Page Summary

A Bitcoin Improvement Proposal (BIP) is a document that suggests changes or features to Bitcoin. The BIP may include proposals for soft or hard forks, changes to peer-to-peer networks, or new models of fallback seed phrases. Simple changes, such as executing code or changes to the interface, don’t need a BIP.

The first Bitcoin Improvement Proposal

Amir Taaki introduced the first proposal to improve Bitcoin. He is the creator of the first alternative implementation of a cryptocurrency protocol – Libbitcoin.

Taaki presented its BIP, known as BIP0001, on August 19, 2011. The document outlined the standard for the BIP process. Taaki described it in the Python improvement proposal (Python Improvement Proposal) PEP 0.

How are Bitcoin Improvement Proposals introduced?

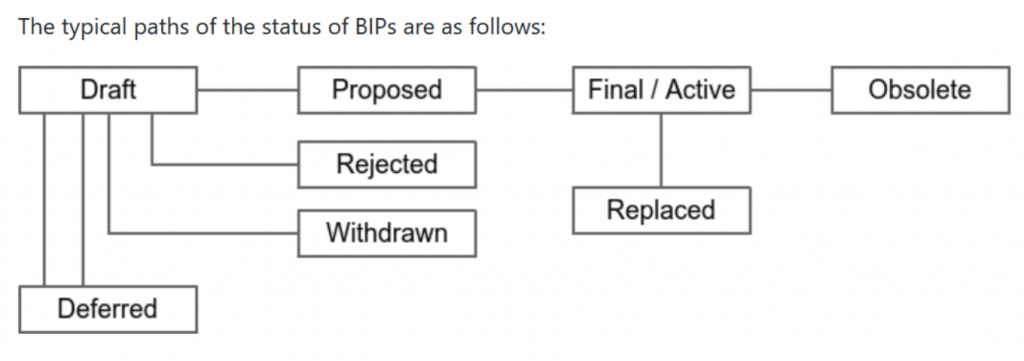

All BIPs are first compiled by one or several authors in draft form and then presented to the public. The community can decide to accept, defer, reject or withdraw a BIP draft. If the BIP introduces changes affecting the Bitcoin protocol, it requires a reference implementation of the code. The BIP is not considered final until the community reaches a consensus.

The developers then deploy the accepted BIP code and users can download and run the code. The BIP is not binding. While developers decide what code to put in place, users also decide what software and protocol to run on their computers. Claims based on the BIP do not stand a chance in court.

Types of Bitcoin Improvement Proposals

There are three types of BIPs:

1. Standards Track BIPs

Standards Track BIPs are proposals that aim to change the Bitcoin protocol. This includes changes to the blocks or the process of confirming transactions. This type also includes attempts to change interoperable functions between two BIPs. Consensus is required for such changes to work. An example of a Standard Track BIP is BIP 91.

2. Informational BIPs

This type of BIP focuses on general guidelines and design issues. An example is BIP 32.

3. Process BIPs

This type of BIP describes or proposes basic process changes outside the Bitcoin protocol. An example is BIP 2.

Examples of the most valuable BIPs

SegWit (Segregated Witness)

Two Bitcoin Core developers introduced BIP 141 in 2015. It proposed to improve Bitcoin scalability through bandwidth-enhancing solutions.

The update used a soft fork that required at least 95% of the miners’ votes over a fixed 14-day period. The SegWit solution allowed one block to contain more transactions.

BIP 91

James Hilliard pushed this soft fork proposal in 2017 with less than 95% computing power.

BIP 148 (UASF)

In 2017 Shaolin Fry came up with BIP 148 as a user-activated solution for a SegWit soft fork to scale Bitcoin throughput. BIP 148 requirement is for the software to update 50+% of full nodes.

SegWit2X

This BIP combines two solutions for scaling – SegWit and increasing the block size to 2 MB. It suggested implementing SegWit first. Three months after SegWit, the block size should increase to 2 MB. Despite strong initial community support, the proposal was never agreed upon.

Lightning Network

Joseph Poon and Thaddeus Dryja came up with this BIP in 2015 to improve Bitcoin’s scalability. It would allow direct payments outside the blockchain using multi-signature wallets. Micropayments would take place, allowing the transfer of money without the risk of theft by the counterparty. The Lightning Network also enables cross-chain payments and smart contracts.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.