Page Summary

Many investors and traders from the UAE want to know how to buy US Stocks. We will explain to you how to do that in this how-to buy US stocks from the UAE guide.

We want to underline that owning stocks and CFD trading stocks are two different things.

Most brokers offer stocks but sell you a CFD (contract for difference). With a CFD you are betting on the stock’s price movement. You do not get to own the stock. With CFDs, you only make money on the price movements of stocks.

None of these ways of investing is better or worse than the other. Some investors prefer owning stock, others to trade CFDs.

In this guide, we will be looking at brokers where you can buy US stocks from UAE. This means you will own the shares. To buy US stocks from UAE, you need to sign up with a reliable broker.

List of brokers where you can buy US stocks from UAE:

- eToro Review UAE 2025 – Best for beginners, social trading

- Interactive Brokers Review UAE 2025 – Best for active traders, trading conditions

- Trading212 – Best broker for mobile trading

- Saxo Bank Review UAE 2025 – Best for professional traders

- Swissquote – Best for investors, research and education

| RANK | BROKER | GENERAL | PLATFORM SCORE | BEST FOR | WEBSITE |

|---|---|---|---|---|---|

| #1 | eToro Review UAE 2025 | Numbers of US stock Available…..Not more than 1k | 4,5/5 | Best for beginners, social trading | Official website

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

| #2 | Interactive Brokers Review UAE 2025 | Numbers of US stock Available…. Approx 100k | 4,9/5 | Best for active traders, trading conditions | Official website |

| #3 | Trading212 | Numbers of US stock Available….Not more than 1k | 4,3/5 | Best broker for mobile trading | Official website |

| #4 | Saxo Bank Review UAE 2025 | Numbers of US stock Available…Approx 10k | 4,9/5 | Best for professional traders | Official website |

| #5 | Swissquote | Numbers of US stock Available…Approx 15k | 4,2/5 | Best for investors, research and education | Official website |

eToro Review UAE 2025

BEST FOR TRADING: Social Copy Trading Forex

TRADER LEVEL: Beginners

Nr. OF CURRENCY PAIRS: 49 Major, Minor and Exotic

MAX LEVERAGE: 1:30

Min Deposit: $100

Fees: 4.2

Assets available: 4.0

Total Fees: Low

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Interactive Brokers Review UAE 2025

BEST FOR TRADING: Stocks, ETFs, Options and Futures

RECOMMENDED FOR: Advance Traders, Day Traders, Institutional Investors

TRADING COSTS: Low

Min Deposit: $0

Fees: 4.9

Assets available: 4.9

Total Fees:

Saxo Bank Review UAE 2025

BEST FOR TRADING: High Volume

TRADER LEVEL: Advanced

Nr. OF CURRENCY PAIRS: 200 forex spot pairs and 125 forwards

MAX LEVERAGE:  1:500

Min Deposit: $0

Fees: 4.7

Assets available: 4.9

Total Fees:

69% of retail investor accounts lose money when trading CFDs with this provider.

Swissquote

Min Deposit: 0

Fees: 3.0

Assets available: 4.9

Total Fees:

84.5% of retail investor accounts lose money when trading CFDs with this provider.

1. eToro Review UAE 2025 – Best for beginners, social trading

Min Deposit: $100

Fees: 4.2

Assets available: 4.0

Total Fees: Low

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

eToro is a reputable global brand and industry leading broker for copy trading. Their robust and cutting edge copy trading platform and social trading features allow users to copy trades and portfolios from professional traders and investors.

As a CFD multi asset broker, eToro allows users to trade on over 3075 different symbols including stocks, forex, cryptos, indices and commodities. Trading spreads are wide, deposits are free and account minimum is low. There are conversion and inactivity fees. eToro provides a comprehensive list of technical tools, charts, and newsfeeds. Their customer support is available through email and live chat in Arabic and English.

eToro is a well established market maker broker with a clean history record, regulated by top tier regulators.

Pros

- Access to over 4000+ tradable symbols

- Great overall market coverage

- Easy to use mobile trading app and platforms

- Industry leading social/copy trading app

- Great cryptocurrency trading features

- Responsive customer support

Cons

- Algorithmic trading not available

- Forex and CFD fees above industry average

- Education and research tools missing

Key features

- Sophisticated social-copy trading features

- Multiple different payment options

- Crypto exchange and brokerage services on the same dashboard

- Super fast registration and KYC on-boarding process

- Zero commission stock trading

- Great ease of use level

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. Interactive Brokers Review UAE 2025 – Best for active traders, trading conditions

Interactive Brokers is a highly trusted global broker with a well-rounded offer of tradable markets, great educational content and sophisticated order type configuration. It is a high trusted and well capitalize company with an industry leading trading platform, a competitive fee structure and great global market access. Their low entry level and the Global Trader platform, which is intuitive and easy to use trading station, make this broker s great choice for beginners and advanced forex traders.

