Page Summary

In this guide, we will be discussing the best swap-free forex brokers for Muslim traders from the United Arab Emirates. Swap-free forex brokers offer trading accounts that follow Sharia law by not charging riba or interest rates on overnight fees. If you are a Muslim trader you might also want to check our list of the best islamic forex brokers.

Best Swap Free Forex Brokers for UAE Traders

- eToro – Best Overall Swap-Free Forex Broker

- AVAtrade – Best Swap-Free Forex Broker with Multiple Trading Platforms

- Plus500 – Best Swap-Free Forex Broker Trading App

| RANK | BROKER | GENERAL | PLATFORM SCORE | BEST FOR | WEBSITE |

|---|---|---|---|---|---|

| #1 | eToro | Transparent fee policy | 4,9/5 | Best trading platform | Official website |

| #2 | AVAtrade | Offers new traders educational material and a demo account | 4,9/5 | Best Swap-Free Forex Broker with Multiple Trading Platforms | Official website |

| #3 | Plus500 | Beginner-friendly | 3,7/5 | Best Swap-Free Forex Broker Trading App | Official website |

Below we will review each of the best swap-free forex brokers for UAE traders.

1. eToro – The Best Overall Swap-Free Forex Broker in the UAE

Min Deposit: $100

Fees: 4.8

Assets available: 4.8

Total Fees:

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro is a reputable global brand and industry leading broker for copy trading. Their robust and cutting edge copy trading platform and social trading features allow users to copy trades and portfolios from professional traders and investors.

As a CFD multi asset broker, eToro allows users to trade on over 3075 different symbols including stocks, forex, cryptos, indices and commodities. Trading spreads are wide, deposits are free and account minimum is low. There are conversion and inactivity fees. eToro provides a comprehensive list of technical tools, charts, and newsfeeds. Their customer support is available through email and live chat in Arabic and English.

eToro is a well established market maker broker with a clean history record, regulated by top tier regulators.

Pros

- Commissionless stocks, indices, forex, cryptocurrencies, and ETF trading.

- Social trading platform

- Regulated by DFSA, CySec, and FCA

Cons

- No advanced technical analysis tools

- Small selection of cryptocurrencies and minor and exotic forex pairs

- Have to contact support to enable swap-free trading

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

2. AVAtrade – The Best Swap-Free Forex Broker with Multiple Trading Platforms

AVAtrade is a forex broker that offers swap-free accounts for Muslim traders on multiple trading platforms. On AvaTrade you can trade forex, CFDs, and cryptocurrencies commission-less on MetaTrader 4, MetaTrader 5, and proprietary trading platforms. AvaTrade offers new traders educational material and a demo account. With this demo account, you can practice trading with $100,000 virtual funds.

For professional traders, AvaTrade has technical analysis tools available. AvaTrade is regulated by the DFSA, CySEC, and ASIC. To create an Islamic account at Avatrade, create an AvaTrade account, deposit funds into it, and then contact customer support about it. It takes 1-2 days to switch your trading account to a swap-free Islamic account.

Pros

- Multiple trading platforms available (MT4, MT5, AvaTradeGO, and AvaSocial)

- Demo account available

- Regulated by DFSA, CySec, and FCA

Cons

- Charges high inactivity fees

71% of retail CFD accounts lose money

3. Plus500 – The Best Swap-Free Forex Broker Trading App for UAE Traders

Plus500 is the forex broker that offers the best swap-free trading app for UAE traders. The Plus500 trading app is beginner-friendly and you can trade over 2,000 financial instruments with it. It is possible to open a demo account to practice trading. You can trade CFDs on cryptos, shares, ETFs, commodities, and forex pairs. To create a swap-free Islamic trading account at Plus500, contact customer support to turn your regular Plus500 account into one.

Pros

- Over 2,000 tradable assets

- Demo account available

Cons

- Only offers CFD trading

CFD Service. Regulated by the DFSA. Trading carries risk.

Swap-Free Forex Brokers for UAE Trader Fees

Broker Comparison

| GBP/USD Spread | EUR/USD Spread | Deposit/Withdrawal fees | Inactivity Fees | |

| eToro | 1.4 pips | 1.0 pips | $5 for withdrawals | $10/month after 1 year |

| AvaTrade | 1.6 pips | 0.9 pips | N/A | $50 after 3 months and $100 after a year |

| Plus500 | 1.3 pips | 0.8 pips | N/A | $10/month after 3 months |

All brokers mentioned in this guide offer 30:1 as maximum leverage for retail Islamic trading accounts.

What is a Forex Swap?

A forex swap is a transaction between two parties where two different currencies are traded for each other. The parties loan this money and they will repay at a specified date and rate. The traders do this to hedge their exposure to exchange rates. There is interest involved with forex swaps. Because Sharia law states that one may not earn interest, Muslim traders need a swap-free forex trading account. Brokers earn a fixed commission on swap-free trading clients, which does not go against Sharia law.

Things to Consider When Trading on Swap-Free Forex Accounts

It is good to know which brokers offer swap-free forex accounts, how leveraged forex trading works, and what fixed rates you will have to pay your broker for trading with a swap-free account. With leveraged trading, you borrow money from your broker to open larger positions than you would normally be able to. This increases both profit potential and risk. You can find out the fixed rates your broker charges by visiting their website and navigating to the ‘fees’ pages or by contacting their support.

