Page Summary

Crypto is getting more and more popular and investors want to get in on the action. Ripple (XRP) is one of the fastest-growing cryptocurrencies and is a good option for investors. In this guide, we will explain where and how to buy Ripple in UAE and how to protect your cryptocurrency investments.

How to Buy Ripple in UAE – Quick Steps

The most common way to buy Ripple in UAE is to open an account at eToro, verify your identity using KYC, deposit funds and store your XRP in a e-wallet.

- Step 1: Open an eToro account. Visit the eToro website and click the green ‘Sign Up’ button to start the process. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

- Step 2: Verify your identity. You need to verify your identity to be able to buy XRP or Ripple at eToro. Upload a passport, driver’s license, or National ID card to verify your eToro account.

- Step 3: Deposit funds into your eToro account. You can do this by credit card, bank transfer, or via e-wallets like PayPal or Skrill.

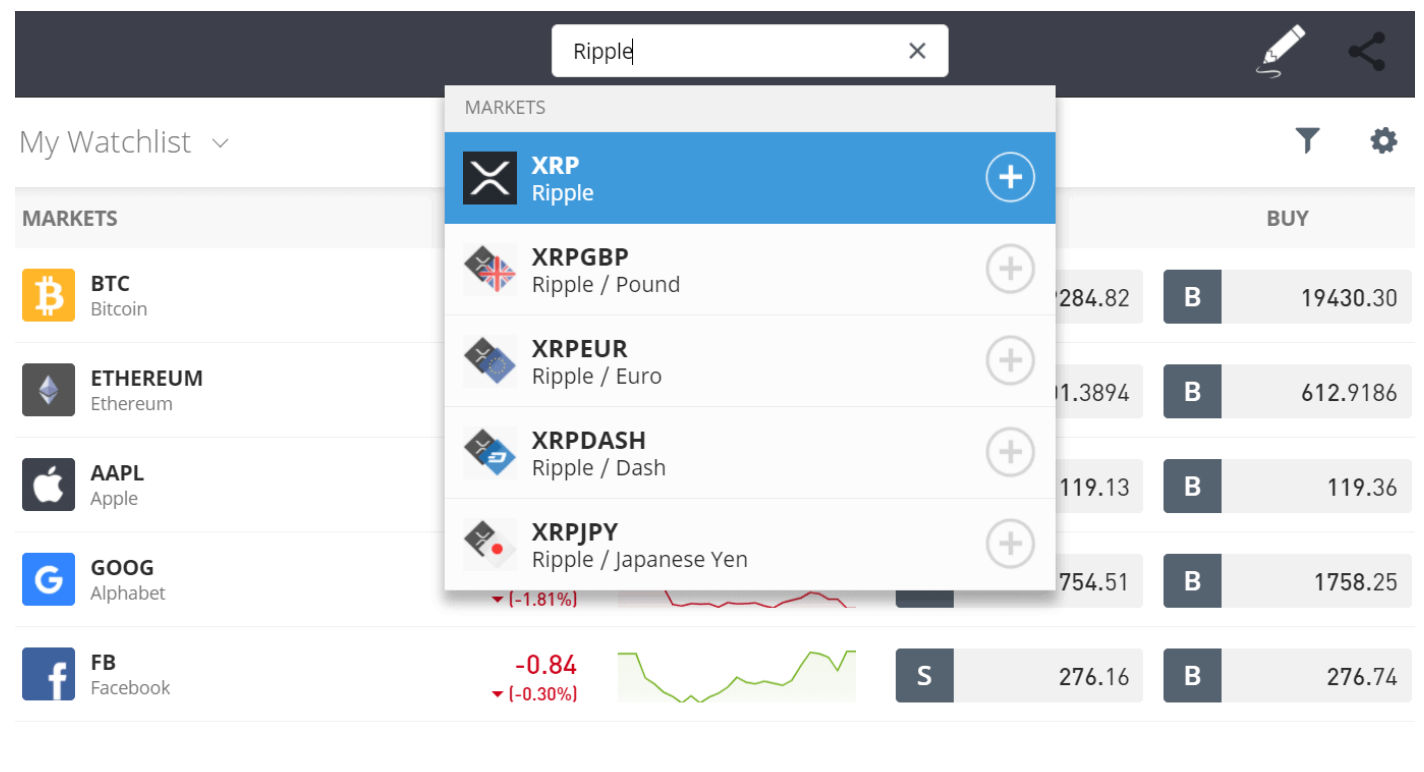

- Step 4: Buy XRP. Use the search feature to find XRP and buy the amount of XRP you like to invest in.