Professional and seasoned traders will appreciate the great selection of advanced trading tools and order type configurations available on their proprietary Trader Workstation desktop platform (TWS).

Pros

- Best market coverage in the industry (100k+ assets on different instruments)

- Access to 16,500 shares and 8,000 stocks as CFDs

- Professional trading platform suitable for different types of traders

- Intuitive and easy to use mobile trading app

- Industry leading fee structure

- Compatible features for casual and professional traders

- Responsive customer support

Cons

- Few deposit and withdrawal options

- Research and education materials missing

Key features

- Margin loan rates on stocks of 1.3%

- Access to 135+ global markets

- Advanced order types, tools and features

- Access to frictional shares

- Lowest commissions in the industry

63.3% of retail investor accounts lose money when trading CFDs with IBKR.

3. Trading212 – Best broker for mobile trading

Trading212 is a CySEC and FCA-regulated forex, CFD, and stock broker where traders can trade over 7,000 financial instruments including shares, commodities, ETF’s, cryptocurrencies with up to 1:30 leverage whilst paying no commission. Trading212 allows investors to buy fractional shares and has two trading platforms available, one for stocks and ETF’s and one for CFD’s.

Trading212 is not compatible with MetaTrader 4, 5, cTrader or other external trading platforms, but its own trading platforms are beginner-friendly and feature all the tools and functionalities needed to trade the financial markets successfully. Traders can make use of dynamic charting, multiple advanced order types, and technical analysis tools like indicators.

Trading212 provides educational material in the form of Youtube videos and has a free demo account available for those who want to test-drive the trading platform before trading with real money. Opening a live trading account can be done from $10.

The Trading212 customer support is available by live chat and email in English, German, French, and 5 other languages.

Pros

- Over 7,000 available assets

- Free demo account

- Up to 1:30 leverage

Cons

- Not compatible with external trading platforms

- Charges 0,7% deposit fees

Key features

- Provides access to over 7,000 different stocks, commodities, forex pairs, ETF’s, and cryptocurrency CFDs

- Dynamic charting, advanced order types, and technical analysis tools

- Regulated by the FCA and CySEC

- Low minimum deposit required of $10

- Funds up to €1m insured by Lloyd’s of London

- Offers the opportunity to invest in fractional shares

4. Saxo Bank Review UAE 2025 – Best for professional traders

Min Deposit: $0

Fees: 4.7

Assets available: 4.9

Total Fees:

69% of retail investor accounts lose money when trading CFDs with this provider.

Saxo Bank is a reputable global brand known for its complete overall offer and exclusive conditions for high volume traders and investors. Users can enjoy cutting edge trading technology paired with a premium interface and great trade execution on mobile and desktop. The Saxo Bank trading platform offers a feature rich trading experience, easy to use interface, competitive margin rates, and trading on over 40,000 financial instruments. This makes them an industry leader in trading assets coverage as an ECN broker.

If you can afford the minimum deposit of $10.000, this is the go to broker for traders and investors at all levels. They combine high-quality in-house research with top-tier third-party providers and a diverse portfolio of investment options.

Investors who are looking to trade in accordance with Sharia Law can open an islamic account. Saxo Bank also offers high quality customer service in Arabic and English language via phone, email or in person at their local office with guaranteed satisfying answers.

Pros

- Industry leading market coverage

- Excellent Trading Features with SaxoTraderGo

- Advanced order type and account protection features

- Intuitive and easy to use mobile trading app

- Great education and research materials

- Competitive fee structure for active traders

Cons

- $10,000 minimum deposit for UAE users

- High time investment to set up

- Only for advanced traders

Key features

- 40.000 tradable symbols available (crypto derivatives, forex options and futures)

- Advanced account protection and order types

- Fast execution of trades

69% of retail investor accounts lose money when trading CFDs with this provider.

5. Swissquote – Best for investors, research and education

Min Deposit: 0

Fees: 3.0

Assets available: 4.9

Total Fees:

84.5% of retail investor accounts lose money when trading CFDs with this provider.

