Page Summary

The best DFSA licensed forex brokers in Dubai are: IQ Option, AVAtrade and Pepperstone. We compared trusted brokers based on: traders score, commodities you can trade, trading platforms, funding methods, minimum deposit and welcome bonus and regulation. Below is a more detailed overview over the best brokers for Dubai residents:

Top 2 Brokers For Forex Trading in Dubai:

Below we list the top 3 brokers for forex trading in Dubai. You can access the full list of best forex brokers in UAE here.

1. AvaTrade Review UAE 2025 –

AVAtrade is a well trusted global online broker for forex and CFD trading. Their multi-asset trading platform and mobile trading app enable traders to access 1365+ tradable symbols overall, including 1200+ CFD’s, major currency pairs with low forex spreads and premium options.

Beside their proprietary platform AVAtradeGo and MetaTrader, AVAtrade has great selection of copy trading solutions including ZuluTrade, DupliTrade and AVAsocial.

Account opening is fast, deposits and withdrawals are free of charge. The minimum deposit is $100.

Choose AVAtrade if you are a beginner or semi advanced forex trader, looking to trade major forex currency pairs, options or CFDs as stocks, cryptos, indices or commodities with premium services.

71% of retail CFD accounts lose money

2. Forex.com –

Forex.com finishes up on second place as the best forex trading platform and app. They offer access to the full MetaTrader platform suite (MT4 and MT5) for desktop and mobile, two proprietary platforms: Advanced Trading (for desktop) and Web Trading (for browser) and a proprietary mobile trading app. It is a real powerhouse on different platforms combined with simple design, great range of different order types, high “ease of use” level and social copy trading features.

Their overall great offer makes this forex and CFD broker a good choice for traders at all levels.

80% of retail CFD accounts lose money

Beginner’s Guide to Forex Trading in Dubai

This article explains UAE forex regulation, the Dubai International Finance Centre (DIFC) and Dubai Financial Services Authority’s (DFSA) regulatory role. We help investors understand security and other issues when selecting a Dubai forex broker and we review the 5 best DFSA-regulated forex brokers in Dubai.

The Importance of Regulation for Forex Trading in Dubai

Globally the forex trading industry deals with increasingly sophisticated methods of fraud, data and identity theft. Dubai traders are not exempt. Large scale fraud and deception led to increased regulation. Fraudsters can easily pose as legitimate broker and steal unsuspecting traders’ funds and data. Dubai required a strong regulatory framework to protect traders and firms.

Exential Investments Scam

A disaster that lingers in Dubai’s forex memory is the Exential Investments scam. Established in spring 2012, Exential Investments, Inc. was a money management company claiming to provide forex investment services that would double an investors’ deposits. 7,000 of their investors lived in the UAE, a large number in Dubai. Concerns surfaced in 2016 when several clients could not withdraw their funds. Others received some returns but these were to encourage investors to keep investing and helped Exential maintain the charade.

Dubai authorities learned many lessons. The UAE put stringent regulations in place. These only cover licensed brokerages. They cannot monitor every platform since new ones spring up in real-time. Forex traders need to remain vigilant. A good rule of thumb is to not trust ANY forex broker promising guaranteed returns.

Dubai International Finance Centre (DIFC)

A better approach is to use regulatory bodies in your jurisdiction. Forex trading in Dubai is regulated by the federal Securities and Commodities Authority (SCA). This includes parts of Dubai. Here we focus on the 110 acres known as the Dubai International Finance Centre (DIFC).

This special economic area, established in 2004, provides a location where local standards align with international counterparts. The purpose is to broaden the range of financial assets on offer and help Dubai become an investment magnet. Since its creation the DIFC became the world’s leading financial hub.

Independent frameworks

DIFC features its own judicial, legal, and regulatory framework. Aligned with international standards, it retains the region’s specific character. This led to Dubai becoming a global top-10 financial center, providing a range of banking services, including deposits, credit, M&A, underwriting, VC/PE, trade finance, capital markets, forex, and other brokerage facilities.

