Mutual funds are entities that pool money from multiple investors to invest it in securities including stocks, bonds currencies and others. Fund managers actively manage the portfolio to meet certain investment goals of their clients, meaning they balance the risk exposure based on the expected returns.

Investing in mutual funds is gaining in popularity in UAE as it offers great opportunities to achieve steady financial gains and passive income. With the wide range of available mutual funds, it can be hard for investors to find the ideal option for their financial goals.

This guide assesses 32 mutual funds available in UAE. To help potential investors find the ideal option for their financial goals, mutual funds are listed, reviewed and compared below considering performance, risk profile, fees and underlying index.

Top Performing Mutual Funds in UAE

- Shelton NASDAQ-100 Index Direct (NASDX)

- Voya Russell Large Cap Growth Index Fund (IRLNX)

- Fidelity NASDAQ Composite Index (FNCMX)

- Voya Russell Large Cap Index Port I (IILRX)

- Fidelity 500 Index Fund (FXAIX)

The highest ranked international funds available in UAE are reviewed in more detail below.

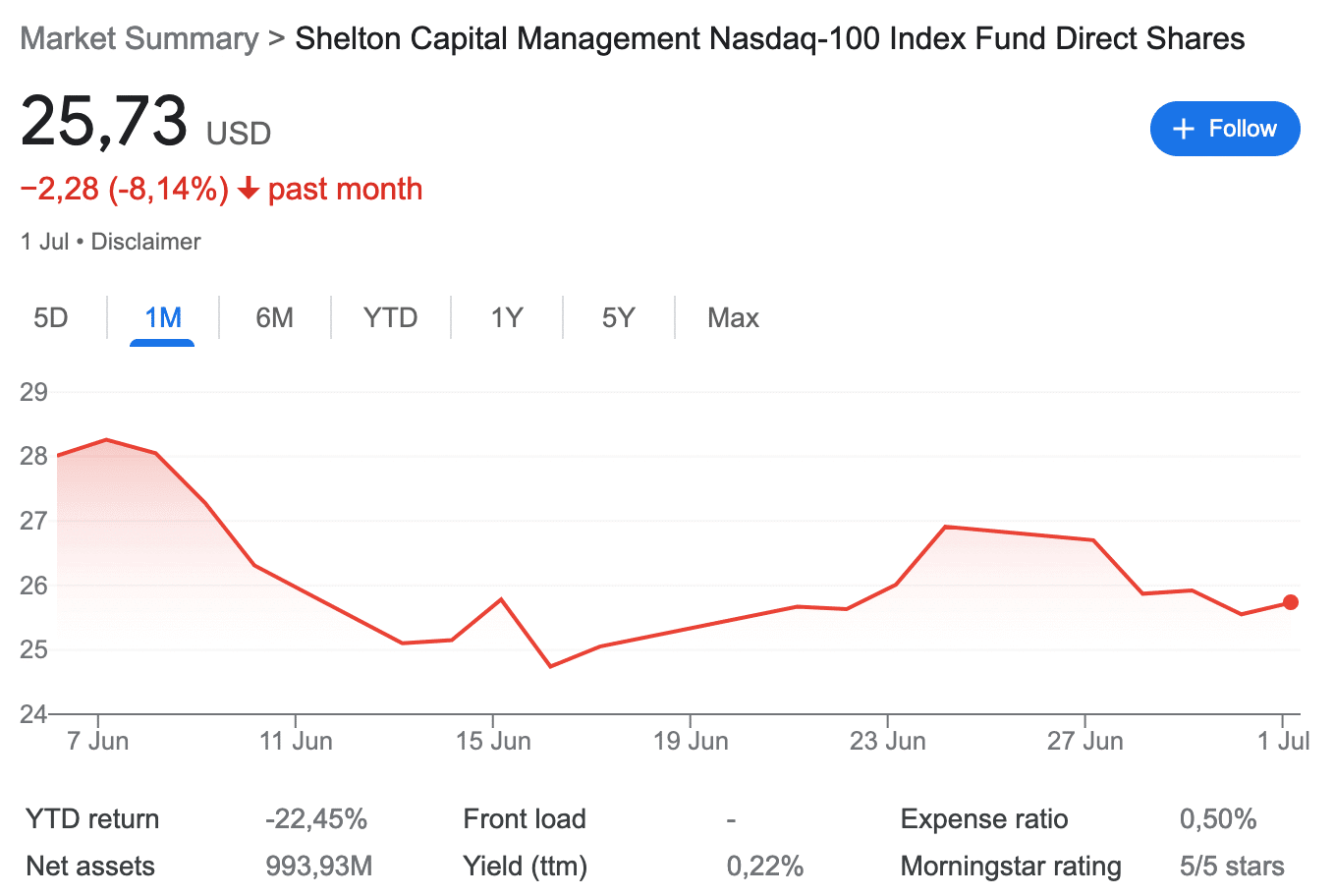

1. Shelton NASDAQ-100 Index Direct (NASDX)

The Shelton Nasdaq-100 Index Direct fund tracks the performance of non financial-primarily tech companies in the Nasdaq 100 Index. Over the last decade, this fund stands out with its strong performance, which started back in 2000.

