Page Summary

There are different forex account types available for traders and its important to choose the right. The most important criteria to consider are costs, features, trading platforms, customer support, currency pairs and research.

This guide breaks down different forex trading accounts available to UAE traders and what the differences are between them.

Forex Account Types

The most common forex trading accounts are:

- Spot Forex and Forex CFD Accounts

- Forex Demo Accounts

- Standard Lot Forex Accounts

- Mini and Macro Forex Accounts

- STP Forex Accounts

- ECN Forex Accounts

- Managed Forex Accounts (MAM, PAMM, LAMM)

- VIP Forex Accounts

- Islamic Forex Accounts

Differences Between Forex Trading Accounts

Forex trading accounts differ in four ways: risk tolerance, trade execution, trade frequency, and religion.

Spot Forex vs Forex CFD Accounts

The difference between Spot Forex and Forex CFD accounts is that Spot Forex accounts are for big participants like banks and hedge funds that trade on the interbank market and that Forex CFD accounts are for retail traders who trade with retail brokerage firms and trading platforms. CFD trading can involve margin through spread betting and leverage. With CFD trading you borrow money from the broker to be able to open bigger positions.

Forex Demo Accounts

Forex Demo accounts are forex trading accounts with a virtual balance that you can use to test out a trading services. A forex demo account is a great way to familiarize yourself with online trading. The most popular forex demo account is the MetaTrader 4 demo account.

Standard Forex Accounts

Standard Forex accounts are forex trading accounts where the trade size is 1 Standard Lot. A Standard Lot is 100,000 of any currency traded and 10 units of this currency resemble 1 pip of movement. In the past, these forex accounts came with high commissions and you needed lots of capital to open them. Nowadays you can open a Standard Forex Account for a few hundred AED and trade the markets with lower fees.

Mini & Micro Forex Accounts

With Mini and Micro Forex accounts, the trading lot size is 10,000 units instead of 100,000 and trading 1 lot has the exposure of either 1 unit per pip or 0.1 unit per pip. Lower lot sizes mean lower potential profit but also less risk. Mini and Micro forex accounts are ideal for beginner traders or people that don’t want to trade with large sums of money.

Standard Forex Accounts and Dealing Desk Execution

Most trades done with Standard Forex accounts are done via a broker’s dealing desk. This dealing desk hedges the risk of brokers. If one trader goes long on EUR/USD and another trader goes short for the same amount, their trades are matched and the broker doesn’t take any risk. If one trade is larger than the other, the broker can choose not to take any risk by taking the other side of the trade. Trading accounts with dealing desks often have lower spreads than STP Forex accounts.

STP Forex Accounts

Trading via a Straight Trough Processing account differs from a dealing desk broker model because the broker passes the risk or exposure of positions over to its liquidity providers. STP brokers earn money by adding spreads on trades rather than taking other sides of trades. This increases trust because the broker doesn’t trade against the trader, but also trading fees.

ECN Forex Accounts

Electronic Communication Network forex accounts are like STP forex accounts but with this account type, the broker sends the trades to the entire market rather than to its liquidity providers. This lowers spreads but most brokers charge commissions for ECN forex trading.

Managed Forex Accounts – PAMM, LAMM, and MAM

Managed forex accounts are forex accounts that are managed by forex fund managers for their clients. There are three types of managed forex accounts: LAMM, PAMM, and MAM.

- LAMM (Lot Allocation Management Module) – With this type of managed forex account the trader decides the number of lots to be traded. The forex fund manager allocates different leverages and places trades according to this amount of lots. LAMM accounts can be copy trading accounts.

- PAMM (Percentage Allocation Management Module) – With PAMM accounts the fund’s gains and losses are distributed among investors according to how much they have invested.

- MAM (Multi-Account Manager) – This type of managed forex account is a combination of LAMM and PAMM, where the investor has more flexibility on how his funds are invested.

Related: MAM vs PAMM accounts

VIP Forex Accounts

VIP Forex accounts are trading accounts for big clients that come with benefits like better spreads, lower commissions, guaranteed pricing, free VPS hosting, access to private research content, and a dedicated account manager.

