This guide helps users to find the best day trading simulator in UAE. Day trading simulators and demo trading accounts mirror activities of the real financial markets and allow users to trade using virtual money. Numerous online brokers in the UAE offer day trading simulation, and it is often hard to choose the best suitable option for traders’ needs and preferences.

Proper evaluation and comparison of different services can help traders to avoid selecting a platform that lacks strategy testing options, availability of virtual funds, user-friendly interface, and responsive customer support.

This guide assesses 44 online brokers in UAE for users to review and find the ideal platform for their needs. To help them make an informed decision, a list of the best day trading simulators in the UAE is shared below, followed by detailed reviews and comparisons.

Top Day Trading Simulators in UAE

- Pepperstone – Best CFD Platform

- AVAtrade – Best For Forex and CFDs

- TradeStation – Ideal For Futures

- eToro – Optimal For Beginners

- IG Trading – Top Trading Platform

The Best Day Trading Simulators in UAE Reviewed

Online brokers with the highest rated day trading simulators in UAE are reviewed in more detail below.

1. Pepperstone Review UAE 2025 – Best CFD Platform

Pepperstone is an Australian CFD broker, founded in 2010. Their platforms offers access to 180 + financial instruments including forex and CFDs on stocks, indices, commodities and cryptocurrencies.

Trading platforms available on Pepperstone are listed below.

- MetaTrader 4

- MetaTrader 5

- TradingView

- cTrader

The platform charges zero spreads on most forex pairs and a fixed commission of $3,50. Peppesrtone is a reputable broker regulated by top-tier financial authorities including the Financial Conduct Authority (FCA), the Dubai Financial Services Authority (DFSA) and the Australian Securities and Investments Commission (ASIC).

Pepperstone’s customer support is available 24/7 in English and Arabic. They are reachable through email, live chat, and phone.

Pros

- Algorithmic trading features

- Multiple third party integrations (MT4, MT5, cTrader, Tradingview)

- Competitive fees

- Social trading features

- Excellent education and research materials

Cons

- Limited video educational resources

- Limited advanced order types

- Customer not available in Arabic

Key features

- 60+ Forex pairs and 700+ different CFDs

- MetaTrader 4, MetaTrader 5, cTrader trading platforms

- TradingView integration

- Zero spreads on a few forex pairs including EUR/USD

- Special set of tools for professional traders

- Islamic swap-free account available

74-89% of retail CFD accounts lose money

2. AvaTrade Review UAE 2025 – Best For Forex and CFDs

AVAtrade is a well trusted global online broker for forex and CFD trading. Their multi-asset trading platform and mobile trading app enable traders to access 1365+ tradable symbols overall, including 1200+ CFD’s, major currency pairs with low forex spreads and premium options.

Beside their proprietary platform AVAtradeGo and MetaTrader, AVAtrade has great selection of copy trading solutions including ZuluTrade, DupliTrade and AVAsocial.

Account opening is fast, deposits and withdrawals are free of charge. The minimum deposit is $100.

Choose AVAtrade if you are a beginner or semi advanced forex trader, looking to trade major forex currency pairs, options or CFDs as stocks, cryptos, indices or commodities with premium services.

Pros

- MetaTrader 4 (MT4) and MetaTrader (MT5) trading platforms available for trading simulation with real time and on historical data

- Good trade execution on Forex and CFDs

- Solid choice for day trading with trading bots

Cons

- Futures not available

Key features

- Access to 1250 CFDs and 44 forex options

- Excellent copy trading features

- Advanced mobile trading app (AvaOptions)

- Industry average pricing

- Perfect for casual and advanced traders

- Access to the full meta trader suite

71% of retail CFD accounts lose money

3. TradeStation – Best For Futures

Min Deposit: $0 ($2000 – Margin account; $25000 – Day Trading account; $5000 – Futures account)

Fees: 4.8

Assets available: 5.0

Total Fees:

Tradestation is a reputable online broker known for its technology-leading trading platforms, great selection of tools and zero commission stock and ETF trading. Their industry leading trading platform suite combines a desktop, web and mobile version which are all performing above industry average. Tradestation offers a great selection of most popular asset classes including stocks, cryptos, options, futures, ETFs and IRAs.

Their trading fees vary based on account selection. Pricing is below industry average on the most used accounts (select and GO). Minimum deposit is $2000 and there are no monthly charges.

Pros

- Reset button to reset trades if you want to try new trade

- Fastest trade execution in futures market

- Competitive futures trading fees

Cons

- Forex and CFDs not available

Key features

- Access to over 20,000 stocks, ETFs, options, futures, mutual funds, bonds, and other financial instruments.