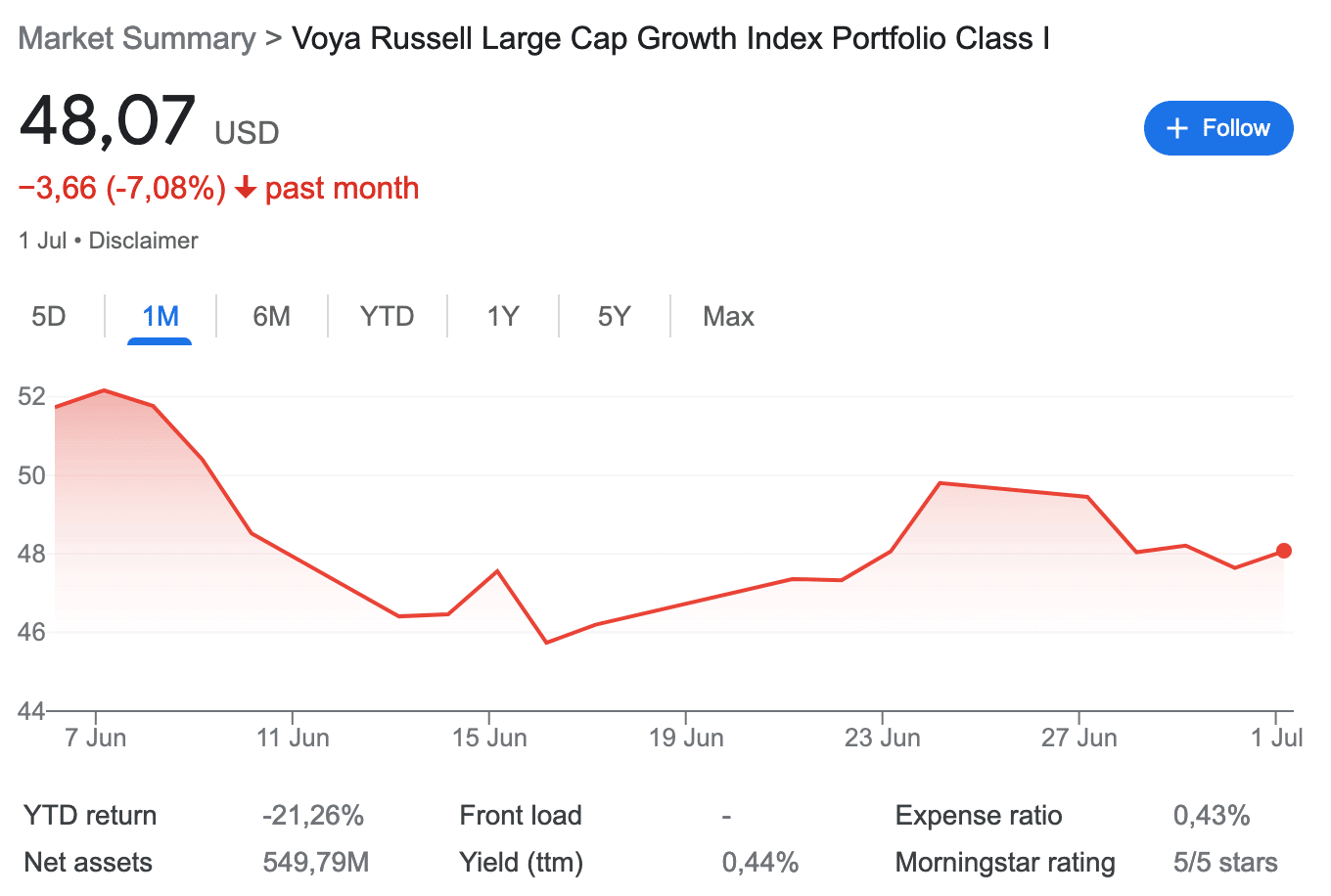

2. Voya Russell Large Cap Growth Index Fund (IRLNX)

IRLNX invests at least 80% of its net assets in the equity of companies, as well as convertible securities. It tracks the performance of large US-traded companies

