Page Summary

This guide explains how to invest in ETFs in UAE. ETFs are popular investments among beginners and intermediate traders in UAE looking to generate a steady income, hedge against market downturns, long-term growth of wealth, diversification, and flexibility. They are commonly used by inexperienced investors that lack expertise or time to research individual stocks looking for exposure in a certain sector or industry.

To increase chances of successful investing, this guide explains the basic ETF terms, how to invest in ETFs in UAE and compares their pros and cons.

ETFs Explained

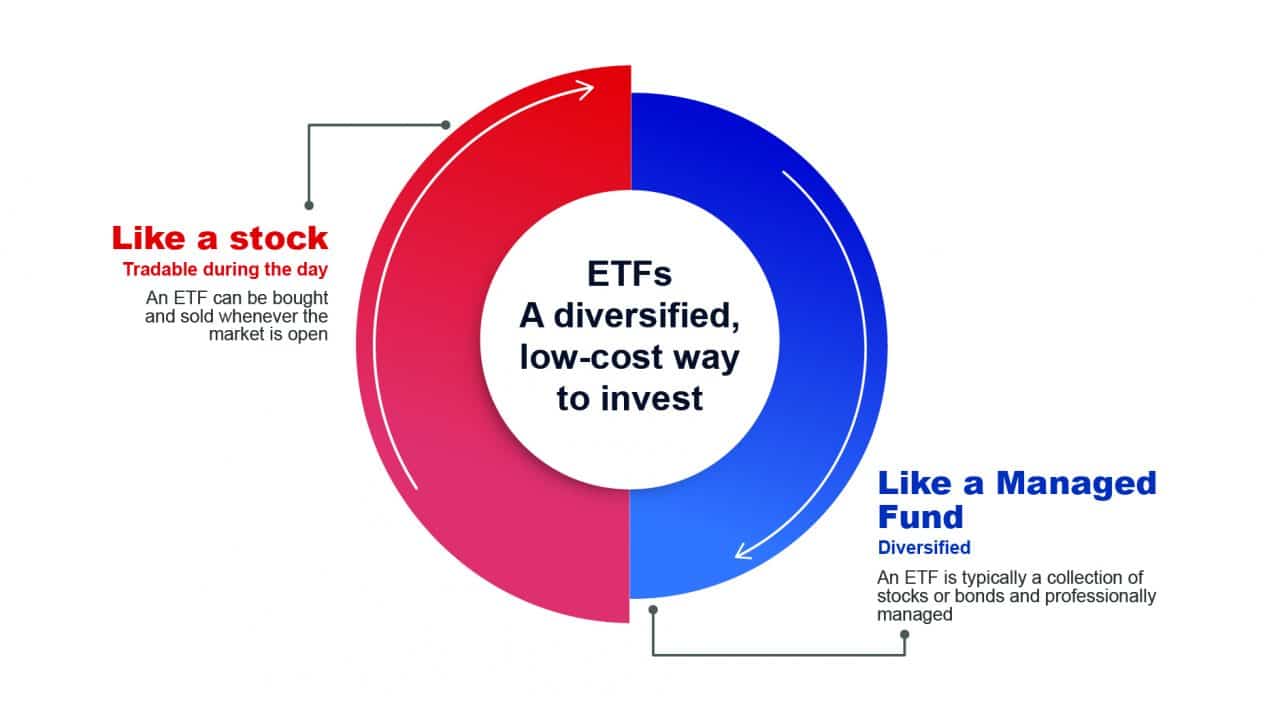

An ETF (exchange-traded fund) is a financial instrument that tracks stocks, indices, currencies, commodities, or markets and sectors that are traded on stock exchanges. ETFs are designed to be less volatile than other financial instruments so that they trade close to their net asset value.

You can invest in ETFs on a stock exchange via online trading platforms and brokers. The most famous ETF is the SPDR S&P 500 ETF, which tracks the S&P 500. ETFs divide their ownership into shares. Investors in the ETFs receive a share of the profits in the form of dividends or interest.

How do ETFs work?

ETF fund providers own the underlying assets and offer investors a fund to invest in that tracks the performance of these assets. By investing in an ETF you become a partial owner of that ETF, but not of the underlying assets. You may receive dividend payments or reinvested stocks that are part of the index.

ETF fund providers choose stocks, bonds, commodities, and currencies and form a basket of them, creating a new ticker. Investors then buy a share of this new ticker, similar to buying stocks of a company. Traders trade the ETF throughout the day on stock exchanges, contrary to mutual funds which are only traded when the market closes. The prices of ETFs change every second unlike mutual funds, which only change in price once a day when the financial markets close.

The trading fees of ETFs are lower and ETFs are more liquid than mutual funds. ETFs have more than one underlying asset, which increases diversification. There is no maximum amount of stocks or other financial instruments an ETF can track. You can go long on ETFs or sell them short.