- Early-access to newly listed securities via TradeStation’s IPO trading platform

- Broad range of research and analysis tools for advanced traders like FuturesPlus, TSCrypto, Discover, and Insights

- Fully paid stock lending and margin trading available

- Low floating spreads, commissions, and other trading fees

- Perfect for both beginner and advanced traders

4. eToro Review UAE 2025 – Best For Beginners

Min Deposit: $100

Fees: 4.2

Assets available: 4.0

Total Fees: Low

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

eToro is a reputable global brand and industry leading broker for copy trading. Their robust and cutting edge copy trading platform and social trading features allow users to copy trades and portfolios from professional traders and investors.

As a CFD multi asset broker, eToro allows users to trade on over 3075 different symbols including stocks, forex, cryptos, indices and commodities. Trading spreads are wide, deposits are free and account minimum is low. There are conversion and inactivity fees. eToro provides a comprehensive list of technical tools, charts, and newsfeeds. Their customer support is available through email and live chat in Arabic and English.

eToro is a well established market maker broker with a clean history record, regulated by top tier regulators.

Pros

- Intuitive day trading platform for simulation is easy to use

- Social trading is available with demo accounts

- Good trade execution

Cons

- Trading simulation on historical data not available

- Futures not available

Key features

- Sophisticated social-copy trading features

- Multiple different payment options

- Crypto exchange and brokerage services on the same dashboard

- Super fast registration and KYC on-boarding process

- Zero commission stock trading

- Great ease of use level

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

5. IG Trading – Best Trading Platform

IG is one of the largest and most popular regulated forex and CFD brokers globally. Traders can trade thousands of markets using IGs trading platforms like L2 Dealer and ProRealTime or connect their IG brokerage account with MetaTrader 4.

IG offers educational material, daily market update videos, and both technical and fundamental analysis case studies. If you are new to online trading, you can practice with IG’s free demo paper trading account first. For experienced traders IG offers spread rebates and access to more advanced financial instruments like digital options.

Pros

- MetaTrader 4 (MT4) and ProRealTime (PRT) trading platforms are available for trading simulation with both real time and historical data

- All trading instruments are available (Forex, CFDs and Futures)

- Good trade execution on all asset classes

Cons

- Higher fees on stock CFDs than other brokers

Key features

- Trade over 17,000 markets with a broker that has been in business since 1974

- Access to Turbo24s, and CFDs and options on forex, indices, crypto, stocks, and commodities

- Unlimited free demo paper trading account

- Advanced research and analysis tools like L2 Dealer and ProRealTime

- Access to APIs to set up Expert Advisors and other automated trading software

- Receive trading signals and alerts to find excellent entry and exit points

75% of retail CFD accounts lose money

How to Find the Ideal Day Trading Simulator in UAE?

Criteria to consider to choose the optimal day trading simulator in UAE are listed below.

- Assets: Your broker should offer day trading simulators in many asset classes. Make sure you can practice with: futures, forex, stocks, ETFs, commodities, indices, bonds, mutual funds, and cryptos.

- Mobile Trading: Mobile trading platforms let you practice and trade from anywhere. Your broker should have a mobile platform that operates with both iOS and Android.

- Research & education: You will learn about trading with practice, but choose a broker that includes market research and free educational tools as well.

- Customer support: Customer support is a vital part of any brokerage account, so look for a broker that has 24/7 support in a language that you understand.

- Fees: Trading simulators should be free, but when you start to trade with real money, look for brokers that offer 0% trading fees, and make your life easy.

- Trading platforms: The trading simulator you use should be identical to the real trading platform, so when you transition to real trading, it is seamless.

- Deposit & Withdrawal: Deposits and withdrawals should be free to make, although the payment platform you choose may have fees attached to transactions.

- Regulation: The FCA, CySEC, and ASIC regulate financial services, including brokers. Don’t risk your capital with unregulated brokers.

Online Brokers With Top Day Trading Simulators Compared

Key features of online brokers with the highest ranked day trading simulators are compared in the table below.

What is trading simulation?

Trading simulations let you test trading ideas before you use real money in the markets. Brokers call a trading simulator a demo account, and it allows you to use hypothetical funds in the real markets. The trades don’t make or lose money, but you will be able to practice trading with the same platform used for trading.

Why You Should Use a Trading Simulator? Pros and Cons Explained

Trading simulators allow you to practice both trading, and operating the trading platform. If you are new to trading, a trading simulator is a great tool. However, the trades in a simulator won’t actually connect to the market, so there won’t be slippage, which isn’t realistic.

The main pros and cons of using trading simulation:

- Trading simulation offers faster trading education

- No exposure to trading risks

- Ability to test trading strategies without risk of loosing money

- Building confidence in your trading

- No fees and commissions included in your trading experience

- The real stress factors are missing

- No real data movements

How to Set up a Simulation Account?

Brokers offer trading simulators to clients for free, so if you sign up for an account with a broker like eToro, you will be able to use its trading simulator. While the trading simulator is free, you have to open and fund an account to access the platform, so keep that in mind.

How to Get Started With a Day Trading Simulator?

