Page Summary

Should You Be Trading Gold Forex?

If you’re looking for a new investment opportunity, maybe it’s time to start thinking about trading in gold. For years, this precious substance has been valued in cultures worldwide for its malleability and luxurious appeal. Today’s savvy traders continue to appreciate gold as one of the best safe-haven assets for their portfolio. Unlike currency, gold can weather any amount of market turbulence, and often retains its value no matter what. Traders use the safety of gold to hedge themselves against inflation and maintain a range of diversity in their trading campaigns.

What Influences Gold Prices?

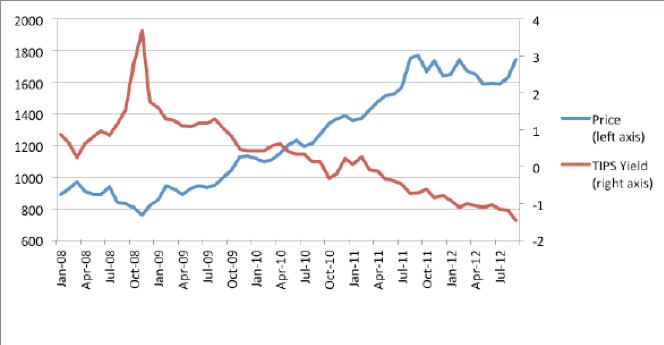

There are a number of things that might influence the price of gold. One of the most common is inflation rates. One of the most reliable insights into gold’s changing price has often been the level of current interest rates. When interest rates are low, alternative investments like bonds or cash will provide a negative or low return. This pushes investors to look for new ways of protecting their wealth. However, when interest rates are high, strong returns occur with bonds and cash, and the appeal of holding gold begins to dwindle. One way to look at real interest rates in the US economy is to examine the yield on TIPS, or treasury-inflation-protected securities.

Speaking of the US, the dollar can also impact the value of gold. One of the biggest focus points for gold traders is the connection between the U.S. dollar and gold. Because it’s typical for gold to be priced in US dollars, it makes sense that the two assets would be correlated. However, this simplistic view doesn’t always hold. Financial stress periods can cause the US dollar to rise while gold rapidly spikes. This sometimes happens when investors invest in both dollars and gold at once.

Strategies for Trading Gold

As with most investment campaigns, there’s rarely a one-size-fits-all way of trading gold. Most traders from other markets have found that technical trading strategies employed on other instruments are adapted easily to the gold market, thanks to its ability to form sustainable trends.

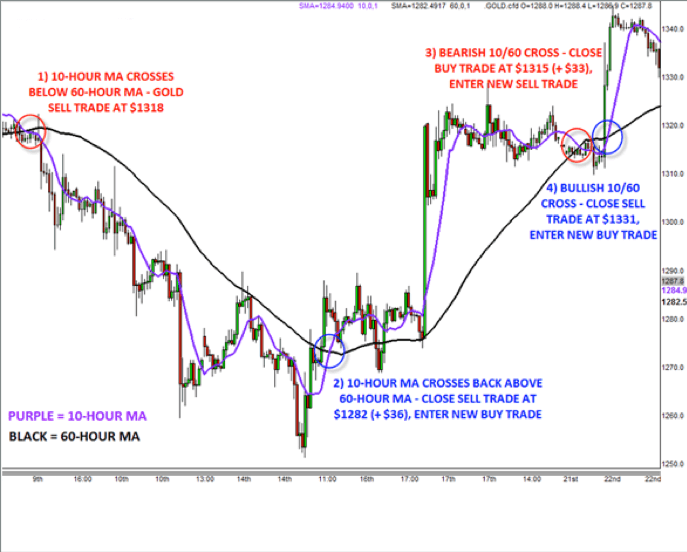

For traders in search of a short-term solution, one option to reap profits from trends in the gold market is to use a moving crossover strategy. In these campaigns, traders look to purchase gold if short-term moving averages move over a long-term moving average. They also sell the asset when the short-term moving average crosses below the long-term average. Solutions like these allow traders to maintain the middle portion of trends, though there’s no promise that they’ll achieve consistent future performance.

By examining the graph above, you can see that the short-term moving average of 10 hours moves underneath the 60-period long-term average at the first point. This means that traders would enter a sell trade as bearish issues might be forming in the market. During point 2, the initial trade has closed for a gain, and a new deal is being triggered trends shift once again. After consolidation, gold prices rally, and the deal is sealed on a bearish average moving into point 3. Of course, like any trade campaign, this methodology can provide both positive and negative trades.

For trades intended to support the growth of wealth over a longer term, investors may decide to focus more of their energy on the fundamental issues that drive gold price, such as real interest rate levels. The following chart highlights the connection between TIPs and gold prices in the US. The correlation is clear, but gold’s rally accelerates as real yields drop to underneath 1% during the early 2009 region. Long-term looks at the relationship also find that gold prices fell in the 1990S, a time when real yields went over the 1% threshold.

Examining details like these may push long-term traders to consider purchasing opportunities when real yields drop to lower than 1%. This is a level that’s typically quite beneficial to gold prices. However, you may want to sell if the yield rates accelerate to over 2%.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.