Page Summary

After a Bitcoin halving event, the compensation that a Bitcoin miner receives in new Bitcoin becomes half of what it was before the event. A Bitcoin halving happens every 210,000 blocks, which equates to about once every four years.

Bitcoin halving creates scarcity of Bitcoins. This works deflationary and raises the price of every Bitcoin. The idea behind Bitcoin halving is that the miner’s fee will remain high enough to deploy computing power. Because there is a limited number of Bitcoins on the market, this seems to work for the time being.

How does Bitcoin halving work?

Bitcoin halving works by reducing the rewards of mining Bitcoin as more blocks are mined. Bitcoin halving has everything to do with the blockchain. Miners receive a fee if they approve a full block of Bitcoin transactions on the blockchain.

This fee consists of a part of the new Bitcoin that the miner receives and a part of transaction costs. In this way, it remains lucrative for miners to use a lot of computer power to keep Bitcoin technology alive.

When did Bitcoin Halvings take place?

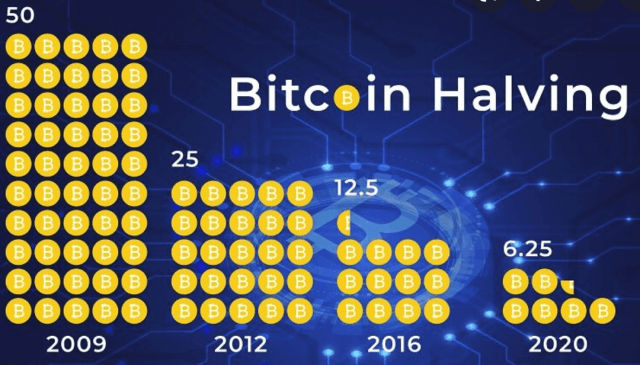

Bitcoin has been around since 2009 and three halvings have now taken place. In the early years of Bitcoin, the mining reward per approved block was 50 new Bitcoin.

- The first Bitcoin Halving took place in 2012. As a result, the reward per block decreased from 50 Bitcoin to 25 Bitcoin.

- The second Bitcoin Halving happened in July 2016. The block reward went down from 25 Bitcoin to 12.5 Bitcoin.

- The last Bitcoin halving was in May 2020, when the reward per block decreased from 12.5 Bitcoin to 6.25 Bitcoin.

When will the next Bitcoin halving happen?

It is unclear when the next Bitcoin halving will take place exactly. Most likely it will roughly continue the trend of once every four years. At the Bitcoin halving date for the Bitcoin halving 2024, the mining rewards will go from 6.25 new Bitcoin to 3.125 Bitcoin.

Because there is a set number of Bitcoin that will ever come on the market, mining rewards will no longer apply at some point. Due to the halving at every 210,000 blocks, the maximum number of Bitcoin in circulation will be around the year 2140.

Miners also receive transaction costs. The idea is that Bitcoin is becoming more valuable over time and that transaction costs are becoming an important part of the miner’s reward. From the year 2140, it may even be the case that mining can be profitable without receiving new Bitcoin for it.

What effect does a Bitcoin halving have on the Bitcoin price?

Historical data shows a correlation between Bitcoin halving and increases in the price of Bitcoin. As soon as this no longer is the case, it may be that it is no longer interesting enough for miners to continue mining. Many investors in the crypto market are always looking at the Bitcoin halving. At the end of 2017, there was a true crypto boom because there was a lot of attention for Bitcoin. The same seems to have repeated itself after the Bitcoin halving 2020.

In the period before a halving is approaching, there is always extra news and tension around Bitcoin. This can cause a strong fluctuation in the price. Apart from Bitcoin halving, Bitcoin Cash halving also takes place. Bitcoin Cash halving takes place with every 210,000 blocks mined and has a similar effect on the price of Bitcoin Cash.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.