Page Summary

This guide helps users to find the best day trading apps in UAE. Mobile trading apps are increasingly popular in UAE as they allow users to trade on the go. Due to the growing number of online brokers that offer apps with different features, it is hard for traders to choose the ideal option for their needs.

Proper evaluation, comparison, and provider reviews can help users avoid selecting an app with a complex interface, limited trading features, high fees, and poor customer support.

This guide assesses 115 online brokers in UAE for users to review and find the ideal platforms for their needs. To help them make an informed decision, a list of the best day trading apps in the UAE is shared below, followed by detailed reviews, comparisons and FAQ’s.

Best Day Trading Apps in UAE

- eToro – Overall Best Day Trading App in UAE

- Libertex – Lowest Spread Day Trading App

- AVAtrade – Ideal MetaTrader 4/5 Trading App in UAE

- Forex.com – Top App for Forex Trading

- Interactive Brokers – Best App for Multiple Asset Classes

- Saxo Bank – Optimal Trading App for Professional Traders and Investors

Top Day Trading Apps in UAE Reviewed

Online brokers with the top 8 day trading apps for UAE users are reviewed below.

1. eToro – Overall Best Day Trading App in UAE in 2023

Min Deposit: $100

Fees: 4.8

Assets available: 4.8

Total Fees:

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro is a reputable global brand and industry leading broker for copy trading. Their robust and cutting edge copy trading platform and social trading features allow users to copy trades and portfolios from professional traders and investors.

As a CFD multi asset broker, eToro allows users to trade on over 3075 different symbols including stocks, forex, cryptos, indices and commodities. Trading spreads are wide, deposits are free and account minimum is low. There are conversion and inactivity fees. eToro provides a comprehensive list of technical tools, charts, and newsfeeds. Their customer support is available through email and live chat in Arabic and English.

eToro is a well established market maker broker with a clean history record, regulated by top tier regulators.

Pros

- Access to over 4000+ tradable symbols

- Great overall market coverage

- Easy to use mobile trading app and platforms

- Industry leading social/copy trading app

- Great cryptocurrency trading features

- Responsive customer support

Cons

- Algorithmic trading not available

- Forex and CFD fees above industry average

- Education and research tools missing

Key features

- Sophisticated social-copy trading features

- Multiple different payment options

- Crypto exchange and brokerage services on the same dashboard

- Super fast registration and KYC on-boarding process

- Zero commission stock trading

- Great ease of use level

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

2. Libertex Review March 2024 – Best Day Trading App in UAE with Lowest Spreads

During our broker reviews, we found out that Libertex charges the lowest spreads. This is important because the fewer fees you pay, the more profit you get to keep from your trading. You can trade most assets like stocks, forex, commodities, and crypto commission-free on Libertex.

Libertex is compatible with both MetaTrader 4 and 5, making it a well-suited broker for professional traders. Libertex offers CFD trading so you can go either long or short on assets.

The Libertex app is available on Android and iOS devices and you can open a real money trading account with them with as little as $10 or 40 AED. Libertex offers a $50k demo account for those who want to practice day trading first.

Pros

- Commission-free stock, forex, metals, and crypto trading

- Excellent multi-lingual customer support

- Compatible with MetaTrader 4 and 5

Cons

- No technical analysis tools offered

- Charges inactivity fees

- No Islamic swap-free accounts available

Key features

- Access to thousands of stocks and CFDs on stocks, forex, crypto, indices, metals, ETFs, and commodities

- Receive dividends into your account monthly

- Extensive education section with trading courses, webinars, and more

- Daily market update and analysis videos

- Unlimited free paper trading demo account

- State-of-the-art mobile trading app available on Android and iOS devices

3. AVAtrade – Best Day Trading App in UAE for MetaTrader 4/5

AvaTrade is the best day trading app in UAE to use with MetaTrader 4 or 5. With the AvaTradeGO app, you can day trade CFDs on stocks, commodities, forex, bonds, futures, options, indices, and cryptos.

But, as AvaTrade is the best day trading app for MetaTrader 4 and 5, it is better to connect your AvaTrade account with MT4 or MT5. This way you can trade the markets on the go with MT4 or MT5 whilst enjoying all the benefits of trading with AvaTrade.

These benefits include low spreads, fast order execution, and the option to use automated trading software. You can start day trading with AvaTrade from $100 or 400 AED.