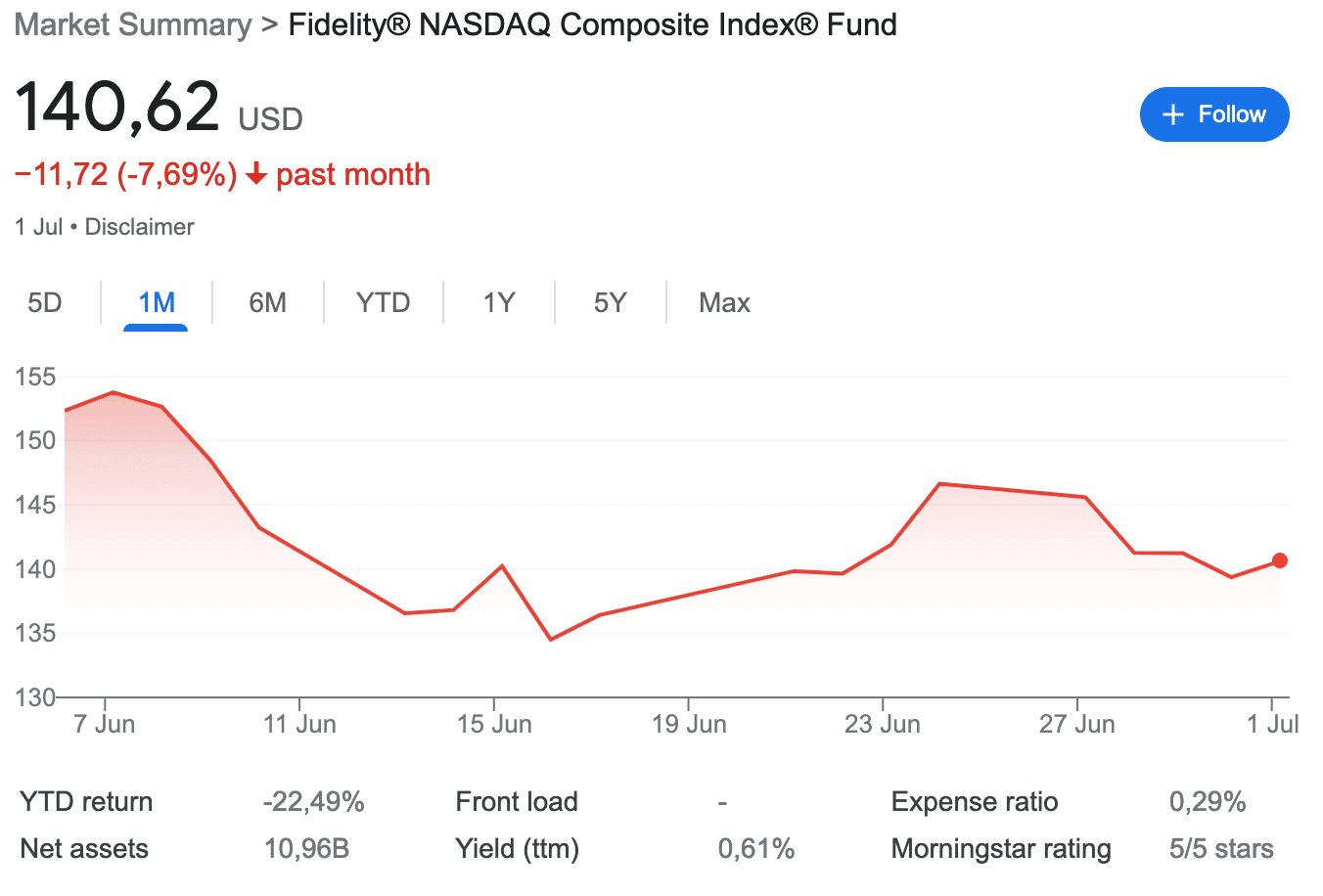

3. Fidelity NASDAQ Composite Index (FNCMX)

FNCMX invests at least 80% of its assets in common stocks included in the NASDAQ index. The advisors use statistical sampling techniques to create a portfolio that represents the entire index. The fund lends securities to earn income.

