Page Summary

Get Your Investment Managed by Professional Traders

If you’re interested in trading Forex, then you might have looked into “Managed Forex accounts” in the past. Essentially, these are a kind of foreign exchange accounts that you can use for trading. In a managed account, a financial expert will trade on your behalf, and you’ll pay a fee for their service. Usually, this is a good option for people who don’t have the time or skills to invest in Forex on their own.

There are a few companies offering such a service, but you should be careful when selecting your broker.

We can highly recommend SCANDINAVIAN CAPITAL MARKETS who have a long standing tradition and are regulated by the top tier regulators which makes them a safe bet. Additionally, their managed accounts offer more and less risky investment options all having great long term performance.

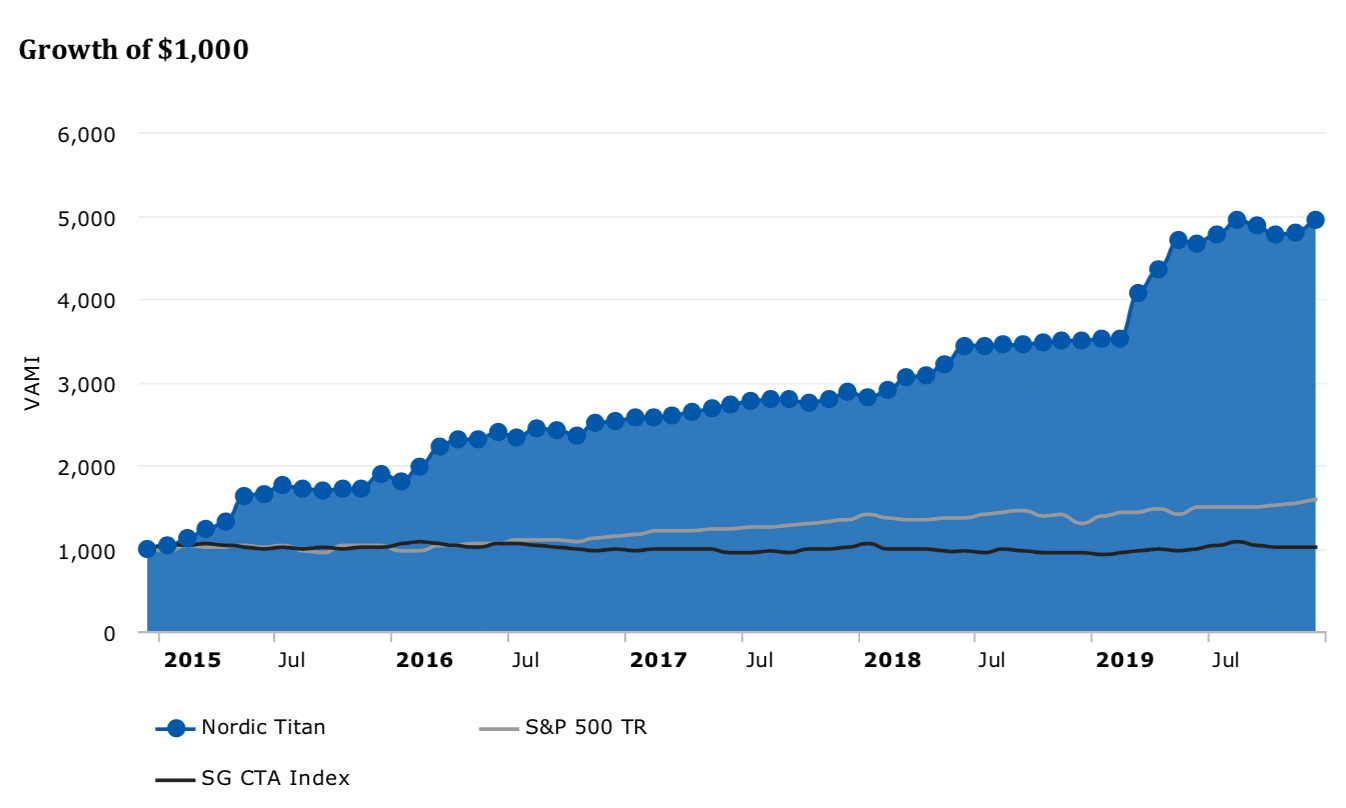

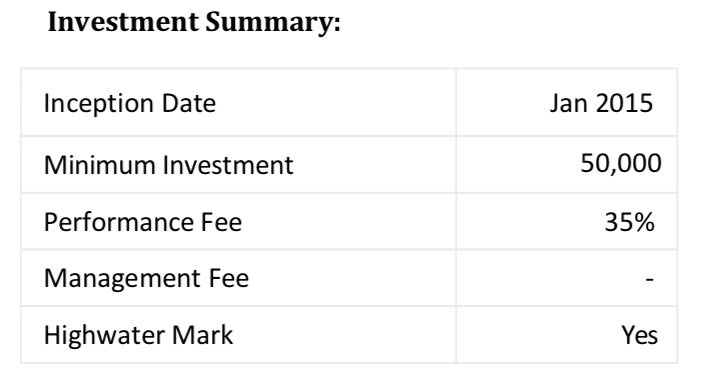

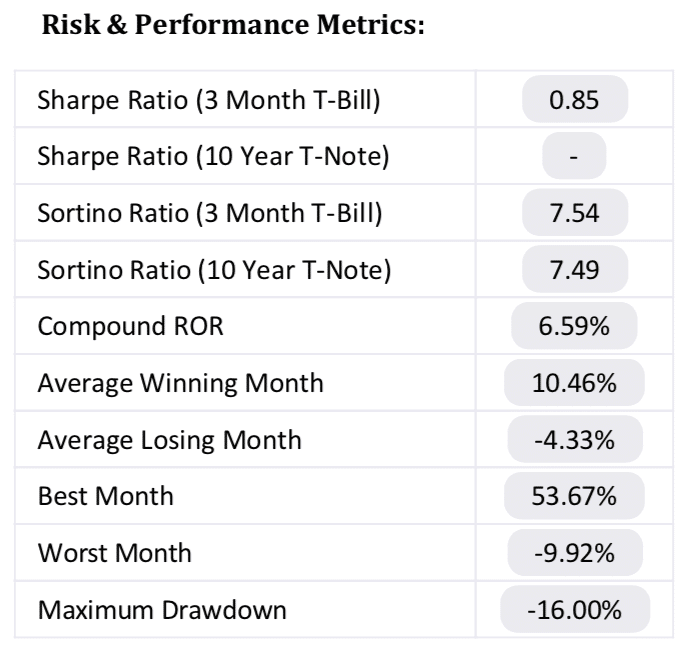

You can check the performance of their two funds:

NORDIC TITAN: which is the more aggressive one

GOLD STRATEGY FUND: the more conservative option

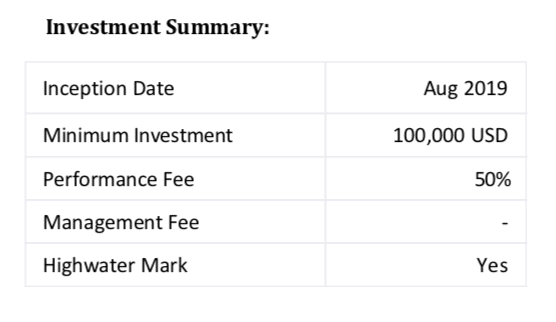

Nordic Titan 2019

Scandinavian Capital Markets is a leading Swedish asset manager in the forex market with one of the most successful trading strategies in the market. Located in the heart of the Scandinavian capital Stockholm, SCM provides its investment clients with intelligent and innovative strategies to preserve and grow their wealth. We have a world-class team of management and analysis professionals from some of the most reputable institutions.

