Fidelity is the most popular brokers in the US with a safe and profitable track record. It offers $0 stock trades, in-depth research, advanced trading tools, and learning opportunities. Fidelity has licenses from top-tier regulators, FINRA and SEC. Fidelity provides significant support for beginning traders and has the most extensive investment library of its competitors.

Fidelity

Best ForStocks & ETFs

Recommended ForLong-term investors, Active stock traders, and Retirement-focused investors

More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

Best ForStocks & ETFs

Recommended ForLong-term investors, Active stock traders, and Retirement-focused investors

- Trader Level Beginner-Advanced

- Stock Fees Low

- Options Fees Low

- Wealth Management Yes

Web trading platform4.7

Fees4.1

Mobile App5.0

Deposit and withdrawal 1.3

Available assets4.9

Account opening5.0

Education and Research 4.3

Support4.5

Overall rating4.2

More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

Top findings from our Fidelity review:

- Fidelity offers an excellent trading experience with a straightforward mobile app and professional-grade tools.

- It has no fees for inactivity, account closure, transfer, and trade confirmations. Fidelity doesn’t charge a commission for online stock, ETF, or OTCBB trades.

- Fidelity offers an extensive asset catalog, including stocks, bonds, and options. Forex and futures trading isn’t available at Fidelity.

We recommend Fidelity for traders looking to improve their trading skills. It has many educational resources and competitive prices for the best trading experience.

Trading Platforms

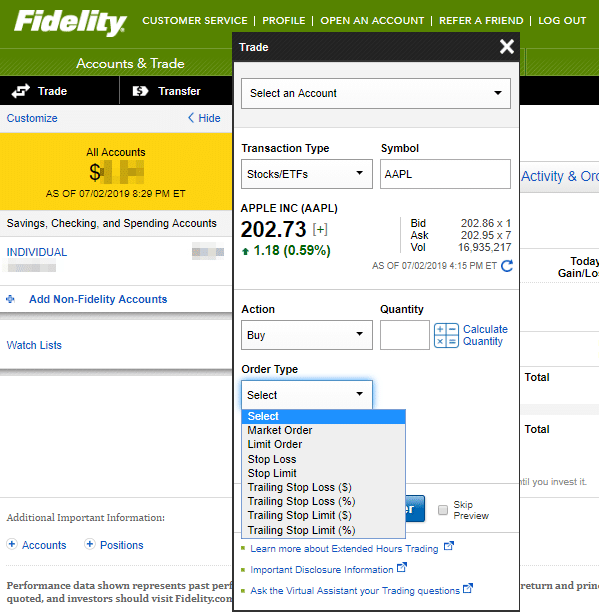

Fidelity offers excellent web, desktop, and mobile platforms. All are simple to understand, reliable, and secure. These platforms include distinct versions of news feeds, alerts, and tools for placing orders. All Fidelity platforms are available in English.

Desktop

Active Trader Pro is Fidelity’s flagship desktop platform. It is an excellent choice for active traders, and it offers several trading tools:

- Watch Lists with streaming quotes and up to 48 columns of data

- Straightforward Charting and 22 distinct drawing tools, 166 studies, notes, and more

- Active Trading features including Real-Time Analytics and Trade Armor

Web

Fidelity has an in-house web platform, well-designed and straightforward. Traders track trades and manage up to 50 stocks as a single entity with basket trading. This app has professional account features including short selling and margin trading.

The active trading software allows qualified traders to get streaming quotes and more. It is a good choice for experienced traders who want access to competitive prices.

Mobile Trading

Fidelity’s mobile trading app is available on iOS and Android. It is user-friendly and great for trading stocks, ETFs, options, and mutual funds. Fidelity has fractional share trading on its mobile platform. It allows customers to choose dollars rather than shares when entering an order.

The app is comprehensive and has several useful features. Its Workflow is functional, contributing to a smooth trading experience.

Fees and Spreads

Fidelity has low trading and non-trading fees. The rates for some financial instruments and mutual funds are higher. Fidelity has a transparent fee policy available on its website.

There are no fees for:

- deposits

- withdrawals

- account

- inactivity

- account closure or transfer

- exercise/assignment

- sending and receiving wires in USD

- sending checks

- paper statements

- trade confirmations

Fees

| Header | Fidelity | Interactive Brokers | Charles Schwab |

| Account Fee | No | No | No |

| Inactivity Fee | No | Yes | No |

| Deposit Fee | $0 | $0 | $0 |

| Withdrawal Fee | $0 | $0 | $0 |

Fidelity has a versatile asset portfolio, including stocks and international stocks. Forex and futures trading isn’t available. The web and desktop platforms offer access to assets available at Fidelity. Equities, options, and mutual funds are tradable instruments only on the mobile app.

