|

Commodity CFDs | 28 | 32 | 27 |

Crypto CFDs | 16 | 74 | 40 |

The downside is that you can’t choose the level of leverage in the application.

Modifying the leverage manually challenges risk management. As an example, you can trade with 2:1 leverage with stock CFDs, instead of 5:1 leverage. You should be careful with CFD and forex trading since the preset leverage levels are high.

ETFs And Stocks

Trading 212 allows you to invest in ETFs and real stock. The portfolio might appear limited when compared to other brokers. Still, you have access to more than 3000 instruments.

| | Trading 212 | eToro | XTB |

|---|---|---|---|

|

Stock markets | 15 | 17 | 17 |

|

ETFs | 1800 | 264 | 366 |

8. Research

Trading 212 offers insights concerning daily trading ideas, and it has reliable charting tools. However, it provides only average analyses and data flow, and the Reuters/Bloomberg newsfeed is not as useful as you might expect.

Good:

- Useful Interactive Chart

- Trading Ideas

- User-friendly

Bad:

- Average News Flow

- No Fundamental Data Available

Both the mobile and web trading platforms have research tools available in several languages.

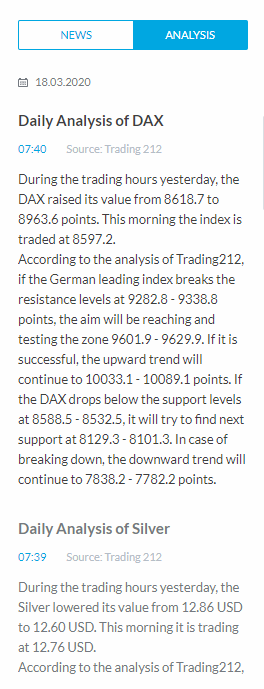

Trading Ideas

This broker offers average daily technical updates. It is best to research, analyze, or complete Trading 212’s T.A. tips with additional sources.

Fundamental Data

One of the leading downsides at Trading 212 is that it does not offer fundamental data or analyse for the available assets.

As an example, if you want information on the P/E ratio of a company, or you need historical U.S. employment rates, you will have to look for additional sources.

Charting

One of the best parts of Trading 212 is charting. All the required technical analysis studies are available, with more than 60 technical indicators to support your trading decisions.

News Feed

The news feed is limited at best. You only receive standard technical analysis, statistics, or news for a few products because trading 212 does not have a market analyst team.

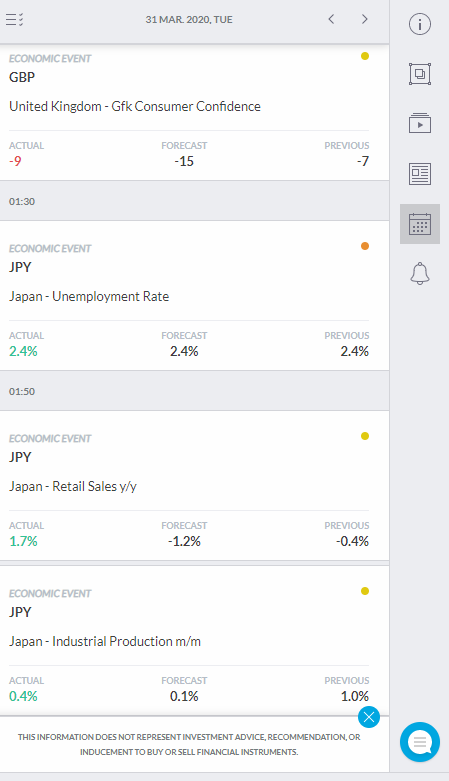

But we like the economic calendar. It is useful to keep track of significant events. Also, it lets you filter by currency pairs and impact.

9. Customer Service

During our testing, the customer service at Trading 212 was helpful. We received reliable and rapid information on all our queries. Still, live chat is not available because of the high volume of customer requests.

Good:

- Phone Support

- Knowledgeable Answers

- Available 24/7

Bad:

- No Live Chat Available

You can reach out to Trading 212 by phone or email.

Email customer service is excellent. They responded promptly and fast to our email. What we liked most was their honest and transparent approach.

The phone support was basic, but we got relevant answers to our problems. The slow response time is the result of high customer volume experienced by various broker companies in March, 2020.

The customer service is available 24/7.

10. Education

Trading 212 offers numerous video and written tutorials on how to trade and how to use its trading platforms.

It is a useful approach for beginner traders, but it doesn’t offer too much value for experienced traders. The only thing missing from Trading 212 is webinars.

Good:

- Demo Account

- Tutorial For Trading Platforms

- Educational Video Material

Bad:

- No Webinars

You can opt for several options if you plan to improve your trading skills:

- Demo account

- Platform tutorial videos

- General educational videos

- Quality educational articles

We recommend you use the information in the education materials available on the Trading 212’s website. It is useful and offers in-depth details on how to use their platforms.

11. Safety

The top-tier FCA regulates Trading 212. It gives negative balance protection for leveraged trading. Still, this broker is not featured on any stock exchange, and it doesn’t have any banking background.

Good:

- Most Clients Come From A Top-Tier Financial Authority

- Negative Balance Protection

Bad:

- No Banking Background

- Not Featured On Any Stock Exchange

- No Public Financial Information

Trading 212 was established back in 2005 in Sofia, Bulgaria. They opened an office in London, the United Kingdom in 2013. From this moment on, the London office has been considered their headquarters.

Trading 212 Regulations

Trading 212 is regulated by Bulgaria’ Financial Supervision Commission and the U.K.’s Financial Conduct Authority. As for today, this broker is not regulated by any other authority.

Trading 212 Safety

When it comes to Trading 212 safety concerns, it is best to check the following:

- Protection if something goes wrong

- Background of the broker

Account Protection At Trading 212

Based on the legal entity with which you open a trading account, distinct compensation schemes apply:

Client Country | Investor Protection Amount | Regulator | Legal Entity |

|---|---|---|---|

|

Germany & UK |

£85,000 |

Financial Conduct Authority (FCA) |

Trading 212 UK Limited (UK) |

|

Other Countries |

90% of your funds but at most €20 000 |

Bulgarian Financial Supervision Commission (FSC) |

Trading 212 Ltd. |

It is worth mentioning that Trading 212 provides negative account balance protection under the ESMA rules. This protection signifies that you can’t lose more than your account value. (For some brokers, negative account balance protection is secured. As such, your leveraged positions can lead to more loss than your total account value).

Bottom Line

Trading 212 is a forex and CFD broker regulated by several financial supervisory authorities. The leading advantage at Trading 212 is that it has no commission for ETFs or stocks. Also, the non-trading and CFD fees are low. The account opening is straightforward, and the trading platforms are simple to understand.

Still, Trading 212 has a limited product portfolio and does not feature popular asset classes, such as options or bonds. Also, there are no research tools for fundamental analysis, while the USD/EUR fees are high.

Trading 212 is an excellent option for those looking forward to investing in equities or trade with leveraged CFD and FX products via a professional trading platform.

Disclaimer 68% of retail CFD accounts lose money