Pros

- Great Research and Educational tools

- Great Customer support

- Good choice of social trading options

Cons

- Comparing others relatively few trading instruments are offered; offers Forex, CFDs and Binary Options

Key features

- Access to 1250 CFDs and 44 forex options

- Excellent copy trading features

- Advanced mobile trading app (AvaOptions)

- Industry average pricing

- Perfect for casual and advanced traders

- Access to the full meta trader suite

71% of retail CFD accounts lose money

4. Forex.com – Best Day Trading App in UAE for Forex Trading

If you prefer forex trading over other asset classes, Forex.com is the best day trading app for you. With the forex.com app, you can day trade over 80 currency pairs, including majors, minors, and exotics.

You can download the Forex.com app on both Android and iOS devices via their respective app stores free of charge. The forex.com app is compatible with MT4 and offers a 30-day free day trading simulator. You can use this day trading simulator to get to know the app and test forex trading strategies.

If you want to start trading with real money, you can open a forex.com trading account with $50 or more. Forex.com accepts a wide range of payment methods like credit cards, PayPal, and bank wire transfers.

Pros

- Great market coverage

- Advanced Trading and Web Trading platforms

- Advanced charting features and performance analytics

- Award Winning Mobile trading app

- Professional customer support

- Competitive fee and commission structure

Cons

- Educational videos are missing

- MT5 available outside of US only

- Limited assets available on MT5

Key features

- 5500 tradable symbols and 4550 CFDs overall

- Award winning mobile trading app

- Advanced charting and performance analytics available

- Great combination of ease of use and personal customisation

- Publicly traded

80% of retail CFD accounts lose money

5. Interactive Brokers – Best Day Trading App in UAE for Trading Multiple Asset Classes

Min Deposit: $0

Fees: 4.9

Assets available: 4.9

Total Fees:

All trading involves risk. More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

Interactive Brokers is one of the oldest retail brokerage firms operating since 1978. It is a top-notch American broker with millions of clients in 33 countries in the world. Interactive Brokers has a desktop trading terminal available and a mobile trading app.

With their trading app, you can trade stocks, futures, options, forex, and stock CFDs. They also offer shares, index funds, and ETFs managed portfolios. The fees they charge vary among the asset classes, but they are competitive compared to other brokers.

You can get started with the Interactive Brokers app with any amount of money, but be ready to be overwhelmed by all the features and tools it offers. Having said that, their app might be hard to understand for beginners.

Pros

- Best market coverage in the industry (100k+ assets on different instruments)

- Access to 16,500 shares and 8,000 stocks as CFDs

- Professional trading platform suitable for different types of traders

- Intuitive and easy to use mobile trading app

- Industry leading fee structure

- Compatible features for casual and professional traders

- Responsive customer support

Cons

- Few deposit and withdrawal options

- Research and education materials missing

Key features

- Margin loan rates on stocks of 1.3%

- Access to 135+ global markets

- Advanced order types, tools and features

- Access to frictional shares

- Lowest commissions in the industry

All trading involves risk. More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

6. Saxo Bank – Best Day Trading App in UAE for Professional Traders and Investors

Min Deposit: $5000

Fees: 4.7

Assets available: 4.9

Total Fees:

69% of retail investor accounts lose money when trading CFDs with this provider.

Saxo Bank is a reputable global brand known for its complete overall offer and exclusive conditions for high volume traders and investors. Users can enjoy cutting edge trading technology paired with a premium interface and great trade execution on mobile and desktop. The Saxo Bank trading platform offers a feature rich trading experience, easy to use interface, competitive margin rates, and trading on over 40,000 financial instruments. This makes them an industry leader in trading assets coverage as an ECN broker.

If you can afford the minimum deposit of $10.000, this is the go to broker for traders and investors at all levels. They combine high-quality in-house research with top-tier third-party providers and a diverse portfolio of investment options.

Investors who are looking to trade in accordance with Sharia Law can open an islamic account. Saxo Bank also offers high quality customer service in Arabic and English language via phone, email or in person at their local office with guaranteed satisfying answers.

Pros

- Industry leading market coverage

- Excellent Trading Features with SaxoTraderGo

- Advanced order type and account protection features

- Intuitive and easy to use mobile trading app

- Great education and research materials

- Competitive fee structure for active traders

Cons

- $10,000 minimum deposit for UAE users

- High time investment to set up

- Only for advanced traders

Key features

- 40.000 tradable symbols available (crypto derivatives, forex options and futures)

- Advanced account protection and order types

- Fast execution of trades

- $2.000 minimum deposit

- “Best in class” educational resources

- Great ease of use level combined with advanced features

69% of retail investor accounts lose money when trading CFDs with this provider.