Withdrawals And Deposits

Fidelity has 16 base currencies in its portfolio for managing funds. Withdrawing and depositing funds isn’t available via debit/credit cards.

Deposits

Fidelity has 16 base currencies for depositing funds, including USD, EUR, and GBP. Deposits are available with a check, ACH transfer, wire transfer, and PayPal.

Withdrawals

Withdrawals are available only for ACH and wire transfers in USD. Non-USD currencies come with a 3% fee on withdrawals.

Account Types

Fidelity has nine account types, depending on your investment preferences and experience. The main categories are retirement, education, general investing, and charitable giving.

Accounts

| Account Type | Description |

|---|---|

| Brokerage Individual Account | A single individual owns and uses the account |

| Brokerage Joint Account | Two or more individuals own and use the account |

| Business Accounts | A legal entity owns and uses the account |

| Estate/ Trust Account | A Trustee (separate legal entity) holds the account for your benefit |

| Roth / Traditional / Rollover IRA Accounts | Individual retirement accounts |

| Education Savings Account | Account is for educational purpose savings |

| Charitable Account | Tax-efficient account for a charitable giving |

| Medical Savings Accounts | Account is for healthcare purpose savings |

| Fidelity Managed Accounts | Fidelity’s professionals manage these accounts (Robo-advisor accounts managed by Fidelity technology) |

Regulation & Reputation

Fidelity has top-tier licenses from FINRA and the SEC. US clients receive the US Investor Protection scheme. The SIPC protects stocks, bonds, notes, mutual funds, and other tradeable assets. It does not cover cryptocurrencies like Bitcoin.

When it comes to safety and reliability, Fidelity is one of our top choices. It receives frequent awards for its safety measures and online trading experience.

Customer Service

Fidelity has an excellent customer service team available through live chat, email, and phone. The service is reachable 24/7, and the response time is decent. Customer support at Fidelity is available only in English.

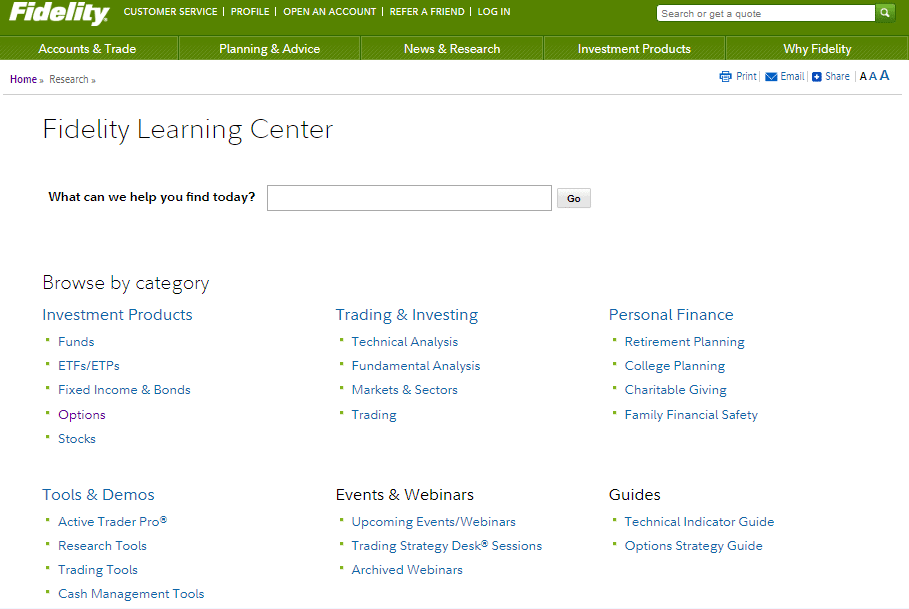

Research & Education

Fidelity has impressive research and education tools for traders of all levels. The research tools include flexible screeners, calculators, and an in-house market commentary. The rich set of educational materials at Fidelity includes webinars, articles, videos, podcasts, and demo accounts.