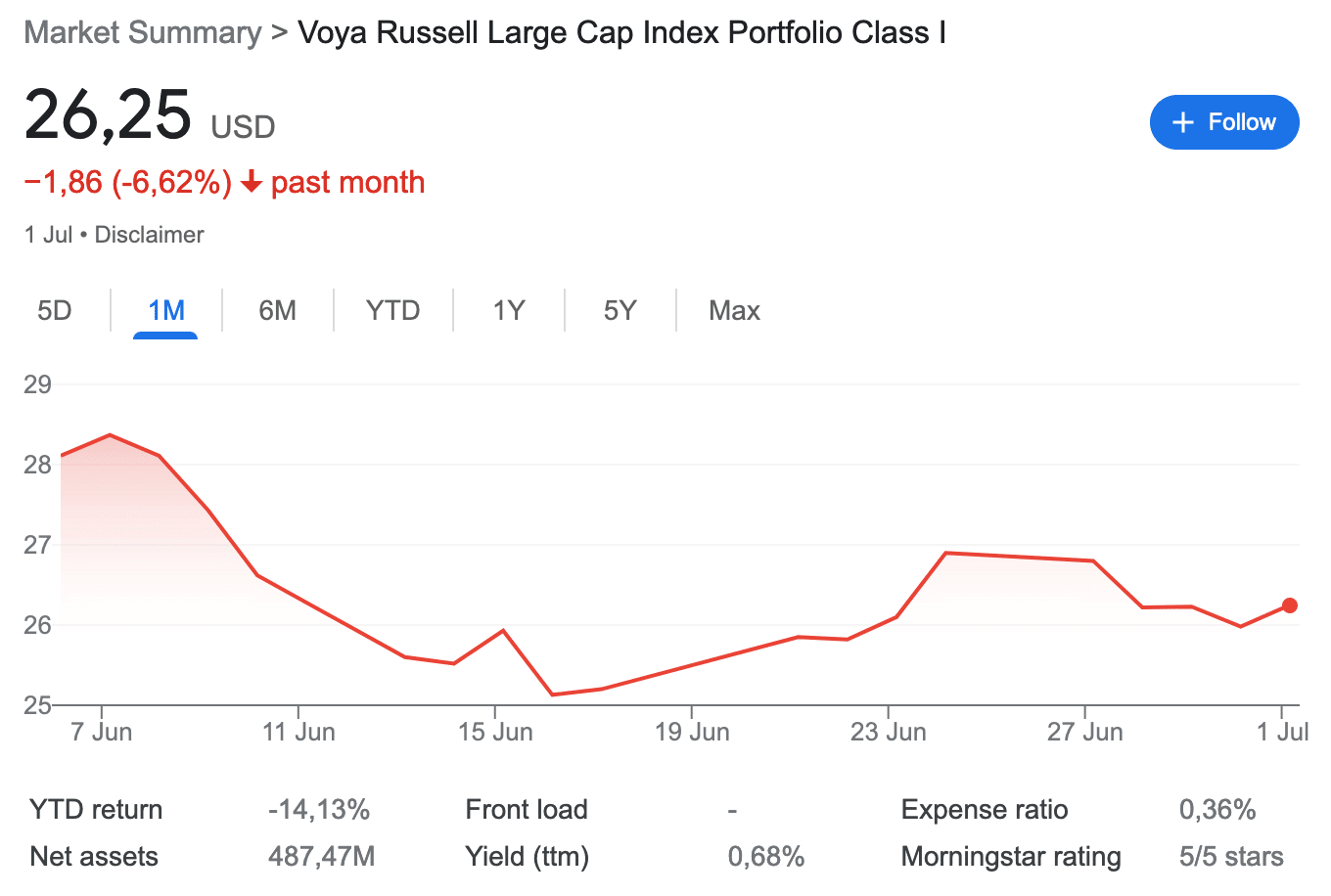

4. Voya Russell Large Cap Index Port I (IILRX)

The fund has a similar investment portfolio as the Voya Russell Composite Index. The main difference is that fund is more focused on the companies with higher value (not with higher growth potential as IRLNX)