Swissquote is a low risk forex and CFD online broker, regulated by 4 top-tier financial regulators. It is a great choice for traders who are looking for high quality research, daily market updates, a great variety of tradable assets and account security on a Swiss bank.

Their Advance Trader proprietary trading platform suite is available as desktop, web and mobile version. Together with the MetaTrader platform suite, it delivers an excellent trading experience for traders and investors at all levels. Minimum deposit is $1000 and trading fees are above industry average. Swissquote operates a bank.

Choose Swissquote if you are looking to trade physical cryptos with a highly trusted online broker that also offers great banking services.

Pros

- Great choice of trading instruments offered

- Very good research and education

- Great For Mobile Trading

Cons

- Few deposit and withdrawal option

Key features

- Access to over 3,000,000 financial instruments

- Cash dividends paid out monthly into your account

- Trade with a FINMA-regulated and Swiss stock exchange-listed broker (SIX:SQN)

- Receive the Swissquote magazine monthly for free

- Set up your own algorithmic trading bot with Swissquote Robo-Advisory services

- Low, fixed fees capped at 0,75% of your invested amount

84.5% of retail investor accounts lose money when trading CFDs with this provider.

Note that there are more brokers that allow you to buy US stocks from UAE, each with its own pros and cons.

What are the differences between brokers?

The differences between brokers are the commissions they charge, their minimum deposits to open an account, and the products they offer. We will discuss the differences between brokers below.

Commissions

Most brokers charge traders a commission every time they want to buy or sell a stock. There are commissionless brokers, but they charge spread. You should always take these fees into consideration. Let’s say you buy $3,000 worth of stocks via a broker and they charge you $90 for doing so, then you pay a total of $180 in fees. $90 for buying and $90 when selling in the future. This means that you are effectively paying 3% in fees. These fees add up and eat your profits.

Minimum Deposits

Minimum deposits vary among brokers. Some brokers like Saxo Bank require you to deposit $10,000 or more to open an account. Other brokers like eToro are low-entry and require only a $50 minimum deposit.

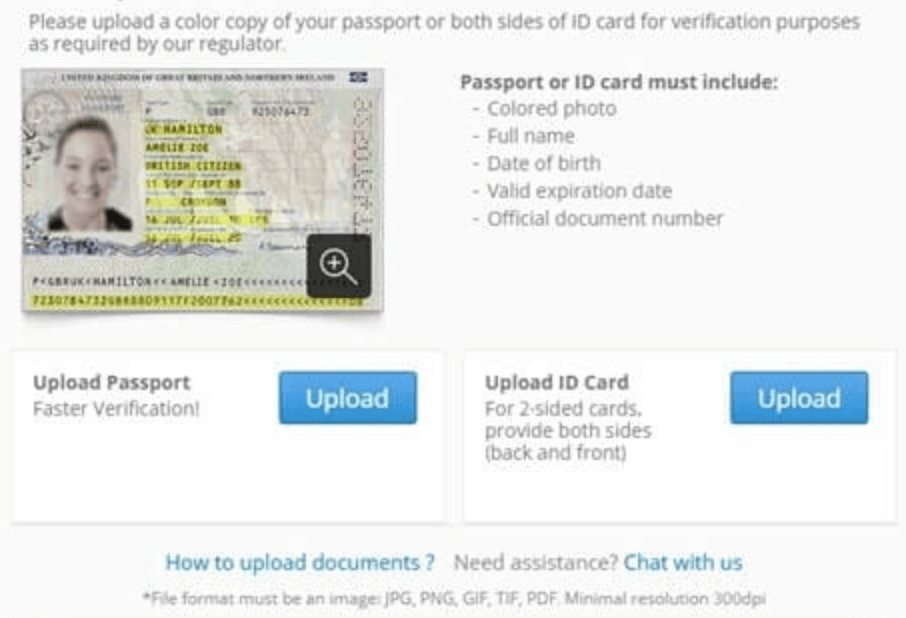

Account Opening

To open a brokerage account, you have to supply personal details. Some brokers need more personal details than others. At most brokers, you need to upload income proof, bank statements, and proof of identity. eToro only requires proof of identity. In most cases, you need to upload a photo of your passport, national ID card, or a recent utility bill (which shows your address).

Which brokers do we recommend trading at?

Every broker has pros and cons and you should consider many factors when choosing a broker. These factors include your trading experience level, the brokers’ trading platform, and the number of trades you place.

