Page Summary

Contract For Difference Explained – What Is CFD?

Some consider them to to be a complex product, others consider CFDs a great way to hedge their portfolio or make bold predictions on market outcomes. CFDs are a window to large profits or equally large losses in a short space of time. It’s important, not only to understand the risks and rewards, but to fully understand what a CFD is and know precisely how to use it.

In short, a CFD trading (CFDT) is one of several forms of derivative trading which enables speculative trades on the prices of constantly moving global markets. CFDs enable you to trade on the rising and falling of shares, commodities, currencies, indices, and treasuries.

A major benefit to this instruments is the ability to trade on margin. If you believe prices are due to fall, you can sell (go short) or buy (go long) if you believe that prices are about to rise. You can use CFD trading to hedge a portfolio, insuring your profits during short-term market downturns. In addition, this contracts are taxed differently to their underlying assets and can be more tax efficient for some traders.

How Trading CFD Works?

CFD trading is distinct from certain other types of trading (shares, currencies, and commodities for example.) It does not involve buying or selling the underlying asset. CFD traders instead purchase and sell units of an instrument which indicates whether you believe prices will rise or fall in the future.

CFD instruments often include currency pairs, commodities, shares, treasuries, and stock indices. For each point of movement the instrument changes to your favor, you will gain multiple units of your chosen contract. Where the price shifts against your previous predictions, you will make losses.

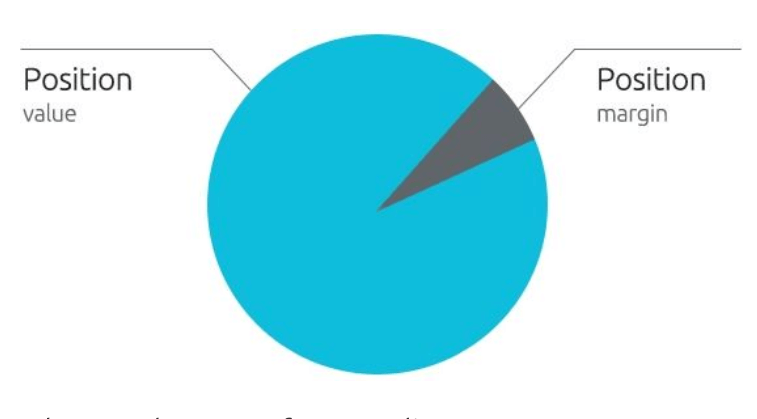

Considering Margin And Leverage

A CFD is what is known as a leveraged product. A leveraged product is one which only requires a low percentage of the entire trade value to be deposited to open your position. Known as trading on margin, or margin requirement, this enables you to amplify your profits (and your losses) by basing them on the complete value of your CFDs position.

Traders utilizing the power of a leveraged product to amplify their gains should take extra care with their positions. Losses can quickly exceed the amount originally deposited to enter the trade.

While an excellent tool to increase profits, the same level of magnification applies to losses too.

Costs Associated In Trading CFDs

Contract for difference products involve some fees, terms, and jargon that traders of physical shares may not yet be familiar with. While they may make some wary of working with the product, these break down simply and provide a better understanding of the process and results of trading with CFDs.

Holding Costs:

Positions still open within your account at the end of the trading day will incur holding costs. This cost can either be positive or negative according to your current position.