Where to Buy Ripple in UAE

1. eToro – The Best Crypto Exchange to Buy XRP

Min Deposit: $100

Fees: 4.8

Assets available: 4.8

Total Fees:

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong Take 2 min to learn more

The most common way to buy Ripple in UAE is through eToro at a minimum trade requirement of $10 and a minimum deposit of $100. AED deposits cost 0.5% across all payment options including debit cards. eToro charges a competative spread of 1% for all digital currency trades which is industry average.

eToro doesn’t charge fees for cryptocurrency trading either. They do charge a spread on crypto purchases like Ripple or XRP. You can check the current spread eToro charges for XRP trading on their website.

eToro’s copy trading platform allows you to copy other traders. This is ideal for those new to trading or who don’t have the time to trade themselves. By copying another trader, you copy the trades they make from your own eToro account. After signing up with eToro, you will receive your own crypto wallet from them.

Pros

- Commissionless trading

- Regulated crypto exchange

- Wide range of tradable cryptos

Cons

- Lacks some tools and features for advanced traders

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong Take 2 min to learn more

2. Binance – The Best Crypto Exchange to Buy XRP for Experienced Traders

Binance is the biggest crypto exchange in the world in the number of users and transactions. Experienced traders may want to buy XRP at Binance because the platform contains many advanced features. Some examples of these features are technical analysis indicators, complex order types, and the ability to trade with leverage. It is also possible to buy NFTs on Binance.

Although Binance focuses on experienced traders, it is also suitable for beginners. Binance offers a wide range of tutorial videos to help beginners get started using the platform. They also have a trading forum where you can ask questions. The trading fees at Binance are very competitive, starting at 0,10%. If you hold BNB (Binance Coin), you can enjoy reduced fees by up to 40%.

Pros

- Low fees

- Well suited for experienced traders

- World’s biggest crypto exchange (enough liquidity)

Cons

- Might be difficult to get used to as a beginner

3. Coinbase – The best Crypto Exchange to Buy XRP and Other Cryptos

At Coinbase users from the UAE can buy and sell around 3,000 different cryptos. This makes Coinbase the best crypto exchange to buy XRP for people that also want to invest in other cryptocurrencies. Coinbase offers traders and investors a lot of tools and features but at a price. To buy XRP on Coinbase you pay around 0,50% in spread fees. This is high compared to Binance’s 0,10%.

Coinbase has its own NFT trading platform where users can trade NFTs. It is possible to upload your own NFTs and sell them on Coinbase. Users can also sell their cryptocurrencies for fiat money on Coinbase. This comes with a 2% fee and Coinbase will then deposit the funds on your bank account within one business day.

Pros

- Large selection of cryptocurrencies

- Regulated crypto exchange

- Build-in crypto wallet

Cons

- High fees

What is Ripple?

XRP is a cryptocurrency based on blockchain technology, whilst Ripple is a decentralized peer-to-peer network that offers financial institutions a digital payment protocol. All transactions that take place within the Ripple network are validated through consensus.

There is no such thing as mining with Ripple’s XRP. All XRP tokens are pre-mined. Some XRP tokens are still locked up but will become available in the future. Every month Ripple Labs, the company behind XRP, releases an x amount of new XRP in circulation. The amount of new XRP depends on how many transactions have taken place.

Ripple’s blockchain system works differently than Bitcoin’s or Ethereum’s. Ripple transactions are faster compared to most other cryptocurrencies because of how their technology and validation systems work. Users can send or receive Ripple to and from other users within seconds. This is one of the biggest advantages of Ripple and the edge it has over other cryptocurrencies.

XRP is made by a company called Ripple Labs. Most people refer to XRP when saying Ripple, but as we said, they are two different things. Ripple Labs helps a network of more than 200 financial institutions to facilitate cross-border payments with XRP.

Why Invest in Ripple?

Traders and investors worldwide want to invest in Ripple. Although a single XRP is only valued at around $0,75, the token has a market capitalization of over $36 billion. XRP is interesting because of its low price per coin.

