A pip represents the smallest price move that a currency exchange rate can make based on market convention. Aka Price Interest Point (PIP) is the smallest unit a currency pair can change. It is 1% of 1% or 0.0001 in value. If a currency pair, like for example GBP/USD moves from 1.2100 to 1.2101, the currency has appreciated by one pip.

A pip should not be confused with bps, which is another unit but it is only used in interest rate markets. It is called basis points and also represents 1% of 1% but is written as 0.01% for calculations.

Pips are central to Forex calculations. All exchange rate fluctuations and spreads are calculated with the help of pips. As a standard practice, all exchange pairs are monitored up to the fourth decimal place only i.e. one pip.

How Do Pips Work in Forex Trading?

Pips are used to measure the amount of change in an exchange rate for a currency pair.

Understanding the Mechanics of Pips

Pips are central to any Forex trading calculation. Currencies fluctuate in value relative to each other all the time and that is where money is expected to be made by Forex traders. Pips provide a useful yardstick for the market and are able to tell the entire market trends within small digits.

Nearly all currency pairs of the world are measured in pips. The US Dollar/ Japanese Yen or USD/JPY pair is measured up to 0.01 value or 100 regular pips. So, in that case, a pip is 100 times a normal pip. In all other currency pairs, the value of pip doesn’t change.

Pips have a unique use case because:

Base Unit: Pips showcase the smallest price movement possible in the exchange market. Anything smaller than a pip is usually rounded off.

Measuring Minute Changes in the Market: Standardized pips allow traders to observe and track minute changes in the Forex market.

Calculating Profit Margins: Pips are instrumental in calculating gross profit margins in the currency trading market.

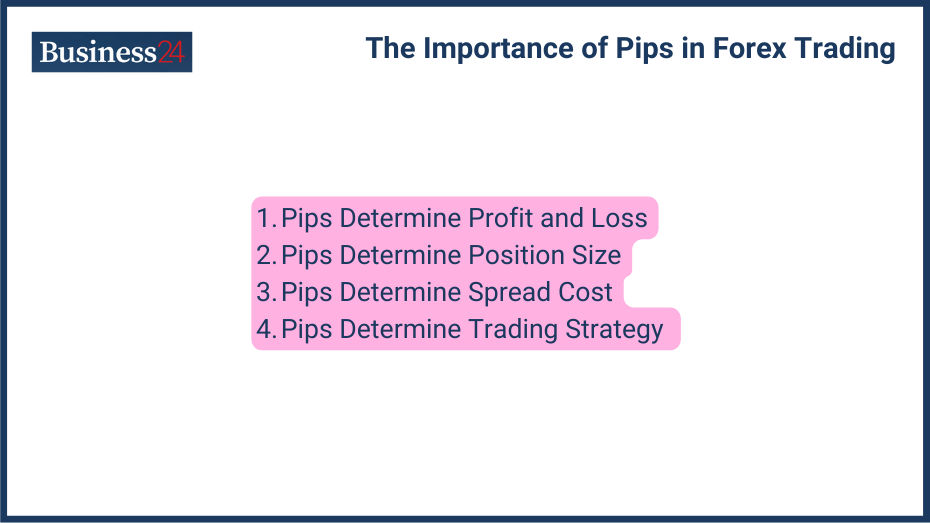

Why are Pips Important in Forex Strategies?

Pips play a crucial role in forex trading as they affect both risk management and profit calculations. Forex trading is a market of small margins overall, so a pip is a small unit you need for help with calculations. Here is how pips help in the Forex market overall:

Pips and Risk Management

Since pips are the smallest units in currency trading, you need to engage in risk management with them. If a currency, let’s say GBP/USD is trading at 1.2002 and you buy it at the spot price.

You wish to make a profit from this investment, but at the same time, you acknowledge the presence of downside risk in the market. So you put a stop-loss order at 1.1998 value or just 4 pips below your purchase price to help you exit the market if the currency pair starts dropping value. This is one way to improve risk management with the help of pip-based calculations.

Pips and Profit Calculations

Pips are used to calculate the profits of Forex trades. If the trade involved is a standard lot of 100,000 units and the exchange pair has moved up ten pips since buying, then the profit is the lot size multiplied by the price difference in pips or 100,000 x 0.001 = $100. The same calculation can be used in loss calculations and associated risk management

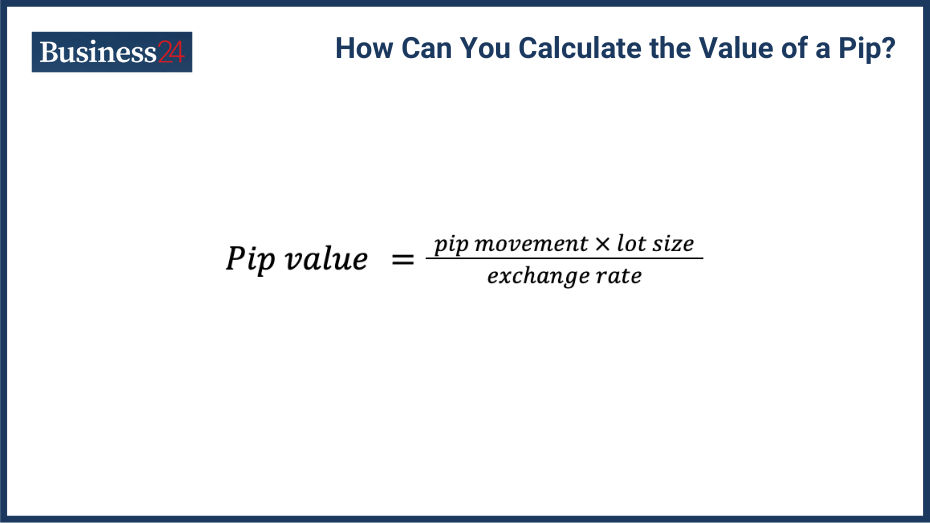

How Can You Calculate the Value of a Pip?