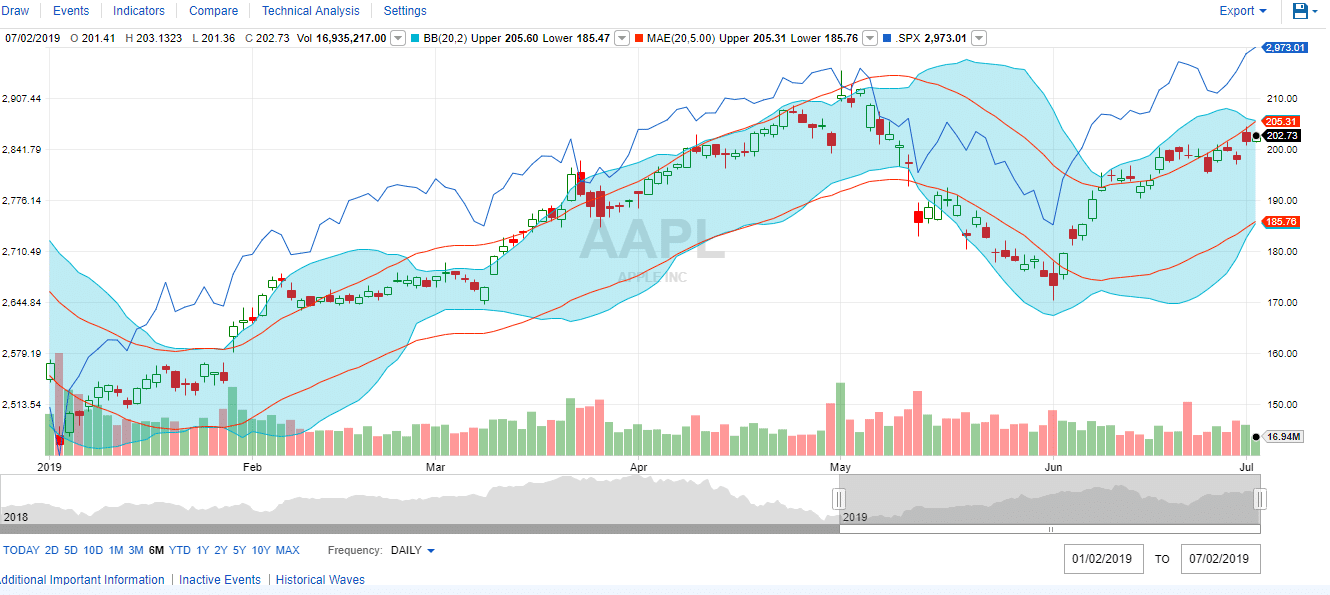

Technical Analysis

Fidelity offers technical patterns and events from Recognia. The social sentiment score comes from Social Market Analytics. Traders have access to up to 40 years of historical price data, 30 days of intraday data, and more than 60 customizable technical indicators.

Charting

Charting is more flexible and reliable on the desktop and web platforms than on the mobile app. Fidelity offers chart styles, including point & figure.

Fundamental Data

Fundamental data has information for assets including funds and stocks. Information is available in peer-group companies, dividend calendars, financial statements, and more.

Trade Ideas

Fidelity’s stock, ETF, and mutual fund screeners are straightforward. They offer rich data and set the standard for the industry.

News

This broker has diverse news sources with real-time updates. These include global markets as well as the US market.

Stock Research

Fidelity has 16 third-party research reports for stocks and five for ETFs. It is the most extensive set of research reports offered by any broker in the industry.

Market Commentary

This broker offers valuable insights on trading with their Viewpoints category. It gives guidelines and insights on which data to follow or trends to watch. The Market Commentary service from Fidelity is best for professional traders due to the in-depth sector analysis.

Education

With many educational materials Fidelity is an excellent choice for inexperienced traders. It organizes content into roadmaps with progress tracking depending on your experience level.

The Online Learning Center features more than 600 resources on options, fixed income, retirement, and technical analysis. The small-group online coaching sessions provide an excellent opportunity for in-depth trading discussions.

Final Verdict

Fidelity is the leading US stockbroker with top-tier licenses and has an impressive reputation. They have an interactive mobile app, with excellent functionality and intuitive design.

The product range at Fidelity covers all popular asset classes. Products cover both the US market and international stock exchanges. Forex and cryptocurrency trading is not available.

Fidelity has a reliable web trading platform with excellent design and research tools. Its competitive cost structure and rapid access to research and education make it a top choice for US-based beginning traders.

FAQ

Is Fidelity a Safe Broker to Invest With?

Fidelity is a reliable online broker with a long standing history. It has top-tier licenses and an impressive reputation in the US and globally.

Is Fidelity Good for Beginners?

Fidelity is a great fit for beginner traders because of its organized learning tools addressing beginner, intermediate, and advanced topics. This broker has an extensive FAQ and educational hub where traders learn the basics about investing and trading.

Is There A Minimum Deposit Fee?

The Basic trading account at Fidelity does not have a minimum deposit. Other accounts do have an initial deposit varying from $2,000 to $500,000.

Is Futures Trading Available At Fidelity?

Trading futures and futures options are not available at Fidelity.

Compare Fidelity With Other Brokers