How To Find The Ideal Day Trading App in UAE?

Criteria to consider to select the optimal day trading app in UAE are listed below.

- License and Regulation: Make sure you trade with a regulated broker. The best financial regulatory bodies are CySec, FCA, ASIC, and the DFSA.

- Available Assets: You should choose a broker that has stocks, ETFs, bonds, indices, mutual funds, and cryptos. You can check the best day trading platforms for crypto here.

- Trading Tools: Trading apps offer tools and features like technical indicators, economic calendars, or social trading. Make sure your broker has the tools you need.

- Educational Material: Anyone who is new to day trading should use a trading app that offers educational materials. eToro is a good example of a broker that has a lot of educational material.

- User Experience: Trading from your smartphone should be easy and error-free with a day trading app that is easy to use and works with iOS and Android.

- Payment Methods: Make sure you can deposit and withdraw money from your account for free. Some fees may apply at the bank, but the broker should be free.

- Customer Service: Your broker needs to take care of you with 24/7 support. When you choose a broker from our list, make sure they have full-time support in a language you understand.

Related: best day trading strategies, best day trading platforms

Top Brokers For Day Trading Compared

Key features of online brokers with the highest rated apps for day trading are compared in the table below.

| Broker | eToro | Libertex | AVAtrade | Forex.com | Interactive Brokers | Saxo Bank |

| Assets to Trade | Stocks, ETFs, Crypto, Forex, CFDs | Forex, CFDs | Forex, CFDs, Options | Forex, CFDs | Stocks, Options, Futures, Forex, Bonds, ETFs, Mutual Funds, Cryptos, CFDs | Stocks, ETFs, Forex, Bonds, Options, Futures, Mutual Funds, CFDs, Cryptos |

| Margin Rates | 1:20 | 1:20 | 1:400 | 1:400 | 1:20 | 1:20 |

| Trade Execution | Fast and reliable | Fast and reliable | Fast and reliable | Fast and reliable | Fast and reliable | Fast and reliable |

| Customer Service | Live Chat and Ticket System | Phone, Email, and Live Chat | Phone, Email, and Live Chat | Phone, Email, and Live Chat | Phone, Email, and Live Chat | Phone, Email, and Live Chat |

| Trading platforms | eToro app | MT4, MT5, Libertex | MT4, MT5, WebTrader, AvaGo | Forex.com, MT5 | IBKR Global Trader, Client Portal, IBKR Mobile, TraderWorkstartion, IBRR EventTrader, Impact | SaxoTraderGO, SaxoTraderPRO, TradingView, MultiCharts, UpData |

| Advanced charting | No | Yes | Yes | Yes | Yes | Yes |

| Algoritgmic Trading | No | Yes | Yes | Yes | Yes | Yes |

| Copy Trading | Yes | Yes | Yes | Yes | No | No |

Fees Compared

Fees of online brokers with the top rated apps for day trading are compared in the table below.

| Fees | eToro | Libertex | AVAtrade | Forex.com | Interactive Brokers | Saxo Bank |

| Commision US Shares | From $0 | – | – | – | From $0 | From $0.01 per share |

| Commision Futures | – | – | – | – | From $0.25 per contract | $1.5 per contract |

| Commision Options | – | – | Spread from 7 | – | From $0.15 per contract | $0.6 per contract |

| Commision Forex | – | $6 | – | $5 | $2 | – |

| Spread Forex (in points) | From 9 | From 0 | From 6 | From 12 | From 1 | From 6 |

| Inactivity Fee | $10/mo after 12mo no login | No | $50 after 3 mo of non use | $15/mo after 12 mo | 1 if trades commision does not meet the account minimum | $100 after 6mo |

| Funding Fees | $5,00 | No | No | No | 1% deposit | Interest on net deposit |

What Are The Main Features of a Day Trading App?

The main features of day trading apps are real time market data, breaking news, watch lists, charts, and order tickets, so make sure those are on the platform you choose. Below we break down the 3 main categories of day trading app features:

- Ease Of Use – Trading platforms aren’t simple, but the platform you choose should be understandable, and offer customizability. If you don’t have much experience with trading platforms, use a demo account before you trade with real money.

