Crypto scams use fraudulent schemes to deceive investors in cryptocurrency markets. Learn how to identify, avoid, and take action against these scams.

Just as financial criminals will try to steal money from your bank account or put fraudulent charges on your credit card, crypto scammers will try to take your digital assets.

To protect your crypto assets, it helps to know when and how you’re being targeted and what you can do if you suspect a cryptocurrency scam.

What Qualifies as a Cryptocurrency Scam?

A cryptocurrency scam involves fraudulent schemes designed to deceive investors for financial gain. Crypto scams are similar to other online financial scams, such as credit card fraud, online banking fraud, and investment fraud. Before investing your hard-earned money in crypto, it is important to know more about crypto scams and how they operate.

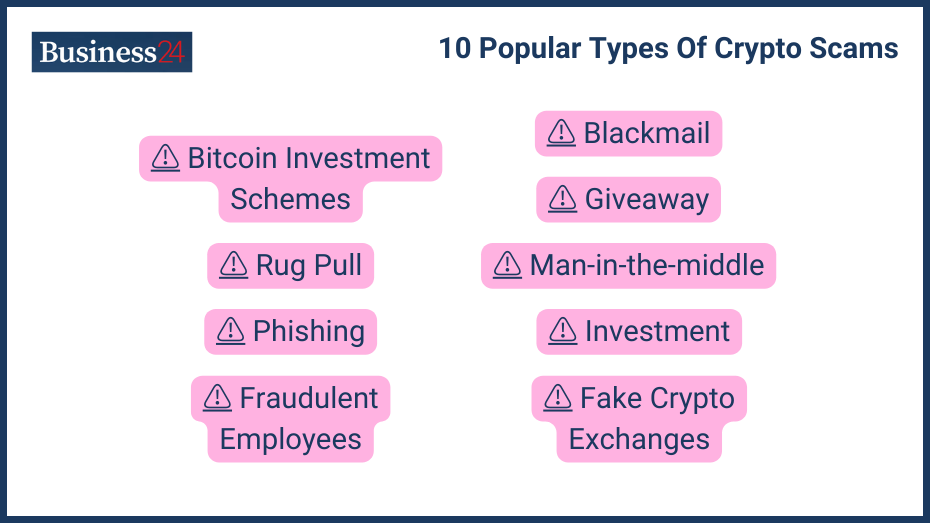

Common Types of Crypto Scams

Phishing attacks are focused on getting access to crypto wallets. In particular, scammers need a wallet’s private keys or the primary email’s password. According to the FBI, 30,000 people fell victim to phishing scams in 2022 alone. For this purpose, they use specially created scam websites to make users give up this crucial information in exchange for something. Then, they use these private keys to steal crypto from the user’s wallet.

Another type of crypto scam is a Ponzi scheme. A Ponzi scheme is characterized by an investment in a High-Yield Program that guarantees an unrealistic Return on Investment (ROI) with negligible risk. Two of the biggest Ponzi schemes in crypto history include OneCoin and BitConnect. Both of them are bankrupt, and their founders are either in jail or facing criminal charges.

Fake ICOs, sometimes called rug pulls, occur when a so-called company raises funds to develop a project. At one point, it runs away with all the funds and removes all liquidity from the system, leaving users holding the bag.

Other crypto scams include extortion attempts and multi-level marketing.