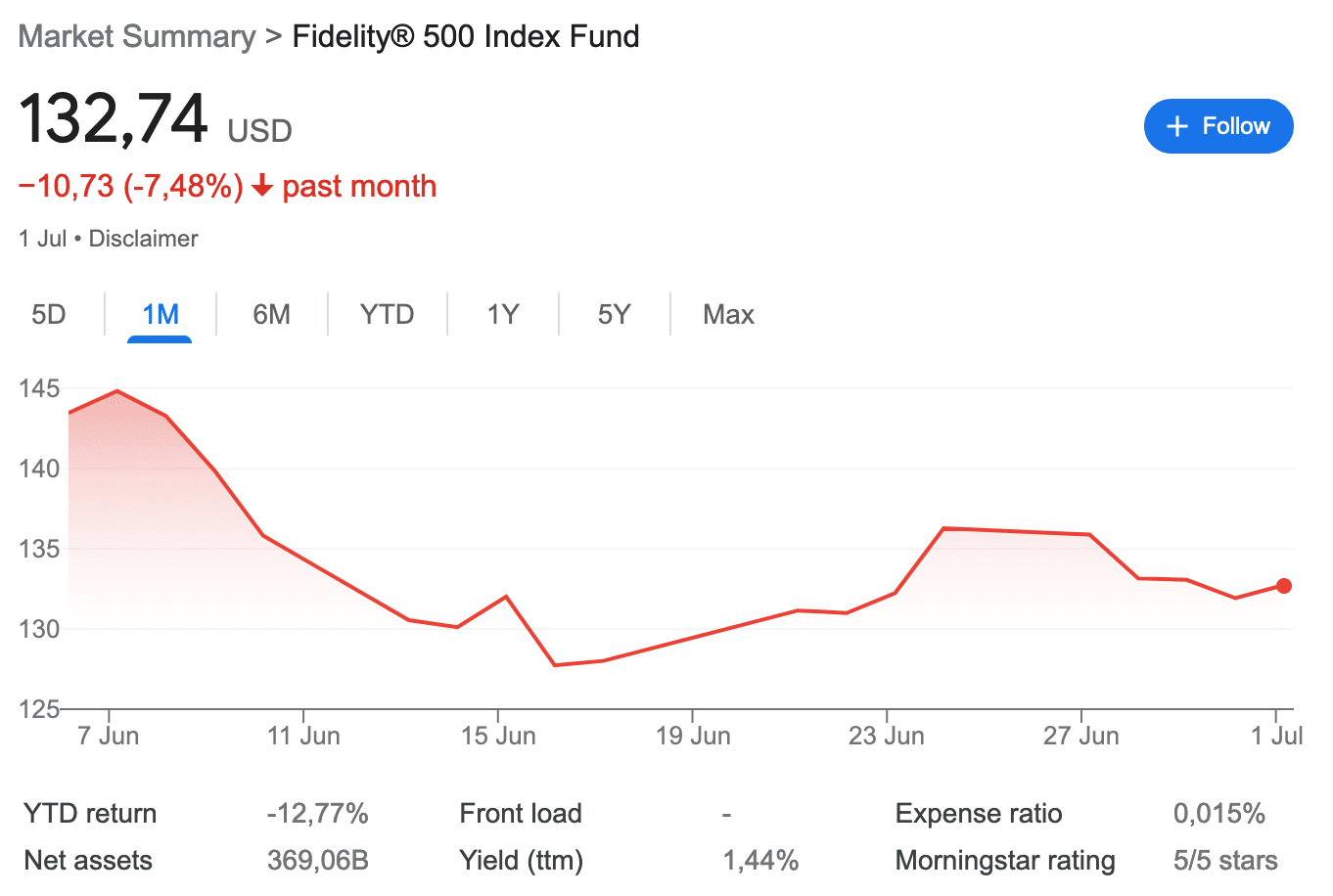

5. Fidelity 500 Index Fund (FXAIX)

The Fidelity 500 Index Fund tracks the S&P 500 index. It is one of the main benchmarks for U.S. stocks. The fund provides returns that are like the performance of the S&P 500. As of May 18, 2022, the fund has assets totaling almost $366.26 billion invested in 509 different holdings

How To Find The Ideal Mutual Funds in UAE?

Criteria to consider to select the optimal mutual fund in UAE are listed below.

- Fund are available to residents of UAE

- 5 star rating according to MorningStar

- MaxFunds rating above 90 points (out of 100)

- No sales load (commission)

- Expense ratio is below 0.60%

- Minimum investment is below $5000

- We measure funds according to 5year annualized performance

- Best Funds Categories

If you are new to investing, we recommend checking this article on how to invest in mutuals first.

Top Mutual Funds Compared

The top mutual funds are compared in the table below considering: expense ratio, max rating, Morningstar rating, returns in different time frames, and minimum investment.