Getting Started with Swap-Free Trading at eToro

You get started trading swap-free at eToro by going to their website, creating a trading account, verifying your identity, depositing funds, and contacting customer support to change your account to a swap-free one.

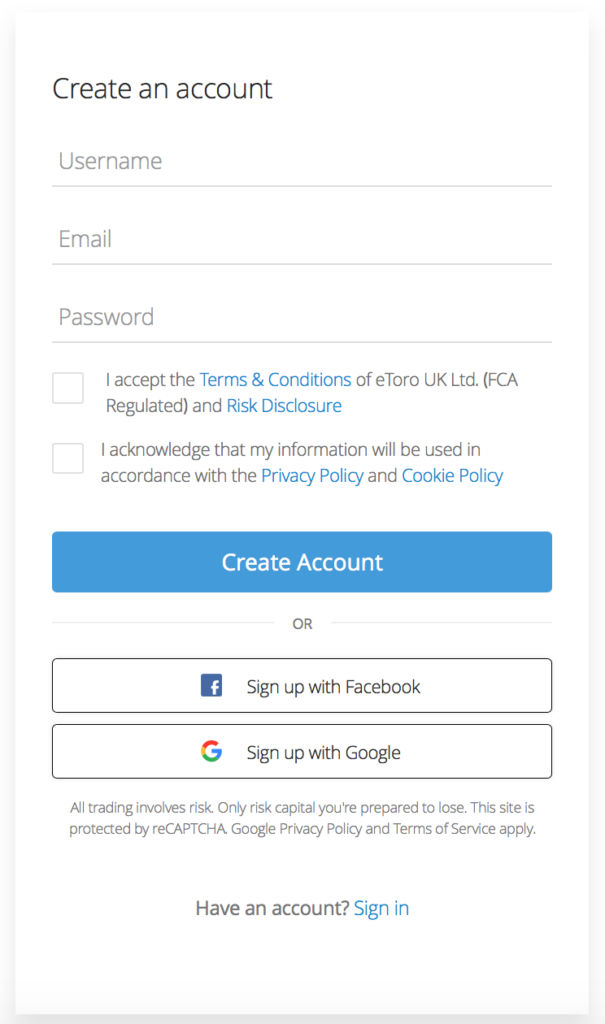

- Go to the eToro website, click ‘Sign Up’, and fill in your personal details. Alternatively, log in with your Google or Facebook account.

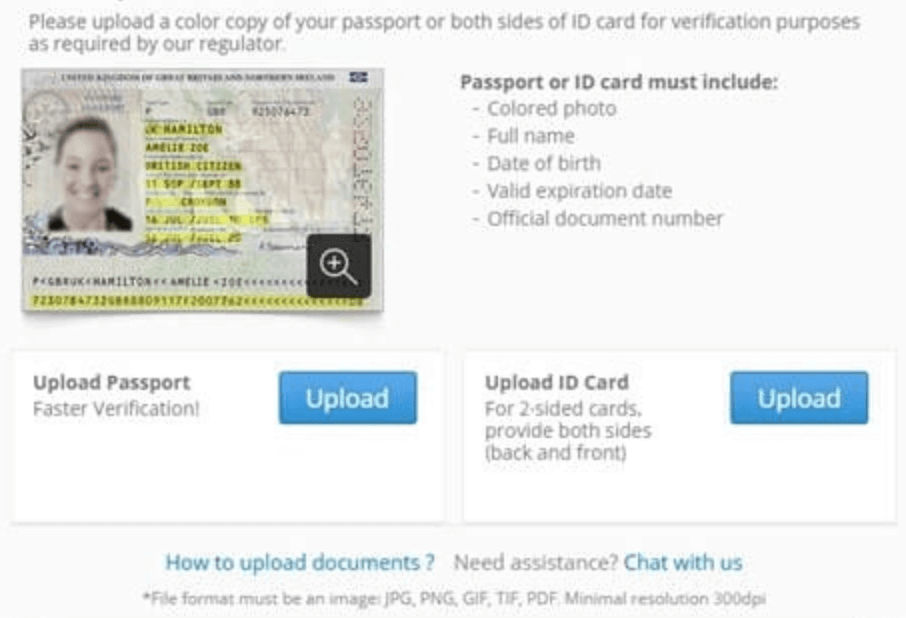

- Upload a photo of your driver’s license, passport, or national ID card to verify your identity.

- Deposit funds into your trading account by credit card, bank transfer, PayPal, Neteller, or Skrill (minimum $1,000).

- Contact customer support to change your account to a swap-free one. Within 1-2 days your account will be swap-free and you can trade with Sharia law in mind.

Summary

Based on our review, we consider eToro as the best swap free trading account for UAE traders, because of their zero commission stock trading, competitive fees, and Sharia law compliant social trading features.

FAQ

What does a swap mean in trading?

A swap is a fee a trader must pay a broker to keep a forex position open for longer than a trading day.

How much money do I need to have to open a swap-free forex account?

This depends on which broker you want to trade with. You can open a swap-free trading account with eToro for a minimum of $1,000.

What are the best swap-free forex brokers?

The best swap-free forex brokers are eToro, AvaTrade, and Plus500.

Do I need to be Muslim to open a swap-free trading account?

No, swap-free trading accounts are available for non-Islamic traders as well.

Is it possible to trade cryptocurrencies with a swap-free account?

Yes, you can trade cryptocurrencies with a swap-free account at the brokers mentioned in this guide.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.