Red Flags in Crypto Offers

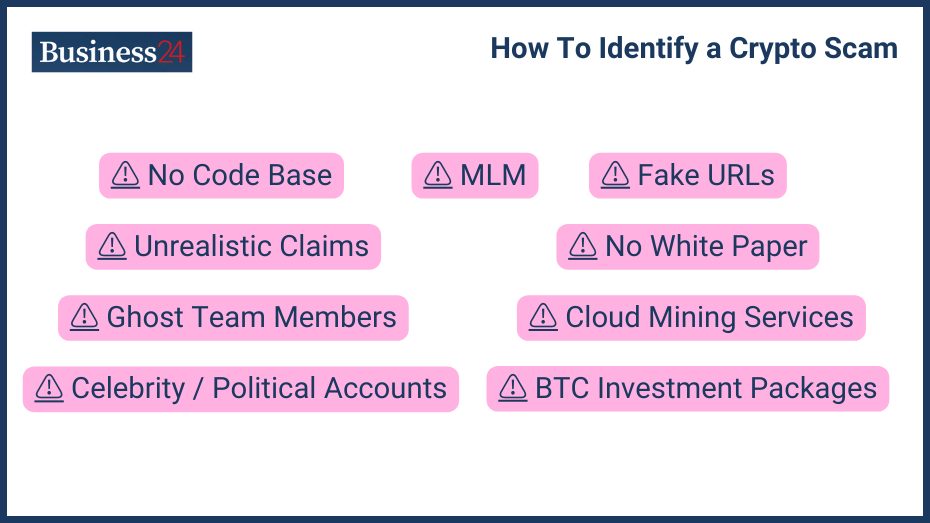

There are immediate red flags that indicate a potential crypto scam. They include a lack of transparency, troubling transaction patterns, anonymous teams, and guaranteed high yields.

Lack of transparency is an immediate giveaway of a digital currency scam. Legitimate startups provide clear, verifiable information regarding their operations. You should be able to view their smart contracts and see how they spend the raised capital.

You need to monitor the company’s crypto transactions. If a troubling pattern emerges, including recurrent transfers to questionable wallet addresses, it raises an immediate red flag.

Anonymous team members are yet another immediate cause of concern for a crypto project. If the team listed on the official website has shady social media and LinkedIn accounts, it is an immediate cause of concern. The names of the teams often do not coincide with the linked accounts, so that you can watch out for that as well.

Guaranteed high yields are an immediate red flag in crypto. While crypto can be immensely profitable if you put your mind to it, risks are always involved. If a company promises guaranteed unnaturally high yields, it is a scam.

How Can You Identify a Crypto Scammer?

You can identify a crypto scammer by their promises of guaranteed high returns with no risk. This is the first indicator, but other signs exist, such as scams in the digital currency space. If it is too good to be true, it probably isn’t the best idea to invest in it.

Behavioral Indicators of Scammers

Typical behaviors and tactics used by scammers include unsolicited contact and creating pressure to act quickly. Scammers do their best to create an environment of perpetual Fear Of Missing Out (FOMO) and make unrealistic promises for the future.

Technical Signs of a Scam

Technical clues that can help you spot a scam include poor website design and content, an unprofessional whitepaper, multiple wallets controlled by the same IP address, and a lack of community involvement.

What Are the Most Infamous Crypto Scams?

The most infamous crypto scams include Ponzi schemes, fraudulent ICOs, and phishing, regarding global crypto scams in history, OneCoin, BitConnect, and Thodex crypto exchange.

Case Studies of Major Scams

Notable scams have always existed in crypto. Users have lost tens of billions of dollars in them, but a few stand out.

OneCoin was a massive $4 billion Ponzi scheme. It originated in Europe and had offices in Dubai. It promised users unrealistic returns. In 2017, authorities shut down OneCoin, and its founders have been on the run ever since.

BitConnect was a $3.4 billion worth multi-level marketing-based Ponzi scheme. Its native coin lost 99.99% of its value several days after its handlers tried to run away with its funds. They were given long prison sentences for their crimes.

The Thodex crypto exchange was a Turkish-origin platform that promised unrealistic returns. Its founder, Faruk Fateh Ozer, fled the country with $2 billion of investors’ money. He was tracked down and sentenced to 11,196 years in prison.

Analysis of Scam Tactics

Breakdown of tactics used in major scams to educate readers on scam methodologies.

Scammers use persuasive social engineering tactics to persuade unsuspecting users to take specific actions. They include:

- Creating a sense of urgency to make the user feel he is missing out on rewards

- Posing as a trusted authority and citing fake certifications

- Fake testimonials from “successful” investors

- Bypass logic into making impulsive decisions

Why Are Cryptocurrency Scams Increasingly Common?

Cryptocurrency scams are increasingly common due to the anonymous nature of transactions and the lack of regulation. The digital currency space has considerable potential for both short-term and long-term gains. Scammers leverage this lucrative side of crypto to lure unsuspecting users into financial traps.