| Mutual Funds | Ticker | MAX Rating | 1y | 3y | 5y | 10y | Expense Ratio | Min Invest. | Type | Category | Morning Star |

| Shelton NASDAQ-100 Index Direct | NASDX | 98 | -7,4 | 21,7 | 17,2 | 18,2 | 0,51 | 1000 | No Load | Large Growth | 5 |

| Voya Russell Large Cap Growth Index Fund | IRLNX | 100 | -3,7 | 19,9 | 16,9 | 16,5 | 0,43 | 0 | No Load | Large Growth | 5 |

| Fidelity NASDAQ Composite Index | FNCMX | 95 | -11,4 | 18,4 | 15,2 | 16,7 | 0,29 | 0 | No Load | Large Growth | 5 |

| Voya Russell Large Cap Index Port I | IILRX | 91 | -1,5 | 16,8 | 13,7 | 14,4 | 0,36 | 0 | No Load | Blend | 5 |

| Fidelity 500 Index Fund | FXAIX | 98 | 0,3 | 16,13 | 13,4 | 14,4 | 0,02 | 0 | No Load | Blend | 5 |

| Schwab Fundamental U.S. Large Company Index Fund | SFLNX | 97 | 4,2 | 18,4 | 13,4 | 14,1 | 0,25 | 0 | No Load | Large Value | 5 |

| Vanguard Growth & Income Inv | VQNPX | 93 | 0,8 | 16,8 | 13,4 | 14,4 | 0,31 | 3000 | No Load | Blend | 5 |