Islamic Forex Accounts

Islamic forex accounts are trading accounts for Muslim traders that follow Sharia laws by not charging interest on overnight positions but commissions and administrative fees instead. Here is our list of the best islamic forex brokers.

Best Forex Brokers Overall

When you know what type of forex account you want to use it is time to choose the right broker to trade with. Below we will discuss the 3 best forex brokers from our list of the best forex brokers in UAE.

eToro – Social Trading Forex Broker

Min Deposit: $100

Fees: 4.8

Assets available: 4.8

Total Fees:

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro is one of the world’s largest forex brokers with a social trading platform. With social trading, it is possible to copy other traders’ positions on auto-pilot. This is great for beginners and traders who don’t have the time to trade the markets themselves. On eToro traders can trade 49 forex pairs, over 2,500 stocks, 249 ETFs, and 94 cryptocurrencies.

Pros

- Easy to use trading platform

- Many available assets to trade

- Copy Trading

- Regulated by multiple authorities like CySEC and FCA.

Cons

- Sometimes the trading platform freezes because of so many users

- Limited technical analysis tools

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Libertex – Broker with Low Trading Fees

Libertex is a broker with low trading fees because they don’t charge spreads but a 0,03% commission per trade. This commission can be lowered further by increasing your status level. Low trading fees matter because if you trade a lot the costs start adding up. You can trade with the Libertex WebTrader or via MT4 or MT5.

Pros

- Low trading fees

- Compatible with MT4 and MT5

- Possibility to further lower commission

Cons

- Charges withdrawal fees

- Charges inactivity fees

Forex.com – Best Forex Broker

Forex.com is the best forex broker because it has many exotic currency pairs, charges low spreads, offers an STP Pro account, and provides educational material and technical analysis tools. Forex.com is a forex broker where you can trade over 80 currency pairs. With most other brokers you can only trade about 50.

Pros

- Biggest selection of forex pairs available

- Provides educational material and analysis tools

Cons

- Small selection of other assets

- $500,000+ needed to reach professional client status

80% of retail CFD accounts lose money

How to Start Trading Forex at eToro

You start trading forex at eToro by choosing a username and password, filling in your personal details, confirming your identity, and depositing funds into your account. Below we will outline each of these steps.

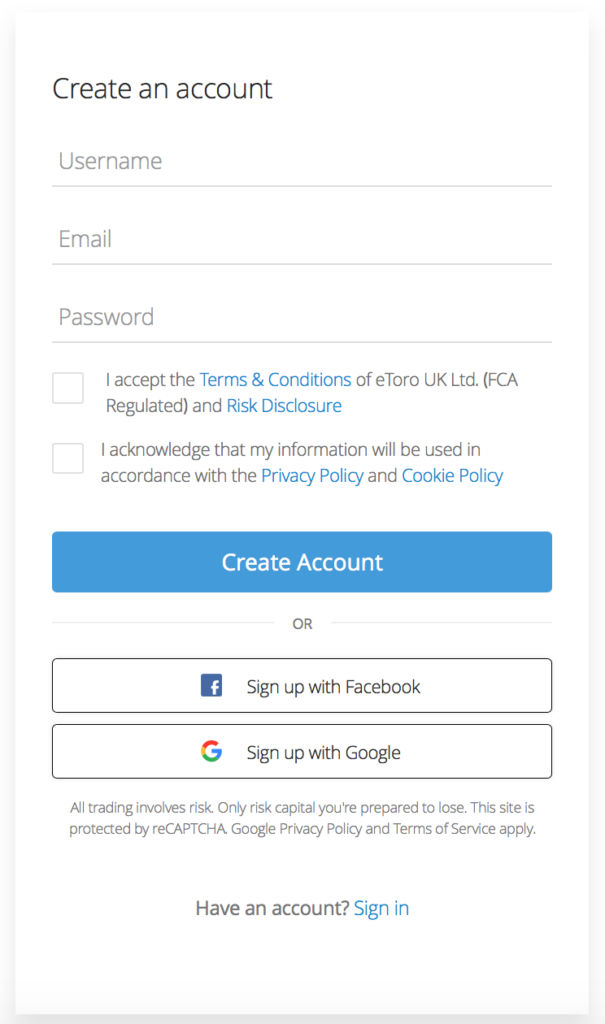

- Go to the eToro website, click on ‘Sign Up’, choose a username and password for your account, fill in your email and phone number, and agree to the Terms and Conditions of Etoro.