Role of Anonymity in Crypto Scams

Anonymity and pseudonymity are essential pillars of the crypto sector. However, they are a double-edged sword. They can help protect users’ privacy and security but also help criminal elements get away with fraud. Once fraud is committed, it is extremely difficult to track and arrest the culprits due to this added layer of cryptographic secrecy.

Challenges in Regulating Cryptocurrency

The decentralized, pseudonymous nature of the crypto sector presents major challenges in regulation. According to government sources, crypto is advancing financial crimes like money laundering, terrorist financing, and tax evasion. The situation will likely worsen with time and needs to be addressed by the authorities.

Digital assets cannot be reined in by one government as they don’t adhere to country borders and state-approved channels. This is why an international regulatory regime needs to be agreed upon.

Are Cryptocurrency Scams Legal?

Cryptocurrency scams are illegal and constitute serious financial fraud. However, some scams, like the FTX exchange collapse, were technically legal, and the crime was in the details. So, users need to be extra careful when investing in digital currency companies. Legal recourse is often long, and even if funds are recovered from the fraudulent organization, it may take several years before the funds are returned to the end user.

Legal Frameworks Against Crypto Scams

Due to the failure of international organizations to have a united front against the rising threat of digital currencies, legal frameworks for regulating crypto need much to be desired. The US, the UK, the EU, Japan, and South Korea have some rules in place for digital currency platforms. They include mandatory Know Your Customer (KYC) and Anti Money Laundering (AML) protocols. These governments have also cracked down against top exchange platforms and forced them to comply with these regulations.

The US, in particular, has banned ICOs and other coin offerings. It regards even some of the top digital currencies as unregistered securities and makes them legal. Still, there is no sign of crypto scams slowing down overall.

Global Legal Variations

The two main legal frameworks adopted by nations include the Markets in Crypto Assets (MiCA) legislation passed in the EU and The Comprehensive Framework For Responsible Development of Digital Assets in the USA.

The American framework addresses various issues, including national security concerns, environmental sustainability of mining operations, consumer protection, and law enforcement. It also envisions a future of international cooperation on crypto matters.

The MiCA legislation in the EU created consistent rules for cryptocurrencies in its shared economy. It is the first comprehensive, tailored legislation to fill in the gaps left by digital currency and its disruptive forces.

How Can You Trace a Crypto Scammer?

Tracing a crypto scammer is complex but possible through blockchain analysis tools and law enforcement cooperation. Here is how you can track your crypto scammer and report them to the authorities:

Tools for Tracing Cryptocurrency

There are several blockchain analytics tools you can use to help investigators and affectees trace their stolen crypto. They include:

- Blockchain.com Explorer is a powerful free tool for navigating transactions across Bitcoin, Ethereum, and other networks.

- Chainalysis is a popular on-chain analytics tool for banks, law enforcement agencies, and crypto companies. It allows them to track crypto.

- Cipher Trace is a widely used solution for assessing crypto risks, following the transaction trail, and identifying shady behavior.

- Dune is a service that converts complex blockchain data into easy-to-understand tables.

- As the name suggests, breadcrumbs follow the trail left behind by scammers. This helps make sense of complex transactions and find the ultimate culprit.

Success Stories in Tracing Scammers

Tracing crypto scammers is challenging but doable. Big crypto exchange hacks, even though not scams per se, have been tracked, and their culprits have been arrested. Many crypto scam artists have also been caught using on-chain analytics and government resources.

They include the biggest ones, like the 2014 Mt. Gox hack, the 2016 Bitfinex hack, the 2018 BitConnect Scam, and the 2021 Terra (LUNA) collapse. While the authorities managed to arrest criminals involved in these scams, many perpetrators are still at large, and not all funds have been successfully recovered. So, even when the culprits are caught, users aren’t fully compensated. The ultimate onus is on the end user to identify and avoid such fraudulent activities.

What Are Common Questions About Cryptocurrency Scams?

This section answers common questions such as:

How can you tell if someone is a crypto scammer?

A crypto scammer is identifiable due to its promise of high yields with no risks, shady websites, and on-chain activity. It employs tactics like creating FOMO, creating a sense of urgency, and bypassing logic to make hasty decisions.