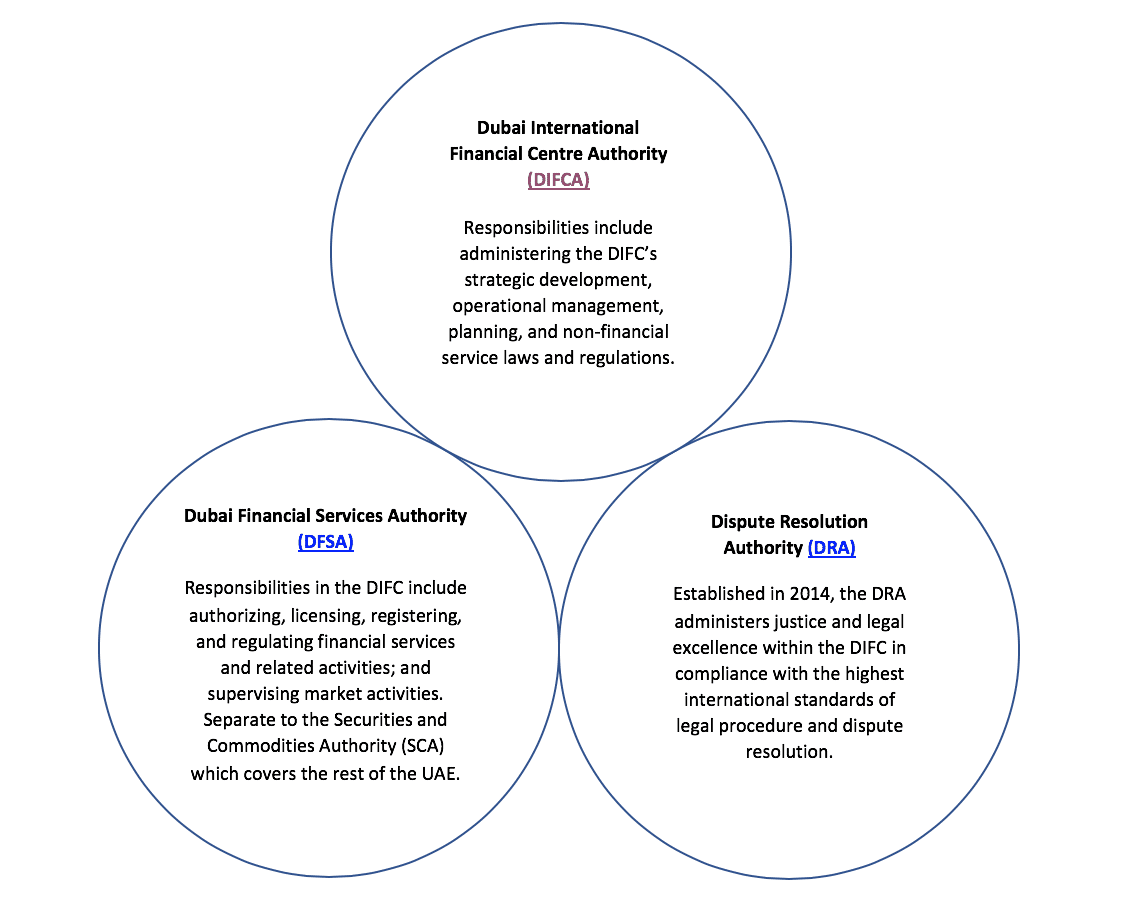

To encourage the DIFC business growth and development, 3 independent bodies were created:

Figure 1: Bodies of the DIFC

Each body has a crucial part to play in the forex regulatory situation. The focus is on the Dubai Financial Services Authority (DFSA) the independent regulator of financial services conducted in or from the Dubai International Financial Centre (DIFC).

Dubai Financial Services Authority (DFSA)

The DFSA is the focus of global forex brokers serving Dubai residents. With stringent guidelines, these applications are not a formality. Those who overcome DFSA hurdles earned their place.

Searching for the right forex broker in Dubai the DIFC requires research and caution. It is easy to confuse security with credibility. Regulated brokers are not immune from hacks. Despite good compliance intentions, your funds and personal data can remain at risk. Brokerage size and length of time trading are two telling security barometers. Brokerages that perform with these criteria, have the best expertise and financial resources to protect you. The opposite is the case for new trading platforms starting and learning as they go.

Essential license check

If you find a preferred broker for forex trading in Dubai, a vital step is to check its DIFC license status. The best way to do this is:

- Go to the DFSA website

- Type in the name of the broker you want to check and

- Click “search”

If your preferred broker for forex trading in Dubai does not appear, it does not have a DFSA license or operates under a different name than its trading name. Take the necessary steps and do your research.

Forex Trading in Dubai – Conclusion

Having learned from experience and thanks to the stringent DFSA regulation, Dubai forex traders have good reason to be confident. There is a wealth of educational material on safer brokerages to use. Competition among regulated and licensed brokerages is increasing. This means there is less reason to increase trading risks for forex trading in Dubai.

If you have used any of the forex brokerages mentioned in this article, please let us know your experiences. We are keen to hear direct user feedback to align it with our research. We want to provide the best information possible.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.