Difference Between ETFs and Mutual Funds

The main differences between ETFs and mutual funds are:

- ETFs are traded all day and mutual funds only when the market closes

- Traders invest an amount of money in mutual funds rather than buying an amount of ETFs

- Mutual fund transactions aren’t instantaneous

ETFs don’t need to maintain a cash reserve to fund expenses like a mutual fund because they do not actively buy and sell shares. The share selection of an ETF is computerized, which costs less than professional fund managers managing mutual funds. Traders trade ETFs on stock exchanges and have to pay brokerage commissions whilst mutual funds only charge front-end and back-end loads.

| ETFs | Mutual Funds | |

| Fund management style | Can be active or passive | Passive |

| Expense Ratios | Lower than mutual funds | Higher than indexed ETFs (though lower than active funds) |

| Price | Determined by trading throughout the day | Determined by NAV |

| Operating Fees | Lower Fees | Higher fees |

What Are The Different Types of ETFs

The basic concepts of ETFs are that there are active and passive ETFs, that ETFs charge expense ratios, and that ETFs pay dividends or DRIPs.

- Passive and Active ETFs: There are active and passive ETFs. Passive ETFs track stock indexes like the S&P 500 whilst active ETFs are managed by portfolio managers. Passive ETFs try to mirror the performance of an index and ETFs want to beat this performance.

- Expense ratios: ETFs charge fees known as the expense ratio, which is expressed as an annual percentage.

- Dividends and DRIPs: ETFs pay you dividends or reinvest them automatically via dividend reinvestment plans (DRIPs).

Based on the underlying asset ETFs are:

- Index ETFs – Index ETFs are ETFs that try to copy the performance of a certain index. Indexes like the S&P 500 consist of stocks, but other index consist of commodities or currencies.

- Commodity ETFs – Commodity ETFs are similar to index ETFs but consist of precious metals, agricultural products, or stocks of commodity-related companies like mining facilities and refineries.

- Currency ETFs – Currency ETFs give investors exposure to multiple currencies on the foreign exchange spot market and allow them to profit from interest rates and collateral yield

- Inverse ETFs – Inverse ETFs contain derivatives with the goal of profiting from a declining market by short selling an underlying index.

- Leveraged ETFs – Leveraged ETFs or LETFs try to net a daily profit of multiple times the underlying index’s profit by using leveraged trading techniques and instruments like derivatives, futures contracts, equity swaps, and rebalancing.

- Thematic ETFs – Thematic ETFs are ETFs that focus on certain trends, technologies, or industries, mostly on the long-term. The Global X Cloud Computing ETF is an example of a thematic ETF, that focuses on AI and machine learning.

How to Invest in ETFs in the UAE?

The most common way to invest in ETFs in UAE is through an online broker like Sarwa who offers robo-advisory and brokerage trading services at the same time. You can also trade ETFs on your own or use expert advisors to help you with that.

Best Online Brokers in UAE to Buy ETFs

The best online brokers to invest in ETFs in UAE are Sarwa, AvaTrade, eToro, and Interactive Brokers.

Sarwa

Sarwa is a broker based in Abu Dhabi that offers ETF trading. You can read our Sarwa broker review or visit their site to claim a free $5 funded account.

Avatrade

AvaTrade is the best overall online broker for UAE traders and investors. Via AvaTrade you can trade stocks, forex, cryptocurrencies, and ETFs on multiple trading platforms.

71% of retail CFD accounts lose money

eToro

Min Deposit: $100

Fees: 4.8

Assets available: 4.8

Total Fees:

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro is our recommended broker. They offer commission-free stock and ETF trading and you can open an account with them from 200 AED.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Interactive Brokers

Min Deposit: $0

Fees: 4.9

Assets available: 4.9

Total Fees:

All trading involves risk. More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

Interactive Brokers is a great broker that offers UAE clients a wide range of ETFs and other financial instruments.

All trading involves risk. More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

What Are The Pros and Cons of Investing in ETFs in UAE

Advantages of investing in ETFs:

- Costs – ETFs have a lower expense ratio than stocks because they are not actively managed by professional fund managers like mutual funds.

- Taxation – Investors don’t pay capital gains taxes on ETFs until they sell them. ETFs are mostly long-term investments and one doesn’t pay a redemption fee when selling like with mutual funds.

- Trading – ETFs can be traded around the clock as opposed to mutual funds which can only be sold at the end of a trading day.

- Market exposure and diversification – ETFs provide diversification and a broader market exposure than mutual funds because investors can rebalance portfolios 24/7.

- Transparency – ETFs have to publish the composition of their portfolio, which makes them more transparent than mutual funds which don’t have to do so.

Disadvantages of Investing in ETFs:

- Lower returns – ETFs spread your investment over multiple stocks, which doesn’t yield as high returns as investing in individual stocks.

- Higher Fees – ETFs charge fees that you wouldn’t pay if you created your own portfolio of individual stocks.

- Limit of investment diversification – ETFs limit your investment diversification when they focus only on a single industry.

You should invest in ETFs in UAE because they are cost-effective, easy to trade and diversify your portfolio. Brokers charge lower trading fees on ETFs than on other financial instruments and ETFs give you exposure to many different stocks, commodities, and other assets. When you invest in mutual funds, you have to pay a sales load every time you buy or sell. This is not the case with ETFs. ETFs are easy to trade because you can trade them like stocks.

Conclusion

Investing in ETFs in UAE and Dubai is a great investment option because they are cost-effective, easy to trade, and diversify your portfolio. Brokers charge lower trading fees on ETFs than on other financial instruments and ETFs give you exposure to many different stocks, commodities, and assets compared to other investment options. There are many ETFs available for UAE-based traders and you can get started with investing in ETFs with eToro from 200 AED

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.