- Low or No Fees – Day trading means you will be making a lot of trades, so the fee structure at your broker matters. Look for a broker that offers 0% fees, so you make your costs as simple as possible.

- Wide Range of Assets – Don’t limit your day trading asset options, and make sure your broker offers a wide range of tradable assets, like stocks, ETFs, commodities, indices, and cryptos. There is always volatility to trade, as long as your broker offers exposure to the market.

What Do You Need to Start Day Trading?

It’s simple to begin with day trading, and you need a few things to get started. We have them listed below:

- Funded Brokerage Account

Start by opening a brokerage account and fund it, brokers offer account minimums under $100, so this step is easy.

Keep in mind that the SEC in the USA has a rule that prohibits accounts with less than $25,000 on deposit from making more than three round-trip trades per five day period.

If you plan to make frequent trades and don’t have $25,000, consider using a CFD broker that isn’t regulated by the SEC. - Easy Access to Data

Day Traders buy and sell daily, so real time market data is necessary. Make sure your broker has all the data you need and also offers access to breaking news.

Charting tools also count, so if you plan to use your broker’s trading platform, look for how the charting tools work. - The Right Mindset

Hedge fund managers that make a consistent return of 25% per year are legends. New traders need to understand it isn’t easy to

take money out of the markets, and most people who try to manage money have problems.

Learn how to manage risk, and focus on making reasonable returns. If you have $100 in your trading account, making $25 per year is a great performance.

Getting Started with a Day Trading App

Getting started with day trading via an app is easy and straightforward. Follow the steps below to do so.

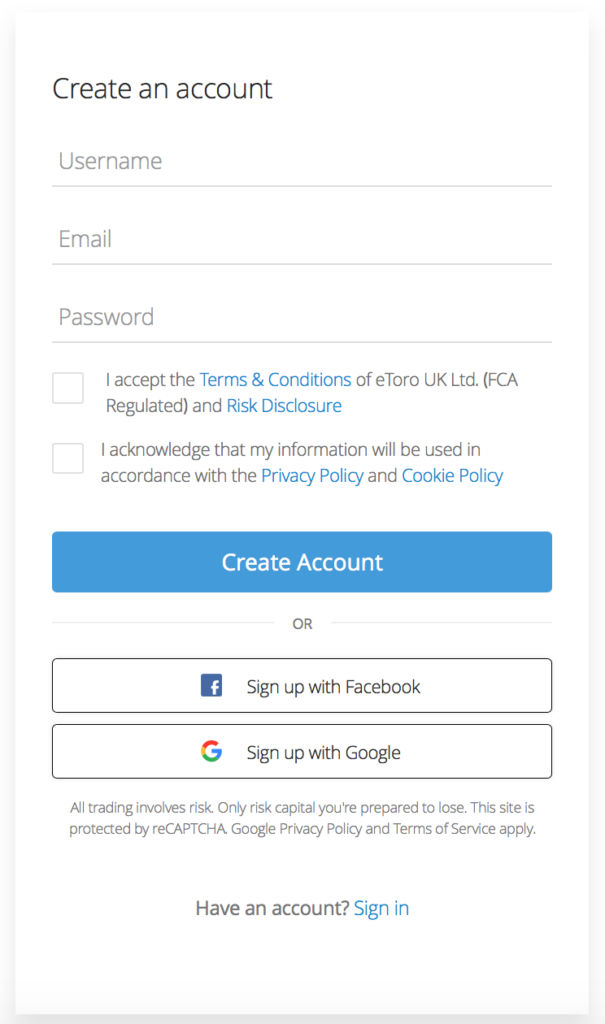

- Open an eToro Day Trading Account

You will need a day trading account before you can download a day trading app. As we recommend eToro for beginner day traders, go to the eToro website and sign up for an eToro account by filling in your personal details.