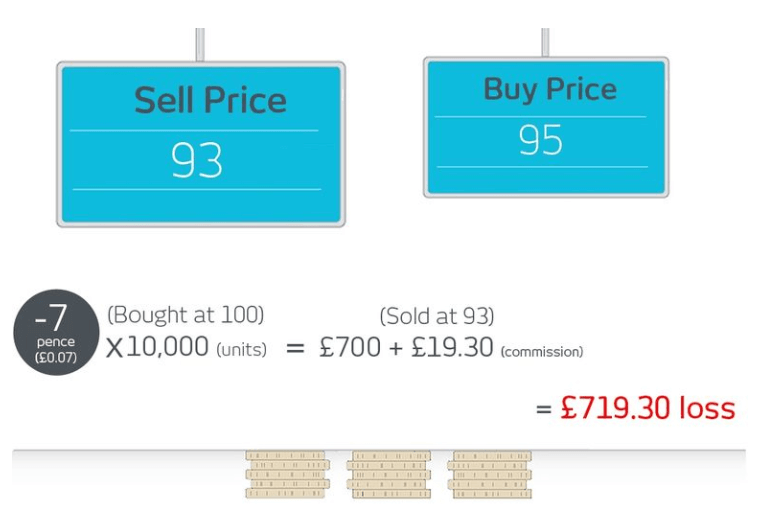

Spread:

Trading CFDs means you are required to pay the spread. The spread is the difference in the purchase price and the selling price of the product. You always enter a trade using the quoted purchase price and exit it using the given selling price.

A narrow spread means just a small price change in your favor will bring you closer to profit and a move against your position, a loss.

Market Data Fees:

Trading or viewing price data for CFDs requires market subscription charges to access the relevant data. Fees for access to this data will typically be charged at various rates according to your data provider.

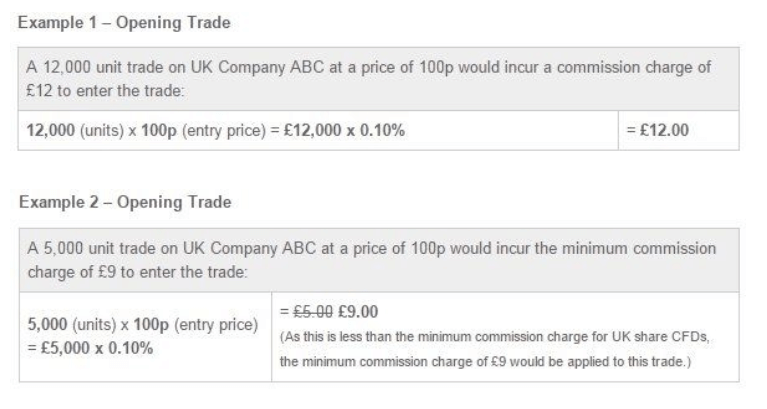

Commission:

CFDs are subject to commission charges when trading. These costs can typically be subject to a minimum charge for smaller trades and often calculated as a percentage from the entire position exposure.

It’s important to remember that commission charges are incurred both when you enter and when you exit a trade too.

Trading examples

To understand this way of trading and get a feel for how it operates, let’s take a look at some simple examples.

Going Long

Consider a UK company, ACME trading at 94 / 100 (This means 94 cents is the selling price and 100 cents is the purchase price). The spread for this particular trade is 6.

You may consider that the company is doing well recently and decide the price is likely to rise in the near future. You want to create a long position on the firm by purchasing 5,000 CFDs at 100 cents. If commission charges are priced at 0.10%, with no minimum in this case, then an additional charge of $5 would also be applied.

You may factor in commission charges into your total profits and losses at the end of the transaction.

The margin rate for ACME is 3%, meaning you are only required to initially deposit 3% of the trade value as position margin. In this trading example you will create a position margin of $150 (100c x 5,000 units = $5,000 x 3%).

Both profits and losses will be based on the entire position value. Therefore, you may gain or lose much more than your $150 margin at the end of the trade.

First Outcome: a profitable trade

You predicted the movement of the market correctly and the price of ACME rises to 104/110, you are ahead of the curve. You can close your position by selling at the new sell price of 104. Commission charges are incurred at the exit of a trade, so an additional charge of $5.20 will be incurred (104c x 5,000 = $5,200 x 0.10%).

The initial price has moved in your favor by 10 cents. The opening price started at 94 and the closing, or current sell price, rose to 104. If you multiply this shift by the amount of units purchased (5,000) you can calculate your trading profit of $500.

