Page Summary

This article guide users through the process of buying cryptocurrencies in UAE.

Bitcoin (BTC) is the leading cryptocurrency on the market, with a market cap of $1.1 trillion. It has been available in the UAE since 2014, and its popularity increases daily. The Securities and Commodities Authority (SCA) monitors Bitcoin’s activity and regulation in the UAE. Buying, selling and holding Bitcoin in the UAE is legal.

This article discusses how to buy Bitcoin in UAE step by step through a crypto exchange or broker.

How To Buy Bitcoin In UAE – Quick Steps

New users need to follow the steps below to learn how to buy Bitcoin in the UAE through a crypto exchange or broker.

- Step 1: Open a Trading Account at eToro – We recommend opening a trading account with eToro, who offers crypto brokerage and exchange services for investors looking to buy Bitcoin in UAE. Account opening is fast, easy and starts at $100 minimum deposit.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 mins to learn more

- Step 2: Upload Your ID – Upload a copy of your government issued ID and proof of address in order to comply with eToro KYC (know your customer) requirements.

- Step 3: Deposit Money – The minimum deposit to open an account at eToro for UAE resident is $100. Users can choose between credit card, debit card and bank transfer options.

- Step 4: Buy Bitcoin in UAE – To buy Bitcoin you will first need to find it in the search box, click on the trade button to open an order file, enter the requested amount and finalise the purchase by clicking on “Open Trade”.

- Step 5: Store Bitcoin in your e-wallet – After you purchase Bitcoin we recommend to store it in a e-wallet. It ensures that only you have access and control over your funds with a private key.

Where to Buy Bitcoin in UAE

| RANK | BROKER | SCORE | BEST FOR | WEBSITE |

| #1 | eToro | 4.9 / 5 | Best Overall Broker To Buy Bitcoin In UAE | Official website |

| #2 | AVAtrade | 4.8 / 5 | Best Broker to Buy Bitcoin as CFD’s | Official website |

| #3 | IQ Option | 4.7 / 5 | Great Place to Buy Bitcoin in UAE as a Beginner | Official website |

| #4 | Saxo Bank | 4.9 / 5 | Best Broker To Buy Bitcoin as ETF’s and ETN’s | Official website |

Below are To buy Bitcoin in UAE you need to have a verified trading account with one of the crypto exchanges (Binance, Coinbase, Kraken) or a crypto brokerage account at one of the brokers offering cryptocurrency trading (eToro).

As there are many different players on the market we have highlighted the best four exchanges and brokers below.