- The next step is to fill in your personal details to complete your profile.

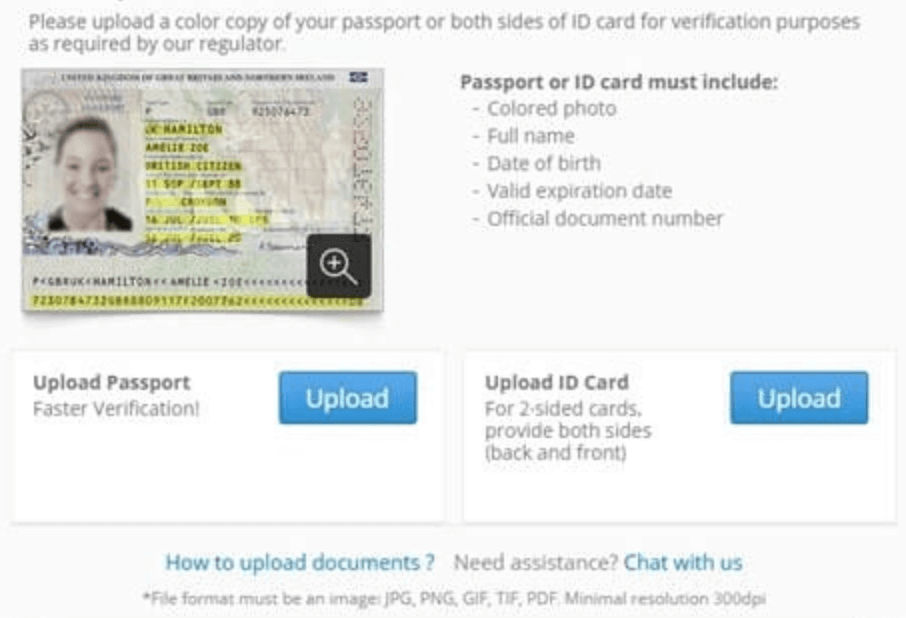

- When you have filled in your details, you will need to confirm your identity by uploading a passport or driver’s license and a recent utility bill or bank statement.

- Once you have done this, you will need to deposit funds into your eToro trading account. You can do this by credit card, bank transfer, Klarna, e-wallets like PayPal, Skrill, and Neteller, and cryptocurrency. The minimum deposit required to open an eToro account is $50 or 200 AED.

Forex Account Types for UAE Traders – Our Verdict

In this guide, we have explained to you the differences between forex trading accounts and what the best forex brokers are for UAE traders. With this knowledge, you can open the right forex account for you today. We recommend you to open a Mini or Micro Trading Account if you are a beginner trader, an STP or ECN Account if you want a transparent broker, a low spread Standard Account if you want low trading fees, a managed trading account if you don’t want to trade yourself, or an Islamic Trading account if you want to trade Sharia-compliant.

FAQ

Can I trade crypto with UAE forex brokers?

Yes, most UAE forex brokers have cryptocurrencies in their available assets. You can either trade crypto CFDs, where you speculate on the price of the underlying asset, or trade crypto directly at brokers like eToro.

Can I trade other assets than forex pairs with a forex broker?

Yes, most brokers offer forex, commodities, indices, cryptocurrencies, ETFs, and equities to trade. At some brokers, you can trade advanced financial instruments like futures, options, interest rates, and bonds.

What is the best trading platform to use for trading forex?

Most forex traders use MetaTrader 4 (MT4) and almost every forex broker offers this platform. Alternatives are cTrader, MetaTrader 5, and brokers’ own trading platforms.

Can I trust forex brokers?

Yes, you can trust regulated forex brokers. You can get an idea of the trustworthiness of a broker by contacting their customer support and seeing how their staff handles questions and issues.

Do I need to trade with a regulated forex broker?

Yes, it is very important that your forex broker is regulated by authorities like the FCA, SEC, and DFSA because else you might not get your money back after funding your account.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.