To calculate your entire profit, subtract commission charges incurred entering and exiting the trade ($5 + $5.20 = $10.20). On closing your position, your total profit comes to $489.80.

Second Outcome: losing a trade

There is, unfortunately, a second possibility to your trade. You may have backed the wrong company at the wrong time, or the right company at the wrong time. In this case, assume your initial prediction was incorrect and over the course of a week, the value of ACME drops to 90/96.

If you believe the price may continue to drop, you could wish to limit future losses by selling at the new price of 90 cents and close the trade. In this case the commission charged at the exit of the trade will total $4.50 (900 x 5,000 units = $4,500 x 0.10%).

In this trade, the price moved against you by 4 cents from 94 (purchase price) down to 90 (current price). If we multiply this change by the number of units purchased (5,000), your loss on the trade is $200. If we add commission charges on top (entry: $5 + exit: $4.50), your total loss for the transaction is $209.50.

Short Selling CFDs

One of the benefits of contract for difference trading is it enables selling an instrument you believe is going to fall in value. In this case, you can profit from predicting a falling market.

If you correctly predict a fall in price, you can buy back the instrument at the new, lower price to turn a profit. If your predictions turn out to be incorrect, if the price rises, you will incur a loss on the trade. Similar to our previous example trades, your losses on short selling a contract can exceed your initial deposit.

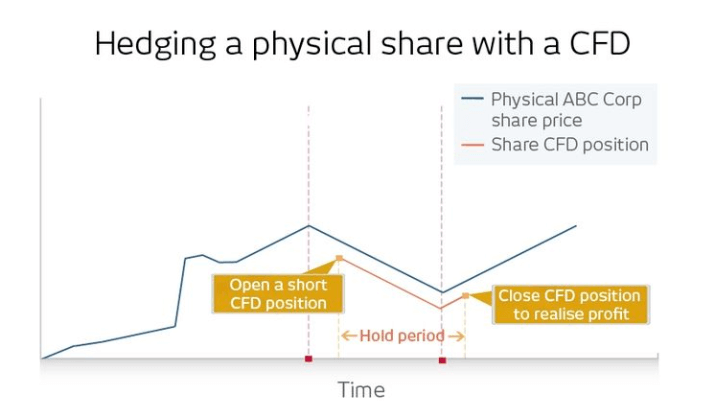

Using CFDs to hedge your physical portfolio

Contracts for difference can be an excellent way to hedge physical shares in your existing portfolio. If you are already invested and think those shares are liable to lose some value in the short-to-medium term, you can choose to hedge using contracts for difference.

By using short selling, you can make a profit by predicting short-term downward shifts which will offset losses from your current portfolio.

If, for example, you hold $10,000 worth of physical ACME Corp shares in your current portfolio; you could take out a short position or choose to short sell the same value of ACME Corp using contracts for difference.

In this case, were ACME Corp’s share price to lose value in the market, the losses incurred within your share portfolio could be offset from the profits you make in your trade. Closing out your trade will secure your short-term profits as the downtrend comes to a close. When the value within your physical shares begins to climb again, your profits will be secured by gains reached using your CFD.

Contract for difference hedging is currently a popular strategy for investors, particularly those operating in volatile markets.

What Is CFD Trading?

Whether looking for new strategies to hedge your portfolio or find more avenues to exploit the markets for profit, contracts for difference are an instrument that open up new doors into the markets.

The benefits and unique opportunities that are provided by contacts for difference can work to the advantage of a market-savvy trader. Their leveraged effect can boost profits and hedge your portfolio. But remain cautious, they can bite back and incur larger than normal losses too.

With background knowledge, a little more awareness, and a brush up on the terms and technicalities; you could be ready to dive into the world of trading and open up entirely new avenues.

Best Trading Platforms for CFDs

If you are about to start trading CFDs, this are the best trading platforms we can recommend to use:

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.