The value of a pip varies depending on the currency pair and the size of the trade. The value of a pip changes from one currency pair to another. It is not an absolute value in Forex markets. However, since most exchange pairs involve the US dollar as the base currency, one can easily calculate the value of pip movement for a particular exchange pair. Use this formula:

Factors Influencing Pip Value

As the above equation to calculate pip value suggests, it depends on three main factors:

Pip movement: The change in value of the currency pair affects the pip value. If it increases, then the pip value also increases.

Lot Size: If the lot size is bigger, it increases the pip value and if it is smaller, it drops the pip value.

Exchange Rate: If the exchange rate at that particular point in time increases, it decreases the pip value.

What are Examples of Pip Calculations in Popular Currency Pairs?

Demonstrations of how pips are calculated across different major and exotic currency pairs. Pip calculations can get tricky for exotic currency pairs but are more reliable when it comes to major currency pairs.

Major Currency Pairs

The value of pips in Forex trading is dynamic and changes according to the situation. If we consider a trading pair like GBP/USD as an example and take these suppositions:

The standard lot is 100,000 GBP, and the price movement during this time is around 50 pips or 0.005. Meanwhile, the exchange rate is 1.25, and the pip value comes at around 400 USD.

Exotic Currency Pairs

For exotic currency pairs, the calculations are the same. However, the dynamics change overall in real time because of the nature of the associated currencies. For example, if the South African Rand’s pair with the US Dollar is considered (USD/ZAR) and it moves 30 pips in a standard lot (100,000 USD) with the latest price of 14 ZAR/USD, the pip value comes out to be around 21.42 ZAR. The pip value reduces considerably for smaller currency pairs, but their volatility more than makes up for it.

What are Essential Definitions in Forex Trading?

What is the definition of a Pip?

A pip is the smallest value a currency pair can move in either direction. It is normally represented as 1% of 1% or 0.0001 apart from very few exceptions like the USD/JPY trading pair.

What is the definition of a Currency Pair?

A currency pair is the market value of one currency relative to another. EUR/USD, GBP/USD, USD/AED, and USD/SGD are currency pairs.

What is the definition of Leverage?

Leverage is when traders borrow funds from broker platforms to magnify their exposure to the market. They can go 2x, 5x, 10x, or even 100x on their initial investment, aka margin. However, leverage trading is risky and can result in a negative balance for the trader.

What is the definition of a Spread?

A spread is the difference between the buying (ask) and selling (quote) price of in Forex markets. It is essentially the retail currency trader’s margin and it is measured in pips.

What is the definition of Forex Trading?

Forex trading is the activity of the sale/purchase of different national currencies to make a profit. Forex trading is always done in currency pairs and the primary goal is to buy low and sell high.

What is the Historical Development of Pips in Forex Trading?

Understanding the evolution of pips provides insight into their fundamental role in modern forex markets.

Development of Pips in Forex

Pips have been around in the Forex market for many decades. Their origin can be traced back to the Bretton Woods agreement’s aftermath. Before World War II, the Forex market used inconsistent units for conversions. The pip shortly emerged as the standard unit in the market, but it was still a small unit overall. The end of the US Dollar’s Gold peg in 1971 inflated currencies around the world, while the rise of electronic trading in the 80s and 90s gave rise to large-scale Forex trading. Both of these developments reinforced the importance of pips as a standardized yardstick of the currency trade.

What are the Most Frequently Asked Questions About Pips in Forex?

What is the difference between a pip and a pipette?

A pipette is 1/10th the value of a pip. This is required for currency pairs whose price movement goes beyond the confines of a pip.

How do pips affect my trading profits and losses?

Pips can be used to calculate trading profits and losses. You take the change in the currency pair measured in pips and multiply it by the lot size. That is your profit/loss depending on the situation.

Can pip values change?

Yes, pip values are dynamic, and they can change based on lot size, pips, and the exchange pair’s value.

Why are pips important when choosing forex brokers?

Pips represent the basic value of change in a currency pair. They can be used to calculate profits and offset any risks involved.

How do leverage and pips interact in forex trading?

Traders use leverage to magnify their exposure to the market. They can use leverage lucratively even if the currency is moving slowly in lower amounts of pips like major currencies do.

Conclusion: Is Understanding Pips Crucial for Forex Trading?

Understanding pips is fundamental for anyone involved in forex trading, impacting decisions on trade size and risk management. Pips are the building blocks of the Forex market and are relative in nature. These calculations are extremely important as the Forex market, just like other markets, is extremely volatile. Pip calculations can help you maximize profits and minimize the risks involved. It is important to understand them well enough, as mistakes can result in huge losses.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.