1. eToro Review UAE 2025 – Best Overall Broker To Buy Bitcoin In UAE

Min Deposit: $100

Fees: 4.2

Assets available: 4.0

Total Fees: Low

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 min to learn more

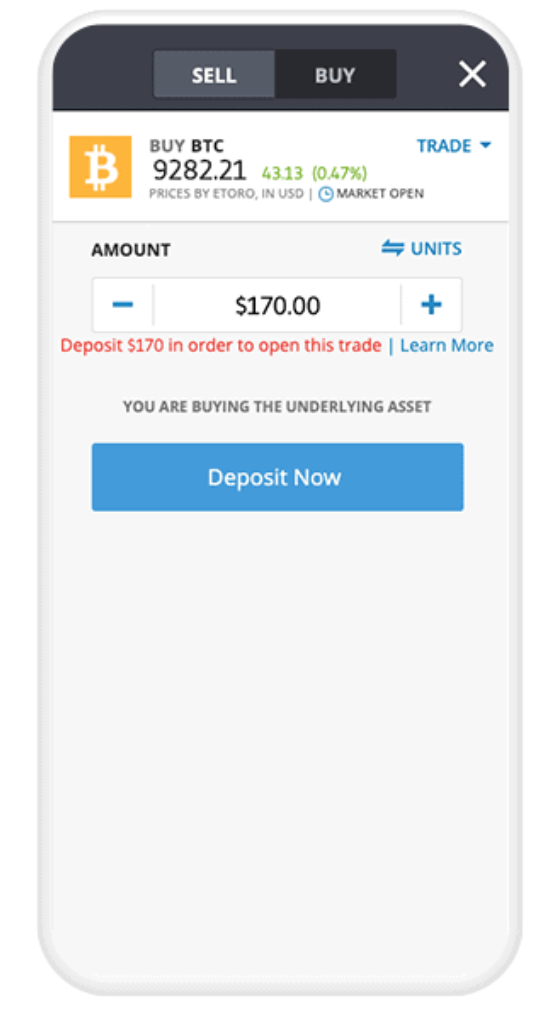

You can buy Bitcoin in UAE with eToro for as little as $10 minimum trade requirement. AED deposits will cost you 0.5% on all supported payments including Paypal and you will need to deposit a minimum amount of $100 to open an account. A fee of 1% is added to the spread when buying or selling crypto assets on eToro. The fee is included in the price shown when users open or close a position.

You can open a trading account at eToro online or via the iOS and Android mobile app – both options offer a great user experience. Once your account is up and running, you will be able to buy Bitcoin instantly with your UAE credit or debit card.

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 min to learn more

2. AvaTrade Review UAE 2025 – Best Broker to Buy Bitcoin as CFD’s

AVAtrade is the best crypto broker to buy Bitcoin through CFD’s. They provide several online trading apps and an advanced copy trading features for cryptocurrency trading. Deposits and withdrawals are free of charge. The minimum deposit is $100. There are fees for inactivity and overnight financing.

3. OKX – Great Place to Buy Bitcoin in UAE as a Beginner

OKX is a Malta-based cryptocurrency exchange established as early as 2014 that offers its users crypto spot, futures, and derivatives trading. OKX also has a built-in NFT Marketplace with access to the biggest NFT provider including: CryptoPunks, Otherdeed for Otherside and ENS.

4. Saxo Bank Review UAE 2025 – Best Broker To Buy Bitcoin as ETF’s and ETN’s

Saxo Bank is the best online broker to buy cryptos in United Arab Emirates as ETF’s or ETN’s at a fixed fee of 0.10%. Users will be able to trade on the award winning app SaxoTraderGO which offers 9 leveraged Crypto FX pairs and over than 60 exchange traded products. The minimum deposit is $2.000, what is above industry average

Ways To Buy Bitcoin in UAE

The crypto technology is developing lightning fast and so are ways how to buy Bitcoin in the UAE. This section reveals different payment methods users can use to buy Bitcoin.

01. Buy Bitcoin With Cash or Cash Deposit

UAE citizens can easily buy Bitcoin for cash by using a Bitcoin ATM. Once you insert cash into the machine and use it to buy Bitcoin, the purchase will be directly stored in your e-wallet. Buying Bitcoin for cash comes at an extra cost of 6-12%, but gets you the cryptocurrency quick, easy and fully discrete.

02. Buy Bitcoin With Credit or Debit Card

Credit and debit cards are the fastest and easiest ways to buy Bitcoin in UAE when used with eToro. In terms of pricing, eToro charges 0.5% on all credit and debit card deposits in AED. A fee of 1% is added to the spread when buying or selling crypto assets on eToro. The fee is included in the price shown when users open or close a position. The minimum required purchase amount is $10.

03. Buy Bitcoin With Paypal

To buy Bitcoin with a UAE Paypal account you need to open an account, link it with preferred payment options, click on the “crypto” button at the top and choose the amount of Bitcoin you want to purchase. Paypall allows you to buy Bitcoin for as low as $1 at a purchase fee of 0.5%

04. Buy Bitcoin Through P2P exchanges

Buying Bitcoin through P2P exchanges is fast and simple. After you set up an account, users request to buy/sell Bitcoin. They check the listings and select the trade partners with whom they wish to transact. P2P exchanges don’t come with the anonymity that other exchanges provide. The advantage of P2P is that users search for the best deal.

Buy Crypto In UAE

You can buy cryptocurrency in UAE the same way you buy Bitcoin. You need to open a trading account with a broker or crypto exchange, deposit money using a debit or credit card, choose the right cryptocurrency and store it on a e-wallet.

The best broker to buy cryptocurrency in UAE is eToro and the best exchange is Coinbase.

How To Buy Bitcoin and Cryptocurrency With eToro?

You can buy cryptocurrency in UAE using eToro at a minimum trade requirement of $10 and a minimum deposit of $100. AED deposits cost 0.5% for all payment methods including credit cards. A fee of 1% is added to the spread when buying or selling crypto assets on eToro. The fee is included in the price shown when users open or close a position.