Ripple’s blockchain technology differs from the ones used by Bitcoin and Ethereum. Ripple’s payment system is much faster. The Ripple network can conduct over 1,500 transactions per second, whilst only 7 Bitcoin transactions per second can take place.

Over 200 financial institutions work together with Ripple. They use XRP tokens to ease their interbank transactions and cross-border payments. Banks that use Ripple have saved millions of dollars so far. This is another good reason to invest in Ripple’s XRP over other cryptocurrencies.

How Much Does an XRP cost?

A single XRP token costs about $0,75 at the time of writing this guide (March 2022). This price is the same across large cryptocurrency exchanges like Binance, eToro, and Coinbase. You can buy Ripple or XRP at these cryptocurrency exchanges with fiat money or exchange them for other cryptocurrencies like Bitcoin and Ethereum.

Most crypto exchanges will charge you fees for doing so. The average fees range from 0,5% to 2% of your total purchase. Some exchanges charge a floating or fixed spread, which means you won’t buy the XRP at the real market price, but pay a bit more per token.

How to Buy Ripple with PayPal?

You buy Ripple indirectly with PayPal on eToro. Although PayPal offers its users the ability to buy and trade cryptocurrencies, it doesn’t support XRP yet. We recommend you sign up for an eToro account and then fund that account with PayPal. This is possible, as you use PayPal instead of your bank account to fund the eToro account.

How to Buy Ripple with Bitcoin?

You buy Ripple with Bitcoin by buying the BTC/XRP pair available at most crypto exchanges. This is like forex trading, where you trade one currency for the other. You can only buy Ripple with Bitcoin if you already own Bitcoin and have this available on a crypto exchange.

Buying and Storing Your XRP Safe and Secure

The safest way to buy XRP is on a regulated and reliable crypto exchange like eToro. Most regulated cryptocurrency exchanges offer crypto wallets. These are online accounts where you can store your XRP.

From these wallets, you can send your XRP to other users or to a hardware wallet. Hardware wallets are USB-like devices that store your XRP and other cryptocurrencies offline. This protects them from getting stolen by hackers and other cybercriminals. Good hardware wallets are the Ledger Nano X and Trezor Model T. Read our Ledger vs. Trezor comparison.

Risks of Investing in XRP

Every investment is risky to some degree. Investing in Ripple’s XRP is risky because other blockchain companies might develop a better global payment system. This would make XRP obsolete. It is also risky to invest in XRP because Ripple Labs is currently in a lawsuit with the SEC. If Ripple Labs loses this lawsuit, XRP will lose a lot of value.

Selling XRP

You can sell your XRP for Bitcoin or fiat currencies any time you want. You do this by placing an XRP sell order at the crypto exchange where you keep your XRP. Most of the time you get the exact market price for your XRP because there is a lot of liquidity in the crypto market.

XRP Price Prediction

The Crypto Coin Society is sticking to its optimistic outlook. They expect the price of XRP to hit $2.50 at some point in 2022. This would be a more than 300% increase within a year. There are several factors that can drive the price up this high. As governments come under increasing pressure to regulate the crypto industry, Ripple is better able than most conventional cryptos to withstand any kind of regulatory crackdown.

According to a CryptoWhale analyst, “The only project in the entire market pushing for Crypto regulation is XRP. They know that once regulations are in place, it will completely destroy almost every other altcoin and increase the demand for XRP.”

CryptoWhale believes that if the United Kingdom or the United States government reaches a consensus on cryptography regulations, demand for Ripple will skyrocket. Since Ripple has been “working with government agencies to ensure compliance” for years, it is much less likely to suffer from new regulations.

Related:

Best AI Trading Platforms

Best Algorythmic Trading Platforms

Best Leverage Trading Platforms

Best Crypto Staking Platforms

Best UAE Crypto Exchange

How to buy Ethereum in UAE

How To Buy Cryptocurrency in UAE – A Step by Step Guide

Best Cryptocurrency Exchange Dubai

Best Cryptocurrency to invest

Best Bitcoin wallets

Best Crypto Day Trading Platform

Best Crypto signals telegram groups

Best Crypto trading bots

Best Crypto portfolio trackers

How To Buy Bitcoin in UAE and Dubai

Best Cryptocurrency Exchanges for Bitcoin Trading

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.