Page Summary

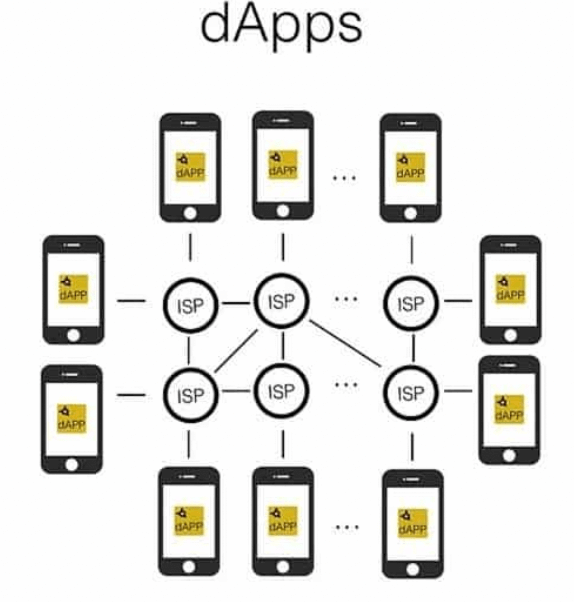

A decentralized application is an application that operates in an autonomous way. It does this by the use of smart contracts on a blockchain. People call decentralized applications Dapps, dApps, Dapps, and dapps. Noone owns a Dapp. Rather DApps distribute tokens that represent ownership in the DApp. Some examples of DApps are Bitcoin, Augur, Blockstack, Steem, and Uniswap.

When is an application decentralized?

An application is decentralized when its open-source and when it runs autonomously without anyone controlling the issuance of its tokens. A blockchain should record all the data and transactions of a Dapp.

Types of decentralized applications

There are three types of DApps: Type 1 DApps run on their own blockchain, Type 2 Dapps are protocols that operate on a blockchain of a Type 1 DApp, and Type 3 DApps are protocols that operate using the protocols of a Type 2 DApp.

Smart Contracts

Developers use smart contracts to keep data on the blockchain. A DApp uses smart contracts to function. Some DApps use a single smart contract, whilst others use multiple.

How does a decentralized application work?

A DApp works by using consensus mechanisms. The two most common consensus mechanisms are proof-of-work and proof-of-stake. Proof-of-work Dapps rely on a process called mining. Proof-of-stake DApps work with validators. Validators secure the blockchain by owning a certain percentage of the application.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.