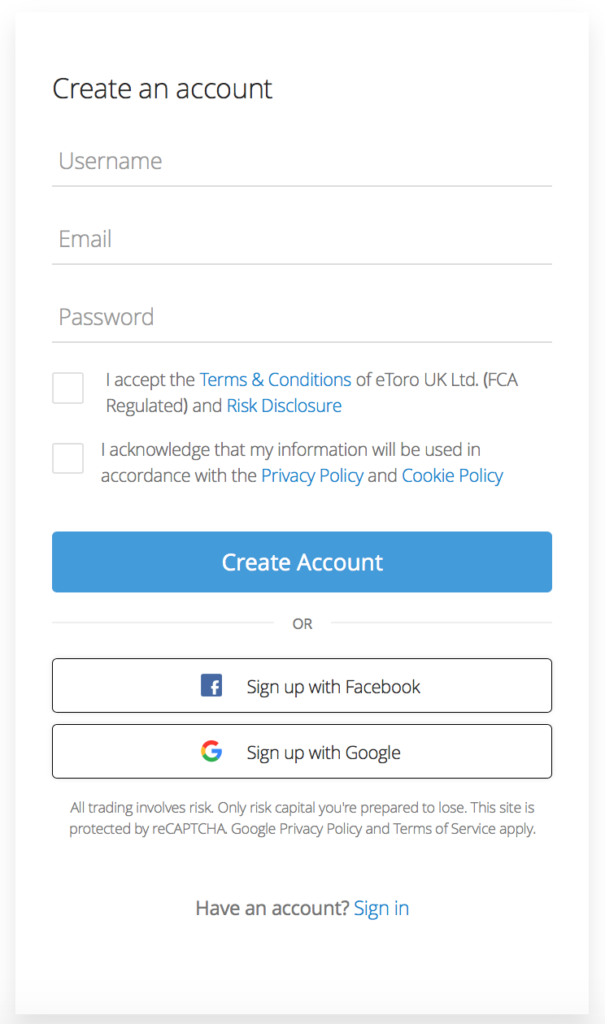

Are you looking to get started with a day trading simulator? Follow the steps below to set up your free eToro demo account.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

1. Register

You will need an eToro account before you can start using their day trading simulator. Navigate to the eToro website and click on the ‘Start Investing’ button. A pop-up will show up and ask for your personal details. Fill these in and click ‘Create Account.

2. Switch to Demo Trading

Once you have created your eToro account, log in and switch to demo mode. You do this by clicking on your username and then selecting ‘Virtual Portfolio’ from the dropdown menu.

3. Trade

Search the available markets for the asset you want to trade. You can use the search bar in the middle of the screen to do so. Click on it, specify how much virtual money you want to invest and click on ‘Open Trade’.

4. Create a Real Money Account

If you get the hang of trading with the eToro day trading simulator and wish to trade with real money, you can do so at any given moment. To do this you click ‘Real Portfolio’ under your username. You then proceed to go to the deposit page. Here you can make a deposit with your credit card or by PayPal.

Conclusion

With the various online brokers in UAE offering demo (simulation) accounts with different features, it can be tough to select the optimal choice for individual testing needs and goals. The analysis and comparison of services of different providers requires time and knowledge.

This guide does the tough work by evaluating top simulators for different types of testing purposes. The results of our analysis and comparison of online brokers with the best day trading simulators in UAE are wrapped up in the table below.

| RANK | BROKER | GENERAL | PLATFORM SCORE | BEST FOR | WEBSITE |

|---|---|---|---|---|---|

| #1 | Pepperstone | Low trading fees | 4,9/5 | CFD Platform | Official website |

| #2 | AVAtrade | Good social trading options | 4,9/5 | Forex and CFDs | Official website |

| #3 | TradeStation | Great choice of trading instruments offered | 4,9/5 | Futures | Official website |

| #4 | eToro | Great Social trading service | 4,9/5 | Beginners | Official website eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. |

| #5 | IG Trading | Very good choice of different trading platforms | 4,2/5 | Trading Platform | Official website |

Based on our review, we consider Tradestation as the broker with the best best day trading simulator. They offer unlimited account funding on demo accounts, access to real time market data, and backtesting on stock, futures and options trading strategies. Users get access to the industry’s largest database of historical market data.

FAQ

Can I use a day trading simulator on MetaTrader 4?

Yes, to do this you sign up at one of the brokers above and sign in MetaTrader 4 with the credentials this broker provides you.

What is the best day trading simulator or demo account in the UAE?

We found eToro to offer the best day trading simulator. With this demo trading account, you can trade over 2,400 stocks and other assets.

Do day trading simulators show the same prices as real trading accounts?

Yes, most day trading simulators and demo accounts mirror real financial markets.

What is the best app to practice day trading for free in the UAE?

We recommend eToro’s day trading app. You can download this app for free on both Android and iOS devices.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.