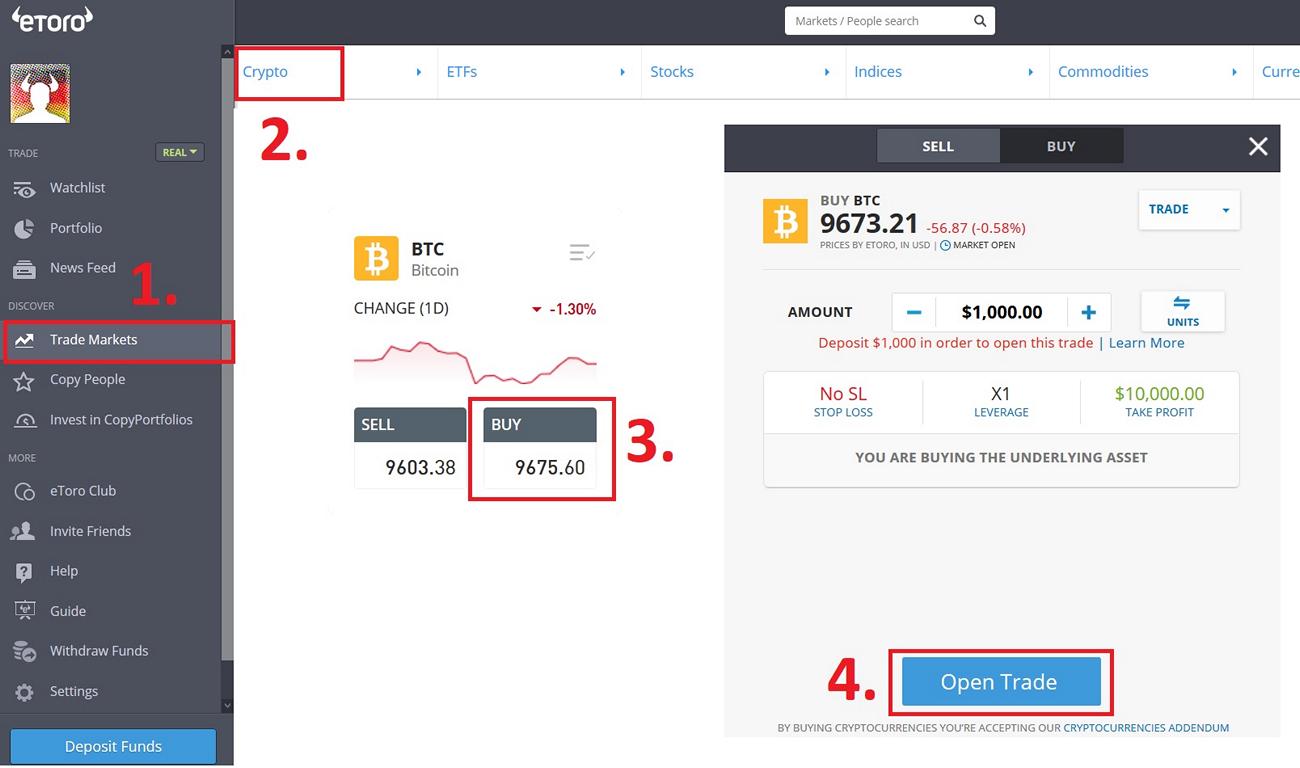

Follow the steps below to learn exactly how to buy Bitcoin in the UAE via eToro:

STEP 1: Go to the eToro official website

Click on link to the eToro crypto section here: https://www.etoro.com/crypto/

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

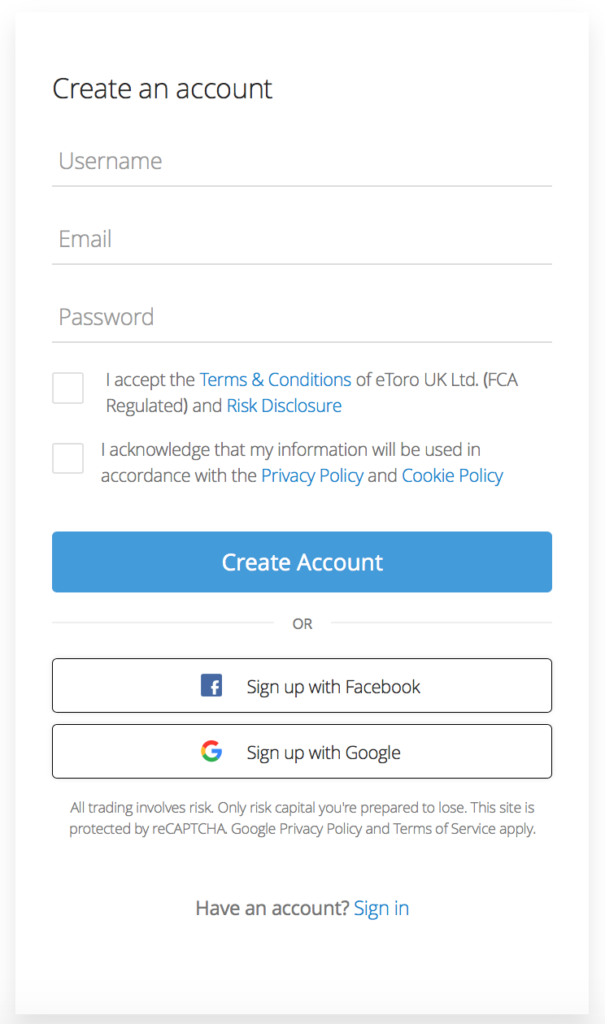

STEP 2: Click on the green “Get Started” Button

STEP 3: Create and Verify Your Account

To buy BTC through eToro you need to sign up, verify your account and make a first time deposit. This will enable you to buy, hold and sell BTC and other cryptocurrencies.

STEP 4: Buy Bitcoin (BTC)

You can buy, hold and sell fractions of Bitcoin. To own BTC you don’t need to buy a full Bitcoin. The same goes for all cryptocurrencies.

Is Bitcoin Legal In UAE?

Based one the publication D.7.3 of the Regulatory Framework for Stored Values and an Electronic Payment System, by the Central Bank of UAE from January 2017, all transactions in “virtual currencies” (encompassing cryptocurrencies in Arabic) are prohibited” and therefore Bitcoin is Illegal in UAE.

Although the UAE regulation recognises Bitcoin as Illegal, the government allows citizens to buy and trade Bitcoin staying in UAE. This means that citizens can buy, sell, and hold BTC, but they are not allowed to buy anything with this currency. People are free to own BTC and any other cryptocurrency, deposit and trade with it on an Exchange and withdraw it to AED.

Cryptocurrencies have no underlying commodity or tangible asset. These coins fall outside financial regulation. If you lose money, the UAE does not offer any financial insurance. eToro, AVAtrade, IQ Option and Pepperstone provide crypto-insurance against theft, hacker attacks, and natural disasters, but not for volatile market movement.

The Regulation of Bitcoin in UAE

Cryptocurrencies in UAE fall under the authority of the Financial Services Regulatory Authority, the Securities and Commodities Authority, and the Dubai Financial Services Agency. The SCA/FRSA oversees the trading of digital coins. The Central Bank in UAE considers crypto trading as highly risky, which is why all parties involved in the transaction must follow strict compliance to the Anti-Money Laundering and Counter-Terrorism Financing Laws of the UAE.

Currently there is no unified regulation on cryptocurrencies in UAE and trading with virtual assets like Bitcoin still remains Illegal. Following the latest statement of The Central Bank of the UAE saying that crypto or virtual assets are not presently accepted or acknowledged as legal tender in the UAE, the only valid currency in this country recognised by the central bank remains the UAE dirham.

While the legality of virtual currencies is still vague, cryptocurrency exchanges like BitOasis have been licensed to operate in the global crypto market. As of now UAE citizens are allowed to buy, sell and hold cryptocurrencies like Bitcoin as investments, but they are not able to buy any physical goods with them.

Why Should You Buy Bitcoin in UAE?

The UAE aim to become a global hub for cryptocurrency and blockchain technology as market capitalization hits $1.4 trillion, up 86 percent year to date. UAE regulators are adopting new legal frameworks and regulations that makes the country open to new crypto and blockchain startups. All of this shows a great opportunity for investors to buy Bitcoin in United Arab Emirates. The following sections will explain this into more details.