| Vanguard Equity Income Fund | VEIPX | 93 | 8,4 | 14,8 | 11,5 | 13 | 0,28 | 3000 | No Load | Large Value | 5 |

| Vanguard Value Index Fund | VVIAX | 91 | 5,4 | 14,3 | 11,4 | 13,2 | 0,05 | 3000 | No Load | Large Value | 5 |

| Fidelity Emerging Market Fund | FEMKX | 87 | -23,3 | 8,3 | 7,2 | 7,1 | 0,88 | 0 | No Load | Emg. Markets | 5 |

| DSP BlackRock Global Allocation Fund | DSPMX | 87 | -12,29 | 7,61 | 6,47 | 5,16 | 2,1 | 0 | No Load | Blend | 5 |

| Vanguard Dividend Growth Inv | VDIGX | 97 | 5,8 | 14,6 | 13,5 | 13,7 | 0,27 | 3000 | No Load | Blend | 4 |

| DFA US Large Company I | DFUSX | 99 | -0,4 | 16,4 | 13,3 | 14,3 | 0,08 | 0 | No Load | Blend | 4 |

| Northern Stock Index | NOSIX | 98 | -0,4 | 16,3 | 13,3 | 14,3 | 0,1 | 2500 | No Load | Blend | 4 |

| T. Rowe Price Equity Index 500 | PREIX | 95 | -0,5 | 16,2 | 13,2 | 14,1 | 0,16 | 2500 | No Load | Blend | 4 |

| PIMCO Commodity Real Ret Strat Instl | PCRIX | 61 | 43,1 | 23,6 | 13,1 | 1,5 | 0,73 | 1000 | No Load | Nat. Resources | 4 |

| T. Rowe Price Dividend Growth | PRDGX | 85 | 1,5 | 14,5 | 13 | 14 | 0,62 | 2500 | No Load | Blend | 4 |

| Fundsmith Equity | FEDX | 86 | 0,19 | 5,97 | 9,49 | 16,02 | 0,94 | 100 | No Load | Blend | 4 |

| Fidelity Global Dividend Fund | FGDF | 91 | 2,6 | 5,26 | 6,17 | 11,4 | 0,93 | 0 | No Load | Blend | 4 |

How to Invest In Mutual Funds in UAE?

There are two different ways to invest in funds from the UAE. You can invest using a brokerage account, which is a more hands on approach and requires some prior experience. Or you use a UAE local investment company that operated as a middleman and handles the investment on your behalf. Although the second option relates to higher fees, it is a choice to consider for absolute beginners, who need some handholding on their first steps.

1. Investing in International Mutual Funds Using a Brokerage Account

You can invest in international funds on your own via a mutual fund broker and platform. While this is a great option for casual traders, it might be to complex for most beginners. If you are new to investing you should start with contacting a financial advisor first and get your risk profile and investment goals checked by a professional.

If you are investing on your own, you can get a better idea of the best performing international funds with a minimum investment below $3000 below: Shelton NASDAQ-100 Index Direct, Voya Russell Large Cap Growth Index Fund, Fidelity NASDAQ Composite Index, Voya Russell Large Cap Index Port I and Fidelity 500 Index Fund.

2. Investing in Local UAE Mutual Funds Through an Investment Bank (Company)

You can invest in local UAE mutual funds via local investment companies that specialize in investing in the MENA and GCC regions. Compared to the self directed approach using a brokerage account, these investment firms offer Islamic and Sharia-compliant funds and additional financial advisory services for beginners. If you are new to investing and have no prior experience you should consider using services of an investment company.

Regardless of the knowledge level and investment type you want to use, below are 5 of the best performing mutual funds over the last 5 years.

Conclusion

Investing in mutual funds is a great choice for investors to diversify their investment portfolio, get their investment managed by professionals and reach better liquidity. Our guide is a great starting point for you to make an informed decision about which fund to choose and how to get started.

Remember that it’s always a good idea to do your own research and to keep an open eye on funds and their managers.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.