What are the biggest crypto scams?

The biggest crypto scams include BitConnect, OneCoin, and the Thodex crypto exchange. If you include fraudulent behavior, FTX and Terra (LUNA) were even bigger criminal enterprises.

Why are crypto scams so common?

Crypto scams are common because of a lack of regulation and understanding of the emerging technology. Scammers lure investors with lucrative promises because of crypto’s potential.

Are crypto scams legal?

Cryptocurrency scams are illegal and constitute serious financial fraud. However, some scams were once legal before they started illicit activities like FTX.

Can you trace a crypto scammer?

Yes, you can trace a crypto scammer’s activity using on-chain analytics tools like Chainlaysis, Dune, Cipher Trace, and Blockchain Explorer.

Can you go to jail for crypto scamming?

Yes, crypto scams can result in lengthy jail times for offenders. Thodex crypto exchange scammer Ozer is serving 11,000 years in jail.

Who is the famous crypto scammer?

Famous crypto scammers include Satish Kumbhani of BitConnect and Ruja Ignatova, Crypto Queen of OneCoin.

How common are crypto scams?

According to Chainalysis, illicit crypto activity is on the rise, but there are no definitive numbers. More than $1 billion is lost to crypto scams each year.

How do crypto romance scams work?

Crypto scams usually involve shady websites, tall promises of unrealistic gains, and consistent FOMO. If it is too good to be true, it usually isn’t.

Where Can You Find More Information on Cryptocurrency Scams?

More information on cryptocurrency scams can be found through trusted financial education websites, cryptocurrency forums, and consumer protection agencies.

They include:

Federal Trade Commission (FTC) Dedicated Resource

SEC’s information on investment scams

Consumer Protection Organizations like FinCEN

Private on-chain reporters like Chainlaysis, Cipher, Trace and Dune

Recommended Online Resources

Recommended online resources include:

Educational Platforms and Courses

Recommended educational platforms and courses related to crypto safety and scam prevention include:

- Informational platforms like Coindesk, CoinGeco and CoinMarketcap

- Online courses from Udemy, Coursera, and Binance Academy

Essential Definitions Related to Cryptocurrency Scams

One way cryptocurrency scams operate is to confuse unsuspecting users. Here are some essential definitions you need to understand to help identify a potential scammer:

What’s the definition of Cryptocurrency Exchange?

A cryptocurrency exchange is a digital marketplace where traders can buy, sell, and exchange cryptocurrencies. It is a common destination where you can buy/sell/swap/stake digital currencies.

What’s the definition of a Smart Contract?

A smart contract is a self-executing contract with the terms of the agreement directly written into lines of code. Smart contracts allow crypto users to perform useful functions like automating workflow and removing trust-based operations.

What’s the definition of Decentralized Finance (DeFi)?

Decentralized Finance (DeFi) refers to financial services built on top of blockchain technologies. These services enable financial transactions to be executed in a distributed and open environment without central intermediaries. With DeFi, users can loan, borrow, and mortgage crypto assets without third parties.

What’s the definition of Blockchain Technology?

Blockchain technology is a decentralized digital ledger that records transactions across multiple computers so that the record cannot be altered retroactively without the alteration of all subsequent blocks. Blockchain technology is the backbone of all digital currencies and a key component of the Web 3.0 revolution.

What’s the definition of a Crypto Wallet?

A crypto wallet is a digital tool that allows users to store and manage their cryptocurrency addresses, facilitating the sending and receiving of cryptocurrencies like Bitcoin and Ethereum. Every crypto wallet has a set of cryptographic passcodes, aka private keys, that can trigger withdrawals. It is essential to keep your private keys safe and not share them with anyone under any circumstances.

What Are the Key Takeaways From This Guide on Cryptocurrency Scams?

Key takeaways include staying informed, practicing skepticism, and using secure transaction methods to avoid cryptocurrency scams.

Cryptocurrency scams appear complex, but they can be identified. Scammers employ a series of psychological techniques to coerce users.

They include unrealistic promises of massive gains and FOMO to encourage hasty decisions. Their illicit activity can be traced using blockchain analytics tools like Chainlaysis.

They can then be reported to the proper authorities.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.