- Post Covid Inflation

The world wide inflation rates are going through the roof as a consequence of post Covid stimulation packages implemented by governments and central banks around the world in 2020 and 2021. The crashing stock prices and uncertainty on the global markets make Bitcoin a great option to hedge against rising inflation rates and stalling stock markets. - Low Entry Levels

Users can buy Bitcoin in United Arab Emirates for as little as 2.00 units of their local currency (2 AED) with Coinbase and for as little as $10 minimum trade requirement at eToro. Compared to other markets and investment types this is a really low entry level which enables access to cryptos to almost everyone. - High Returns of Investments

At the time of writing, the price of Bitcoin has again gained 10% over the last two days and pushed back to over $42.000. Gains of 10 and more percent on a daily basis are quite normal for Bitcoin and promise high returns for investors who invest at the right time.

How To Buy Cryptocurrency in UAE – Tutorial

If you want to buy cryptocurrency in UAE right now, the tutorial below will guide you through the process step by step.

As there are many different exchanges on the market we have highlighted few of the best below.

- Step 1: Sign Up at a Cryptocurrency Exchange or Broker – To buy cryptocurrency in UAE users need to open a trading account with a broker like eToro or a cryptocurrency exchange like Binance, Coinbase or Kraken. Account opening is fast and simple and can be completed to 100% online.

- Step 2: Deposit Money – After the trading account verification you will be allowed to deposit money using a direct bank transfer or credit card. Money deposits take up to 3 days to appear on your account.

- Step 3: Buy Cryptocurrency in UAE – After your money is visible on your trading account, you can buy cryptocurrencies the exchange or broker is offering.

- Step 4: Store Cryptocurrency – The safest way to hold cryptocurrency is by storing it on a e-wallet with a private key. This way you keep your purchase safe also if the broker or exchanges is hacked or stops working.

Summary

Buying Bitcoin in UAE is straightforward. Investors must open a trading account with a crypto exchange or broker, deposit money into their account, open a trade and store the purchased Bitcoins.

eToro is the most common broker used by beginners while OKX is the preferred choice by experienced traders.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

FAQ

Should I buy Bitcoin through PayPal?

We do not recommend buying Bitcoin through PayPal because Bitcoin bought on PayPal cannot be transferred out of PayPal in any way. This restriction means that PayPal owns your Bitcoin, not you.

Which is the Simplest Way to Create a Bitcoin Wallet?

To open a Bitcoin wallet you need to:

- Choose an exchange account to buy/sell cryptocurrency;

- Choose a hot wallet if you want to hold small to medium amounts of crypto coins;

- Choose a cold wallet for larger holdings and long-term purposes.

How Much Does it Cost to Trade Bitcoin in UAE?

Costs for trading Bitcoin vary and might become high across various websites and unregulated exchanges. Bitcoin trading fees start from 0.002% and might reach up to 2% of the trade value.

How to Invest In Bitcoin in UAE?

Users can buy Bitcoin in United Arab Emirates as physical Bitcoin through an exchange and get ownership of the underlying asset (BTC). You can also buy Bitcoin as CFD.

Where Can I Find a Bitcoin ATM in Dubai?

At the time of writing there is no Bitcoin ATM in Dubai. There is a Bitcoin teller at this address: Coinsfera Bitcoinshop, Baniyas Square on 14th Road.

Does Coinbase work in Dubai?

Coinbase does not grant access to their platform for UAE customers as of 1.9.2020.

How do I cash out of Bitcoin in UAE and Dubai?

The most common way to cash out BTC is through an exchange or broker who offers a Dirham (AED) trading pair. You can also use LocalBitcoins service to cash out BTC using vouchers, bank transfers and gift cards.

Should I buy physical Bitcoin or use CFDs to trade Bitcoin?

Long-term cryptocurrency traders benefit from purchasing the underlying physical Bitcoin. It is the safest and lowest-cost strategy to invest in Bitcoin. Active traders prefer CFDs, but these come with significant financing charges.

Do I need a broker to buy Bitcoin?

No. But they are very helpful.

Can I Use Cryptocurrency to Buy Property in the UAE?

Based on the latest statement by the UAE Ministry of Economy that every use of cryptocurrencies to buy property is a potential money laundering case, you can not buy property using cryptocurrencies.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.