After testing many brokers, we recommend eToro to our users. eToro offers stock trading without commissions, but other fees may apply. Their trading platform is well suited for all kinds of traders and investors. This trading platform is available in most languages and accessible from more than 140 countries, including the UAE.

eToro Social Trading

One of the pros of using eToro’s trading platform is that you can take part in social trading. With social trading, you can see other traders’ portfolios and their profit/loss rates. You have the possibility to copy one or more traders.

This means that your account will place the same trade as they are doing, every time they do so. You can expect around the same profit or loss as them by copying them.

How to open an account with eToro?

You open an account and invest in stocks with eToro by registering an account, verifying, and funding it. We will describe this process below.

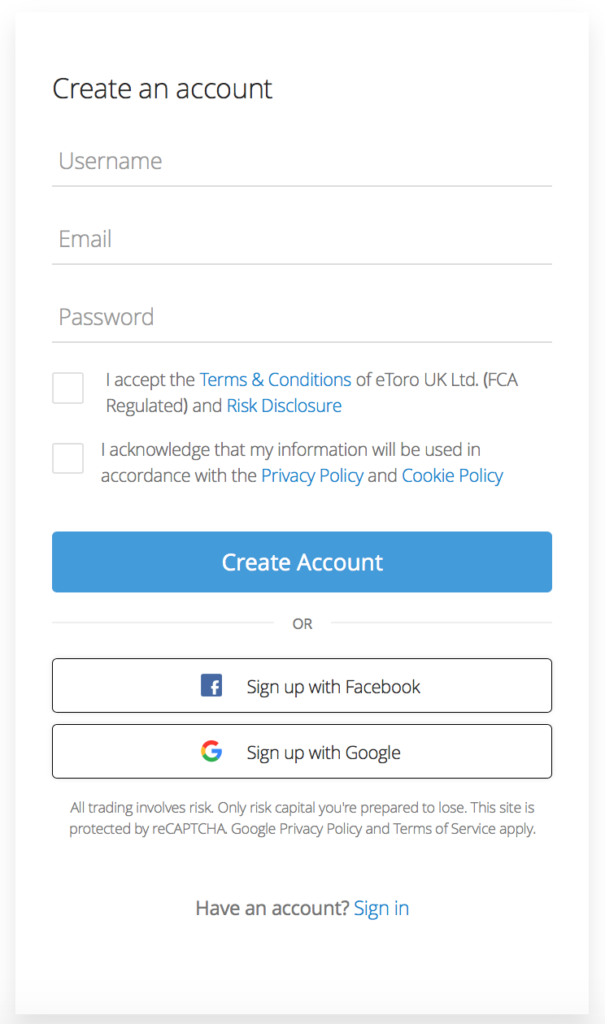

Step 1: Open an eToro account

Click this link to visit eToro’s website. On their website you click on the ‘Join Now’ button, choose a username and a password for your account and fill in your email address.

You will receive an email to confirm your registration. Click on the link in this email to proceed with your onboarding with eToro.

Once you have clicked on this link, you can log in to the eToro trading platform. Your account will still be unverified, so you will have to verify it. We recommend doing this because it removes any deposit and trading limitations.

Step 2: Verify your eToro account

Verifying your eToro account is an easy and straightforward process. You need to upload a photo of your passport and a valid utility bill to do so. This proves your identity and address. Note that it can take eToro a few days to check the information. Your account is verified when your personal details are approved.

Step 3: Funding your eToro account

You will need to fund your account before you can trade on eToro. Funding your account can be done via the eToro cashier page. eToro has many available payment methods to make a deposit like PayPal, Skrill, credit cards, and other e-wallets. The minimum deposit at eToro is $50, which means you cannot deposit less.

Step 4: Start trading and investing on eToro

Once you have funded and verified your eToro account, you are ready to invest. You can use the search bar to search for any stock you would like to buy. Like we said before, it is possible to buy US stocks from UAE this way.

When you have found the stock you want to buy, you click the ‘trade’ button and enter how much you want to invest. It is not necessary to buy entire stocks. It is possible to buy a Fractional Share, which means that you can buy parts or shares of stock. If a certain stock is $1000 and you only want to invest $500, you will get 0,50 shares.

How to buy US Stocks from UAE – Bottom Line

Buying US stocks from the UAE is easy and everyone can do it. All you need is a brokerage account with a reliable broker. Opening such an account is hassle-free, as long as you provide all necessary documents. We recommend signing up at eToro, as it’s one of the most beginner-friendly brokers.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.