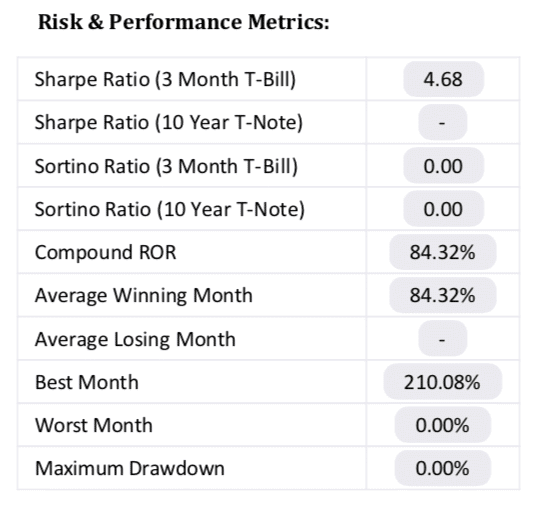

Gold Strategy Fund

Scandinavian Capital Markets is a leading Swedish asset manager in the forex market with one of the most successful trading strategies in the market. Located in the heart of the Scandinavian capital Stockholm, SCM provides its investment clients with intelligent and innovative strategies to preserve and grow their wealth. We have a world-class team of management and analysis professionals from some of the most reputable institutions.

If you’re interested in trading Forex, then you might have looked into “Managed Forex accounts” in the past. Essentially, these are a kind of foreign exchange accounts that you can use for trading. In a managed account, a financial expert will trade on your behalf, and you’ll pay a fee for their service. Usually, this is a good option for people who don’t have the time or skills to invest in Forex on their own.

How Do Managed Forex Accounts Work?

Managed accounts can be useful for traders from all backgrounds. They give you an excellent degree of exposure to different asset classes and allow you to diversify your investment strategy. Unlike bonds and stocks, managed fx accounts look at the FX market and build wealth through predictions on whether the value of one currency will drop lower or rise higher than another. Some experts refer to foreign exchange traders as people who “speculate” rather than invest.

Anyone who starts buying and selling on the FX market earns the name of a “trader.” Trading in forex markets has significant risk. The investor’s approach needs to be carefully thought out.It is often thought of as a different term from an investor. If you’re an investor, you generally hold onto your assets for a long amount of time, allowing it to build in value. On the other hand, if you’re a trader, you make the most of the short-term changes in your chosen market.

Foreign exchange markets are most popular among traders who can strategically manage large amounts of borrowed money, improving their gains over time. Compared to other markets, Forex has far more liquidity and delivers faster-paced trading than most too. Because Forex is the most active market available today, the transaction costs associated with it are usually lower too.

Are Managed Forex Accounts Safe?

No trading environment comes without any risk.

Trading in forex markets has significant risk. The investor’s approach needs to be carefully thought out. If you don’t understand the market, or how to make the most of your investments, then you’ll struggle to get anything out of your foreign exchange trades. The people who get the most out of FX are those who learn how to respond to monetary decisions in the banking world of economic changes. If you want to get started with forex trading on your own then we can recommend you to check out our favorite forex trading platform called Plus500 or check out our whole list of the best forex brokers.

Who Are Forex Managed Accounts Meant For?

These accounts are an effective solution for people who are interested in trading foreign currencies but don’t have a lot of experience in the market. With a managed account, you can tap into the specialist skills of another trader. Of course, you will need to pay something for the expert help you get. Some Forex managers charge up to 30% of your trade earnings.

When you’re choosing a managed account, make sure that you look at the Calmer Ratio of the account manager, you’re thinking of using. This gives you an insight into the average annual compound rate that the trader gets. Assessing this ratio will provide you with a basic overview of the success of the trader over a three-year period. If their ratio is higher, then their risk-adjusted return should be good too.

Want to know how to find the best managed fx accounts? Check out the video below:

FAQ

How do Managed Accounts Work?

Managed forex accounts work on the principle of an investor allocating his money to a fund of his choice which is managed by a professional trader/manager. These managers/traders normally manage different accounts using their own capital as well based on the aim to generate profits for their clients/investors.

What is a Managed Forex Account?

The term managed fx account is used to describe an agreement between an account manager and an investor, where the account manager trades on behalf of the investor using his money. We can compare this agreement to traditional investment accounts of stocks and bonds where the manager takes care of the trading logistics.

What is a fund manager in forex?

The fund manager is a professional trader. They operate their fund to make a profit for their investors. Their compensation consists of a management fee and a share of the profits generated.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.