- Download and Install the eToro App

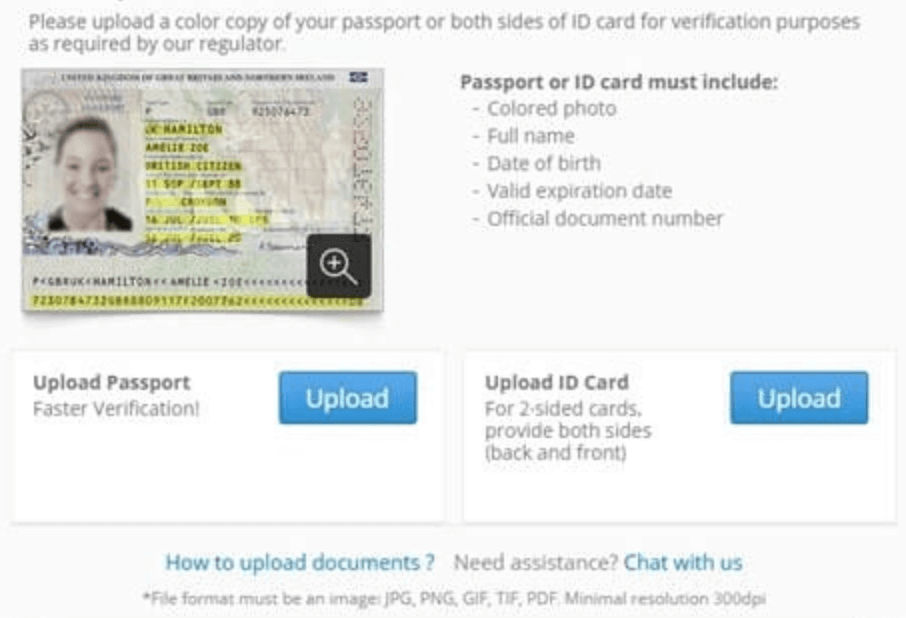

Once you have set up your eToro account, navigate to the Apple Store or Google Play Store to download the eToro app. Install the app when it is done downloading. - Verify your Identity

eToro will ask you to verify your identity before you can place any trades. To do so, take a photo with your phone’s camera of your driver’s license, passport, or national ID card.

- Deposit Funds

When you have verified your identity it is time to deposit funds into your trading account. You can do this by credit card, PayPal, Neteller, Skrill, or bank transfer. - Trade

Now that you have money in your trading account, you can open your first trade. Use the search bar to find your preferred asset. Click on it and determine how much you want to invest and when you want to take profit. Once you have done this, you click ‘Set Order’ to place your trade.

Conclusion

With the various online brokers in UAE offering different apps and features, it can be hard to find the ideal choice for individual needs. Analyzing and comparing the services of different providers requires knowledge, experience and time.

This guide does the hard work by evaluating top apps for different types of traders and preferences. The results of our analysis and comparison of the best day trading apps in UAE are wrapped up in the table below.

| RANK | BROKER | PLATFORM SCORE | BEST FOR | WEBSITE |

|---|---|---|---|---|

| #1 | eToro | 4,9/5 | Overall | Official website |

| #2 | Libertex | 0,0/5 | Lowest Spreads | Official website |

| #3 | AVAtrade | 4,9/5 | MetaTrader 4&5 | Official website |

| #4 | Forex.com | 4,4/5 | Forex Trading | Official website |

| #5 | Interactive Brokers | 4,9/5 | Trading Multiple Asset Classes | Official website |

| #6 | Saxo Bank | 4,9/5 | Professional Traders and Investors | Official website |

Based on our assessment, we consider eToro as the best day trading app in UAE. It offers a variety of instruments, a professional grade trading platform, industry lowest fees, and full time support. Investors can buy stocks, options, futures, commodities, and more with Interactive Brokers.

FAQ

Are day trading apps legal in UAE?

Yes, day trading apps are legal. We recommend only using day trading apps from regulated brokers.

Is day trading options possible from my phone?

Yes, with the Interactive Brokers, TD Ameritrade, and AvaTrade apps you can day trade options from your phone.

What is the best free day trading app in UAE?

We recommend eToro as the best free day trading app for UAE traders. They offer a $100k demo account to practice day trading with.

What is the best day trading app for stocks in UAE?Does the app offer real-time market data and updates?

We recommend using the Robinhood or Interactive Brokers apps for day trading stocks for UAE traders.

Does day trading apps offer real-time market data and updates?

Yes, all of the day trading apps listed in this article offer real-time market data and updates.

Does day trading apps offer access to technical analysis tools?

Yes, most of the day trading apps mirror technical analysis tools from their desktop versions.

Does day trading apps allow users to manage trading portfolios and see trading history?

Yes, typically, day trading apps allow users to manage trading portfolios and checking the trading history.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and crypto assets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.